Regulatory News:

Tikehau Capital (Paris:TKO), the global alternative asset

management group, has completed fundraising for its T2 investment

strategy focused on energy transition. This unique growth equity

strategy attracted over €1 billion.

- Tikehau Capital’s T2 Energy Transition investment strategy

outperformed its original fundraising goals with over €1 billion

raised1

- T2 fund is one of the leading and largest global growth private

equity vehicles singularly committed to enabling the transition

towards a low-carbon economy and fighting global warming

- T2 Energy Transition investment strategy has already invested

€440 million in SMEs focused on clean energy generation, low-carbon

mobility and energy efficiency

- T2 fund portfolio companies have already provided goods and

services that, over their lifetime, will avoid one million tons of

CO2 from being emitted

Mathieu Chabran, co-founder of Tikehau

Capital, declared:

“The purpose of our energy transition-focused platform is to

make equity investments in profitable companies in this sector. We

give these companies a major boost so that they can immediately

reduce greenhouse gas emissions. In line with our commitment in

terms of ESG and particularly with our intention to address the

climate emergency, we decided to launch the first private equity

fund on this scale to focus entirely on energy transition. Tikehau

Capital committed €100 million of its own balance sheet to the

fund. This close alignment of interest with our investors, whom I

thank for the trust they have placed in us, has enabled us to

attract a wide range of people wanting to invest in a strategy

aimed at decarbonising our economy. This has made our initiative a

real success. And this is just the start. We can meet the targets

set by the Paris agreements in 2015 provided that we invest today

in these companies that are transforming our economic system by

moving us towards a decarbonised future.”

Emmanuel Laillier, Head of Private Equity at

Tikehau Capital, added:

“Investors’ enthusiasm for this fund shows the appeal of our

energy transition-focused private equity platform. We launched the

platform in 2018 with the ambitious objective of raising between

750 million euros and 1 billion euros, which we have now far

exceeded. Our success also highlights the need to strengthen

companies’ equity bases to move faster with energy transition. This

is an outstanding performance for a first generation of funds

dedicated to energy transition. I would like to congratulate the

Tikehau Capital team for this achievement. Together, we want to

support the growth of European SMEs in a sector that is playing a

crucial role in addressing the climate emergency.”

Tikehau Capital launched this

strategy in 2018 with €100 million from its own balance sheet. This

unique alignment of interest with LPs has proven successful,

attracting large strategic investors from several geographies

(whose commitments represent 45% of the funds raised

overall).

Tikehau Capital’s T2 Energy

Transition Fund is one of the leading and largest global growth

private equity vehicles singularly committed to fighting climate

change.

The T2 Energy Transition Fund,

set up to help reach the goals of the 2015 Paris Agreement,

provides growth equity to European SMEs that directly help lower

GHG emissions. The T2 fund’s mission is to fight global warming by

funding the growth of emerging corporate leaders in the energy

transition space and investing in European SMEs that provide tools

to response to the climate emergency.

Over the last 18 months,

Tikehau Capital has invested €440 million in six European SMEs

focused on clean energy generation, low-carbon mobility and energy

efficiency. Pierre Abadie and Mathieu

Badjeck, co-managers of

Tikehau Capital’s T2 Energy Transition Fund, said: "In 2019 alone,

Tikehau Capital’s energy transition portfolio companies have

provided goods and services that, over their lifetime, will avoid

one million tons of CO2 from being emitted. And this is the just

the beginning.”

Tikehau Capital’s T2 Energy

Transition Fund has already acquired stakes in: Greenyellow, a

provider of energy efficient refrigeration solutions to retail

outlets; Groupe Rougnon, a specialist in energy-efficient

refurbishment of buildings; Crowley Carbon, a service provider that

helps factories become more energy efficient; Amarenco a leading

developer in distributed solar projects; Enso, a biomass boiler

specialist; and EuroGroup, a supplier of engine parts for

EVs.

The enclosed video highlights

some of the fund’s LPs and government support. Thanks to

Mr. Philippe Etienne, French Ambassador to the United

States, Mr. Alex Doñé, Deputy Comptroller, Asset Management &

CIO, Office of the NYC Comptroller, Mr. Scott Stringer,

Ms. Olivia Grégoire,

Minister of State for the Social Solidarity and Responsible

Economy, as well as Mr. Nicolas Dufourcq, CEO of BPI France and Mr. Alain

Godard, CEO of European

Investment Fund, for their participation.

To view this testimony: click here

ABOUT TIKEHAU CAPITAL

Tikehau Capital is a global alternative asset management group

with €28.5 billion of assets under management (as of 31 December

2020). Tikehau Capital has developed a wide range of expertise

across four asset classes (private debt, real assets, private

equity and capital markets strategies) as well as multi-asset and

special opportunities strategies.

Tikehau Capital is a founder-led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€2.8 billion of shareholders’ equity as of

30 June 2020), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 570 employees (as of 30 June 2020)

across its 11 offices in Europe, Asia and North America. Tikehau

Capital is listed in compartment A of the regulated Euronext Paris

market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com

DISCLAIMER:

This transaction was carried out by TIKEHAU INVESTMENT

MANAGEMENT SAS (on behalf of the funds that it manages), a

portfolio management company approved by the AMF since 19/01/2007

under number GP-0700000006.

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties. actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

__________________ 1 Circa €990 million raised by the T2 Energy

Transition Fund and circa €100 million raised for the energy

transition strategy through co-investments mandates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210222005873/en/

PRESS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39 30

France – Image 7: Florence Coupry & Charlotte Le Barbier – +33

1 53 70 74 70 UK – Prosek Partners: Clare Glynn – +44 7912 107 653

USA – Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDERS AND INVESTORS: Louis Igonet – +33 1 40 06 11

11 shareholders@tikehaucapital.com

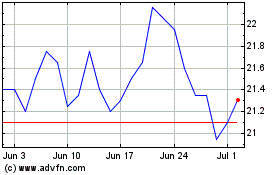

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

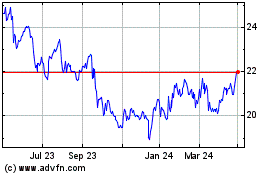

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Apr 2023 to Apr 2024