Just Eat Shareholders Back Takeaway.com Combination

January 10 2020 - 10:04AM

Dow Jones News

By Adria Calatayud

Takeaway.com NV (TKWY.AE) said Friday that its offer for Just

Eat PLC (JE.LN) has received support from a majority of

shareholders of the U.K. company, paving the way for a deal that

will create a European food-delivery giant.

The Dutch meal-delivery company said its all-share offer has

been declared unconditional as to acceptances after getting the

backing of shareholders representing 80.4% of Just Eat and

defeating a rival all-cash bid from Prosus NV (PRX.AE).

Just Eat's board had recommended Takeaway.com's offer and

rejected Prosus' bid.

"Just Eat Takeaway.com is a dream combination and I am very much

looking forward to leading the company for many years to come,"

Takeaway.com Chief Executive Jitse Groen said.

Mr. Groen will lead the combined entity with Just Eat Chairman

Mike Evans as chairman.

As part of the deal, Just Eat shareholders will own a 57.5%

stake of the combined group while Takeaway.com investors will hold

the remaining 42.5%. The merged entity is worth $13.89 billion

based on the respective share prices of Just Eat and Takeaway.com

as of Jan. 9.

Takeaway said it now expects the offer to be wholly

unconditional by Jan. 31.

Takeaway.com and Just Eat first agreed to merge this summer, but

their deal was challenged by a hostile offer from Prosus, a spinoff

of South African technology investor Naspers Ltd. (NPN.JO), which

houses a major stake in Chinese internet giant Tencent Holdings

Ltd. (0700.HK).

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

January 10, 2020 09:49 ET (14:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

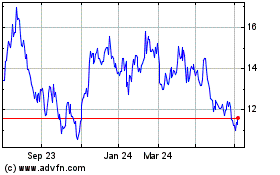

Just Eat Takeaway.com N.V (EU:TKWY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Just Eat Takeaway.com N.V (EU:TKWY)

Historical Stock Chart

From Apr 2023 to Apr 2024