SocGen Shares Rise After Bank Strengthens Capital - Update

August 01 2019 - 4:40AM

Dow Jones News

--Societe Generale's core Tier 1 ratio rose to 12% at the end of

June from 11.5% in March

--SocGen's quarterly net profit fell 14% to 1.05 billion

euros

--Shares rise more than 5% in morning trade

By Pietro Lombardi

Societe Generale SA (GLE.FR) shares jumped after the bank

strengthened its capital in the second quarter, while lower revenue

and restructuring costs contributed to a fall in net profit for the

period.

The results follow a consensus-beating performance by French

peer BNP Paribas SA (BNP.FR) and come as SocGen restructures after

weak trading revenue hit its investment-bank business in the final

quarter of last year, forcing the bank to cut its 2020

profitability target and promise further cost cuts.

SocGen's core Tier 1 ratio, a key measure of capital strength,

rose to 12% at the end of June from 11.5% in March, helped by the

sale of some businesses and the payment of part of its dividend in

shares.

"Based on what has been achieved in H1 2019 the capital debate

is no longer an issue, if they are able to stick to the plan,"

Jefferies analysts said.

Quarterly net profit fell 14% to 1.05 billion euros ($1.16

billion), France's third-largest listed bank by assets said

Thursday.

Net banking income, the bank's top-line revenue figure, fell

2.6% on the year to EUR6.28 billion.

The bank showed continuing improvement in capital, Citi analysts

said.

"These results are a step in improving market confidence on

management ability/focus to deliver," Citi said.

Shares traded 5.1% higher at 0755 GMT.

"Societe Generale has provided further evidence of the

successful execution of its strategic plan with two priority

financial objectives: increasing its level of capital and improving

profitability," Chief Executive Frederic Oudea said.

SocGen booked a EUR227 million charge related to the

restructuring of its corporate and investment banking business.

In April, the lender presented a plan to cut nearly 1,600 jobs

globally after a slump in investment-banking revenue in the fourth

quarter. The plan followed a cut to its 2020 profitability target.

The global markets and investor services--which includes fixed

income and equity trading and securities services--will bear the

brunt of the job cuts.

"Only a few months after it was announced, Global Banking &

Investor Solutions' adaptation plan has entered the execution

phase," Mr. Oudea said.

The global banking and investor-solutions business, which

includes investment banking and asset management, reported a 6.1%

fall in second-quarter revenue, while profit fell 46%. Global

markets revenue fell 9.2% "impacted by still challenging market

conditions," it said. Fixed-income revenue declined 9.7% on

year.

"The low interest rate environment in Europe and low volatility

observed in currency activities adversely affected Rate and

Currency activities" in the second quarter, it said.

Equities revenue fell 6.6%.

Net income fell 2.5% at the bank's French retail banking

operations while it was down 4.8% at the international retail

banking & financial services division.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

August 01, 2019 04:25 ET (08:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

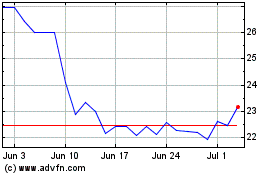

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

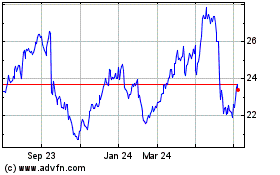

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024