- 2021 outlook confirmed, including improved activity and

recurring margin in H2 2021 excluding the positive impact of the

acquisition of TAC

- First half 2021 results still impacted by the effects of the

crisis, but we expect the first quarter to be the low

point

- Reported financials include the Bombardier's electrical

wiring business in Querétaro (Mexico) from February 1, 2021,

onwards, and Technical Airborne Components (TAC) as of May 1,

20211

Major post-closing events

Strengthening of the Group's balance sheet: capital increase

of €222.4 million completed on August 4, 2021 and obtention of €130

million in French State backed loans (PGE); these resources will

enable the Group to pursue its external growth strategy and secure

its liquidity.

Regulatory News:

Latécoère (Paris:LAT), a tier 1 partner to major international

aircraft manufacturers, today announced that its Board of Directors

under the Chairmanship of Pierre Gadonneix, at their meeting on

September 13, 2021, adopted Latécoère’s financial statements for

the six-month period ended June 30, 2021.

Thierry Mootz, Group Chief Executive Officer, stated:

“The recapitalization of Latécoère was a success giving us the

means of our growth ambitions. H1 results have been impacted by the

Covid-19 crisis and it seems that the lowest level of activity has

been reached during this period.”

Adjusted results for the first half of 2021

Preamble

In order to better monitor and compare its operating and

financial performance, the Group has decided to disclose adjusted

financial statements alongside the consolidated financial

statements. The explanation of the restatements is presented in the

appendix to this press release.

All figures are expressed in adjusted figures, unless otherwise

stated.

(Adjusted data - € thousand)

Jun, 30 2021

Jun 30, 2020 Revenue

181.1

231.9

Reported growth

-21.9

%

-37.6

%

On like-for-like and constant exchange rate basis

-31.7

%

-36.8

%

Recurring EBITDA *

(23.0

)

(14.1

)

Recurring EBITDA margin on revenue

-12.7

%

-6.1

%

Recurring operating income

(36.5

)

(30.8

)

Recurring EBIT margin on revenue

-20.2

%

-13.3

%

Non recurring items

(2.8

)

(34.6

)

Impairment depreciation

(28.2

)

Other non recurring items

(2.8

)

(6.4

)

Operating income

(39.3

)

(65.4

)

Net Cost of debt

(1.4

)

(1.6

)

Other financial income/(expense)

(14.2

)

(10.7

)

Financial result

(15.6

)

(12.3

)

Income tax

(1.7

)

(12.1

)

Net result

(56.6

)

(89.8

)

Operating free cash flows

(16.7

)

(5.2

)

* Adjusted recurring EBITDA corresponds to recurring operating

income before recurring amortization, depreciation and impairment

losses. Details of non-recurring items are presented in the Group's

accounting principles from consolidation financial statements.

Latécoère's half-year financial results for 2021 reflect the low

level of production in the aeronautical sector as a whole. As

previously indicated, the crisis continued into the first half of

2021, reaching its low point in the period. Overall, in the first

half of 2021, the Group's revenue decreased by (21.9)% to €181.1

million on a reported basis or (31.7)% on a like-for-like basis,

with all business segments being affected. It should be noted that

the 2020 business activity included a pre-covid 1st quarter

2020.

Recurring EBITDA in the first half of 2021 amounted to €(23.0)

million, representing a margin of (12.7)%, in decline from the

first half of 2020. Latécoère's current operating income in the

first half of 2021 amounted to €(36.5) million, compared to €(30.8)

million for the same period in 2020.

Latécoère's net financial result amounted to €(15.6) million in

the first half of 2021 compared to €(12.3) million in the first

half of 2020. Other financial income and expenses include the

impact of the amortisation of the shareholder loan for an amount of

€(16.4) million following the early repayment of the shareholder

loan in August 2021 for an amount of €52.5 million in accordance

with the conciliation protocol approved on July 2, 2021.

The Group's net result amounted to €(56.6) million in the first

half of 2021 compared to a loss of €(89.9) million which included

notably an asset impairment of the Aerostructures division of

€(28.2) million.

Free cash flow from operations for the period was €(16.7)

million compared to €(5.2) million a year ago.

