Renault, Nissan Smooth Over Their Differences -- WSJ

June 20 2019 - 3:02AM

Dow Jones News

By Sean McLain in Tokyo and Nick Kostov in Paris

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 20, 2019).

Nissan Motor Co. and Renault SA have resolved a standoff over

corporate governance at the Japanese car maker, according to people

familiar with their talks, easing tensions that had scuttled the

French car maker's merger talks with Fiat Chrysler Automobiles

NV.

The detente allows Nissan to install a new board, a step that

Renault executives see as allowing for the possible resumption of

merger talks with Fiat Chrysler, according to a person close to

Renault. Those discussions foundered as Nissan withheld its support

for a tie-up and the French government asked for a delay until

Nissan was on board -- prompting Fiat to pull its offer.

Renault executives would like to revive talks with the

Italian-American car maker in the near future before market

conditions change, this person said.

Renault and Nissan hold stakes in each other under an

auto-making partnership that stretches back two decades. French

President Emmanuel Macron is expected to discuss the alliance when

he meets with Japanese Prime Minister Shinzo Abe next week at the

G-20 meeting in Japan.

The corporate-governance issue spawned a highly technical, yet

high-profile, standoff between Nissan and Renault. It revolved

around whether Renault Chief Executive Thierry Bolloré should be

given a post on an audit committee proposed for Nissan's board.

Renault threatened to abstain in a vote on governance changes at

Nissan, effectively thwarting them, unless Mr. Bolloré was seated.

That prompted Nissan Chief Executive Hiroto Saikawa to issue an

uncharacteristic rebuke of Renault, calling its stance "most

regrettable."

Under the recent agreement, Mr. Bolloré would get the committee

seat, said people familiar with the discussions. One of Nissan's

independent directors, Masakazu Toyoda, had communicated the offer

to Renault Chairman Jean-Dominique Senard in writing, said one of

the people.

Nissan wants to create three new board committees -- for audit

matters, director nominations and executive compensation -- to

address governance problems that the auto maker has said allowed

alleged wrongdoing by former Nissan Chairman Carlos Ghosn to go

unnoticed by company watchdogs. Shareholders are set to vote on the

plan at the annual Nissan shareholder meeting June 25. It requires

a two-thirds majority to pass, and Renault's support is

essential.

At Renault's shareholder meeting last week, Mr. Senard said that

the argument involved "a fundamental detail," but that there was no

need to "cause an eruption of Mount Fuji."

Nissan had already agreed to put Mr. Senard on the new

nomination committee, but he said that wasn't enough. "We have two

Nissan representatives sitting on Renault committees, and I thought

the least we can do is have two Renault representatives sit in

Nissan committees," Mr. Senard said. "I could not very well vote in

favor of a change in governance unless that very simple condition

be respected from the start."

The Japanese car maker had sought to keep Mr. Bolloré off the

audit committee because it thought his role as Renault's most

senior executive might conflict with the committee's job of

checking that Nissan's business plans were in the Japanese

company's best interests.

The conflict-of-interest risk was hypothetical, but it worried

Nissan after an outside committee tapped to review lessons of the

Ghosn case said Nissan should avoid the appearance of conflicts of

interest, said people familiar with the talks. Mr. Ghosn was

chairman of both Nissan and Renault, as well chief executive of

Renault and of a separate company dealing directly with the

alliance's operation.

Since Mr. Ghosn's arrest and indictment, Nissan and Renault have

clashed about aspects of the investigation into his alleged

wrongdoing and over the future shape of the alliance. Before

contributing to the failure of the talks between Renault and Fiat

Chrysler, Nissan fended off a plan to merge with Renault.

Mr. Senard said last week that Renault has lost influence in the

alliance since a 2015 revision to its shareholding agreement with

Nissan, which limited the ability of Renault to exercise its voting

rights.

"I won't be the chairman who will lead to a further reduction of

Renault's influence in the alliance, because I don't think that

would be acceptable," Mr. Senard told shareholders.

Write to Sean McLain at sean.mclain@wsj.com and Nick Kostov at

Nick.Kostov@wsj.com

(END) Dow Jones Newswires

June 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

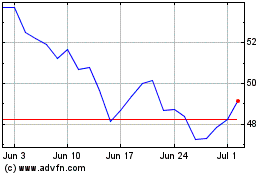

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

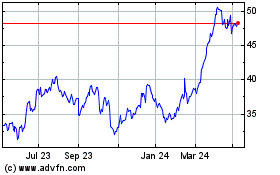

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024