Drugmakers Brace for Sales to Slow in China Amid Generic Drug Push

April 26 2019 - 8:19AM

Dow Jones News

By Denise Roland

As global companies struggle with an economic slowdown in China,

big drugmakers have a different problem: local competition is

starting to bite.

Executives at Sanofi SA and AstraZeneca PLC on Friday said they

expect strong growth in China to slow later this year as hospitals

switch to Chinese-made generic versions of some of their

top-selling drugs.

Multinationals have for years benefited from strong sales of

some of their older medicines in China, where brand recognition

gave them an edge over cheaper copies. Robust sales growth in China

was a factor in upbeat results for both companies in the first

quarter.

But that source of revenue is about to take a big hit. In an

effort to lower drug costs, the Chinese government earlier this

year rolled out a policy aimed at getting large public hospitals to

switch to generics. Beijing has also been raising standards for its

domestic drugmakers, closing the gap in quality with the

multinationals.

The policy required drugmakers to bid for contracts to become

the sole supplier of a certain drug to all public hospitals in 11

key cities. Multinational companies won just two of the 25

contracts, with the rest going to Chinese generic drugmakers. The

contracts came into effect around the end of the first quarter.

Two of Sanofi's best sellers in China, blood thinner Plavix and

Aprovel for lowering blood pressure, will be replaced by

Chinese-made drugs at the country's public hospitals. A company

spokesman said the cities affected represented around 30% of

nationwide demand for these products.

AstraZeneca also expects China sales to slow later this year.

While the British drugmaker won a contract for lung cancer drug

Iressa, its cholesterol-busting pill Crestor lost out to a

lower-cost version.

Pfizer Inc.'s Lipitor and Novartis AG's Gleevec were also among

the big-name drugs that lost out to Chinese-made generics.

China has recently made a raft of policy changes aimed at

improving access to medicines for its 1.4 billion population. Some

of these -- such as speedier approvals of new drugs -- are

benefiting multinational companies.

"The good news here is that China is very much focusing on

innovation," said AstraZeneca Chief Executive Pascal Soriot. He

said some of the company's new drugs, including Tagrisso for lung

cancer, were performing well in China.

Sanofi is also counting on new drugs to drive growth in China. A

spokesman said seven of its drugs were included in a list of

medicines that could be eligible for a faster-than-normal approval

by the Chinese regulator.

The French company on Friday said business net income, a closely

watched measure that strips out certain one-time items, rose 10.5%

to EUR1.77 billion ($1.97 billion), while sales rose 6.2% to

EUR8.39 billion in the three months to March 31.

Both measures beat analyst expectations, sending shares up 3.5%

in early trading, although Sanofi's Chief Financial Officer

Jean-Baptiste Chasseloup de Chatillon said the company had opted

not to raise its full-year guidance because of the anticipated

slowdown in China.

AstraZeneca said its core operating profit, an adjusted measure,

climbed 84% to $1.65 billion in the quarter because of stronger

margins and higher product sales, which rose 10% to $5.47 billion.

AstraZeneca shares climbed 0.1% Friday morning.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

April 26, 2019 08:04 ET (12:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

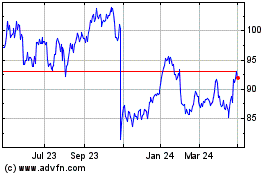

Sanofi (EU:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

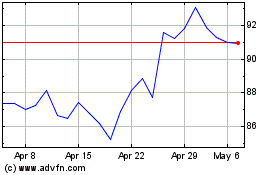

Sanofi (EU:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024