Regulatory News:

Legrand (Paris:LR):

Consolidated key figures

2

Consolidated statement of income

3

Consolidated balance sheet

4

Consolidated statement of cash flows

6

Notes to the consolidated financial

statements

7

Consolidated key figures

(in € millions)

9 months 2019

9 months 2018

Net sales

4,888.9

4,437.4

Adjusted operating profit

998.5

907.9

As % of net sales

20.4 %

(1)

20.5%

20.8 % (1) before

acquisitions

(2)

Operating profit

931.3

854.3

As % of net sales

19.0 %

(1)

19.3%

Net profit attributable to the

Group

625.0

574.5

As % of net sales

12.8 %

(3)

12.9%

Normalized free cash flow

757.0

673.9

As % of net sales

15.5 %

(4)

15.2%

Free cash flow

671.6

441.6

As % of net sales

13.7 %

(4)

10.0%

Net financial debt at September

30

2,769.1

(5)

2,260.1

(1) Including a favorable impact of around +0.1 points linked to

implementation of the IFRS 16 standard. (2) At 2018 scope of

consolidation. (3) Implementation of the IFRS 16 standard does not

have a significant impact on the net profit attributable to the

Group. (4) Including a favorable impact of around +1.0 point linked

to implementation of the IFRS 16 standard. (5) Including €328.1

million of lease financial liabilities (implementation of the IFRS

16 standard since January 1, 2019).

Adjusted operating profit is defined as operating profit

adjusted for amortization and depreciation of revaluation of assets

at the time of acquisitions and for other P&L impacts relating

to acquisitions and, where applicable, for impairment of

goodwill.

Normalized free cash flow is defined as the sum of net cash from

operating activities - based on a working capital requirement

representing 10% of the last 12 month’s sales and whose change at

constant scope of consolidation and exchange rates is adjusted for

the period considered - and net proceeds of sales from fixed and

financial assets, less capital expenditure and capitalized

development costs.

Free cash flow is defined as the sum of net cash from operating

activities and net proceeds from sales of fixed and financial

assets, less capital expenditure and capitalized development

costs.

Net financial debt is defined as the sum of short-term

borrowings and long-term borrowings, less cash and cash equivalents

and marketable securities.

The reconciliation of consolidated key figures with the

financial statements is available in the appendices to the first

nine months 2019 results press release.

Consolidated statement of income

9 months ended

(in € millions)

September 30, 2019

September 30, 2018

Net sales

4,888.9

4,437.4

Operating expenses

Cost of sales

(2,345.4)

(2,108.3)

Administrative and selling

expenses

(1,313.9)

(1,202.6)

Research and development

costs

(232.9)

(205.2)

Other operating income

(expenses)

(65.4)

(67.0)

Operating profit

931.3

854.3

Financial expenses

(67.7)

(59.7)

Financial income

9.5

8.7

Exchange gains (losses)

0.9

7.0

Financial profit

(loss)

(57.3)

(44.0)

Profit before tax

874.0

810.3

Income tax expense

(246.9)

(235.0)

Share of profits (losses) of

equity-accounted entities

(1.3)

(0.3)

Profit for the period

625.8

575.0

Of which:

- Net income excluding

minority interests

625.0

574.5

- Minority interests

0.8

0.5

Basic earnings per share

(euros)

2.343

2.152

Diluted earnings per share

(euros)

2.322

2.133

Statement of comprehensive income

9 months ended

(in € millions)

September 30, 2019

September 30, 2018

Profit for the period

625.8

575.0

Items that may be reclassified

subsequently to profit or loss

Translation reserves

188.6

(12.5)

Cash flow hedges

0.2

0.0

Income tax relating to components

of other comprehensive income

6.7

5.6

Items that will not be

reclassified to profit or loss

Actuarial gains and losses after

deferred taxes

(14.2)

2.6

Other

0.0

0.0

Comprehensive income for the

period

807.1

570.7

Of which:

- Comprehensive income

attributable to the Group

806.2

570.3

- Minority interests

0.9

0.4

Consolidated balance sheet

(in € millions)

September 30, 2019

December 31, 2018

ASSETS

Non-current assets

Intangible assets

2,520.0

2,309.7

Goodwill

4,574.2

4,322.0

Property, plant and equipment

675.9

661.4

Right-of-use assets*

320.1

0.0

Investments in equity-accounted

entities

18.3

17.4

Other investments

2.8

2.1

Other non-current assets

37.4

14.3

Deferred tax assets

110.8

107.8

Total non-current

assets

8,259.5

7,434.7

Current assets

Inventories (Note 4)

945.2

885.9

Trade receivables (Note 5)

767.8

666.4

Income tax receivables

43.0

89.6

Other current assets

217.8

206.0

Other current financial

assets

1.8

1.2

Cash and cash equivalents

1,449.3

1,022.5

Total current assets

3,424.9

2,871.6

Total Assets

11,684.4

10,306.3

*out of which the €249.1 million transition impact of the IFRS

16 standard.

