BNP Paribas Profit Drops as Structured-Products Business Takes Hit - Update

May 05 2020 - 5:44AM

Dow Jones News

By Noemie Bisserbe and Pietro Lombardi

PARIS -- BNP Paribas SA reported Tuesday a drop in first-quarter

net profit as France's largest bank set aside new provisions to

prepare for a flood of customers to default on their loans because

of the coronavirus pandemic.

Like crosstown rival Société Générale SA, companies that

canceled their dividend payments dealt a big hit to BNP Paribas's

equity derivatives unit -- a business where the two French banks

have a strong foothold. The move wiped EUR184 million ($200

million) from BNP Paribas' structured products revenue this

quarter.

Banks world-wide have been setting aside billions of dollars to

cover bad loans and have been shoring up capital by canceling

dividends and share buybacks, as lockdowns and uncertainty as a

result of the novel coronavirus pandemic have slammed the brakes on

the global economy.

The Paris-based lender, the biggest by assets in France, said

net profit fell by 33% to EUR1.28 billion in the three months ended

March 31, while revenue declined by 2% to EUR10.89 billion.

BNP Paribas warned net profit for 2020 might fall by 15% to 20%

as a result of the health crisis. The lender pledged to intensify

its efforts to cut costs, but warned this could be offset by

increasing provisions.

It set aside EUR657 million to cover bad loans, raising its

total provision to EUR1.43 billion.

Strong fixed revenue, up 34% to EUR1.39 billion, helped offset

the EUR87 million loss posted by the bank's equity business. As a

result, BNP Paribas's corporate and investment bank reported a 1.9%

decline in revenue to EUR2.95 billion. The bank's domestic-markets

division, which includes retail operations in Italy, France and

Belgium, posted a 1.6% decline in revenue to EUR3.76 billion.

Revenue at its international financial-services unit -- which

includes wealth management, consumer finance and insurance -- were

also down 5.4% at EUR4.05 billion.

Still, BNP's core Tier 1 capital ratio -- a key measure of

capital strength -- stood at 12% in March from 12.1% in December,

well above the requirements notified by the European Central Bank,

and in line with the bank's target.

BNP Paribas shares were up 4.6% at EUR28.35 in early morning

trading in Paris.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com and Pietro

Lombardi at Pietro.Lombardi@dowjones.com

(END) Dow Jones Newswires

May 05, 2020 05:29 ET (09:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

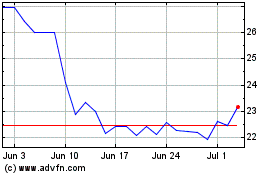

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

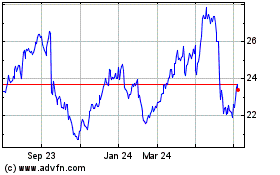

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024