Net debt increased by €64.4 million (€40.6 million excluding

IFRS 16) and includes the impact of the accelerated amortisation of

the shareholder loan of €16.4 million, the change in lease

liabilities of €23.4 million (mainly related to the lease of the

Group's new headquarters) and a deterioration in cash and cash

equivalents of €22.1 million. The cash position at June 30, 2021

amounts to €55.6 million.

Adaptation plan

Following previous announcements made, Latécoère has continued

to further adjust its cost base and industrial footprint to ensure

its long-term sustainability in the post Covid-19 reality.

Aerostructures

Revenue in Latécoère's Aerostructures Division declined by

(36.5)% at constant exchange rates and scope of consolidation, or

by (32.9)% on a reported basis for the first half of 2021.

The division's activity was penalised by low production rates

and the temporary stoppage of production by one of the Group's

customers.

In this context, the division's activity reached a low point in

the first quarter of 2021 and amounted to €82.8 million in the

first half of 2021 compared to €123.5 million for the same period

in 2020.

The division's recurring EBITDA amounted to €(13.5) million

compared to €(6.6) million in H1 2020, with lower production rates

partially offset by a reduction in operating costs in response to

the Covid-19 crisis.

It should be noted that the division's results take into account

the activity of Technical Airborne Components (TAC) since the end

of April 2021.

Aerostructures(Adjusted data - € thousand) Jun 30, 2021

Jun 30, 2020 Consolidated revenue

82.8

123.5

On like-for-like and constant exchange rate basis

-36.5

%

-41.7

%

Inter-segment revenue

10.2

11.1

Revenue

93.1

134.6

Recurring EBITDA *

(13.5

)

(6.6

)

Recurring EBITDA margin on revenue

-14.5

%

-4.9

%

Recurring operating income

(21.0

)

(15.1

)

Recurring EBIT margin on revenue

-22.6

%

-11.2

%

* Recurring EBITDA corresponds to recurring operating income

before recurring amortization, depreciation and impairment losses.

Details of non-recurring items are presented in the Group's

accounting principles from consolidation financial statements.

Interconnection Systems

The revenue of €98.3 million was down (26.3)% at constant

exchange rates and perimeter and (9.4)% on a reported basis,

compared to €108.5 million in the first half of 2020. This decrease

is attributable to the base effect between the pre-covid first

quarter of 2020 and the first quarter of 2021. The change in

revenue on a reported basis is due to lower production rates,

particularly on the A350 and ATR programs, partially offset by the

integration of the Bombardier activity for €18.9 million in the

first half of 2021.

Recurring EBITDA for the Interconnection Systems reached €(9.5)

million, compared to €(7.5) million in H1 2020, affected similarly

by the decline in production rates.

Interconnection Systems(Adjusted - € thousand) Jun 30, 2021

Jun 30, 2020 Consolidated revenue

98.3

108.5

On like-for-like and constant exchange rate basis

-26.3

%

-30.2

%

Inter-segment revenue

0.5

0.5

Revenue

98.8

108.9

Recurring EBITDA *

(9.5

)

(7.5

)

Recurring EBITDA margin on revenue

-9.6

%

-6.9

%

Recurring operating income

(15.6

)

(15.7

)

Recurring EBIT margin on revenue

-15.7

%

-14.5

%

* Recurring EBITDA corresponds to recurring operating income

before recurring amortization, depreciation and impairment losses.

Details of non-recurring items are presented in the Group's

accounting principles from consolidation financial statements.

Confirmation of 2021 outlook

Following the Company’s FY 2020 results press release published

on March 16, 2021, and the amendment to the Latécoère 2020

Universal Registration Document filed on July 13, 2021, Latécoère

is confirming the guidance previously published excluding the

impact of acquisitions.

As a reminder, the Group's outlook for 2021 is as follows:

- Revenue will be around 25% lower than in 2020 on an organic

basis. On a reported basis, the decline is expected to be around

(10)%;

- Recurring EBITDA will improve by around 20% from FY 2020

levels, demonstrating the Group's strong fundamentals as it

completes its adaptation plan; however, it will remain

negative;

- Free Cash Flow from operations will remain negative partly due

to the roll-out of the adaptation plan.

