Results of the first half of 2020-2021

May 20 2021 - 11:45AM

Results of the first half of 2020-2021

Derichebourg on the frontlines of the

recovery, exceptional performance in the first half:

Half-year recurring EBITDA up 88.8% at

€172.6 million

Net profit up 229% at €73.6

million

The Board meeting of May 20, 2021, chaired by

Mr. Daniel Derichebourg, approved the half-year financial

statements at March 31, 2021. During the meeting, the Chairman and

CEO expressed his satisfaction with the results of the Group’s

various business lines, and more particularly those of the

Environmental Services division, which benefited from the early

effects of the recovery in global economic activity and the

successful integration of the businesses acquired last year in

Spain.

Revenue: €1.65 billion in the first half

Revenue amounted to €1.65 billion, up 26.7% year

on year. The increase was attributable chiefly to Environmental

Services (up 42%), dampened by the slight decline in Multiservices

revenue (down 3%) compared with the first half of last year.

|

(in thousand tons) |

3/31/2021 |

3/31/2020 |

Change |

|

|

|

|

|

|

Ferrous metals |

1,998.3 |

1,654.8 |

20.8% |

|

Non-ferrous metals |

322.1 |

297.7 |

8.2% |

|

Total volumes |

2,320.4 |

1,952.5 |

18.8% |

|

|

|

|

|

|

(in millions of euros) |

3/31/2021 |

3/31/2020 |

Change |

|

|

|

|

|

|

Ferrous metals |

578.7 |

361.0 |

60.3% |

|

Non-ferrous metals |

505.6 |

368.7 |

37.1% |

|

Services |

135.9 |

128.0 |

6.2% |

|

Environmental Services revenue |

1,220.3 |

857.6 |

42.3% |

|

Multiservices revenue |

429.2 |

444.4 |

(3.4%) |

|

Holding company revenue |

0.5 |

0.4 |

27.0% |

|

Total half-year revenue, Derichebourg Group |

1,649.9 |

1,302.3 |

26.7% |

Environmental Services

The volume of ferrous scrap metals sold

increased by 20.8% (up 14% at constant scope) due to:

- a favorable comparison base, deliveries having been low in the

first quarter of fiscal 2019-2020

- sustained and growing demand for ferrous metals, including from

blast furnaces, as they help reduce their CO2 emissions

- robust demand from Turkish steel mills throughout the past

half-year, keeping volumes and selling prices up

- the late resumption of activity at some of the blast furnaces

shut down during the first wave of the health crisis last year,

which created shortages of certain products, and, for those where

this is possible, prompted a shift in demand toward steel from

electrical mills.

The volume of non-ferrous metals sold increased by 8.2% (at

constant scope, down 10%, due to a marked decline in the American

subsidiary).

Prices of ferrous and non-ferrous metals were

significantly higher than in the first half of last year, resulting

in a 42% increase in Environmental Services revenue.

Multiservices

The increase in revenue in the waste management

business lines (18% in France,16% in Spain-Portugal) was not

sufficient to fully offset the decline in jobs related to

aeronautics (declines of 39% in outsourced services and 61% in

specialized temporary work), meaning that revenue for the half-year

was down 3%.

Recurring EBITDA1

The Group’s main business lines saw their

recurring EBITDA improve year on year. Thanks to improved margins

in the Environmental Services division, the Group’s recurring

EBITDA rose by 88.8% (or €81.2 million) to €172.6 million. It

represents 10.5% of revenue.

The recurring EBITDA of the Environmental

Services division was €153.3 million, up 116.7% (or €82.5 million)

compared with last year. It represents 12.6% of revenue. The

factors behind the improvement are an increase in ferrous metal

volumes, higher prices for ferrous and non-ferrous metals, tight

control of the various expense items and improved results in

household waste collection activities in Canada.

The recurring EBITDA of the Multiservices

division increased by 7.7% to €24 million thanks to the improvement

in the profitability of the waste management businesses and the

resilience of outsourced aeronautical services despite the

challenging economic climate.

The Group’s recurring EBITDA over 12 rolling

months amounted to €262 million, with no adjustment for the impact

of the period from April to May 2020, which was heavily impacted by

the first period of lockdown.

Recurring operating profit

(loss)2

After taking into account €60.4 million in

depreciation and amortization over the half-year, recurring

operating profit amounted to €112.3 million, up 236.6% compared

with the first half of last year.

Operating Profit (loss)

There were few non-recurring items in the first

half other than a gain of €2.9 million following a reversal of a

provision for litigation at Derichebourg Multiservices and

Derichebourg Propreté that had become irrelevant.

Operating profit amounted to €115.5 million, up

175.9% compared with the same period last year.

Net profit (loss) attributable to the

shareholders of the consolidating entity

The net profit attributable to shareholders was

€73.6 million, up 229% compared with the first half of last

year.

Outlook

The Group expects the favorable conditions for

the recycling business that prevailed in the first half to continue

in the second, with a high price environment for raw materials.

Demand for steel is strong in China: on May 1,

2021, China abolished import duties on steel and ferrous

metals.

The Group plans to continue its investment

policy and at the end of the half-year or the beginning of fiscal

2021-2022 is to:

- Increase its WEEE (waste electrical and electronic equipment)

processing capacity in France

- Increase its lead ingot production capacity

The pre-notification file relating to the

prospective acquisition of Ecore is currently being reviewed by the

competent antitrust authorities.

Growth in revenue from services activities

(utilities and multiservices) is also expected.

