Tikehau Capital Appoints Vincent Archimbaud as Head of Wholesale Sales for Europe

December 01 2021 - 2:45AM

Business Wire

Regulatory News:

Tikehau Capital (Paris:TKO), the alternative asset management

group, today announced the appointment of Vincent Archimbaud as

Head of Wholesale Sales for Europe. Based in Paris, his role will

be to develop the distribution of the Group’s funds in Europe and

contribute to the growth of its assets under management.

As Head of Wholesale Sales for Europe, Vincent Archimbaud will

be responsible for accelerating the development and supporting

Tikehau Capital’s client base of multi-family offices, funds of

funds, asset managers, independent financial advisors, bank fund

selectors, insurers and fund platforms, as well as private banking

divisions. Vincent will coordinate the coverage of this client base

with the regional managers in Europe across all asset classes in

which Tikehau Capital invests (private debt, private equity, real

assets and capital markets strategies).

Vincent Archimbaud will be based in Paris, reporting to Frédéric

Giovansili, Deputy CEO and Global Head of Sales, Marketing and

Business Development at Tikehau IM.

Vincent Archimbaud brings with him more than 20 years of

experience in the asset management industry. Prior to joining

Tikehau Capital, he was since 2014, Director of head of Third Party

Distribution at Lombard Odier IM (France, Belgium, Luxembourg and

Monaco). Prior to that, Vincent spent a year at Goldman Sachs as

responsible for sales of UCITS platforms before joining Citigroup

Global Markets for three years, also as responsible for sales of

UCITS platforms. In addition, Vincent was responsible for Sales for

Lyxor Asset Management (2006-2010), for AXA IM (2003-2006) and for

Société Générale AM (2001-2003). Vincent is a graduate of ESC

Bordeaux Business School (1996).

Frédéric Giovansili, Deputy CEO and Global Head of Sales,

Marketing and Business Development at Tikehau IM said: " We are

delighted with the arrival of Vincent Archimbaud. His extensive

experience in distribution, combined with his substantial network

and his in-depth understanding of the needs of wholesale clients in

Europe will enable him to successfully contribute to the Group's

ambitious growth dynamic.”

ABOUT TIKEHAU

CAPITAL

Tikehau Capital is a global alternative asset management group

with €31.8 billion of assets under management (as of 30 September

2021). Tikehau Capital has developed a wide range of expertise

across four asset classes (private debt, real assets, private

equity and capital markets strategies) as well as multi-asset and

special opportunities strategies.

Tikehau Capital is a founder led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€2.9 billion of shareholders’ equity as of

30 June 2021), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 672 employees (as of 30 September

2021) across its 12 offices in Europe, Asia and North America.

Tikehau Capital is listed in compartment A of the regulated

Euronext Paris market (ISIN code: FR0013230612; Ticker:

TKO.FP).

For more information, please visit: www.tikehaucapital.com

DISCLAIMER:

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties. actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211130006197/en/

PRESS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39 30 UK –

Prosek Partners: Henrietta Dehn – +44 7717 281 665 USA – Prosek

Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDERS AND INVESTORS: Louis Igonet – +33 1 40 06 11 11

shareholders@tikehaucapital.com

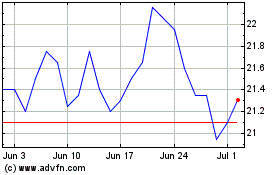

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

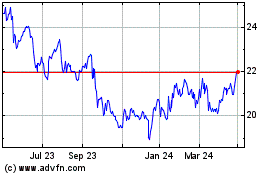

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Apr 2023 to Apr 2024