By Sean McLain in Tokyo and Nick Kostov in Paris

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 6, 2020).

Spring was supposed to herald a fresh start for the troubled

car-making alliance of Renault SA and Nissan Motor Co. Executives

were hoping to grab investors' attention with a vision for the next

three years, backed up with detailed projections of profits and

sales.

So much for projecting anything. With sales evaporating and most

factories closed, the companies' leaders say they are flying blind

with no way of knowing when business will return to normal.

"I'm not sure that in 2020 any car company can make an accurate

budget today," Nissan Chief Executive Makoto Uchida said in an

interview.

He is like many CEOs around the world whose core work of setting

a vision and carrying it out has suddenly been rendered impossible

by the coronavirus pandemic. Many are taking lessons from the 2008

global financial crisis and focusing on staying viable until

whenever the world becomes more normal again.

"Simply put, we need to watch our cash management," Mr. Uchida

said.

The pandemic has hit the allied auto makers at a time when they

were already struggling. The arrest in Japan of former alliance

leader Carlos Ghosn in November 2018 set off more than a year of

management turmoil, and Nissan had seen sales fall sharply in the

U.S., its most important market.

Nissan shares have lost half their value this year, while the

overall Japanese stock market is down by a quarter. The price of

insuring against a Nissan default on its debt has quadrupled in a

month.

Moody's Investors Service on March 26 reduced Nissan's credit

rating two notches, the third downgrade in a year. It stands at the

lowest investment-grade rating, and Moody's put it on review for a

further downgrade over concerns about Nissan's ability to grow

again. Renault's credit rating was lowered to junk status by

Moody's in February.

As with the virus itself, there is no immediate elixir.

"The situation is quite clear: We're not getting any revenues

because we're not selling anything," Jean-Dominique Senard,

Renault's chairman, said in an interview.

In March, Nissan's sales fell 48% in the U.S. as car buyers

stayed home to avoid the virus. The company had hoped to pare back

discounts, but the crisis has left it with no choice: It is

offering 0% loans to new customers and no payment for 90 days.

Renault's new car registrations in France, its biggest market,

fell 72% in March, according to France's car industry association.

April is expected to be even worse, and no one has a clear view of

what will happen from May onward.

For the moment, neither company sees much point in making more

cars, even in countries where factories are permitted to operate.

Renault has shut all its plants indefinitely except in China and

South Korea, where factories have resumed work. Nissan has closed

all its plants except those in China and Japan, where some are

running at reduced capacity.

Yet the executives said that even in a crisis, it still made

sense to push forward with longer-range plans, to assure employees

and investors that the alliance has a future once the pandemic

eases. As before, they intend to announce their program for the

next three years in mid-May.

"Unless the plan is well demonstrated and digested, then the

share price will not recover and people will not believe that

Nissan will recover," Mr. Uchida, the Nissan CEO, said.

Nissan and Renault executives say they plan to end products and

businesses that show little hope of becoming profitable. That means

Nissan is expected to wind down plants in Spain, and Renault will

likely pull its namesake brand out of China, according to people

familiar with the plans. Research and engineering work will be

divided up to avoid duplication.

Billions of dollars in savings are planned, in part by more than

doubling the proportion of parts the two companies share to 75% to

80%. "All of us, we're not satisfied at all about the valuation of

our company in the market," Renault's Mr. Senard said. "We're

determined to get out of that situation."

Mr. Senard said he believed Renault could weather a downturn,

and analysts agree neither company is in immediate danger of

running out of cash.

Renault is taking advantage of the French government's expansion

of benefits by paying some white-collar staff in the Paris region

for half a day's work, while the government pays unemployment

benefits for the other half-day. It has access to state-backed

loans in France and a EUR3.5 billion ($3.8 billion) credit line it

has yet to tap. Nissan has untapped credit lines of about $12

billion.

Mr. Senard predicted that at some point car sales would come

back. But in a prolonged recession, he said, "we would be testing

the limits of a new world."

Write to Sean McLain at sean.mclain@wsj.com and Nick Kostov at

Nick.Kostov@wsj.com

(END) Dow Jones Newswires

April 06, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

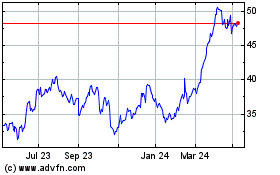

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

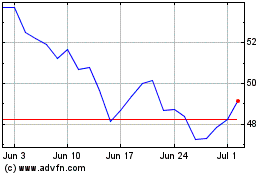

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024