Casino Group: first-half 2021 results and second-quarter 2021 net

sales

FIRST-HALF 2021 RESULTS AND SECOND-QUARTER 2021 NET SALES

Further increase in profitability

Trading profit up +24% at constant exchange rates, of

which +9% in France and +33% in Latin America

Net sales for first half stable (-0.5%) on an organic

basis

In France, success in the transformation

of banners with trading margin up +81 bps and 353 stores

opened, laying the foundation for a strong return to growth in

H2

In France

- Retail banners1:

- Strong increase in profitability across all

banners with trading margin up +81 bps to

2.1%. Trading profit rose by +50%1 (+€49m) thanks to the Group’s

transformation plans and reduced Covid-related costs, in a

context of lower net sales relative to the very high basis of

comparison due to the first lock-down during H1 2020.

- Net sales represented a same-store change of

-8.4% in Q2 2021, due to the high basis of comparison

in 2020 (+6.0% in Q2 2020), the temporary drop of

tourism and public health restrictions in H1 2021 (closure of

non-essential product sections, curfew). Looking beyond

these temporary challenges, the Group continued to activate its

growth drivers:

- Faster delivery on the strategic priorities of:

(i) expansion, with the opening of 353 convenience

stores during H1 (initial target: 300 stores),

and (ii) E-commerce, with same-store sales up

+103% over two years, outperforming the market (+59%2),

and continued roll-out of the Ocado and Amazon partnerships and

quick-commerce solutions from

800 stores.

- Outlook for H2 2021: growth in profitable formats,

with (i) expansion of the store base

(400 openings in local formats Franprix, Vival, Naturalia,

etc.) and (ii) acceleration in E-commerce thanks

to our exclusive partnerships (Ocado, Amazon) and the solutions

deployed at our stores.

- Inflection since early July with sales down

-4.0%3 on a same-store basis vs. -8.4% in Q2, i.e. an improvement

of +4.4 pts, and an increase in Cdiscount GMV of +13.5%.

- Cdiscount: H1 2021 EBITDA of €48m4.

Further growth in the marketplace in H1 of +33% over two

years (+10% year‑on‑year) and growth in digital

marketing of +72% over two years (+44% y-o-y).

- Outlook for H2 2021: further progress on priority

strategic plans (marketplace, digital marketing, Octopia) resulting

in strong EBITDA growth.

- GreenYellow: strong business momentum, with

a photovoltaic pipeline of 809 MWp (+85% vs.

H1 2020) and 3.5 GWp in additional opportunities.

- Outlook for H2 2021: growth in EBITDA.

- RelevanC: growth in net sales of +32% in Q2 2021.

Signing of a commercial partnership with Google Cloud and

Accenture.

- Outlook for H2 2021: accelerated expansion in France

and internationally.

- Disposal plan: signing with BNPP of a partnership and

an agreement for the disposal of Floa for a total amount of €179m5

and securing of a €99m6 earn-out, bringing total disposals

to €3.1bn.

- The Group is maintaining its target of €4.5bn in asset

disposals in France.

- Improved financial terms, revised covenants and

extension of €1.8bn of Casino’s main syndicated credit facility to

July 2026. At 30 June 2021, the Group comfortably

complied with the covenant7, with headroom of

€359m on EBITDA after lease payments (2.1x vs. limit of

3.5x).

In Latin America

- Strong growth in profitability with H1 EBITDA and

trading profit up +21% and +33% respectively at constant

exchange rates. Organic growth in net sales of +5.5% in Q2, driven

by Assaí (+22%).

- Two-fold increase in Latam asset value since the Assaí

spin-off was announced8.

FIRST-HALF 2021 RESULTS

Consolidated net sales amounted

to €14,480m in H1 2021, stable

(-0.5%) on an organic basis12 and down -10.3%

after taking into account the effects of exchange rates and

hyperinflation for -7.2%, changes in scope for -2.2% and fuel for

+0.5%.On the France Retail scope, net sales were down -7.3%

on a same-store basis. Including Cdiscount, same-store

growth in France came to -6.3%.E-commerce

(Cdiscount) gross merchandise volume (GMV) came to

nearly €2bn, a year-on-year increase of +2.3%13

(+14%2 over two years), led by the expansion of the marketplace.

