Not to be published, distributed or circulated

directly or indirectly in the United States, Canada, Australia or

Japan.

This press release is an advertisement and not

a prospectus within the meaning of Regulation (EU) 2017/1129.

Regulatory News:

Latécoère (Paris:LAT) (the “Company”), a tier 1 partner

to major international aircraft manufacturers, announces today the

success of its capital increase with preferential subscription

rights for an amount, issue premium included, of approximately

€222.4 million (the “Capital Increase”), after total

exercise of the extension clause.

Thierry Mootz, CEO of Latécoère declared: “We would like

to thank all of our shareholders who actively contributed to the

Capital Increase’s success. This Capital Increase will allow the

Company to strengthen its financial flexibility in order to address

the difficulties related to the Covid-19 crisis and accelerate its

transformation plan. Additionally, the Group is now in position to

seize external growth opportunities that will create value for its

clients and shareholders.”

RESULTS OF THE CAPITAL INCREASE

Following the subscription period which ended on July 28th,

2021, total demand amounted to approximately €244.4 million

(including the subscription on a reducible basis of Searchlight

Capital Partners), representing a subscription rate of 126.4%

before exercising the extension clause:

- 345,024,820 new shares have been subscribed on an irreducible

basis (“à titre irréductible”) representing approximately 91% of

the shares to be issued (before exercising the extension

clause);

- 134,275,122 new shares have been applied for on a reducible

basis (“à titre réductible”);

- The Company thus decided to exercise all of the extension

clause. Consequently, the extension clause will be allocated with

56,891,110 new shares.

The gross proceeds of the Capital Increase (issue premium

included) will thus amount to 222,444,242.82 euros, with the issue

of 436,165,182 new shares at a subscription price of €0.51 per

share.

IMPACT OF THE CAPITAL INCREASE ON THE ALLOCATION OF THE SHARE

CAPITAL

As a result of the Capital Increase, the Company’s share capital

will amount to €132,745,925 divided in 530,983,700 shares.

Searchlight Capital Partners (through the company SCP SKN

Holding I SAS), that committed, irrevocably, (i) to exercise all

its rights on an irreducible basis and subscribe to new shares for

a total amount of €126,925,125.96, representing approximately 65.6%

of the initial amount (excluding extension clause) of the Capital

Increase and (ii) to subscribe on a reducible basis to 130,401,276

new shares, will hold 400,244,882 shares after the Capital

Increase, representing 75.4 % of the Company’s share capital.

INDICATIVE TIMETABLE FOR THE CAPITAL INCREASE

The issue, settlement and delivery and start of trading of the

New Shares on the regulated market of Euronext Paris are expected

to take place on August 4th, 2021. The New Shares will immediately

entitle their holders to receive dividends declared by Latécoère as

from the date of issuance. They will be immediately fungible with

existing shares of the Company and will be traded on the same

trading line under the same ISIN code FR0000032278.

The Capital Increase was conducted by Société Générale acting as

Global Coordinator and Bookrunner.

LOCK-UP COMMITMENTS

The Company has agreed to a lock-up period starting on the date

of the approval by the French Autorité des Marchés Financiers (the

“AMF”) of the Prospectus relating to the Capital Increase

and expiring 90 calendar days following the settlement- delivery

date of the New Shares, subject to (i) the possibility to implement

the Reserved Capital Increase, as defined below and (ii) to certain

customary exceptions.

In the context of the authorisation granted by the French

Ministry of Economy and Finance pursuant to the foreign investment

regulations applicable in France, a potential reserved share

capital increase is contemplated, on the basis of the 29th

resolution of the Company's combined general shareholders' meeting

of May 21st, 2021, with a view to give access to at least 10% of

the share capital and voting rights of the Company to one or more

French investors selected with the prior approval of the French

State (the “Reserved Capital Increase”).

SCP SKN Holding I SAS has agreed to a lock-up period starting on

the date of the Prospectus approval and expiring 180 calendar days

following the settlement-delivery date of the New Shares, subject

to certain usual exceptions.

