Unilever Picks Insider as New CEO -- 3rd Update

November 29 2018 - 5:03AM

Dow Jones News

By Saabira Chaudhuri

Unilever PLC, the maker of Hellmann's mayonnaise and Dove soap,

named Alan Jope to replace longtime Chief Executive Paul Polman as

it, like the rest of the industry, struggles to navigate a sharp

shift in consumer tastes.

The appointment of Mr. Jope, a Unilever lifer who currently

heads the beauty and personal-care business, comes amid the

company's push under Mr. Polman to bolster that higher-margin

business and pivot away from slower-growing food.

The job is one of the highest-profile posts in corporate Europe.

The leadership change is also the latest in a series of

high-profile departures of consumer-goods bosses -- an

unprecedented changing of the guard as the industry faces down a

raft of challenges. Among these is a broad-based retreat by

consumers in many big western markets from the well-known brands

the industry has made and marketed for decades.

The industry also is grappling with rising commodity costs,

volatile emerging markets and fierce competition from Amazon.com

Inc. and discount chains that are increasingly launching own-label

products.

Unilever has been searching for new leadership for a year,

hiring an executive search firm last November to help find a

successor to Mr. Polman, who has led the company for a decade.

That effort had stepped up of late after Mr. Polman failed to

win investor support for a move to consolidate the company's

British and Dutch operating units and make Rotterdam its sole

headquarters, according to a person familiar with the matter.

Mr. Jope, who led the company's largest division since 2014 and

regularly presents to investors, was seen as a leading candidate to

be Unilever's next CEO, with experience in emerging and developed

markets across both food and personal care. He previously has

worked for the company in Asia and the U.S. after joining the

company as a graduate marketing trainee in 1985.

Under Mr. Polman's leadership, Unilever has shifted toward

faster-growing segments in personal and home care while jettisoning

lagging food businesses like spreads and pasta sauce.

Mr. Polman, a former P&G and Nestlé executive, also last

year fended off a $143 billion takeover approach from Kraft Heinz

Co. Since then he has launched share buybacks, raised margin

targets, further shuffled Unilever's portfolio and accelerated a

restructuring to make the company more agile. Unilever's stock rose

strongly during his tenure and continues to outperform rivals.

But Mr. Polman -- an outspoken Dutchman with a passion for the

planet -- was often divisive, riling some investors by flying

around the world to speak at sustainability conferences and openly

deriding the short-termism of the investment community. He was

roundly criticized after ignoring opposition by many prominent

British investors who saw his plan to consolidate the company's

headquarters in Rotterdam to simplify its operations as in fact

being protectionist. Ultimately, Unilever was forced to scrap that

move, an embarrassing U-turn for Mr. Polman.

Thursday, Bernstein analyst Andrew Wood said while some

investors disliked Mr. Polman's "preachy" style about

sustainability issues and thought he had a "god complex" he thought

Mr. Polman had been "an exceptionally good CEO of Unilever."

Naming Mr. Jope, a Scotsman, as its new CEO firmly cements the

company's status as an Anglo-Dutch company. The 54-year-old is well

liked within Unilever. A person who has worked closely with him

described Mr. Jope as having a far more amiable style than Mr.

Polman, saying he is "warm, very funny and a real people person."

Compared with Unilever's current CEO, Mr. Jope is less focused on

financials and is more of a "classic marketeer" with experience

building brands, added this person. In his spare time, the personal

care head who lives in London, goes on long motorbike rides and

plays soccer.

Under Mr. Jope, Unilever bought online razor-delivery startup

Dollar Shave Club and made a string of other small deals in areas

like high-end skin care. Mr. Jope also expanded Dove, rolling out a

new line of baby products from wipes to moisturizers under the

brand while also pushing deeper into men's products and launching

new brands like Love, Beauty and Planet to appeal to

millennials.

Mr. Jope will start his new job as CEO on Jan. 1 with Mr. Polman

staying on to assist with the transition through the first half of

next year, the company said.

RBC analyst James Edwardes Jones described Mr. Jope as "a deep

thinker about his category," saying the incoming CEO's biggest

immediate challenge is whether to retain the financial targets set

for Unilever under Mr. Polman.

"We think these targets are not going to be easy to achieve and

constrain Unilever's freedom of action," said Mr. Edwardes

Jones.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

November 29, 2018 04:48 ET (09:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

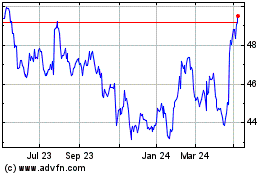

Unilever (EU:UNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

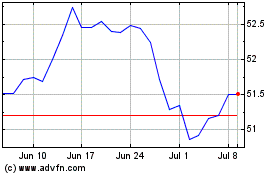

Unilever (EU:UNA)

Historical Stock Chart

From Apr 2023 to Apr 2024