AXA 1st Half Net Profit Fell

August 01 2019 - 1:38AM

Dow Jones News

By Pietro Lombardi

AXA SA (CS.FR) said Thursday that first-half net profit fell

17%, missing expectations, as the impact of the deconsolidation of

U.S. life-insurance business AXA Equitable Holdings Inc. (EQH) and

the change in fair value of derivatives more than offset growing

revenue.

Net profit for the period declined to 2.33 billion euros ($2.59

billion), the French insurance giant said.

Revenue rose 8% to EUR57.95 billion.

Analysts had expected net profit of EUR2.83 billion on revenue

of EUR56.15 billion, according to a consensus forecast provided by

FactSet.

Underlying earnings grew 10% on year, AXA said.

Annual premium equivalent, known as APE, rose 2%. APE measures

new business growth by combining the value of payments on new

regular premium policies, and 10% of the value of payments made on

one-time, single-premium products.

The French insurer's solvency II ratio--a key measure of

financial strength for insurance companies--was 190%.

"AXA continued to deliver strong operating performance," Chief

Executive Thomas Buberl said.

"AXA's earnings benefited from a virtuous double dynamic, both

growing volumes and improving profitability across all our

geographies and preferred segments."

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

August 01, 2019 01:23 ET (05:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

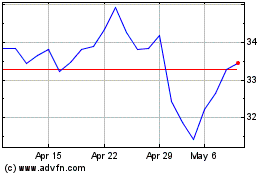

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024