BOUYGUES: 2019 Full-year results

Press release – Paris, 20/02/2020

2019 Full-year results

- ROBUST RESULTS WITH FULL-YEAR TARGETS ACHIEVED

- Improvement in Group current operating profit and current

operating margin1 year-on-year

- Free cash flow of €301m generated by Bouygues Telecom

- TWO-FOLD INCREASE IN GROUP FREE CASH FLOW AFTER WCR TO €815m2

YEAR-ON-YEAR

- DECREASE IN NET DEBT TO €2.2bn AT END-2019 VS €3.6bn AT

END-2018

- DIVIDEND OF €2.60 PER SHARE3, OF WHICH €0.90 IS

EXCEPTIONAL

- GROUP'S TARGET OF €1bN IN FREE CASH FLOW AFTER WCR4 CONFIRMED

FOR 2020

1 Restated for the capital gain related to the partial

divestment of shares and remeasurement of the residual interest in

Axione in 20182 Restated for Alstom dividends (€341m in 2019 versus

€22m in 2018)3 To be proposed to the Annual General Meeting on 23

April 20204 See glossary on page 14

The consolidated financial statements at

31 December 2019 are presented in comparison with the

financial statements at 31 December 2018, restated to

take account of the application from 1 January 2019 of IFRS 16 on

leases.

|

KEY FIGURES (€ million) |

2018 restated |

2019 |

Change |

|

Sales |

35,555 |

37,929 |

+7%a |

| Current

operating profit |

1,564 |

1,676 |

+€112m |

|

o/w impact of Axione |

106 |

- |

-€106m |

|

Current operating margin excl. Axione |

4.1% |

4.4% |

+0.3 pts |

|

Current operating profit after Leases4 |

1,507 |

1,619 |

+€112m |

| Operating

profit |

1,829b |

1,696c |

-€133m |

|

Operating profit after Leases4 |

1,772b |

1,639c |

-€133m |

| Net profit

attributable to the Group |

1,308 |

1,184 |

-€124m |

|

Free cash flow after WCR4 (excl. Alstom

dividends2) |

405 |

815 |

+€410m |

|

Net surplus cash (+)/Net debt (-) |

(3,612) |

(2,222) |

+€1,390m |

(a) Up 5% like-for-like and at constant exchange rates (b)

Including non-current income and non-current charges of €265m (c)

Including non-current income and non-current charges of €20m

The Group achieved its full-year targets

in 2019 with robust results in its three sectors of activity and a

high level of cash generation.

- Sales were up 7% year-on-year (up 5%

like-for-like and at constant exchange rates) to

€37.9 billion, driven by all businesses.

- As expected, Group profitability improved. Current

operating profit increased €112 million to

€1,676 million versus 2018. Excluding the impact of Axione5,

it was up €218 million year-on-year, resulting in a 0.3-point

year-on-year increase in the current operating

margin to 4.4% in 2019.

- Net profit attributable to the Group in 2019

was down €124 million year-on-year to €1,184 million due

to a decline in non-current income (€20 million in 2019 versus

€265 million in 2018), mainly at Bouygues Telecom.

- Group free cash flow, restated for the

dividends paid by Alstom in 2018 and 20196, rose €234 million

year-on-year to €1,038 million. It notably benefited from a

€109-million increase in free cash flow generation at Bouygues

Telecom, which achieved its target of €300 million in

2019.

- Group free cash flow after

WCR of €815 million excluding Alstom dividends

increased two-fold versus 2018. This reflects net cash flow growth

in all three sectors of activity (up €330 million), stable net

capex and a €176-million improvement in the Group’s WCR7.

The Group strengthened its financial

structure.

- The Group substantially reduced its net debt

at end‑2019 to €2.2 billion versus €3.6 billion at

end-2018, benefiting from the positive €1.4-billion impact of

Alstom (dividends and sale of 13% of share capital).

- Net gearing8 improved 14 points to 19% at

end-2019 versus 33% at end-2018.

DIVIDEND

The Board of Directors will ask at the Annual General Meeting on

23 April 2020 for the approval of a dividend of €2.60 per

share, of which €0.90 is exceptional.

The ex-date, record date and payment date have

been set at 5 May, 6 May and 7 May 2020 respectively.

OUTLOOK

In long-term growth markets, the

construction businesses will strengthen their

portfolio of low-carbon solutions to maintain

their leadership in sustainable construction and

benefit from their actions to improve

profitability.Expected improvement in the current

operating margin of the construction businesses in 2020

versus 2019.

TF1 is benefiting from

long-term growth to position itself as a major player in

the video market:

- Double-digit current operating margin in

2020;

- Cost of programs at

€985 million in 2020.

5 Restated for the capital gain related to the partial

divestment of shares and remeasurement of the residual interest in

Axione in 20186 €341m in 2019 versus €22m in 20187 WCR related to

operating activities8 Net debt / shareholders’

equity

Bouygues Telecom will continue

to leverage its differentiation

strategy (quality of networks and customer experience, as

well as brand appeal). In 2020, it is aiming

for: Growth in

sales from services at around 5%;

Free cash

flow9 of over €300 million, with

increasing investment (expected gross capex of €1.1 to

€1.2 billion excluding frequencies) required to expand 4G

mobile capacity and start rolling out 5G.

