- Approval by the Board of Directors of a c.€193M rights issue

fully backstopped by Searchlight Capital Partners, as a part of a

comprehensive c. €323M recapitalisation package

- Changes of governance at Latécoère with Thierry Mootz being

promoted CEO and Greg Huttner being appointed as Deputy CEO, both

effective August 2, 2021

- Potential1 acquisition of Technical Airborne Components, a

leading designer and manufacturer of rods and struts for the

aerospace industry

Regulatory News:

Latécoère (Paris:LAT), a tier 1 partner to major international

aircraft manufacturers, today announced that its Board of Directors

held yesterday under the Chairmanship of Pierre Gadonneix, has

appointed Thierry Mootz as Chief Executive Officer of Latécoère SA

with effect on August 2, 2021 in replacement of Philip Swash.

Thierry Mootz will also remain General Manager of the

Interconnection Systems division. The Board has also approved the

principle of a capital increase for c.€193M with shareholders’

preferential subscription rights fully underwritten by its

reference shareholder Searchlight Capital Partners to enable

organic and inorganic growth.

Approval by the Board of Directors of a c.€193M rights

issue

Latécoère launches a comprehensive c.€323M recapitalisation plan

to strengthen its balance sheet, further invest in the

competitiveness and competencies of its global footprint and

continue to actively pursue M&A opportunities following the

successful acquisition of Bombardier EWIS in Mexico as well as the

potential acquisition of Technical Airborne Systems (TAC) announced

today.

As part of the transaction, the Board of Directors of Latécoère

has approved the principle of a c.€193M rights issue which is fully

backstopped by its anchor shareholder Searchlight Capital

Partners.

The terms and conditions of the rights issue will be described

in a specific press release to be published once the AMF has

approved the prospectus; this press release is expected to be

published in the coming days.

Strategy and changes of Governance at Latécoère

COVID-19 has had a highly disruptive impact on the aerospace

sector. The Company immediately embarked upon an extensive program

to secure, reset and position Latécoère to grow into a larger, more

competitive and resilient global aerospace leader.

The group has completed a number of significant steps to survive

the crisis and prepares for growth, including the implementation of

rigorous safety standards to protect employees and the adaptation

of its workforce and industrial capacities to the new market

environment. This required extensive and difficult re-structuring

initiatives in order to reset the Company for the forthcoming years

ahead. A lower fixed and variable costs structure will enable

Latécoère to emerge from the crisis stronger and more

competitive.

A new strategy and five-year business plan have been approved by

the Board of Directors, setting a clear course for the next chapter

for Latécoère. The core pillars of the strategy are:

- Operational Excellence and Cost Competiveness

- Organic Growth in traditional markets and adjacent

Interconnection Systems markets

- Focused innovation in Aerostructures and Interconnection

Systems to improve competitiveness and position Latécoère for the

next generation of aircraft

- External Growth (M&A): a key driver of future growth for

the business as evidenced by the acquisition of Bombardier EWIS in

Mexico (closed February 2021) and the potential acquisition of

Technical Airborne Systems in Belgium that was announced today

- Ongoing development of the Latécoère people

The Board of Directors of Latécoère decided yesterday the

following changes of governance of the Group:

- Thierry Mootz, current Deputy CEO, will be promoted CEO

of Latécoère, effective August 2, 2021.

- Grégoire Huttner will be appointed Deputy CEO effective

August 2, 2021 and will continue to serve as the General Manager of

the Aerostructures Division.

The composition of the Board of Directors will remain unchanged,

with Philip Swash to continue as director of Latécoère.

In addition, Christopher Seherr-Thoss has been appointed

as Director of M&A, to lead Latécoère’s ambitious inorganic

growth strategy.

Commenting on today’s communication, Philip Swash, Chief

Executive Officer, said: “It has been a great honor to lead the

Latécoère team and re-engage with global Aerospace customers and

suppliers. I would like to thank all stakeholders and shareholders

for their trust and support. The Company now has the plan and the

financing to develop into a truly global leader and I feel that it

is now an appropriate time for me to return to a non-executive

board position where I shall continue to support Thierry Mootz and

the Latécoère team.”

Pierre Gadonneix, Chairman of the Latécoère Board of

Directors said: “I would like to thank Philip Swash for

agreeing to lead Latécoère at the beginning of a major crisis. He

was able to lead the company through this period and ensure a

transformation plan that today puts Latécoère on a sound basis to

face the future with confidence. I am pleased that he stays

involved with the Company as a non-executive director at our Board

of Directors. I believe Thierry Mootz is the right man to implement

this transformation since he has been with the Company for over 6

years and Latécoère can approach the next chapter with confidence

and ambition.”

