By David Hodari

Global stocks gained Wednesday on a fresh wave of trade optimism

and climbing oil prices, shrugging off a leadership challenge

against U.K. Prime Minister Theresa May.

U.S. futures put the S&P 500 and the Dow Jones Industrial

Average on course to rise 1% at the open, with trade-sensitive

stocks like Caterpillar and Cisco up 2% and 1.1% in premarket

trade, respectively. Meanwhile rising oil prices helped push Exxon

Mobil stock 2.1% higher ahead of the market open.

Brent crude oil prices rose 1.6% to $61.18 a barrel and West

Texas Intermediate Futures were up 1.5% at $52.58 a barrel, after

weekly American Petroleum Institute figures released Tuesday

revealed a larger-than-expected fall in U.S. inventories.

Stocks in Europe built on Tuesday's gains, with the

pan-continental Stoxx Europe 600 index up 1.3% in afternoon trade,

while the British pound edged up 0.7% but remained near its lowest

level in 20 months.

Lawmakers in the U.K.'s ruling Conservative party initiated a

no-confidence vote against Mrs. May. On Monday, she postponed a

parliamentary vote on her Brexit bill, which prompted a new volley

of criticism over her handling of the country's exit from the

European Union. The yield on U.K. 10-year government bonds was at

1.23%, up from 1.18% late Tuesday. Yields rise as prices fall.

Rises in European stocks echoed gains in Asia, where the Nikkei

climbed 2.2% and Hong Kong's Hang Seng Index rose 1.6% as signs of

a further softening in trade tensions revived risk appetite.

Benchmarks in Taiwan, South Korea and Singapore all increased more

than 1%.

Details continued to emerge from the first trade talks between

Washington and Beijing, with China agreeing to boost purchases of

soybeans and other crops, and to reduce auto tariffs.

The warming in U.S.-China trade relations has prompted cautious

optimism among some investors, said Viktor Hjort, global head of

credit strategy at BNP Paribas.

"A resolution on global trade is one of the most important

issues for markets going into 2019," Mr. Hjort said. "The positive

angle is that U.S. and Chinese negotiators appear to be making an

effort, but I think at this point, any absence of bad news is good

news."

President Trump said in an interview with Reuters he would

intervene in the Justice Department's case against Huawei Chief

Financial Officer Meng Wanzhou if it would help smooth a trade deal

with China. Ms. Wanzhou was granted bail by a Canadian judge

Tuesday, after her arrest last week sent shock-waves through global

stocks.

Uncertainty around trade will remain elevated, though, with

technological and intellectual property disputes between Washington

and Beijing unlikely to die down despite more conciliatory

rhetoric, said Ann-Katrin Petersen, investment strategist at

Allianz Global Investors.

The Chinese yuan was last up 0.1% against the U.S. dollar. The

WSJ Dollar Index, which measures the buck against a basket of other

currencies, was up 0.2%, its five-day gains eroded to 0.4%.

U.S. investors were also keeping an eye out for inflation data,

due out later in the day. It comes a day after producer price data,

another gauge of inflation, signaled a third straight monthly rise.

The numbers will be scrutinized in the context of next week's

Federal Reserve meeting, at which investors broadly expect Chairman

Jerome Powell to raise interest rates.

CME Group data gave a 78.,4% probability that Mr. Powell will

announce an interest-rate increase.

Market participants will closely monitor the no-confidence vote

on U.K. Prime Minister Theresa May's leadership later Wednesday,

although British assets' initial reaction to the announcement was

muted. The U.K.'s FTSE 100 index was last up 1.3%, broadly in line

with gains elsewhere in Europe, while the FTSE 250 was up 1.2%.

More volatility may be ahead for U.K. assets, though, with some

analysts seeing the confidence vote as a binary event for

sterling.

Wednesday's vote is the latest in a series of developments that

have prompted investors from outside the U.K. to limit their

exposure to Brexit uncertainty in recent months, said Emmanuel Cau,

head of European equity strategy at Barclays.

"Global investors have left the U.K. equities and FX markets and

not many people have the ability to trade on what's going to

happen," said Mr. Cau. "In this particular situation, nobody's been

able to make forecasts so they've stopped trying."

A victory for Mrs. May could prompt a rally as large as 2% for

the pound, while defeat would shave off another 3%, Nomura said in

a note.

Elsewhere in Europe, investors monitored the reaction to French

President Emmanuel Macron's decision to cut taxes in the wake of

protests. The move may test the EU's budgetary rules and embolden

other members, such as Italy, to do the same.

In commodities, gold was up 0.2% at $1,249.50 a troy ounce.

Write to David Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

December 12, 2018 08:29 ET (13:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

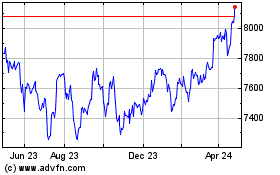

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

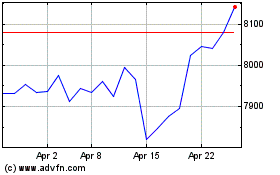

FTSE 100

Index Chart

From Apr 2023 to Apr 2024