Unilever ADRs Drop After Approach for Glaxo's Consumer-Health Business

January 18 2022 - 10:56AM

Dow Jones News

By Robb M. Stewart

Unilever PLC's U.S.-listed stock retreated Tuesday as investors

reacted to the company's efforts to push further into health,

beauty and hygiene products with a $68 billion approach for

GlaxoSmithKline PLC's consumer-health business.

In morning trading, the American depositary receipts were 11%

lower at $48.41. They now stand down 10% in the new year, and 19%

weaker over the last 12 months.

The maker of Dove soap and Ben & Jerry's ice cream over the

weekend said it made a takeover approach for the business, which is

68% owned by Glaxo and 32% by Pfizer Inc. If successful, it would

be Unilever's biggest-ever acquisition and the company said it

would be accompanied by significant divestitures as it looks to

shift its portfolio toward higher-growth categories.

Fitch Ratings on Tuesday cautioned an acquisition of the

consumer-health business is likely to raise Unilever's debt to a

level the company wouldn't be able to reduce it sufficiently to

maintain an A rating category over 2024-2025, which could open the

door to a multi-notch downgrade into the BBB category. Fitch said

it believes Unilever's offer would need to be raised to be

successful, given Glaxo's refusal to consider it, resulting in a

further deterioration of the company's expected credit metrics.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

January 18, 2022 10:41 ET (15:41 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

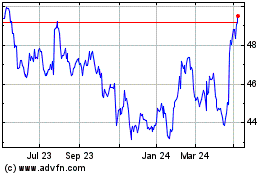

Unilever (EU:UNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

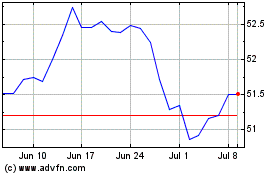

Unilever (EU:UNA)

Historical Stock Chart

From Apr 2023 to Apr 2024