In 2020, the Bouygues

group will continue to pursue its sustainable

growth strategy:

- Free cash flow generation after WCR10 of

€1 billion with the contribution from all

three sectors of activity;

- Reduction of greenhouse gas emissions by 2030.

Definition of a target compatible with the Paris Agreement (to keep

the global temperature increase below 1.5°C) and preparation of an

action plan by the Group’s five business segments

in 2020.

DETAILED ANALYSIS BY SECTOR OF

ACTIVITY

CONSTRUCTION BUSINESSES

The backlog in the construction

businesses remained stable at a very high level of €33 billion

(versus €33.1 billion at end-2018). At constant exchange rates

and excluding main disposals and acquisitions, it was slightly down

by 1%.

In France, the backlog

decreased 2%11 to €13.8 billion. This reflects:

- A stable backlog at Bouygues Construction of €8.6 billion

at end-2019;

- A 2%11 decrease in the backlog at Colas to €3.1 billion at

end-2019 due to a slowdown in order intake in the latter part of

the year linked to the forthcoming municipal elections in March

2020;

- An 11% decrease in the backlog at Bouygues Immobilier to

€2.1 billion, due to a decline in residential property

reservations in a stable housing market. Bouygues Immobilier was

affected by a lower supply in a market hit by delays in obtaining

building permits linked to the forthcoming municipal elections in

March 2020.

Internationally, the backlog

was €19.2 billion at end-2019, a year-on-year increase of

1%11. It includes some significant orders taken in fourth-quarter

2019: the construction by Bouygues Construction of a 3.4‑kilometer

subsea road tunnel in Hong Kong, worth €756 million, the

construction and maintenance by Colas of a network of Rapid Bus

Transit system in French Guiana, worth €180 million, and the

execution by Colas Rail of the first phase of work on railway lines

for Network Rail in the United Kingdom, worth

€553 million.International business represented 62% of the

combined backlog of Bouygues Construction and Colas at end-2019,

versus 61% at end-2018.

9 Free cash flow = net cash flow (determined after (i) cost of

net debt, (ii) interest expense on lease obligations and

(iii) income taxes paid), minus net capital expenditure and

repayments of lease obligations. It excludes 5G frequencies. It is

calculated before changes in working capital requirements (WCR)

related to operating activities and excluding 5G frequencies.

10 Free cash flow after WCR = net cash flow

(determined after (i) cost of net debt, (ii) interest expense on

lease obligations and (iii) income taxes paid), minus net capital

expenditure and repayments of lease obligations. It is calculated

after changes in working capital requirements (WCR) related to

operating activities and excluding 5G frequencies11 At constant

exchange rates and excluding main disposals and acquisitions

Sales in the construction

businesses were €29.6 billion in 2019, up 6% year-on-year and

up 4% like-for-like and at constant exchange rates.

Current operating profit was

€910 million in 2019, versus €941 million in 2018.

Excluding Axione, it was up €75 million year-on-year and the

current operating margin improved slightly to 3.1%, versus 3% in

2018.

Current operating profit improved sharply at

Colas, up €60 million year-on-year, driven by the good

performance of the roads activity in mainland France and the return

to breakeven at Colas Rail. As a result, Colas’ current operating

margin increased 0.4 points to 3.2% year-on-year.

Current operating profit at Bouygues

Construction was stable in 2019 versus 2018, and up

€106 million restated for Axione. This improvement was due to

recovery of the current operating margin at the

Energies and Services arm (2.1% in 2019 versus -0.4% in

2018) following the adjustment measures introduced in the last

year.

At Bouygues Immobilier, commercial property

deals signed at the end of the year significantly boosted current

operating profit and current operating margin in fourth-quarter

2019 (5.2% versus 2.6% in the first nine months of 2019).

The Bouygues group has been building up an

extensive portfolio of sustainable construction solutions for more

than 15 years. It has focused its climate strategy on seeking

innovative, low-carbon solutions for its customers as well as

reducing the greenhouse gas emissions associated with its

activities.The construction businesses continued to innovate in

2019 and consolidated their leadership position in sustainable

construction. In Strasbourg, for example, Bouygues Immobilier

delivered France’s tallest apartment building made entirely out of

timber. The company was awarded the BBCA low-carbon label for the

Enjoy project, France’s largest timber-frame positive-energy office

building. The first smart city project in France was inaugurated in

Dijon, operated by a consortium led by Bouygues Energies &

Services. In Lyon, Bouygues Construction started work on Office

Switch Home, a circular-economy project for a reversible building

with offices that can easily be converted into homes. Colas started

to market Wattway Pack, a turnkey solution for an autonomous power

outlet installed on the road. Using solar power, it provides an

energy supply for a range of road-related services such as power

charging stations and connected services.

TF1

The TF1 group’s audience share

among key targets stabilized at a high level in 2019, with 32.6% of

women under 50 who are purchasing decision-makers and 29.4% of

individuals aged 25 to 49.

2019 sales reached €2,337 million, up 2%

versus 2018, supported by external growth. Advertising sales were

almost stable at €1,658 million, while sales from other

activities rose €53 million to €679 million versus

2018.

Current operating profit in 2019 was

€255 million, a year-on-year increase of €56 million. The

current operating margin rose 2.2 points to 10.9%, allowing TF1 to

achieve its 2019 target of double-digit current operating margin.

