Legrand: Liquidity Agreement

July 31 2020 - 1:37PM

Business Wire

Regulatory News:

Legrand (Paris:LR):

Termination of the liquidity agreement entered into with

Kepler Chevreux

Legrand announces having terminated the liquidity agreement

relating to its ordinary shares (code ISIN FR0010307819) concluded

on May 29, 2007 with Kepler Cheuvreux.

The termination is effective as of today.

The following assets were booked on the liquidity account on the

termination date:

- 90,346 shares.

- 19,880,644.05 euros.

Signing of a new liquidity agreement with Exane

Legrand has appointed Exane, effective on August 3, 2020, and

for an initial period expiring on December 31, 2020, tacitly

renewable thereafter for periods of twelve months, to implement a

liquidity agreement that complies with the decision of the Autorité

des marchés financiers (AMF) n°2018-01 of July 2, 2018 related to

the establishing of liquidity contracts on shares as accepted

market practice and the standard contract of the Association

française des marchés financiers (AMAFI) dated January 15,

2019.

The following assets are allocated to the liquidity account for

the implementation of this agreement:

- 90,346 shares.

- 19,880,644.05 euros.

-----------------

Key financial dates:

- 2020 nine-month results: November 5, 2020 “Quiet

period1” starts October 6, 2020

- 2020 annual results: February 11, 2021 “Quiet period1”

starts January 12, 2021

- General Meeting of Shareholders: May 26, 2021

About Legrand

Legrand is the global specialist in

electrical and digital building infrastructures. Its comprehensive

offering of solutions for commercial, industrial and residential

markets makes it a benchmark for customers worldwide. The Group

harnesses technological and societal trends with lasting impacts on

buildings with the purpose of improving life by transforming the

spaces where people live, work and meet with electrical, digital

infrastructures and connected solutions that are simple, innovative

and sustainable. Drawing on an approach that involves all teams and

stakeholders, Legrand is pursuing its strategy of profitable and

sustainable growth driven by acquisitions and innovation, with a

steady flow of new offerings—including Eliot* connected products

with enhanced value in use. Legrand reported sales of close to €6.6

billion in 2019. The company is listed on Euronext Paris and is

notably a component stock of the CAC 40 and Euronext ESG 80

indexes. (code ISIN FR0010307819).

https://www.legrandgroup.com

*Eliot is a program launched in 2015 by Legrand to speed up

deployment of the Internet of Things in its offering. A result of

the group’s innovation strategy, Eliot aims to develop connected

and interoperable solutions that deliver lasting benefits to

private individual users and professionals.

https://www.legrandgroup.com/en/group/eliot-legrands-connected-objects-program

1 Period of time when all communication is suspended in the

run-up to publication of results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200731005423/en/

Investor relations Legrand Ronan Marc Tel: +33 (0)1 49 72

53 53 ronan.marc@legrand.fr

Press relations Publicis Consultants Vilizara Lazarova

Tel: +33 (0)1 44 82 46 34 Mob: +33 (0)6 26 72 57 14

vilizara.lazarova@publicisconsultants.com

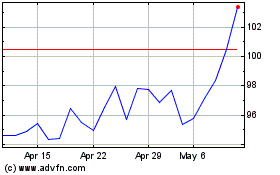

Legrand (EU:LR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Legrand (EU:LR)

Historical Stock Chart

From Apr 2023 to Apr 2024