By Nick Kostov and William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 28, 2020).

Renault SA is planning to name former Volkswagen AG executive

Luca de Meo as its chief executive at an extraordinary board

meeting this week, according to people familiar with the matter, as

the French auto maker seeks to get past the Ghosn scandal and

reinvigorate its alliance with Nissan Motor Co.

Mr. De Meo's move to Renault, subject to a board vote, has been

widely expected in the industry after Volkswagen said earlier this

month that the 52-year-old Italian was stepping down as head of

Seat, its Spanish auto unit. Under his leadership, Seat returned to

profitability and became one of the German auto maker's

fastest-growing brands.

Renault has had two CEOs since Carlos Ghosn's arrest in Japan in

November 2018, resulting in his resignation as the head of the auto

maker. The post has been held on an interim basis since October,

when Renault's board ousted the chief executive at the time as part

of wave of departures of executives who were close allies of Mr.

Ghosn.

Tensions between Renault and Nissan -- which Mr. Ghosn also once

headed -- have been strained since his arrest in Tokyo on

allegations of financial misconduct, which he denies.

Mr. De Meo's appointment was delayed by protracted negotiations

between Renault and Volkswagen over the terms of his departure, the

people said. As a result of a noncompete provision, Mr. De Meo

won't be starting at Renault immediately, one of the people said.

It couldn't be learned when exactly Mr. De Meo would take the

reins.

The auto executive will arrive at a difficult time for Renault,

with its shares at their lowest point in more than seven years and

profit shrinking as sales in some key emerging markets are on the

wane. Meanwhile, Renault's relationship with Nissan has been

strained by battles over the direction of the 20-year-old

alliance.

Decision making on that score has slowed since the arrest of Mr.

Ghosn, who forged the partnership. Last month Mr. Ghosn fled to

Lebanon, saying he couldn't get a fair trial in Japan.

One tricky issue confronting Mr. De Meo will be the future

structure of the alliance. The two auto makers are bound by a

shareholding arrangement that Nissan has long complained favors

Renault. The French company owns a 43.4% stake in Nissan, while the

Japanese company owns a 15% nonvoting stake in Renault. The two

partners tried to hammer out a new agreement in secret negotiations

last summer, but failed to find a compromise.

Jean-Dominique Senard will remain Renault's chairman, as well as

chairman of the alliance, people familiar with the matter said.

For Mr. De Meo, taking the job at Renault is something of a

homecoming. He launched his auto-industry career at the company,

before continuing his journeyman years with a stint at Toyota Motor

Corp. The Milan native then went to work for Fiat, where he ran the

Lancia, Fiat and Alfa Romeo business units and headed Abarth &

C. SpA, the Italian auto maker's racing unit. He also served as

Fiat's chief marketing officer, and was a driving force behind the

successful revival of the Fiat 500 as a retro model.

Mr. De Meo was hired by Volkswagen to run sales and marketing of

the VW brand in 2009, around the time the German car maker was

preparing a new series of small cars in its bid to become the

world's biggest car maker within 10 years. Volkswagen poached

several executives from Fiat for their expertise in designing and

marketing small cars.

"We are very, very sad that Luca is leaving us because he played

a very important role in the group," Volkswagen CEO Herbert Diess

said during an interview with CNBC that was televised from the

World Economic Forum in Davos, Switzerland, last week.

Mr. De Meo joined Volkswagen when the car maker was pursuing a

"clean diesel" campaign to promote its lineup as more

environmentally friendly. Then in 2015, U.S. authorities disclosed

that Volkswagen had rigged diesel engines to cheat emissions tests

and charged the company with violating U.S. environmental laws and

committing fraud. Mr. De Meo was never identified as an insider in

Volkswagen's own investigation and hasn't been charged or named as

a suspect in any criminal investigation in connection with the

scandal.

As a salesman, Mr. De Meo, who speaks five languages, has always

had an eye on the young, trend-focused consumer. He pushed

Volkswagen in 2010 to become the first auto maker to offer a

branded app, timed with the European debut of the Apple iPad. When

launching the New Beetle at Volkswagen in 2011, he described the

target audience of the model's revival as an "I have a Mac

person."

When Volkswagen installed him at Seat in 2015, Mr. De Meo began

immediately to reshape the struggling Spanish car maker into a

sexy, youthful brand, targeting new customers outside the

Volkswagen group in Southern Europe, Northern Africa and

Germany.

To capture the growing African market, and challenge rivals

Renault and Peugeot, Mr. De Meo oversaw the opening of Volkswagen's

first factory in the region.

He also convinced Mr. Diess to let Seat create its own luxury

offering, intending the Cupra brand in part to challenge the

expansion of Renault and Peugeot into the premium segment.

Under Mr. De Meo's tenure, Seat became profitable for the first

time in more than a decade. Last year, the company sold 518,000

vehicles, an increase of nearly 11%. It reported sales of EUR10

billion ($11 billion), up 3%, and boosted pretax earnings 33% to

EUR254 million.

Mr. De Meo was well-liked and respected at Volkswagen, but if he

had his sights on the top job he likely would have had to wait. Mr.

Diess turned 60 in October and has strong support as CEO from the

company's core shareholders and labor representatives.

Volkswagen also has never had a non-German CEO, and Mr. De Meo

faced internal competition from the likes of Porsche chief Oliver

Blume.

Write to Nick Kostov at Nick.Kostov@wsj.com and William Boston

at william.boston@wsj.com

(END) Dow Jones Newswires

January 28, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

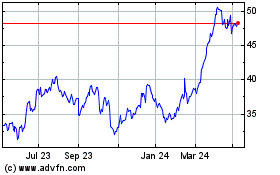

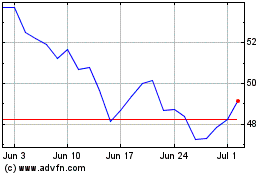

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024