The increase in current operating profit reflected not only sales

growth but also TF1’s ability to keep the cost of programs under

tight control (€985 million at end-2019, versus

€1,014 million in 2018).

BOUYGUES TELECOM

Bouygues Telecom maintained

strong commercial momentum.The company had 11.5 million mobile

plan customers excluding MtoM at end-December 2019, an increase of

653,000 new customers during the year, of which 152,000 were in the

fourth-quarter 2019.

Bouygues Telecom had 1 million FTTH

customers, with 427,000 new adds over the year, of which 142,000

were in the fourth-quarter 2019 alone. The FTTH penetration rate

rose to 25% at end-2019, versus 16% a year earlier. The company had

a total of 3.9 million fixed customers at

31 December 2019.

Bouygues Telecom reported sales of

€6,058 million in 2019, up 13% year-on-year and up 12%

like-for-like and at constant exchange rates. It includes an 8%

increase in sales from services to €4,597 million versus 2018.

This increase reflected growth in both the mobile and the fixed

customer base, as well as higher ABPU. For the first time since

2011, mobile ABPU increased in fourth-quarter 2019 year-on-year (up

€0.5 to €19.7 per customer per month). Fixed ABPU rose €1.1

year-on-year to €27.0 per customer per month.

EBITDA after Leases showed a sharp €147-million

increase year-on-year to €1,411 million in 2019. The EBITDA

margin after Leases was 30.7%, up 1 point versus 2018.

Current operating profit was €540 million

in 2019, up €86 million year-on-year.Operating profit

decreased €166 million year-on-year to €610 million due

to lower capital gains on the disposal of sites (€63 million

in 2019 versus €250 million in 2018) and non-current income of

€110 million booked in third-quarter 2018 related to the

cancellation of fees paid for the use of 1800 MHz frequencies

prior to 2018.

Gross capex was €940 million in 2019, down

€302 million year-on-year.

Free cash flow reached €301 million in

2019, a year-on-year increase of €109 million.

Bouygues Telecom therefore achieved its free cash flow target

announced in 2017.

For over 20 years, the teams at Bouygues Telecom

have made every effort to ensure that technology brings friends and

family closer together, strengthens ties and creates new ones. By

leveraging its differentiation strategy, Bouygues Telecom offers

customers high-quality mobile and fixed networks, as well as a

simple, seamless experience.Mobile network sharing in less dense

area ensures that Bouygues Telecom’s services are accessible in the

least densely populated parts of the country. For the second year

in a row, Bouygues Telecom was recognized by the French telecom

regulator Arcep12 as the number one mobile operator in rural areas

in France and the second one on average nationwide.Bouygues Telecom

is keeping pace with new usage developments and covers 99% of

the population with 4G from 21,000 mobile sites at the end of 2019.

It expects to have over 28,000 sites by the end of 2023.In the

fixed segment, Bouygues Telecom had nearly 12 million FTTH

premises marketed at the end of 2019 and has raised its target for

the end of 2022 from 20 million to 22 million.Bouygues

Telecom also intends to accelerate its development in the BtoB

segment, offering a comprehensive range of fixed and mobile

solutions to meet the needs of business customers. Building

strategic partnerships to develop innovative services and taking

advantage of its share of the mobile market, it seeks to increase

its market share among major accounts and mid-size businesses.

Bouygues Telecom also aims to increase its market share among SMEs

and micro businesses by capitalizing on FTTO13 infrastructure in

very dense area and the recent acquisitions of Keyyo and Nerim.

12 Arcep surveys of October 2018 and October 201913

Fiber-To-The-Office

Continuing its strategy of optimizing

infrastructure management, Bouygues Telecom has launched two

projects.

- Project Saint Malo aims at rolling out a nationwide optical

fiber infrastructure (FTTA14 and FTTO) to address the data usage

growth of its networks. The goal is to connect Bouygues Telecom’s

network equipment (mobile antennas and central offices) with

optical fiber so the company can offer very-high-speed broadband

services to business users. Bouygues Telecom is negotiating with a

partner to roll-out, market and manage the infrastructure

operations in a joint venture with Bouygues Telecom as a minority

shareholder. The project is worth around €1 billion over seven

years. A long-term service agreement will then be concluded between

Bouygues Telecom and the joint venture.

- The aim of the second project, Asterix, is to accelerate

Bouygues Telecom’s FTTH roll-out in medium dense area. A joint

venture with Bouygues Telecom as a minority shareholder will buy

from Orange the FTTH connections in tranches of 5% of completed

lines on one area in keeping with growth in the number of

customers. Bouygues Telecom will have access to this infrastructure

through a long-term service agreement with the joint venture.

Bouygues Telecom will also transfer existing co-investment

contracts to the joint venture, that will buy the FTTH connections

currently leased by Bouygues Telecom from Orange. A call for

tenders has been launched in order to choose a partner.

14 Fiber-To-The-Antenna

ALSTOM

As announced, Alstom’s contribution to the

Group’s net profit was €238 million for the year, versus a

contribution of €230 million in 2018. The contribution

included a net capital gain of €172 million on the sale of 13%

of Alstom’s share capital in September 2019.

