Unilever Faces Squeeze in North America -- 2nd Update

January 31 2019 - 8:11AM

Dow Jones News

By Peter Stiff

LONDON -- Unilever PLC reported disappointing quarterly revenue

growth and warned of a tough year ahead amid fierce competition in

North America and volatile emerging markets, underscoring the

challenge facing new Chief Executive Alan Jope.

The maker of Hellmann's mayonnaise and Dove soap, reporting its

first earnings since Mr. Jope took charge, said Thursday its

closely watched underlying sales rose 2.9% in the fourth quarter,

below the 3.5% level expected by analysts.

For 2019, it forecast underlying growth at the lower half of its

long-term guidance of 3% to 5%, citing uncertainty in several

countries. The downbeat tone prompted the company's shares to fall

more than 3%.

"Accelerating quality growth will be my No. 1 priority, we still

have many untapped opportunities," Mr. Jope said on a call with

analysts.

The Unilever veteran, who replaced longtime CEO Paul Polman at

the start of the year, is trying to spur growth while raising the

company's operating margin to 20% by 2020 -- a target set by his

predecessor after fending off a takeover approach from Kraft Heinz

Co. For 2018, the margin rose to 18.4%, with Mr. Jope saying

Unilever was on track to meet its 2020 goals.

A challenging industry backdrop doesn't make the new CEO's task

any easier.

Unilever, like its peers, is grappling with changing consumer

tastes, competition from new brands and volatile emerging markets,

which make up about 60% of the Anglo-Dutch company's revenue. The

industry also faces rising commodity costs and growing competition

from Amazon.com Inc. and discount chains that are launching

own-label products.

In response, Unilever has focused more on higher-margin

personal-care brands, pivoted away from slower-growing food and

pushed into e-commerce with acquisitions such as online

razor-delivery startup Dollar Shave Club.

Over 2018, competition was particularly intense in North

America, where full-year underlying sales growth was 1%, excluding

its recently sold spreads business. The company said categories

such as ice cream, tea and dressings were challenging, with all

growth in the region coming from beauty and personal-care

products.

At its third-quarter update last year, Unilever cheered

investors by saying it had been able to raise list prices. However,

on Thursday the company said pricing gains had been washed away in

the fourth quarter by a higher level of discounting.

One particularly competitive area is mayonnaise, where Unilever

is engaged in a promotional battle with Kraft Heinz.

Unilever said its performance was encouraging in Europe, where a

warm summer boosted sales of its ice cream brands like Magnum. But

this was overshadowed by challenges in struggling economies such as

Argentina, where it sold fewer products amid a bout of

hyperinflation.

Overall, Unilever reported a fall of 5.1% in full-year revenue

to EUR50.98 billion ($58.54 billion), which it attributed to the

sale of its spreads business and currency headwinds. Net profit

jumped to EUR9.39 billion from EUR6.05 billion, boosted by the

sale.

--Carlo Martuscelli contributed to this article.

Write to Peter Stiff at peter.stiff@wsj.com

(END) Dow Jones Newswires

January 31, 2019 07:56 ET (12:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

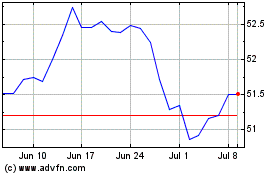

Unilever (EU:UNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

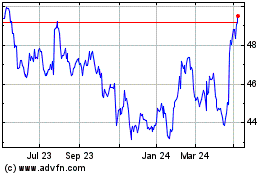

Unilever (EU:UNA)

Historical Stock Chart

From Apr 2023 to Apr 2024