MARKET SNAPSHOT: S&P 500, Nasdaq Set For 3rd Gain In A Row, As Investors Watch Boeing, Brexit Issues

March 13 2019 - 3:29PM

Dow Jones News

By Sue Chang and Chris Matthews, MarketWatch

Boeing shares extend losses as U.S. prepare to ground 737 Max

8

U.S. stocks rose Wednesday, putting the S&P 500 and the

Nasdaq on track for a third straight day of gains, as investors

weighed conflicting data on the U.S. economy with concerns tied to

the U.K.'s exit from the European Union.

Boeing remained in the spotlight as concerns about the safety of

its cutting edge 737 Max 8 continued unabated following the second

deadly crash involving the model in Ethiopia over the weekend.

How are major indexes performing?

The Dow Jones Industrial Average came off earlier highs to rise

84 points, or 0.3%, to 25,640, while the S&P 500 index added 19

points, or 0.7%, to 2,810. The Nasdaq Composite Index advanced 60

points, or 0.8%, at 7,651.

What's driving the market?

Boeing Co. (BA) shares fell more than 3% after President Donald

Trump told reporters that U.S. regulators will ground 737 Max 8 and

9

(http://www.marketwatch.com/story/us-to-ground-boeing-737-max-8-and-9-jets-trump-says-2019-03-13)

in line with similar decisions in other countries.

Investors continue to parse data on the U.S. economy, with a

report on durable goods orders coming in surprisingly strong

(http://www.marketwatch.com/story/durable-goods-orders-rise-in-january-for-3rd-straight-month-and-investment-rebounds-2019-03-13),

following previous reports showing a sharp slowdown in business

investment.

The Commerce Department report also showed core capital orders,

a key measure of business investment, rising 0.8% in January after

falling sharply the two months previous.

The cost of wholesale goods rose 0.1% in February

(http://www.marketwatch.com/story/wholesale-prices-creep-higher-in-february-but-inflation-poses-little-threat-ppi-shows-2019-03-13),

below the 0.2% increase expected by economists, per a MarketWatch

poll. The 12-month increase in producer prices fell from 2.5% to

2.3%, well below last summer's peak of 3% growth.

U.S. construction spending increased 1.3% in January, the

largest increase since April, after a 0.8% decrease in December,

the Commerce Department said.

British lawmakers on Tuesday rejected Prime Minister Theresa

May's revised Brexit deal in a 242-391 vote and now are looking at

a second vote on whether an exit without a pact with Europe's trade

bloc can be taken off the table before a March 29 deadline. A

so-called hard-Brexit scenario has stoked volatility in Britain's

currency and has the potential to unsettle financial markets,

experts say.

What are strategists saying?

"The rebound in underlying capital goods orders in January is

still consistent with a slowdown in business equipment investment

growth in the first quarter, although it suggests that slowdown

won't be as sharp as signaled by some of the incoming survey

evidence," wrote Michael Pearce senior U.S. economist with Capital

Economics in a note.

"With the February producer price figures showing few signs of a

pickup in inflation in the pipeline, there is still a strong case

for the Fed to remain patient," he added.

David Madden market analyst at CMC Markets UK, said the

investment climate is "gloomy this morning as Brexit still hangs

over the markets. Theresa May's withdrawal agreement was voted down

yesterday, which wasn't a huge surprise."

Which stocks are in focus?

Shares of Rite Aid Corp.(RAD) rose 3.6% after the drugstore

chain's Chief Executive John Standley said he would step down.

Shares of Express Inc. (EXPR) sank 11% after the fashion apparel

retailer

(http://www.marketwatch.com/story/expresss-stock-plunges-after-sales-miss-downbeat-outlook-offsets-adjusted-profit-beat-2019-03-13)

beat fourth-quarter profit expectations but missed on net sales and

provided first-quarter outlook that was worse than forecasts.

Take-Two Interactive Software (TTWO)stock climbed 5.2% after

Joel Kulina, head of technology and media trading at Wedbush

Securities, referenced rumors about potential takeover interest

from Sony Corp. (6758.TO) in his note to clients.

How are other markets trading?

Asian markets closed lower

(http://www.marketwatch.com/story/asian-markets-lower-amid-weight-of-global-uncertainties-2019-03-12),

with Japan's Nikkei 225 losing 1%, Hong Kong's Hang Seng Index

shedding 0.4% and China's Shanghai Composite Index retreating

1.1%.

European stocks were higher, with the Stoxx Europe 600 rising

0.6%.

The price of oil continued to rise

(http://www.marketwatch.com/story/oil-aims-for-3-day-win-streak-us-benchmark-trades-near-four-month-high-2019-03-13),

while gold settled higher and the U.S. dollar edged lower

(http://www.marketwatch.com/story/dollar-weaker-as-british-pound-bounces-higher-ahead-of-hard-brexit-vote-2019-03-13).

--Mark DeCambre contributed to this article

(END) Dow Jones Newswires

March 13, 2019 15:14 ET (19:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

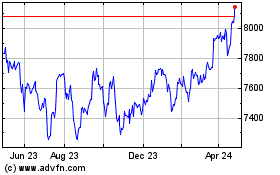

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

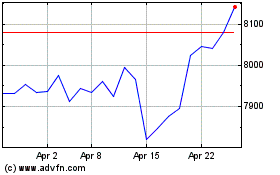

FTSE 100

Index Chart

From Apr 2023 to Apr 2024