(in € millions)

September 30, 2019

December 31, 2018

EQUITY AND LIABILITIES

Equity

Share capital (Note 6)

1,068.8

1,070.0

Retained earnings

4,296.8

4,051.8

Translation reserves

(342.1)

(530.6)

Equity attributable to equity

holders of Legrand

5,023.5

4,591.2

Minority interests

10.1

5.9

Total equity

5,033.6

4,597.1

Non-current

liabilities

Long-term provisions

136.4

145.2

Provisions for post-employment

benefits

170.6

155.9

Long-term borrowings (Note 7)

3,592.3

2,918.6

Deferred tax liabilities

727.8

701.0

Total non-current

liabilities

4,627.1

3,920.7

Current liabilities

Trade payables

624.7

662.0

Income tax payables

50.5

31.5

Short-term provisions

95.8

87.9

Other current liabilities

625.8

605.2

Short-term borrowings (Note

7)

626.1

400.5

Other current financial

liabilities

0.8

1.4

Total current

liabilities

2,023.7

1,788.5

Total Equity and

Liabilities

11,684.4

10,306.3

Consolidated statement of cash flows

9 months ended

(in € millions)

September 30, 2019

September 30, 2018

Profit for the period

625.8

575.0

Adjustments for non-cash

movements in assets and liabilities:

– Depreciation and impairment of

tangible assets

81.6

74.1

– Amortization and impairment of

intangible assets

71.1

58.4

– Amortization and impairment of

capitalized development costs

16.1

19.4

– Amortization of right-of-use

assets

52.0

0.0

– Amortization of financial

expenses

2.0

1.9

– Impairment of goodwill

0.0

0.0

– Changes in long-term deferred

taxes

2.6

25.5

– Changes in other non-current

assets and liabilities

25.8

29.0

– Unrealized exchange

(gains)/losses

(1.9)

3.0

– Share of (profits) losses of

equity-accounted entities

1.3

0.3

– Other adjustments

(0.1)

0.4

– Net (gains)/losses on sales of

assets

3.2

2.8

Changes in working capital

requirement:

– Inventories (Note 4)

(13.8)

(125.3)

– Trade receivables (Note 5)

(49.4)

(99.3)

– Trade payables

(56.1)

13.7

– Other operating assets and

liabilities

22.7

(41.5)

Net cash from operating

activities

782.9

537.4

– Net proceeds from sales of

fixed and financial assets

6.5

4.7

– Capital expenditure

(93.0)

(75.3)

– Capitalized development

costs

(24.8)

(25.2)

– Changes in non-current

financial assets and liabilities

(4.4)

(0.5)

– Acquisitions of subsidiaries,

net of cash acquired

(389.1)

(87.7)

Net cash from investing

activities

(504.8)

(184.0)

– Proceeds from issues of share

capital and premium (Note 6)

4.9

12.8

– Net sales (buybacks) of

treasury shares and transactions under the liquidity contract (Note

6)

(17.1)

(38.8)

– Dividends paid to equity

holders of Legrand

(357.1)

(336.8)

– Dividends paid by Legrand

subsidiaries

0.0

(0.2)

– Proceeds from long-term

financing

402.7

404.7

– Repayment of long-term

financing (Note 7)

(54.3)

(400.0)

– Debt issuance costs

(5.4)

(3.7)

– Increase (reduction) in

short-term financing

155.4

16.2

– Acquisitions of ownership

interests with no gain of control

(2.3)

(39.9)

Net cash from financing

activities

126.8

(385.7)

Translation net change in cash

and cash equivalents

21.9

(5.2)

Increase (decrease) in cash

and cash equivalents

426.8

(37.5)

Cash and cash equivalents at the

beginning of the period

1,022.5

823.0

Cash and cash equivalents at

the end of the period

1,449.3

785.5

Items included in cash flows:

– Interest paid* during the

period

66.8

71.4

– Income taxes paid during the

period

177.0

189.2

* Interest paid is included in the net cash from operating

activities.