Furthermore, on 17 February 2020, Alstom

announced the signature of a memorandum of understanding with

Bombardier Inc. and Caisse de dépôt et placement du Québec to

acquire Bombardier Transportation. Bouygues has expressed its

support for the deal and has committed to:

- maintain its stake in Alstom until the Extraordinary general

meeting related to the transaction or, at the latest, until 31

October 2020;

- vote in favour of all related resolutions at that Extraordinary

general meeting to be held no later than 31 October 2020.

UPDATE ON THE CYBER-ATTACK AT BOUYGUES

CONSTRUCTION

On 30 January 2020, Bouygues Construction was

the target of a ransomware attack caused by malware.Bouygues

Construction initially shut down its IT system as a precaution to

prevent the virus from spreading, and specific measures were taken

to ensure business continuity in France and abroad.A number of

hardware and software systems were put back into service very

quickly. As these were being restored, the security of the entire

IT system was strengthened with help from experts both within and

outside the Group.There was a very low impact on the operational

and commercial activity of worksites.The relevant insurance

policies have been activated and a complaint has been filed with

the competent authorities.

BOARD OF DIRECTORS

At the Annual General Meeting on 23 April 2020,

the Board of Directors will seek:

- the renewal of the term of office of Alexandre de

Rothschild,

- the appointment of Benoît Maes as an independent director in

order to maintain the ratio of independent directors on the Board,

since Helman le Pas de Sécheval’s term of office expires at the

conclusion of the Annual General Meeting.

Subject to approval by the Annual General

Meeting, the ratio of independent directors15 will continue to be

50% and of women directors16 58%.

15 Excluding directors representing employees and employee

shareholders16 Excluding director representing employees

|

|

FINANCIAL

CALENDAR

- 23 April 2020: Bouygues Annual General Meeting

- 7 May 2020: Dividend payment

- 14 May 2020: First-quarter 2020 results (7.30am)

- 27 August 2020: First-half 2020 results (7.30am)

- 19 November 2020: Nine-month 2020 results (7.30am CET)

|

|

|

The financial statements have been audited and the statutory

auditors have issued a report certifying them without reserve.You

can find the full financial statements and notes to the financial

statements on bouygues.comThe full-year results presentation to

financial analysts will be webcast live on 20 February 2020 at 11am

(CET) on bouygues.com

About Bouygues

Bouygues is a diversified services group with a

strong corporate culture whose businesses are ouygues around three

sectors of activity: Construction, with Bouygues Construction

(building & civil works and energies & services),

Bouygues Immobilier (property development) and Colas (roads);

Telecoms, with Bouygues Telecom, and Media, with TF1.

INVESTORS AND ANALYSTS CONTACT:

INVESTORS@bouygues.com • Tel.: +33 (0)1 44 20 10 79

PRESS CONTACT:

presse@bouygues.com • Tel.: +33 (0)1 44 20 12 01

| BOUYGUES SA • 32 avenue Hoche • 75378 Paris

CEDEX 08 • bouygues.com |

|

|

|

|

|

|

|

2019 BUSINESS ACTIVITY

|

BACKLOGAT THE CONSTRUCTION

BUSINESSES(€ million) |

End-December |

|

|

2018 |

2019 |

Change |

| Bouygues

Construction |

22,183 |

21,600 |

-3% |

| Bouygues

Immobilier |

2,478 |

2,213 |

-11% |

|

Colas |

8,485 |

9,209 |

+9% |

|

Total |

33,146 |

33,022 |

0% |

|

BOUYGUES CONSTRUCTIONORDER

INTAKE(€ million) |

|

|

|

2018 |

2019 |

Change |

| France |

5,834 |

5,070 |

-13% |

|

International |

8,706 |

7,238 |

-17% |

|

Total |

14,540 |

12,308 |

-15% |

|

BOUYGUES

IMMOBILIERRESERVATIONS(€ million) |

|

|

|

2018 |

2019 |

Change |

| Residential

property |

2,337 |

2,074 |

-11% |

|

Commercial property |

277 |

625 |

+126% |

|

Total |

2,614 |

2,699 |

+3% |

|

COLASBACKLOG(€ million) |

End-December |

|

|

2018 |

2019 |

Change |

| Mainland France |

3,414 |

3,071 |

-10% |

|

International and French overseas territories |

5,071 |

6,138 |

+21% |

|

Total |

8,485 |

9,209 |

+9% |

|

TF1AUDIENCE SHAREa |

|

|

|

2018 |

2019 |

Change |

|

Total |

32.6% |

32.6% |

0 pt |

(a) Source: Médiamétrie – women under 50 who are purchasing

decision-makers

|

BOUYGUES TELECOMCUSTOMER BASE

(‘000) |

End-December |

|

2018 |

2019 |

Change |

| Mobile customer base

excl. MtoM |

11,414 |

11,958 |

+544 |

|

Mobile plan base excl. MtoM |

10,890 |

11,543 |

+653 |

|

Total mobile customers |

16,351 |

17,800 |

+1,449 |

|

Total fixed customers |

3,676 |

3,916 |

+240 |

2019 FINANCIAL PERFORMANCE

Because of the reclassification of lease

payments as amortization expense and interest expense, and the new

presentation of lease expenses in the financial statements, the

Group has adopted new financial indicators to continue to reflect

the operating nature of lease expenses (see glossary on page 14):

“EBITDA after Leases”, “Current operating profit after Leases” and

“Operating profit after Leases”. “Free cash flow”, “Free cash flow

after WCR” and “Net financial debt” have also been redefined.