AVAILABILITY OF THE PROSPECTUS

The Prospectus approved by the AMF under number 21-317 on July

13th, 2021 and comprised of (i) Latécoère’s 2020 universal

registration document filed with the AMF on April 22nd, 2021 under

number D.21-0337 (the “Universal Registration Document” or

“URD”) , (ii) an amendment to the URD filed with the AMF on

July 13th, 2021 (the “Amendment to the URD”), (iii) the

securities note dated July 13th, 2021 (the “Securities

Note”) and (iv) the summary of the Prospectus (included in the

Securities Note) is available on the websites of the AMF

(www.amf-france.org) and the Company (www.latecoere.aero). Copies

of the Prospectus are available free of charge at the Company’s

registered office (135, rue de Périole, 31500 Toulouse).

RISK FACTORS

Investors’ attention is drawn to the risk factors relating to

Latécoère included in chapter 2 “Risk Factors and Internal Control”

of the URD as updated in chapter 2 "Risk Factors" of the Amendment

to the URD and the risk factors relating to the transaction and the

securities included in chapter 2 “Risk Factors” of the Securities

Note.

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

ordinary shares in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the member states of the European Economic Area

(other than France) and the United Kingdom (each a “Relevant

State”), no action has been undertaken or will be undertaken to

make an offer to the public of the securities referred to herein

requiring a publication of a prospectus in any Relevant State. As a

result, the securities may and will be offered in any Relevant

State only (i) to qualified investors within the meaning of the

Prospectus Regulation, for any investor in a Member State of the

European Economic Area, or Regulation (EU) 2017/1129 as part of

national law under the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”), for any investor in the United

Kingdom, (ii) to fewer than 150 individuals or legal entities

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions set forth in Article 1 (4)

of the Prospectus Regulation or under any other circumstances which

do not require the publication by Latécoère of a prospectus

pursuant to Article 3 of the Prospectus Regulation, of the UK

Prospectus Regulation and/or to applicable regulations of that

Relevant State.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling within

Article 49(2)(a) to (d) (“high net worth companies, unincorporated

associations, etc.”) of the Order, or (iii) are persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of Article 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated

(all such persons together being referred to as “Relevant

Persons”). Any investment or investment activity to which this

document relates is available only to Relevant Persons and will be

engaged in only with Relevant Persons. Any person who is not a

Relevant Person should not act or rely on this document or any of

its contents.

This press release may not be published, distributed or

transmitted in the United States (including its territories and

dependencies).This press release does not constitute or form part

of any offer of securities for sale or any solicitation to purchase

or to subscribe for securities or any solicitation of sale of

securities in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”) or the law of

any State or other jurisdiction of the United States, and may not

be offered or sold in the United States absent registration under

the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act.

Latecoère does not intend to register all or any portion of the

securities in the United States under the Securities Act or to

conduct a public offering of the securities in the United

States.

This announcement may not be published, forwarded or

distributed, directly or indirectly, in the United States, Canada,

Australia or Japan.

___________________________________________________________________________

About Latécoère

As a "Tier 1" international partner of the world's major

aircraft manufacturers (Airbus, Boeing, Bombardier, Dassault,

Embraer and Mitsubishi Aircraft), Latécoère is active in all

segments of the aeronautics industry (commercial, regional,

business and military aircraft), in two areas of activity:

- Aerostructures (55% of turnover): fuselage sections and

doors,

- Interconnection Systems (45% of turnover): wiring, electrical

furniture and on-board equipment.

As of December 31, 2020, the Group employed 4,172 people in 13

different countries. Latécoère, a French limited company

capitalised at € 23,704,629.50 divided into 94,818,518 shares with

a par value of €0.25, is listed on Euronext Paris - Compartment B,

ISIN Codes: FR0000032278 - Reuters: LAEP.PA - Bloomberg:

LAT.FP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210801005048/en/

Taddeo Antoine Denry / Investor Relations +33 (0)6 18 07

83 27

Pierre-Jean Le Mauff / Media Relations +33 (0)7 77 78 58 67

teamlatecoere@taddeo.fr

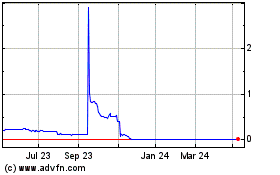

Latecoere (EU:LAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

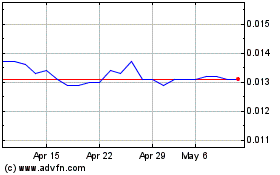

Latecoere (EU:LAT)

Historical Stock Chart

From Apr 2023 to Apr 2024