Notes to the consolidated financial statements

Note 1 - Introduction

This unaudited consolidated financial information is presented

for the nine months ended September 30, 2019. It should be read in

conjunction with consolidated financial statements for the year

ended December 31, 2018 such as established in the Registration

Document deposited under visa no D.19-0306 with the French

Financial Markets Authority (AMF) on April 10, 2019.

All the amounts are presented in millions of euros unless

otherwise indicated. Some totals may include rounding

differences.

The consolidated financial statements have been prepared in

accordance with the International Financial Reporting Standards

(IFRS) and International Financial Reporting Interpretations

Committee (IFRIC) interpretations adopted by the European Union and

applicable or authorized for early adoption from January 1,

2019.

None of the IFRS standards issued by the International

Accounting Standards Board (IASB) that have not been adopted for

use in the European Union are applicable to the Group.

The IFRS 16 standard was applied from January 1, 2019 using the

simplified retrospective transition method ("cumulative catch-up"

method). As a result, the 2018 comparative period has not been

restated.

Main impacts resulting from the implementation of this standard

are mentioned in the consolidated key figures and were explained in

Note 1.2.1.3 of the consolidated financial statements as of

December 31, 2018.

Note 2 – Significant transactions and events for the

period

Apart from the points mentioned in this document, no significant

transactions or events are to be reported over the period.

Note 3 - Changes in the scope of consolidation

The contributions to the Group’s consolidated financial

statements of companies acquired since January 1, 2018 were as

follows:

2018

March 31

June 30

September 30

December 31

Full consolidation

method

Modulan

Balance sheet only

Balance sheet only

6 months' profit

9 months' profit

GemNet

Balance sheet only

Balance sheet only

7 months' profit

Shenzen Clever Electronic

Balance sheet only

6 months' profit

Kenall

Balance sheet only

Debflex

Balance sheet only

Netatmo

Balance sheet only

Trical

Balance sheet only

2019

March 31

June 30

September 30

Full consolidation

method

Modulan

3 months' profit

6 months' profit

9 months' profit

GemNet

3 months' profit

6 months' profit

9 months' profit

Shenzen Clever Electronic

3 months' profit

6 months' profit

9 months' profit

Kenall

3 months' profit

6 months' profit

9 months' profit

Debflex

Balance sheet only

6 months' profit

9 months' profit

Netatmo

Balance sheet only

6 months' profit

9 months' profit

Trical

Balance sheet only

6 months' profit

9 months' profit

Universal Electric

Balance sheet only

6 months' profit

The main acquisition carried out in the first nine months of

2019 was Universal Electric Corporation, the US leader in busways.

Universal Electric Corporation reports annual sales of over $175

million.

In all, acquisitions of subsidiaries (net of cash acquired) came

to a total of €389.1 million in the first nine months of 2019 (plus

€2.3 million for acquisitions of ownership interests without gain

of control), versus €87.7 million in the first nine months of 2018

(plus €39.9 million for acquisitions of ownership interests without

gain of control).

Note 4 - Inventories

Inventories are as follows:

(in € millions)

September 30, 2019

December 31, 2018

Purchased raw materials and

components

378.0

347.6

Sub-assemblies, work in

progress

111.4

98.5

Finished products

598.4

563.7

Gross value at the end of the

period

1,087.8

1,009.8

Impairment

(142.6)

(123.9)

Net value at the end of the

period

945.2

885.9

Note 5 - Trade receivables

Trade receivables are as follows:

(in € millions)

September 30, 2019

December 31, 2018

Trade receivables

855.2

750.4

Impairment

(87.4)

(84.0)

Net value at the end of the

period

767.8

666.4

Note 6 - Share capital

Share capital as of September 30, 2019 amounted to

€1,068,828,524 represented by 267,207,131 ordinary shares with a

par value of €4 each, for 267,207,131 theoretical voting rights and

266,905,487 exercisable voting rights (after subtracting shares

held in treasury by the Group as of this date).

As of September 30, 2019, the Group held 301,644 shares in

treasury, versus 905,347 shares as of December 31, 2018, i.e.

603,703 fewer shares corresponding to:

- the net acquisition of 600,000 shares outside of the liquidity

contract;

- the transfer of 331,335 shares to employees under performance

share plans;

- the cancellation of 550,000 shares;

- the net sale of 322,368 shares under the liquidity contract

(Note 6.2.2).

As of September 30, 2019, among the 301,644 shares held in

treasury by the Group, 273,793 shares have been allocated according

to the allocation objectives described in Note 6.2.1, and 27,851

shares are held under the liquidity contract.