|

|

|

|

|

CONDENSED CONSOLIDATED INCOME STATEMENT

(€ million) |

2018 restated |

2019 |

Change |

|

Sales |

35,555 |

37,929 |

+7%a |

| Current operating

profit |

1,564 |

1,676 |

+€112m |

|

Current operating profit after Leasesb |

1,507 |

1,619 |

+€112m |

| Other

operating income and expenses |

265c |

20d |

-€245m |

| Operating profit |

1,829 |

1,696 |

-€133m |

| Operating

profit after Leasesb |

1,772 |

1,639 |

-€133m |

| Cost of net debt |

(216) |

(207) |

+€9m |

| Interest

expense on lease obligations |

(57) |

(57) |

€0m |

| Other financial income and

expenses |

18 |

(10) |

-€28m |

| Income

tax |

(426) |

(452) |

-€26m |

| Share of net

profit of joint ventures and associates |

302 |

350 |

+€48m |

| o/w Alstom |

230 |

238 |

+€8m |

| Net

profit from continuing operations |

1,450 |

1,320 |

-€130m |

| Net profit

attributable to non-controlling interests |

(142) |

(136) |

+€6m |

| Net

profit attributable to the Group |

1,308 |

1,184 |

-€124m |

(a) Up 5% like-for-like and at constant exchange rates (b) See

glossary on page 14

(c) Including non-current charges of €31m at

Colas related mainly to works for the dismantling of the Dunkirk

site and the one-year-end employee bonus and non-current charges of

€22m at TF1 corresponding to amortization of audiovisual rights

remeasured as part of the acquisition of Newen Studios and

non-current income of €322m at Bouygues Telecom (essentially

non-current income of €250m related to the capital gain on disposal

of sites and non-current income of €110m related to the

cancellation of fees paid for the use of 1800 MHz frequencies prior

to 2018 and non-current charges of €47m related to network

sharing)(d) Including non-current income of €70m at Bouygues

Telecom essentially related to the capital gain on the disposal of

sites, non-current charges of €28m at Colas related to the

continued dismantling of the Dunkirk site and to adaptation costs

at structures, and non-current charges of €23m at Bouygues

Construction related to restructuring costs

|

|

|

|

|

CALCULATION OF EBITDA AFTER LEASESa

(€ million) |

2018 restated |

2019 |

Change |

|

Current operating profit after

Leasesa |

1,507 |

1,619 |

+€112m |

| Net depreciation and amortization expense on

property, plant and equipment and intangible assets |

1,703 |

1,777 |

+€74m |

| Charges to provisions and impairment losses,

net of reversals due to utilization |

417 |

516 |

+€99m |

| Reversals of unutilized provisions and

impairment losses and other |

(487) |

(364) |

+€123m |

|

EBITDA after Leasesa |

3,140 |

3,548 |

+€408m |

(a) See glossary on page 14

|

SALES BY SECTOR OF ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

Forex effect |

Scope effect |

lfl & |

|

constant fx |

| Construction

businessesa |

27,966 |

29,575 |

5.8% |

-1.1% |

-1.1% |

3.5% |

| o/w Bouygues Construction |

12,358 |

13,355 |

8.1% |

-1.4% |

-4.6% |

2.0% |

| o/w Bouygues Immobilier |

2,628 |

2,706 |

3.0% |

0.0% |

0.0% |

3.0% |

| o/w

Colas |

13,190 |

13,688 |

3.8% |

-1.1% |

2.0% |

4.7% |

| TF1 |

2,288 |

2,337 |

2.1% |

-0.1% |

-2.4% |

-0.3% |

| Bouygues Telecom |

5,344 |

6,058 |

13.4% |

0.0% |

-1.0% |

12.3% |

| Bouygues SA and

other |

168 |

202 |

nm |

- |

- |

nm |

|

Intra-Group eliminationsb |

(421) |

(417) |

nm |

- |

- |

nm |

|

Group sales |

35,555 |

37,929 |

6.7% |

-0.9% |

-1.1% |

4.6% |

| o/w

France |

21,788 |

22,446 |

3.0% |

0.0% |

3.0% |

6.1% |

|

| o/w

international |

13,767 |

15,483 |

12.5% |

-2.3% |

-7.7% |

2.4% |

(a) Total of the sales contributions (after eliminations within

the construction businesses)(b) Including intra-Group eliminations

of the construction businesses

|

|

|

|

|

CONTRIBUTION TO GROUP EBITDA AFTER LEASES BY SECTOR OF

ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

1,427 |

1,640 |

+€213m |

| o/w Bouygues

Construction |

490 |

591 |

+€101m |

| o/w Bouygues

Immobilier |

161 |

117 |

-€44m |

|

o/w Colas |

776 |

932 |

+€156m |

|

TF1 |

469 |

514 |

+€45m |

| Bouygues

Telecom |

1,264 |

1,411 |

+€147m |

|

Bouygues SA and other |

(20) |

(17) |

+€3m |

|

Group EBITDA after Leases |

3,140 |

3,548 |

+€408m |

|

|

|

|

|

CONTRIBUTION TO GROUP CURRENT OPERATING PROFIT BY SECTOR OF

ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

941 |

910 |

-€31m |

| o/w Bouygues

Construction |

378 |

378 |

€0m |

| o/w Bouygues

Immobilier |

190 |

99 |

-€91m |

|

o/w Colas |

373 |

433 |

+€60m |

|

TF1 |

199 |

255 |

+€56m |

| Bouygues

Telecom |

454 |

540 |

+€86m |

|

Bouygues SA and other |

(30) |

(29) |

+€1m |

|

Group current operating profit |

