Veolia Makes Increased Bid of EUR3.4 Billion for Engie's Suez Stake

September 30 2020 - 3:48AM

Dow Jones News

By Joshua Kirby

Veolia Environnement SA on Wednesday raised its offer for the

majority of Engie SA's stake in waste-management company Suez SA,

offering 3.4 billion euros ($3.99 billion) for 29.9% of Suez.

The EUR18-per-share offer represents an increase on the French

resource-management company's previous offer of EUR15.50 a share

for the stake in Suez. Engie holds around 32% of Suez.

Veolia's new bid includes a commitment to maintaining full

employment at Suez in France. The company also said it would only

launch a tender offer for the remaining 70.1% of Suez on a friendly

basis.

Engie has been holding out for better terms. Chairman

Jean-Pierre Clamadieu told a French National Assembly hearing

Tuesday that the French energy company was confident Veolia was

ready to offer necessary guarantees around jobs.

Veolia said it proposed a six-month period for the related

parties to come to a deal.

Suez has been opposed to Veolia's approach, which it has

characterized as hostile. It argues that the offer undervalues the

company and risks antitrust issues and job cuts. But Suez itself

has come under fire, with Mr. Clamadieu telling the National

Assembly hearing he was disappointed with Suez management's refusal

to cooperate regarding a new offer.

He also criticized Suez's decision to place its water division

in the hands of a Dutch foundation last week, calling the move a

"poison pill" and "a serious error of judgement."

Write to Joshua Kirby at joshua.kirby@dowjones.com

(END) Dow Jones Newswires

September 30, 2020 03:33 ET (07:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

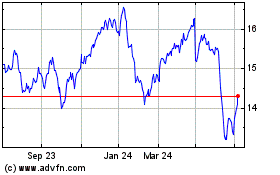

Engie (EU:ENGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

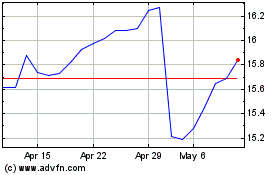

Engie (EU:ENGI)

Historical Stock Chart

From Apr 2023 to Apr 2024