6.1 Changes in share capital

Number of shares

Par value

Share capital (euros)

Premiums (euros)

As of December 31, 2018

267,495,149

4

1,069,980,596

721,214,426

Exercise of options under the

2009 plan

82,578

4

330,312

728,173

Exercise of options under the

2010 plan

179,404

4

717,616

3,095,870

Cancellation of shares

(550,000)

4

(2,200,000)

(32,734,305)

Repayment of paid-in capital*

(146,768,602)

As of September 30, 2019

267,207,131

4

1,068,828,524

545,535,562

*Portion of dividends distributed in June 2019 deducted from the

premium account.

On February 13, 2019, the Board of Directors decided the

cancellation of 550,000 shares acquired under the share buyback

program (shares bought back in 2018). The €32,734,305 difference

between the buy-back price of the cancelled shares and their par

value was deducted from the premium account.

In the first nine months of 2019, 261,982 shares were issued

under the 2009 and 2010 stock option plans, resulting in a capital

increase representing a total amount of € 4.9 million (premiums

included).

6.2 Share buybacks and transactions under the liquidity

contract

As of September 30, 2019, the Group held 301,644 shares in

treasury (905,347 as of December 31, 2018, of which 555,128 under

the share buyback program and 350,219 under the liquidity contract)

which can be analyzed as follows:

6.2.1 Share buybacks

During the first nine months of 2019, the Group acquired 600,000

shares, at a cost of €36.7 million.

As of September 30, 2019, the Group held 273,793 shares,

acquired at a total cost of €16.8 million. These shares are being

held for the following purposes:

- for allocation, upon exercise of performance share plans, of

8,793 shares purchased at a cost of €0.5 million; and

- for cancellation of 265,000 shares acquired at a cost of €16.3

million.

6.2.2 Liquidity contract

On May 29, 2007, the Group appointed a financial institution to

maintain a liquid market for its ordinary shares on the Euronext™

Paris market under a liquidity contract complying with the Code of

Conduct issued by the AMAFI (French Financial Markets Association)

approved by the AMF on March 22, 2005. €15.0 million in cash was

allocated by the Group to the liquidity contract.

As of September 30, 2019, the Group held 27,851 shares under

this contract, purchased at a total cost of €1.8 million.

During the first nine months of 2019, transactions under the

liquidity contract led to a cash inflow of €19.6 million

corresponding to the net sales of 322,368 shares.

Note 7 - Long-term and short-term borrowings

7.1 Long-term borrowings

Long-term borrowings can be analyzed as follows:

(in € millions)

September 30, 2019

December 31, 2018

Bonds

2,900.0

2,500.0

Yankee bonds

358.0

340.4

Lease financial liabilities

265.5

6.5

Other borrowings

87.8

87.3

Long-term borrowings excluding

debt issuance costs

3,611.3

2,934.2

Debt issuance costs

(19.0)

(15.6)

Total

3,592.3

2,918.6

7.2 Short-term borrowings

Short-term borrowings can be analyzed as follows:

(in € millions)

September 30, 2019

December 31, 2018

Negotiable commercial paper

500.0

363.5

Lease financial liabilities

62.6

1.5

Other borrowings

63.5

35.5

Total

626.1

400.5

7.3 Changes in long-term and short-term borrowings

Changes in long-term and short-term borrowings can be analyzed

as follows:

September 30, 2019

Cash flows

Variations not impacting cash

flows

December 31, 2018

(in € millions)

Acquisitions

Reclassifications

Translation

adjustments

Other

Long-term borrowings

3,592.3

398.2

25.5

(56.6)

24.5

282.1

2,918.6

Short-term borrowings

626.1

100.2

8.9

56.6

3.5

56.4

400.5

Gross financial debt

4,218.4

498.4

34.4

0.0

28.0

338.5*

3,319.1

*out of which the €270.2 million transition impact of the IFRS

16 standard.

Note 8 - Segment information

In accordance with IFRS 8, operating segments are determined

based on the reporting made available to the chief operating

decision maker of the Group and to the Group's management.

- Europe, including France, Italy and Rest of Europe (mainly

including Benelux, Germany, Iberia (including Portugal and Spain),

Poland, Russia, Turkey, and the United Kingdom);

- North and Central America, including Canada, Mexico, the United

States, and Central American countries; and

- Rest of the world, mainly including Australia, China, India,

Saudi Arabia and South America (including particularly Brazil,

Chile and Colombia).

