EUROPE MARKETS: European Markets Buoyed By Lifting Of Huawei Ban, Trade Talks

July 01 2019 - 7:26AM

Dow Jones News

By Dave Morris

European markets rallied Monday on the perceived lightening of

trade skirmishes among the U.S. and China, with tech stocks among

the best performers.

How did markets perform?

The Stoxx 600 rallied to 388.1, up nearly 0.9%. It increased

0.7% Friday.

The U.K.'s FTSE 100 jumped 1.1% to 7,509.9, after rising 0.3%

Friday.

The pound fell 0.4% to $1.2646, giving back Friday's 0.4% gain

almost exactly.

In Germany, the DAX climbed 1.3% to 12,558.4. It advanced 1%

Friday.

France's CAC 40 grew 0.8% to 5,582.1, after moving up 0.8%

Friday.

Italy's FTSE MIB edged up 0.3% to 21,291.6. On Friday it swelled

0.6%.

What's moving the markets?

Weekend reports from the G-20 summit in Osaka, Japan that U.S.

President Donald Trump and Chinese President Xi Jinping had agreed

to restart trade negotiations

(https://www.wsj.com/articles/trump-says-he-is-set-to-discuss-huawei-with-xi-11561769726?mod=hp_lead_pos1)

put investors in a bullish mood Monday. The relief rally lifted

European indexes, though they have retreated somewhat from their

highs.

"The two most positive things from the weekend were that

President Trump won't put the additional tariffs on China for the

'time being' and that he softened his stance on Huawei. He will

allow U.S. companies to sell some equipment to Huawei, as long as

it was 'no great national security problem'," Deutsche Bank

strategist Jim Reid told clients in a note.

Judging by fresh economic data, China's manufacturing sector

could use a break from trade tensions. The Markit/Caixin Purchasing

Managers' Index (PMI) survey showed manufacturing in June was still

contracting, coming in at 49.4 versus a flat reading of 50

predicted.

The Eurozone's Markit PMI manufacturing survey also came in

lower than expected in June, at 47.6 versus a consensus prediction

of 47.8. Germany was not immune; its Markit PMI manufacturing

(Final) PMI for June showed 45 versus 45.4 predicted.

Which stocks are active?

The announcement that the U.S. would remove some sanctions from

Chinese electronics company Huawei fueled relief for chip makers.

STMicroelectronics NV (STM.FR) shot up 6%, AMS AG (AMS.EB) popped

4.5% and Infineon Technologies AG (IFX.XE) climbed 4%.

British Airways parent International Consolidated Airlines Group

PLC (IAG.LN) was caught in the jetwash after a downgrade from

Bernstein analysts, while Deutsche Lufthansa cut it (LHA.XE) from

buy to market perform. The analysts cited the risk that, as leisure

travel slows in Europe, corporate travel could follow suit. IAG

shares shrank 1.3% while Deutsche Lufthansa moved down 0.6%.

Burberry Group PLC (BRBY.LN) was upgraded to neutral from sell

by Goldman Sachs, which said weakness in the U.K. currency could

prove to be a significant boost. Burberry also boasts an attractive

price to earnings radio, the analysts wrote. Shares rose 3%.

(END) Dow Jones Newswires

July 01, 2019 07:11 ET (11:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

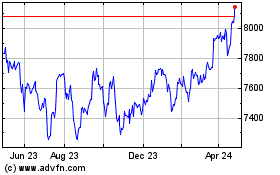

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

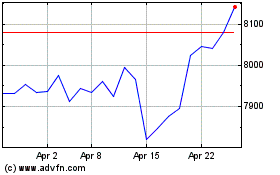

FTSE 100

Index Chart

From Apr 2023 to Apr 2024