Post-closing events

Recapitalisation and strengthening of the Group's

liquidity

In accordance with the terms of the conciliation protocol

approved on July 7, 2021, the Group conducted recapitalization

operations, the main measures of which are as follows:

- Capital increase completed at the beginning of August for an

amount of €222.4 million, resulting in the issue of 436,165,182 new

shares at a unit subscription price of €0.51;

- Obtention of new state guaranteed loans (PGE) in the amount of

€130 million;

- Rescheduling of the repayment schedules of existing PGE and

postponement of the maturity of loans contracted with the European

Investment Bank (EIB) to 2027.

The proceeds from this recapitalisation were used to repay the

shareholder loan for an amount of €52.5 million on September 6,

2021, and to finance the acquisition of Technical Airborne

Components Industries (TAC) closed on August 31, 2021. The balance

of the proceeds will be used to achieve external growth operations

and more generally to finance the general needs of the Group, in

the short and medium term.

Acquisition of Technical Airborne Components (TAC)

On August 31, 2021, the Group definitively acquired Technical

Airborne Components (TAC), based in Belgium (Liège), from

Searchlight Capital Partners. The investment company had acquired

TAC from TransDigm Group Incorporated in April of this year and the

Group held an option to purchase the company from Searchlight

Capital Partners since that date. With a turnover of approximately

€25 million and nearly 150 employees, TAC supplies parts for

commercial aircraft, regional and business jets, helicopters, as

well as for several military and space programmes.

About Latécoère

As a "Tier 1" international partner of the world's major

aircraft manufacturers (Airbus, Boeing, Bombardier, Dassault,

Embraer and Mitsubishi Aircraft), Latécoère is active in all

segments of the aeronautics industry (commercial, regional,

business and military aircraft), in two areas of activity:

- Aerostructures (55% of turnover): fuselage sections and

doors,

- Interconnection Systems (45% of turnover): wiring, electrical

furniture and on-board equipment.

As of December 31, 2020, the Group employed 4,172 people in 13

different countries. As of August 31, 2021, Latécoère, a French

limited company capitalised at €132,745,925 divided into

530,983,700 shares with a par value of €0.25, is listed on Euronext

Paris - Compartment B, ISIN Codes: FR0000032278 - Reuters: LAEP.PA

- Bloomberg: LAT.FP.

Appendix – Table of content

Reconciliation of the consolidated financial statements to

the adjusted financial statements

In order to better monitor and compare its operating and

financial performance, the Group presents, in parallel with the

consolidated financial statements, adjusted financial

statements:

- for the foreign exchange result of instruments not eligible

for hedge accounting under IFRS. This result, presented as

financial result in the consolidated financial statements, is

reclassified as revenue (operating result) in the adjusted

financial statements, - for changes in fair value, which include

all changes in the fair value of derivatives not eligible for hedge

accounting and relating to flows in future periods and the

revaluation at the hedged rate of balance sheet positions (trade

receivables and trade payables denominated in USD), the amount of

which is presented in operating income. - changes in deferred taxes

resulting from these items are also adjusted if necessary.

