SocGen Swings to Loss on Higher Provisions, Equities Rout - Update

April 30 2020 - 4:13AM

Dow Jones News

--SocGen Swung to a first-quarter loss of EUR326 million

compared with a profit of EUR686 million a year earlier

--Provisions for bad loans more than tripled, reaching EUR820

million

--Equities revenue shrank 99% to just EUR9 million

By Pietro Lombardi

Societe Generale SA said it will cut costs further this year

after it swung to a loss in the first quarter as the bank set aside

more provisions and the market volatility sparked by the

coronavirus pandemic hit the performance of its investment banking

operations.

Like its European and U.S. peers, France's third-largest listed

bank by assets is bracing for the economic impact of the pandemic

and set aside more money to cover potential loan losses.

Provisions for bad loans more than tripled, reaching 820 million

euros ($890.3 million).

Higher provisions, compounded by a sharp revenue fall, led to a

quarterly loss of EUR326 million compared with a profit of EUR686

million a year earlier.

Net banking income, the bank's top-line revenue figure, fell

almost 17% to EUR5.17 billion.

The bank gave a bad surprise this morning, Citi said, mentioning

the extent of the weakness in investment banking, the high

provisions and the expected reduction in capital buffer.

SocGen shares fell 3.9% at 0713 GMT, after opening more than 5%

lower.

The results of the bank's global banking and investor-solutions

business, which includes investment banking and asset management,

weighed on the performance. The division swung to a loss of EUR537

million from a profit of EUR140 million, and posted a 27% decline

in revenue. Equities revenue collapsed, falling 99% to just EUR9

million.

"Revenues from structured-products activities were severely

impacted by the equity markets dislocation in March, the

cancellation of dividend payments... and by counterparty defaults,"

it said.

The bank's core Tier 1 ratio, a key measure of capital strength,

fell to 12.6% in March from 13.2% in December, the latter including

the cancellation of dividends for last year. This represents a

buffer of 350 basis points over regulatory requirements. By the end

of the year, SocGen expects this to fall to between 200 and 250

basis points, also depending on the distribution of an

extraordinary dividend.

The bank targets further cost cuts of up to EUR700 million this

year. It sees cost of risk of between 70 and 100 basis points,

depending on the evolution of the pandemic.

"Beyond our focused adaptation to the immediate impact of the

crisis, we are already working on the designs of our next strategic

plan 2021-2025 to take into account the new environment

postcrisis," Chief Executive Frederic Oudea said.

The lender launched last year a plan to cut nearly 1,600 jobs

globally after a slump in investment-banking revenue at the end of

2018.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

April 30, 2020 03:58 ET (07:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

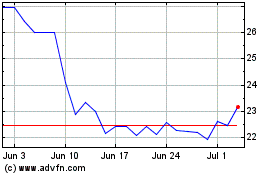

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

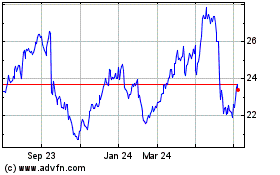

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024