Thierry Mootz, Deputy Chief Executive Officer said: “I am

honored and excited to take the leadership of Latécoère, which is a

strong contributor to the Aerospace market in France. Thanks to the

job done by Latécoère team, the Company has successfully navigated

through the crisis, will emerge stronger from it and is now ready

for growth. The recapitalization of the Company will allow us to

execute our plan, deliver high performance to our customers and

finance growth.”

Potential acquisition of Technical Airborne Components

(TAC)

Subject to completion of the information and consultation

process with the employee representative bodies of the Group,

Latécoère envisages to acquire Technical Airborne Components (TAC),

a leading designer and manufacturer of rods and struts for the

aerospace industry, for approximately € 30 million from Searchlight

Capital Partners2.

Lastly, Latécoère adds that it is actively looking at other

external growth opportunities, particularly in North America. Those

discussions are at a preliminary stage and would require a maximum

investment of around €100 million should these opportunities be

concluded.

Important Information

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

ordinary shares in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction. The distribution of this press release may, in

certain jurisdictions, be restricted by local legislations. Persons

into whose possession this press release comes are required to

inform themselves about and to observe any such potential local

restrictions.

This press release is not a prospectus within the meaning of

Regulation (UE) 2017/1129 of the European Parliament and of the

Council of 14 June 2017 as amended (the “Prospectus

Regulation”) and as it forms part of domestic law in the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”). With respect to the member

States of the European Economic Area and the United Kingdom (each a

“Relevant State”), securities may not be offered or sold

absent the publication of a prospectus in any Relevant State or an

exemption from such publication under the Prospectus Regulation or

the UK Prospectus Regulation.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling within

Article 49(2)(a) to (d) (“high net worth companies, unincorporated

associations, etc.”) of the Order, or (iii) are persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of Article 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated

(all such persons together being referred to as “Relevant

Persons”). Any investment or investment activity to which this

press release relates is available only to Relevant Persons and

will be engaged in only with Relevant Persons. Any person who is

not a Relevant Person should not act or rely on this document or

any of its contents.

This press release does not constitute or form part of any offer

of securities for sale or a solicitation of an offer to purchase or

to subscribe securities in the United States. The securities

referred to herein have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the “Securities Act”),

or the securities laws of any State or other jurisdiction of the

United States, and may not be offered or sold in the United States

absent registration under the Securities Act or pursuant to an

exemption from such registration. Latécoère does not intend to

register all or any portion of its securities in the United States

under the Securities Act or to conduct a public offering of the

Securities in the United States.

About Latécoère

As a "Tier 1" international partner of the world's major

aircraft manufacturers (Airbus, Boeing, Bombardier, Dassault,

Embraer and Mitsubishi Aircraft), Latécoère is active in all

segments of the aeronautics industry (commercial, regional,

business and military aircraft), in two areas of activity:

- Aerostructures (55% of turnover): fuselage sections and

doors,

- Interconnection Systems (45% of turnover): wiring, electrical

furniture and on-board equipment.

As of December 31, 2020, the Group employed 4,172 people in 13

different countries. Latécoère, a French limited company

capitalised at € 23,704,629.50 divided into 94,818,518 shares with

a par value of €0.25, is listed on Euronext Paris - Compartment B,

ISIN Codes: FR0000032278 - Reuters: LAEP.PA - Bloomberg:

LAT.FP.

1 Implementation of this acquisition is subject to completion of

the information and consultation process with the employee

representative bodies of the Group. 2 Latécoère has a call option

to acquire Technical Airborne Component for a transfer price of

€35.4 million from Searchlight Capital Partners, or approximately

€30 million net of cash on balance sheet and including deal related

expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210712005863/en/

Taddeo Antoine Denry / Investor Relations +33 (0)6 18 07

83 27

Marie Gesquière / Media Relations +33 (0)6 26 48 97 98

teamlatecoere@taddeo.fr

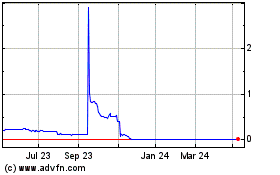

Latecoere (EU:LAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

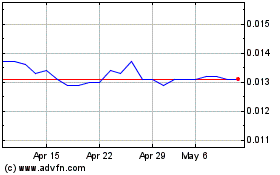

Latecoere (EU:LAT)

Historical Stock Chart

From Apr 2023 to Apr 2024