Just Eat Board Recommends Takeaway.com Offer, Rejects Prosus Bid

December 20 2019 - 6:41AM

Dow Jones News

By Adria Calatayud

U.K. food-delivery platform Just Eat PLC (JE.LN) said Friday

that its board unanimously recommends an improved all-share offer

from Dutch peer Takeaway.com NV (TKWY.AE), and rejects a rival

all-cash bid from Prosus NV (PRX.AE).

Just Eat said its board believes the final Takeaway offer will

deliver greater value to Just Eat shareholders than the final

Prosus bid, as Takeaway's proposal is based on a compelling

strategic rationale that allows shareholders to participate in the

upside potential of the enlarged group.

Just Eat's board had also recommended a previous offer from

Takeaway and rejected bids from Prosus.

Just Eat's response comes after its two suitors put in improved

offers and declared them final on Thursday, in an escalation of the

bidding war for the U.K. company.

Takeaway said its increased bid would give Just Eat shareholders

a 57.5% stake in the combined group, up from 52.12% under its

previous offer. The Dutch company also said it plans to explore

options to exit Just Eat's minority stake in Brazil's iFood--in

which Prosus owns a major stake--and return approximately half of

the net proceeds to the shareholders of the combined group.

Meanwhile, Prosus raised its cash bid for Just Eat to 800 pence

a share from 740 pence a share, valuing the company at 5.5 billion

pounds ($7.20 billion).

Both offers will remain open for acceptances until Jan. 10, Just

Eat said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

December 20, 2019 06:26 ET (11:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

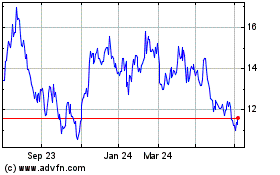

Just Eat Takeaway.com N.V (EU:TKWY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Just Eat Takeaway.com N.V (EU:TKWY)

Historical Stock Chart

From Apr 2023 to Apr 2024