Income statement for the 1st half of 2021

('000 EURO) Hedging

ConsolidatedincomestatementJune 30, 2021 Exchangerate

result Change infair value

Adjusted

incomestatementJune 30, 2021

Revenue

178 476

2 590

181 066

Other operating revenue

460

460

Change in inventory : work-in-progress & finished goods

-7 997

-7 997

Raw material, Other Purchases & external charges

-118 519

-118 519

Personnel expenses

-78 758

-78 758

Taxes

-2 431

-2 431

Amortization

-13 554

-13 554

Net operating provisions charge

-3 609

-3 609

Net depreciation of current assets

819

819

Other operating income

6 308

220

6 528

Other operating expenses

-543

-543

RECURRING OPERATING INCOME

-39 348

2 590

220

-36 538

Operating Income / Sales

-22.05%

-20.18%

Other non-recurring operating

income and expenses

-2 753

-2 753

OPERATING INCOME

-42 101

2 590

220

-39 291

Net Cost of debt

-1 428

-1 428

Foreign Exchange gains / losses

5 730

-2 590

-438

2 702

Change in fair value of financial derivative instruments

2 784

-2 784

0

Other financial incomes and expenses

-16 903

-16 903

FINANCIAL RESULT

-9 816

-2 590

-3 222

-15 628

Income tax

-1700

-1 700

NET RESULT FOR THE PERIOD

-53 617

0

-3 002

-56 619

• Of which, Owners of the parent

-53 617

0

-3 002

-56 619

• Of which, non controlling interests

0

0

0

0

Income statement for the 1st half of 2020

('000 EURO) Hedging

ConsolidatedincomestatementJune 30, 2020 Exchangerate

result Change infair value

Adjusted

incomestatementJune 30, 2020

Revenue

231 917

231 917

Other operating revenue

306

306

Change in inventory : work-in-progress & finished goods

-6 751

-6 751

Raw material, Other Purchases & external charges

-148 475

-148 475

Personnel expenses

-90,395

-90,395

Taxes

-3 927

-3 927

Amortization

-16 727

-16 727

Net operating provisions charge

870

870

Net depreciation of current assets

-4 519

-4 519

Other operating income

6,648

3,190

9,838

Other operating expenses

-2 915

-2,915

RECURRING OPERATING INCOME

-33 967

2,590

3 190

-30 777

Operating Income / Sales

-14.65%

-13,27%

Other non-recurring operating

income and expenses

-34 627

-34 627

OPERATING INCOME

-68,594

0

3,190

-65,404

Net Cost of debt

-1,599

-1,599

Foreign Exchange gains / losses

-9,830

282

-9,549

Change in fair value of financial derivative instruments

-755

755

0

Other financial incomes and expenses

-1,111

-1,111

FINANCIAL RESULT

-13,295

0

1,037

-12,258

Income tax

-12,128

-12,128

NET RESULT FOR THE PERIOD

-94,016

0

4,227

-89,789

• Of which, Owners of the parent

-94,016

0

4,227

-89,789

• Of which, non controlling interests

0

0

0

0

Half-Year Consolidated financial statements (IFRS)

Consolidated Income statement

('000 EURO)

Jun 30, 2021 Jun 30, 2020

Revenue

178 476

231 917

Other operating revenue

460

306

Change in inventory: work-in-progress & finished goods

-7 997

-6 751

Raw material, Other Purchases & external charges

-118 519

-148 475

Personnel expenses (*)

-78 758

-90 395

Taxes

-2 431

-3 927

Amortization

-13 554

-16 727

Net operating provisions charge

-3 609

870

Net depreciation of current assets

819

-4 519

Other operating income (*)

6 308

6 648

Other operating expenses

-543

-2 915

RECURRING OPERATING INCOME

-39 348

-33 967

Other non-recurring operating income and

expenses

-2 753

-34 627

OPERATING INCOME

-42 101

-68 594

Net Cost of debt

-1 428

-1 599

Foreign Exchange gains/losses

5 730

-9 830

Change in fair value of financial derivative instruments

2 784

-755

Other financial incomes and expenses

-16 903

-1 111

FINANCIAL RESULT

-9 816

-13 295

Income tax

-1 700

-12 128

NET RESULT FOR THE PERIOD

-53 617

-94 016

• Of which, Owners of the parent

-53 617

-94 016

• Of which, Non-controlling interests

0

0

(*) At June 30, 2020, a reclassification was made from "Other

operating income" to "Personnel expenses" for €3.9 million

following the reallocation of a part of operating expenses

transfer.

Half-Year Consolidated Balance sheet

('000 EURO)

Jun 30, 2021 Dec 30, 2021

Goodwill

23 177

0

Intangible assets

60 994

56 022

Tangible assets

152 037

154 155

Other financial assets

4 800

4 291

Deferred tax assets

547

684

Financial derivative instruments

0

0

Other non-current assets

422

129

TOTAL NON-CURRENT ASSETS

241 977

215 282

Inventories

127 150

115 122

Accounts receivable

82 354

65 269

Tax receivable

11 821

11 509

Financial derivative instruments

4 371

3 347

Other current assets

2 722

1 816

Cash & Cash Equivalents

55 561

77 614

TOTAL CURRENT ASSETS

283 979

274 676

TOTAL ASSETS

525 956

489 957

('000 EURO)