These three operating segments are under the responsibility of

three segment managers who are directly accountable to the chief

operating decision maker of the Group.

The economic models of subsidiaries within these segments are

quite similar. Indeed, their sales are made up of electrical and

digital building infrastructure products in particular to

electrical installers, sold mainly through third-party

distributors.

9 months ended September 30,

2019

North and

Rest

Europe

central

of the

(in € millions)

America

world

Total

Net sales to third

parties

2,033.9

1,935.0

920.0

4,888.9

Cost of sales

(896.7)

(933.3)

(515.4)

(2,345.4)

Administrative and selling

expenses, R&D costs

(660.3)

(640.2)

(246.3)

(1,546.8)

Other operating income

(expenses)

(27.2)

(30.3)

(7.9)

(65.4)

Operating profit

449.7

331.2

150.4

931.3

- of which acquisition-related

amortization, expenses and income

· accounted for in administrative

and selling expenses, R&D costs

(10.0)

(47.4)

(9.8)

(67.2)

· accounted for in other

operating income (expenses)

0.0

- of which goodwill

impairment

0.0

Adjusted operating

profit

459.7

378.6

160.2

998.5

- of which depreciation

expense

(46.6)

(16.8)

(17.9)

(81.3)

- of which amortization

expense

(6.5)

(1.6)

(0.6)

(8.7)

- of which amortization of

development costs

(15.1)

0.0

(1.0)

(16.1)

- of which amortization of

right-of-use assets

(19.9)

(17.6)

(14.5)

(52.0)

- of which restructuring

costs

(9.3)

(2.4)

(6.2)

(17.9)

Capital expenditure

(65.2)

(13.3)

(14.5)

(93.0)

Capitalized development costs

(23.6)

0.0

(1.2)

(24.8)

Net tangible assets

411.2

137.5

127.2

675.9

Total current assets

1,704.6

1,002.1

718.2

3,424.9

Total current liabilities

1,231.3

377.4

415.0

2,023.7

9 months ended September 30,

2018

North and

Rest

Europe*

central

of the

(in € millions)

America

world

Total

Net sales to third

parties

1,933.2

1,650.1

854.1

4,437.4

Cost of sales

(837.6)

(796.1)

(474.6)

(2,108.3)

Administrative and selling

expenses, R&D costs

(619.1)

(557.7)

(231.0)

(1,407.8)

Other operating income

(expenses)

(30.6)

(16.9)

(19.5)

(67.0)

Operating profit

445.9

279.4

129.0

854.3

- of which acquisition-related

amortization, expenses and income

· accounted for in administrative

and selling expenses, R&D costs

(4.7)

(39.1)

(7.6)

(51.4)

· accounted for in other

operating income (expenses)

(2.2)

0.0

0.0

(2.2)

- of which goodwill

impairment

0.0

Adjusted operating

profit

452.8

318.5

136.6

907.9

- of which depreciation

expense

(43.6)

(13.9)

(17.6)

(75.1)

- of which amortization

expense

(5.9)

(2.1)

(0.6)

(8.6)

- of which amortization of

development costs

(18.8)

0.0

(0.6)

(19.4)

- of which amortization of

right-of-use assets

0.0

- of which restructuring

costs

(5.4)

(0.1)

(2.9)

(8.4)

Capital expenditure

(53.0)

(9.8)

(12.5)

(75.3)

Capitalized development costs

(23.6)

0.0

(1.6)

(25.2)

Net tangible assets

387.6

100.1

116.2

603.9

Total current assets

1,125.4

731.5

761.8

2,618.7

Total current liabilities

799.3

299.6

399.8

1,498.7

* For the 9-month period ended September 30, 2018, the

presentation of the published data has been modified to reflect the

change in operating segments starting January 1, 2019.

Note 9 - Subsequent events

The Group acquired Connectrac, an innovative US company

specializing in over-floor power and data distribution for new

construction and renovation of commercial buildings. Connectrac

reports annual sales of around $20 million.

Furthermore, subject to standard conditions precedent, the Group

acquired Jobo Smartech. Chinese leader in connected management

solutions dedicated to China’s hotel segment, Jobo Smartech

generates annual sales of over €10 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191107005780/en/

LEGRAND

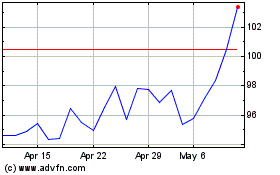

Legrand (EU:LR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Legrand (EU:LR)

Historical Stock Chart

From Apr 2023 to Apr 2024