1,564 |

1,676 |

+€112m |

|

|

|

|

|

CONTRIBUTION TO GROUP CURRENT OPERATING PROFIT AFTER

LEASESA BY SECTOR OF ACTIVITY

(€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

915 |

882 |

-€33m |

| o/w

Bouygues Construction |

367 |

367 |

€0m |

| o/w

Bouygues Immobilier |

188 |

97 |

-€91m |

|

o/w Colas |

360 |

418 |

+€58m |

|

TF1 |

195 |

251 |

+€56m |

|

Bouygues Telecom |

427 |

515 |

+€88m |

|

Bouygues SA and other |

(30) |

(29) |

+€1m |

|

Group current operating profit after Leasesa |

1,507 |

1,619 |

+€112m |

|

(a) See glossary on page 14 |

|

|

|

CONTRIBUTION TO GROUP OPERATING PROFIT BY SECTOR OF

ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

906 |

859 |

-€47m |

| o/w Bouygues

Construction |

374 |

355 |

-€19m |

| o/w Bouygues

Immobilier |

190 |

99 |

-€91m |

|

o/w Colas |

342 |

405 |

+€63m |

|

TF1 |

177 |

255 |

+€78m |

| Bouygues

Telecom |

776 |

610 |

-€166m |

|

Bouygues SA and other |

(30) |

(28) |

+€2m |

|

Group operating profit |

1,829a |

1,696b |

-€133m |

(a) Including non-current charges of €31m at

Colas related mainly to works for the dismantling of the Dunkirk

site and the one-year-end employee bonus and non-current charges of

€22m at TF1 corresponding to amortization of audiovisual rights

remeasured as part of the acquisition of Newen Studios and

non-current income of €322m at Bouygues Telecom (essentially

non-current income of €250m related to the capital gain on the

disposal of sites and non-current income of €110m related to the

cancellation of fees paid for the use of 1800 MHz frequencies prior

to 2018 and non-current charges of €47m related to network

sharing)(b) Including non-current income of €70m at Bouygues

Telecom essentially related to the capital gain on the disposal of

sites, non-current charges of €28m at Colas related to the

continued dismantling of the Dunkirk site and to adaptation costs

at structures, and non-current charges of €23m at Bouygues

Construction related to restructuring costs

|

|

|

|

|

CONTRIBUTION TO GROUP OPERATING PROFIT AFTER

LEASESa BY SECTOR OF

ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

880 |

831 |

-€49m |

| o/w Bouygues

Construction |

363 |

344 |

-€19m |

| o/w Bouygues

Immobilier |

188 |

97 |

-€91m |

|

o/w Colas |

329 |

390 |

+€61m |

|

TF1 |

173 |

251 |

+78 M€ |

| Bouygues

Telecom |

749 |

585 |

-164 M€ |

|

Bouygues SA and other |

(30) |

(28) |

+€2m |

|

Group operating profit after Leasesa |

1,772b |

1,639c |

-€133m |

(a) See glossary on page 14

(b) Including non-current charges of €31m at

Colas related mainly to works for the dismantling of the Dunkirk

site and the one-year-end employee bonus and non-current charges of

€22m at TF1 corresponding to amortization of audiovisual rights

remeasured as part of the acquisition of Newen Studios and

non-current income of €322m at Bouygues Telecom (essentially

non-current income of €250m related to the capital gain on the

disposal of sites and non-current income of €110m related to the

cancellation of fees paid for the use of 1800 MHz frequencies prior

to 2018 and non-current charges of €47m related to network

sharing)(c) Including non-current income of €70m at Bouygues

Telecom essentially related to the capital gain on the disposal of

sites, non-current charges of €28m at Colas related to the

continued dismantling of the Dunkirk site and to adaptation costs

at structures, and non-current charges of €23m at Bouygues

Construction related to restructuring costs

|

CONTRIBUTION TO NET PROFIT ATTRIBUTABLE TO THE GROUP BY

SECTOR OF ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

653 |

623 |

-€30m |

| o/w Bouygues

Construction |

296 |

325 |

+€29m |

| o/w Bouygues

Immobilier |

137 |

46 |

-€91m |

|

o/w Colas |

220 |

252 |

+€32m |

|

TF1 |

55 |

67 |

+€12m |

| Bouygues

Telecom |

444 |

343 |

-€101m |

|

Alstom |

230 |

238 |

+€8m |

|

Bouygues SA and other |

(74) |

(87) |

-€13m |

|

Net profit attributable to the Group |

1,308 |

1,184 |

-€124m |

|

NET SURPLUS CASH (+)/NET DEBT (-) BY BUSINESS SEGMENT

(€ million) |

End-Dec 2018 restated |

End-Dec 2019 |

Change |

|

| Bouygues

Construction |

3,119 |

3,113 |

-€6m |

|

| Bouygues

Immobilier |

(238) |

(279) |

-€41m |

|

| Colas |

(475) |

(367) |

+€108m |

|

| TF1 |

(28) |

(127) |

-€99m |

|

| Bouygues Telecom |

(1,275) |

(1,454) |

-€179m |

|

|

Bouygues SA and other |

(4,715) |

(3,108) |

+€1,607m |

|

|

Net surplus cash (+)/Net debt (-) |

(3,612) |

(2,222) |

+€1,390m |

|

|

Current and non-current lease obligations |

(1,644) |

(1,686) |

-€42m |

|

|

|

|

|

|

|

|

CONTRIBUTION TO NET CAPITAL EXPENDITURE BY SECTOR OF

ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

497 |

521 |

+€24m |

| o/w Bouygues

Construction |

201 |

189 |

-€12m |

| o/w Bouygues

Immobilier |

8 |

11 |

+€3m |

|

o/w Colas |

288 |

321 |

+€33m |

|

TF1 |

204 |

242 |

+€38m |

| Bouygues

Telecom |

865 |

836 |

-€29m |

|

Bouygues SA and other |

7 |

3 |

-€4m |

|

Group Net capex |

1,573 |

1,602 |

+€29m |

|

|

|

|

|

CONTRIBUTION TO GROUP FREE CASH

FLOWa BY SECTOR OF ACTIVITY

(€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

544 |

675 |

+€131m |

| o/w Bouygues

Construction |

102 |

204 |

+€102m |

| o/w Bouygues

Immobilier |

101 |

100 |

-€1m |

|

o/w Colas |

341 |

371 |

+€30m |

|

TF1 |

140 |

156 |

+€16m |

| Bouygues

Telecom |

192 |

301 |

+€109m |

|

Bouygues SA and other |

(50) |

247 |

+€297m |

| Group free

cash flowa |

826 |

1,379 |

+€553m |

|

Excluding Alstom dividends: €22m in 2018 and €341m in 2019 |

804 |

1,038 |

+€234m |

(a) See glossary on page 14

|

|

|

|

|

CONTRIBUTION TO GROUP FREE CASH FLOW AFTER

WCRa BY SECTOR OF ACTIVITY (€ million) |

2018 restated |

2019 |

Change |

|

Construction businesses |

440 |

704 |

+€264m |

| o/w Bouygues

Construction |

388 |

58 |

-€330m |

| o/w Bouygues

Immobilier |

6 |

305 |

+€299m |

|

o/w Colas |

46 |

341 |

+€295m |

|

TF1 |

157 |

124 |

-€33m |

| Bouygues

Telecom |

(90) |

135 |

+€225m |

|

Bouygues SA and other |

(80) |

193 |

+€273m |

| Group free

cash flow after WCRa |

427 |

1,156 |

+€729m |

|

Excluding Alstom dividends: €€22m in 2018 and 341m in 2019 |

405 |

815 |

+€410m |

(a) See glossary on page 14

GLOSSARY

4G consumption: data consumed

on 4G cellular networks, excluding Wi-Fi.

4G users: customers who have

used the 4G network during the last three months (Arcep

definition).

ABPU (Average Billing Per

User):- In the mobile segment, it is equal to the total of

mobile sales billed to customers (BtoC and BtoB) divided by

theaverage number of customers over the period. It excludes MtoM

SIM cards and free SIM cards.- In the fixed segment, it is equal to

the total of fixed sales billed to customers (excluding BtoB)

divided by theaverage number of customers over the period.

BtoB (business to business):

when one business makes a commercial transaction with another.

Backlog (Bouygues Construction,

Colas): the amount of work still to be done on projects

for which a firm order has been taken, i.e. the contract has been

signed and has taken effect (after notice to proceed has been

issued and suspensory clauses have been lifted).

Backlog (Bouygues Immobilier):

sales outstanding from notarized sales plus total sales from signed

reservations that have still to be notarized.Under IFRS 11,

Bouygues Immobilier’s backlog does not include sales from

reservations taken via companies accounted for by the equity method

(co-promotion companies where there is joint control).

Construction businesses:

Bouygues Construction, Bouygues Immobilier and Colas.

Current operating profit after

Leases: current operating profit after taking account of

the interest expense on lease obligations.

EBITDA after Leases: current

operating profit after Leases (i.e. current operating profit after

taking account of the interest expense on lease obligations),

before (i) net depreciation and amortization expense on property,

plant and equipment and intangible assets, (ii) net charges to

provisions and impairment losses, and (iii) effects of acquisitions

of control or losses of control. Those effects relate to the impact

of remeasuring previously-held interests or retained interests.

EBITDA margin after Leases (Bouygues

Telecom): EBITDA after Leases as a proportion of sales

from services.

Free cash flow: net cash flow

(determined after (i) cost of net debt, (ii) interest expense on

lease obligations and (iii) income taxes paid), minus net

capital expenditure and repayments of lease obligations. It is

calculated before changes in working capital requirements (WCR)

related to operating activities and excluding 5G frequencies.

Free cash flow after WCR: net

cash flow (determined after (i) cost of net debt, (ii) interest

expense on lease obligations and (iii) income taxes paid),

minus net capital expenditure and repayments of lease obligations,

and after changes in working capital requirements (WCR) related to

operating activities.It is calculated after changes in working

capital requirements (WCR) related to operating activities and

excluding 5G frequencies.A calculation of free cash flow after WCR

by business segment is presented in Note 17 “Segment information”

to the consolidated financial statements at 31 December 2019,

available at bouygues.com.

