Societe Generale Shares Rise on 1Q Results -- Update

May 03 2019 - 4:53AM

Dow Jones News

Adds earnings details, background, CEO comments, analyst

comments, share price

--SocGen first-quarter net profit fell 26% to 631 million

euros

--The bank's core Tier 1 ratio, a key measure of capital

strength, rose to 11.7% in March from 11.2% at the end of

December

--Fixed-income revenue fell 16% while equities revenue declined

5.3%

By Pietro Lombardi

Shares in Societe Generale SA (GLE.FR) gain ground after the

bank reported a significant improvement in capital despite a sharp

decline in net profit.

The results come as France's third-largest listed bank by assets

embarks on a restructuring plan unveiled after weak trading revenue

hit its investment bank business in the final quarter of last year,

forcing the bank to cut its 2020 profitability target and vow

further cost cuts.

The bank's core Tier 1 ratio, a key measure of capital strength,

rose to 11.7% in March from 11.2% at the end of December, the

lender said Friday.

SocGen shares traded 2% higher at 0739 GMT.

SocGen is already reaping the benefits of the restructuring,

Chief Executive Frederic Oudea said.

"We continued with the transformation of French Retail Banking,

provided further evidence of the robust momentum in International

Retail Banking & Financial Services and demonstrated Global

Banking & Investor Solutions' ability to rapidly adapt, with an

already tangible reduction in risk-weighted assets which, combined

with the finalization of five disposals, has resulted in a

substantial increase in the level of our capital," the CEO

said.

The bank's capital is well above expectations, Citi said, adding

that the results will boost market confidence in management's focus

and ability to deliver.

A string of disposals boosted the bank's capital. Along with the

results, SocGen said it signed an agreement to sell SKB Banka in

Slovenia to OTP Bank (BISI.RS), a deal that should have a positive

impact on capital.

SocGen has in recent months sold businesses in countries

including Serbia, Albania and Bulgaria.

"We are continuing to steadily implement our refocusing program,

with the announcement this morning of the disposal of our SKB

subsidiary in Slovenia. As a result of our determined actions, we

saw a substantial increase in CET1 ratio in Q1 19, strengthening

our ability to achieve the 12% CET1 ratio target as soon as

possible," Mr. Oudea said.

First-quarter net profit fell 26%, hurt by lower revenue and

growing costs.

Net profit for the period was 631 million euros ($705 million),

compared with EUR850 million a year earlier.

Net banking income, its top-line revenue figure, declined 1.6%

to EUR6.19 billion, while operating expenses grew 1.3% to EUR4.79

billion.

The global banking and investor-solutions business, which

includes investment banking and asset management, reported a 16%

decline on-year in net income. Revenue at its Global Markets &

Investor Services division fell 7.2% as a result of challenging

market conditions, it said. Fixed-income revenue fell 16% as "rate

activities were hit by low rate volatility in Europe and weak

client activity." Equities revenue declined 5.3%.

Last month, the bank unveiled a plan to cut nearly 1,600 jobs

globally after a slump in investment-banking revenue in the fourth

quarter. The move followed a cut to its 2020 profitability

target.

Net income declined 13% at the bank's French retail banking

business and grew 8.2% at the international retail banking &

financial services division.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 03, 2019 04:38 ET (08:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

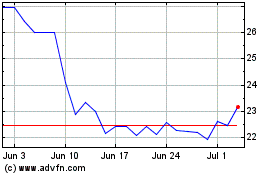

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

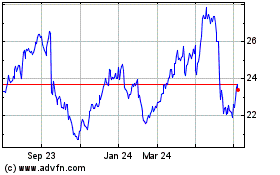

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024