SocGen Swings to Loss on Higher Provisions, Weak Investment Banking

April 30 2020 - 2:07AM

Dow Jones News

By Pietro Lombardi

Societe Generale SA said it will cut costs further this year

after it swung to a loss in the first quarter as the bank set aside

more provisions and was hit by the weak performance of its

investment banking operations.

France's third-largest listed bank by assets said Thursday that

net loss for the quarter was 326 million euros ($353.9 million)

compared with a profit of EUR686 million a year earlier.

Net banking income, the bank's top-line revenue figure, fell

almost 17% to EUR5.17 billion.

The performance of the bank's global banking and

investor-solutions business, which includes investment banking and

asset management, weighed on the performance. The division swung to

a loss of EUR537 million from a profit of EUR140 million, and

posted a 27% decline in revenue. Fixed-income revenue rose 32% but

SocGen reported a 99% decline in equities revenue.

Cost of risk more than tripled, "marked by an increase of

provisioning in the context of the Covid-19 crisis and some

specific files, including two exceptional fraud files," it

said.

The bank targets further cost cuts of up to EUR700 million this

year. It sees cost of risk of between 70 and 100 basis points,

depending on the evolution of the pandemic and expects its core

Tier 1 ratio to show a buffer of between 200 and 250 basis points

over regulatory requirement.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

April 30, 2020 01:52 ET (05:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

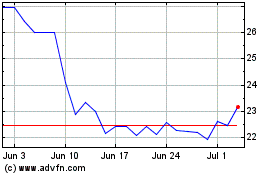

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

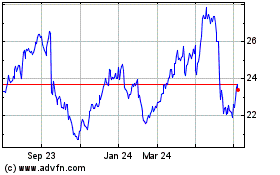

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024