Jun 30, 2021 Dec 31, 2020

Share capital

23 705

189 637

Share premium

213 658

213 658

Treasury stock

-459

-455

Other reserves

-198 809

-177 595

Derivatives future cash flow hedges

370

509

Group net result

-53 617

-189 566

EQUITY ATTRIBUTABLE TO PARENT OWNERS

-15 153

36 188

NON-CONTROLLING INTERESTS

0

0

TOTAL EQUITY

-15 153

36 188

Loans and bank borrowings

204 525

215 546

Refundable Advances

21 724

22 359

Employee benefits

17 403

17 770

Non-current provisions

25 510

26 445

Deferred tax liabilities

51

29

Financial derivative instruments

0

0

Other non-current liabilities

5 062

3 650

TOTAL NON-CURRENT LIABILITIES

270 276

285 799

Loans and bank borrowings (less than 1 year)

63 043

9 707

Refundable Advances

2 254

2 254

Current provisions

24 577

18 096

Accounts payable

140 801

89 480

Income tax liabilities

1 222

2 745

Contracts liabilities

35 736

38 982

Other current liabilities

1 974

3 844

Financial derivative instruments

1 226

2 863

TOTAL CURRENT LIABILITIES

270 832

167 970

TOTAL LIABILITIES

541 108

453 769

TOTAL EQUITY & LIABILITIES

525 956

489 957

Half-Year Consolidated cash flow statement

('000 EURO)

Jun 30, 2021 Jun 30, 2020

Net result for the period

-53 617

-94 016

Adjustments related to non-cash activities

: Depreciation and provisions

15 571

46 445

Fair value gains/losses

-2 784

755

Net (gains)/losses on disposal of assets

290

71

Other non-cash items

16 528

1 874

CASH FLOWS AFTER COST OF DEBT AND INCOME TAXES

-24 011

-44 871

Income taxes

1 700

12 128

Net Cost of debt

1 435

1 593

CASH FLOWS BEFORE COST OF DEBT AND INCOME TAXES

-20 876

-31 150

Changes in inventories net of provisions

10 999

-3 841

Changes in client and other receivables net of provisions

-7 585

69 795

Changes in suppliers and other payables

7 671

-33 579

Income tax paid

-3 095

-1 248

CASH FLOWS FROM OPERATING ACTIVITIES

-12 887

-23

Effect of changes in group structure (*)

3 973

0

Purchase of tangible and intangible assets (including changes in

payables to fixed asset suppliers)

-10 449

-6 494

Purchase of financial assets

0

0

Increase (decrease) in loans and advances made

-504

57

Proceeds from sale of tangible and intangible assets

92

1

Dividends received

0

0

CASH FLOWS FROM INVESTING ACTIVITIES

-6 888

-6 436

Purchase or disposal of treasury shares

-4

1 296

Proceeds from borrowings

1 562

60 000

Repayments of borrowings

0

0

Repayments of lease liabilities

-2 815

-2 816

Financial interest paid

-1 516

-1 448

Dividends paid

0

0

Flows from refundable advances

-635

-594

Other flows from financing operation

811

-38 538

CASH FLOW FROM FINANCING ACTIVITIES

-2 596

17 900

Of which financing flows provided / (used) by discontinued

operations* Effects of exchange

rate changes

270

-777

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

-22 102

10 664

Opening cash and cash equivalents position

77 589

33 762

Closing cash and cash equivalents position

55 487

44 426

(*) Composed of opening cash of Technical Airborne Components

(TAC) and put option on this company paid in April 2021

____________________ 1 In accordance with IFRS 10, the Group has

controlled Technical Airborne Components (TAC) since the date of

acquisition of the company's call option.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210913005926/en/

Taddeo Antoine Denry / Investor Relations +33 (0)6 18 07

83 27

Marie Gesquière / Media Relations +33 (0)6 26 48 97 98

teamlatecoere@taddeo.fr

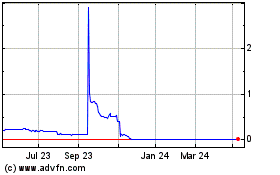

Latecoere (EU:LAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

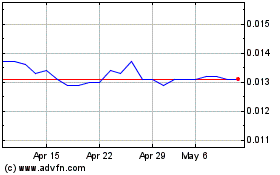

Latecoere (EU:LAT)

Historical Stock Chart

From Apr 2023 to Apr 2024