Suez Accelerates Strategic Plan, Promises Higher Shareholder Returns Amid Takeover Interest -- Update

September 22 2020 - 5:31AM

Dow Jones News

--Suez is accelerating its 2030 strategic plan, citing good

results, and it detailed financial targets for 2021, 2022

--Shareholder returns could reach at least EUR2 billion by the

end of 2022

--Suez rejected a 'hostile' approach from Veolia earlier this

month

By Olivia Bugault

Suez SA said Tuesday that it is accelerating its "SUEZ 2030"

strategic plan after good results and it promised an exceptional

dividend or share buyback of at least 1.0 billion euros ($1.17

billion) as it defends itself from takeover interest.

"The implementation of Suez' strategy announced in 2019, is

delivering tangible results already this year on several

workstreams, allowing the group to bring the overall timeline

forward," Suez said.

The French waste-management company said it would pay the

dividend or share buyback "as soon as possible" and by no later

than the first half of 2021. Including an ordinary dividend of

EUR0.65 per share to be paid in 2021 and of EUR0.70 per share for

the following year, shareholder returns could reach at least EUR2

billion by the end of 2022, Suez said. The plan intends to double

shareholder value by 2022, it added.

Suez rebuffed hostile interest from Veolia Environnement SA

earlier this month, saying that it undervalued the company and

raised concerns about the risk of job cuts. Suez's rejection

followed Veolia's offer to acquire a 29.9% stake in its peer Suez

from energy company Engie SA for EUR2.91 billion.

"The board supports the management in the reinforcement of the

plan, which will significantly increase the value creation

potential of an independent Suez group, for the benefit of all

stakeholders," Philippe Varin, president of the board of directors,

said.

Suez raised the saving objective part of the plan and now aims

for EUR1.2 billion in annual savings by 2023, including EUR900

million that would be achieved by 2022, compared with a previous

annual savings objective of EUR1 billion by 2023, it said.

Suez also provided more details on its financial goals for the

years to come. Suez targets recurring earnings per share in 2021 of

between EUR0.75 and EUR0.80 and up to EUR1 in 2022. It sees revenue

above EUR16 billion for 2021 and above EUR17 billion for 2022. It

targets earnings before interest and taxes between EUR1.35 billion

and EUR1.5 billion for next year and of roughly EUR1.7 billion in

2022, it said.

Meanwhile, the company backed its guidance for this year.

The company expects organic growth, profitability, recurring

free cash flow and return on capital to improve by 2022, it said.

Organic growth is expected to be above 4%-5% per year from 2022,

while its earnings before interest, taxes, depreciation, and

amortization margin should expand by 100 basis points to 300 basis

points, it said.

Suez is redeploying its capital and therefore plans at least

EUR4.5 billion of growth investment from June 2020 to December

2022, including EUR3 billion of continued targeted capital

expenditure to boost its organic growth, it said.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

September 22, 2020 05:16 ET (09:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

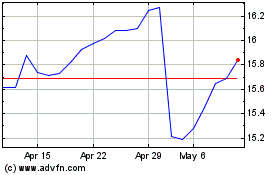

Engie (EU:ENGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

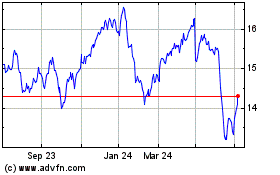

Engie (EU:ENGI)

Historical Stock Chart

From Apr 2023 to Apr 2024