Fixed churn: the total number of cancellations

in a given month, divided by the total number of subscribers at the

end of the previous month

FTTH (Fiber to the Home):

optical fiber from the central office (where the operator’s

transmission equipment is installed) all the way to homes or

business premises (Arcep definition).

FTTH penetration rate: the FTTH

share of the total fixed subscriber base (the number of FTTH

customers divided by the total number of fixed customers)

FTTH premises secured: the

horizontal deployed, being deployed or ordered up to the

concentration point.

FTTH premises marketed: the

connectable sockets, i.e. the horizontal and vertical deployed and

connected via the concentration point.

Growth in sales like-for-like and at

constant exchange rates:- at constant exchange rates:

change after translating foreign-currency sales for the current

period at theexchange rates for the comparative period;- on a

like-for-like basis: change in sales for the periods compared,

adjusted as follows:

- for acquisitions, by deducting from the current period those

sales of the acquired entity that have no equivalent during the

comparative period;

- for divestments, by deducting from the comparative period those

sales of the divested entity that have no equivalent during the

current period.

Mobile churn: the total number

of cancellations in a given month, divided by the total number of

subscribers at the end of the previous month

MtoM: machine to machine

communication. This refers to direct communication between machines

or smart devices or between smart devices and people via an

information system using mobile communications networks, generally

without human intervention.

Net surplus cash/(net debt):

the aggregate of cash and cash equivalents, overdrafts and

short-term bank borrowings, non-current and current debt, and

financial instruments. Net surplus cash/(net debt) does not include

non-current and current lease obligations. A positive figure

represents net surplus cash and a negative figure represents net

debt. The main components of change in net debt are presented in

Note 9 to the consolidated financial statements at 31 December

2019, available at bouygues.com.

Operating profit after Leases:

operating profit after taking account of the interest expense on

lease obligations.

Order intake (Bouygues Construction,

Colas): a project is included under order intake when the

contract has been signed and has taken effect (the notice to

proceed has been issued and all suspensory clauses have been

lifted) and the financing has been arranged. The amount recorded

corresponds to the sales the project will generate.

PIN: Public-Initiative

Network.

Reservations by value (Bouygues

Immobilier): the € amount of the value of properties

reserved over a givenperiod.- Residential properties: the sum of

the value of unit and block reservation contracts signed by

customers andapproved by Bouygues Immobilier, minus registered

cancellations.- Commercial properties: these are registered as

reservations on notarized sale.For co-promotion companies:

- if Bouygues Immobilier has exclusive control over the

co-promotion company (full consolidation), 100% of amounts are

included in reservations;

- if joint control is exercised (the company is accounted for by

the equity method), commercial activity is recorded according to

the amount of the equity interest in the co-promotion company.

Sales from services (Bouygues Telecom)

comprise: - Sales billed to customers, which

include:- In Mobile:

- For BtoC customers: sales from outgoing call charges (voice,

texts and data), connection fees, and value-added services.

- For BtoB customers: sales from outgoing call charges (voice,

texts and data), connection fees, and value-added services, plus

sales from business services.

- Machine-To-Machine (MtoM) sales.

- Visitor roaming sales.

- Sales generated with Mobile Virtual Network Operators

(MVNOs).

- In Fixed:

- For BtoC customers: sales from outgoing call charges, fixed

broadband services, TV services (including Video on Demand and

catch-up TV), and connection fees and equipment hire.

- For BtoB customers: sales from outgoing call charges, fixed

broadband services, TV services (including Video on Demand and

catch-up TV), and connection fees and equipment hire, plus sales

from business services.

- Sales from bulk sales to other fixed line operators.

- Sales from incoming Voice and Texts.- Spreading of handset

subsidies over the projected life of the customer account, required

to comply withIFRS 15.- Capitalization of connection fee sales,

which is then spread over the projected life of the customer

account.

Other sales (Bouygues Telecom): difference

between Bouygues Telecom’s total sales and sales from services.It

comprises:- Sales from handsets, accessories and other- Roaming

sales- Non-telecom services (construction of sites or installation

of FTTH lines)- Co-financing of advertising

Very-high-speed: subscriptions

with peak downstream speeds higher or equal to 30 Mbit/s. Includes

FTTH, FTTLA, 4G box and VDSL2 subscriptions (Arcep definition).

Your data is collected by Bouygues so that you may receive

information relating to the Group’s activity and other news. Your

data will be kept for a period of 3 years. You have data access,

amendment, portability and deletion rights. You also have the right

to restrict data processing and the right to object. These rights

can be exercised upon request to Bouygues SA, 32 avenue Hoche,

75008 Paris, France, or by email to: presse@bouygues.com.

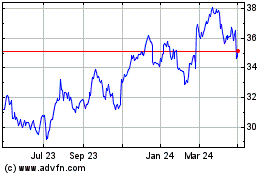

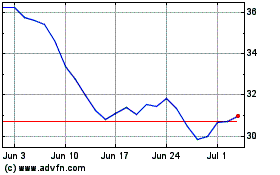

Bouygues (EU:EN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bouygues (EU:EN)

Historical Stock Chart

From Apr 2023 to Apr 2024