INCOME STATEMENT

|

(in millions of euros) |

3/31/2021 |

3/31/2020 |

Change |

|

|

|

|

|

|

Revenue |

1,649.9 |

1,302.3 |

26.7% |

|

of which Environmental Services |

1,220.3 |

857.6 |

42.3% |

|

of which Multiservices |

429.2 |

444.4 |

(3.4%) |

|

|

|

|

|

|

Recurring EBITDA |

172.6 |

91.5 |

88.8% |

|

of which Environmental Services |

153.3 |

70.7 |

116.7% |

|

of which Multiservices |

24.0 |

22.3 |

7.7% |

|

|

|

|

|

|

Recurring operating profit (loss) |

112.3 |

33.4 |

236.6% |

|

of which Environmental Services |

107.1 |

26.6 |

302.4% |

|

of which Multiservices |

11.6 |

9.7 |

19.1% |

|

|

|

|

|

|

Non-current items, net |

3.2 |

8.5 |

(62.4%) |

|

|

|

|

|

|

Operating Profit (loss) |

115.5 |

41.9 |

175.9% |

|

|

|

|

|

|

Net financial expenses |

(7.2) |

(5.7) |

26.0% |

|

Other financial items |

0.6 |

(0.3) |

(292.7%) |

|

|

|

|

|

|

Profit (loss) before tax |

108.9 |

35.9 |

203.7% |

|

|

|

|

|

|

Income tax |

(33.4) |

(13.1) |

156.0% |

|

Share of profit (loss) of associates and joint ventures |

(0.8) |

0.2 |

(413.4%) |

|

Net profit (loss) attributable to non-controlling interests |

(1.1) |

(0.7) |

66.6% |

|

|

|

|

|

|

Net profit (loss) attributable to

shareholders |

73.6 |

22.4 |

228.8% |

BALANCE SHEET

|

(in millions of euros) |

3/31/2021 |

9/30/2020 |

Change (%) |

|

Goodwill |

261.1 |

261.1 |

|

|

Intangible assets |

6.7 |

7.5 |

|

|

Property, plant and equipment |

496.9 |

497.7 |

|

|

Right-of-use assets |

202.8 |

190.2 |

|

|

Financial assets |

10.3 |

10.0 |

|

|

Equity interests in associates and joint ventures |

11.8 |

12.6 |

|

|

Deferred taxes |

32.4 |

31.1 |

|

|

Total non-current assets |

1,022.0 |

1,010.1 |

1.2% |

|

Inventories |

136.7 |

105.3 |

|

|

Trade receivables |

399.6 |

309.9 |

|

|

Tax receivables |

4.6 |

4.1 |

|

|

Other assets |

90.4 |

68.3 |

|

|

Financial assets |

20.0 |

15.4 |

|

|

Cash and cash equivalents |

403.7 |

361.9 |

|

|

Financial instruments |

1.4 |

0.0 |

|

|

Total current assets |

1,056.4 |

865.0 |

22.1% |

|

Total non-current assets and groups of assets |

0.0 |

0.0 |

|

|

Total assets |

2,078.3 |

1,875.1 |

10.8% |

|

(in millions of euros) |

3/31/2021 |

9/30/2020 |

Change (%) |

|

Group shareholders’ equity |

596.3 |

521.6 |

|

|

Non-controlling interests |

3.4 |

2.6 |

|

|

Total shareholders’ equity |

599.7 |

524.2 |

14.4% |

|

Loans and financial debts |

541.5 |

572.2 |

|

|

Provision for pensions and similar benefits |

52.0 |

50.8 |

|

|

Other provisions |

32.8 |

33.4 |

|

|

Deferred taxes |

22.6 |

23.2 |

|

|

Other liabilities |

4.5 |

3.2 |

|

|

Total non-current liabilities |

653.4 |

682.6 |

(4.3%) |

|

Loans and financial debts |

182.9 |

130.9 |

|

|

Provisions |

2.6 |

4.6 |

|

|

Trade payables |

346.0 |

254.5 |

|

|

Tax payables |

27.1 |

4.7 |

|

|

Other liabilities |

264.8 |

271.2 |

|

|

Financial instruments |

1.9 |

2.3 |

|

|

Total current liabilities |

825.3 |

668.2 |

|

|

Total liabilities related to a group of assets held for

sale |

0.0 |

0.0 |

23.5% |

|

Total liabilities |

2,078.3 |

1,875.1 |

10.8% |

CHANGE IN NET FINANCIAL DEBT FROM SEPTEMBER 30, 2020 TO

MARCH 31, 2021

|

Net financial debt at September 30, 2020 |

341.1 |

| Recurring

EBITDA |

(172.6) |

| Investments |

59.0 |

| Net financial

expenses |

7.2 |

| Corporate income

taxes |

12.9 |

| Others |

2.9 |

|

Subtotal |

250.4 |

| Change in working

capital requirement |

52.8 |

| New IFRS 16

right-of-use assets |

17.4 |

|

Net financial debt at March 31, 2021 |

320.7 |

1 Recurring EBITDA = Recurring operating profit (loss) + net

depreciation and amortization on tangible and intangible assets,

and right-of-use assets

2 Recurring operating profit (loss) = Operating profit (loss)

+/- non-recurring items

- Results of the first half of 2020-2021

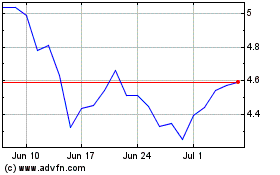

Derichebourg (EU:DBG)

Historical Stock Chart

From Mar 2024 to Apr 2024

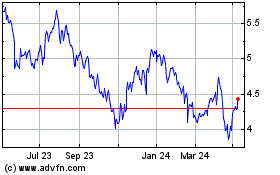

Derichebourg (EU:DBG)

Historical Stock Chart

From Apr 2023 to Apr 2024