Sales in Latin America were up by +6.9% on an

organic basis1, mainly supported by the very good performance in

the cash & carry segment (Assaí), which grew by

+22%2 on an organic basis.

Consolidated EBITDA came to

€1,099m, an increase of +3% including currency

effects and +11.1% at constant exchange rates.France EBITDA

(including Cdiscount) amounted to €622m, including €573m

on the France Retail scope and €48m for Cdiscount. France

Retail banners EBITDA (France Retail

excluding GreenYellow, property development and Vindémia) was up

+9% to €543m. GreenYellow generated EBITDA of

€28m14 and property development operations

delivered €3m. France EBITDA margin (including

Cdiscount) came to 8.0%, an increase of +105 bps. In

Latin America, EBITDA rose by +21.1% excluding

currency effects and including tax credits15 for €6m. EBITDA

excluding tax credits4 was up +19.8%.

Consolidated trading profit

came to €444m (€438m excluding tax credits4), an

increase of +11.4% including currency effects and +23.5% at

constant exchange rates (+22% excluding tax credits).In

France (including Cdiscount), trading profit stood at

€173m, including €166m on the France Retail scope

and €7m for Cdiscount. France Retail banners trading

profit (France Retail excluding GreenYellow, property

development and Vindémia) grew by a strong +50% to

€146m. Trading profit came to €19m for GreenYellow

and to €2m for property development

operations. Trading margin in

France (including Cdiscount) was up +39 bps at

2.2%, supported by an improvement from

France Retail, which recorded a +45 bps

increase in trading margin to 2.4%.In Latin

America, trading profit totalled €271m, an increase of

+13.5% (+29.9% excluding tax credits and currency

effects), driven by the continued strong sales momentum at

Assaí, the transfer of sales to E-commerce and the

repositioning of hypermarkets at Multivarejo, and

the continued profitability and positive effect of real estate

development at Éxito.

Underlying net financial expense and net

profit, Group share16

Underlying net financial

expense for the period came to -€398m (-€244m

excluding interest expense on lease liabilities) vs.

-€404m in H1 2020 (-€239m excluding interest expense on lease

liabilities). In France Retail, net financial

expense include, as for the refinancing of the Term Loan B of April

2021, (i) a non-recurring expense of €40m mainly non-cash, and (ii)

a permanent reduction in financial expenses of €9m

over the full year. E-commerce net financial

expense was virtually stable compared with 2020. In Latin

America, financial expense was down.

Underlying net profit, Group

share was up +€23m versus

H1 2020.Diluted underlying earnings per

share17 stood at -€1.00, vs. -€1.20 in H1 2020.

The Group recorded a sharp improvement

in other operating income and expenses of +€257m (+€11m in

H1 2021 vs. -€246m in H1 2020). In

France, excluding the asset disposal plan and

GreenYellow, non-recurring expenses declined by

29% (from -€107m in H1 2020 to -€76m in

H1 2021). In Latin America, other operating income and

expenses amounted to a net expense of -€34m in H1 2021 (vs.

-€18m in H1 2020).

Consolidated net profit (loss), Group

share

Net profit (loss) from continuing

operations, Group share improved by a sharp +€306m to

-€35m, from -€340m in H1 2020.Net profit (loss) from

discontinued operations, Group share came out at -€170m in

H1 2021, compared with -€162m in

H1 2020.Consolidated net profit (loss), Group

share amounted to -€205m vs. -€502m in H1 2020.

Financial position at 30 June 2021

-Consolidated net debt excluding the effect of

IFRS 5 was stable compared with

30 June 2020, at €6.3bn, reflecting stable net debt in

both France and the Latam region. Including the impact of

IFRS 5, consolidated net debt came to €5.5bn versus

€4.8bn in H1 2020.

At 30 June 2021, the Group's liquidity

in France (including Cdiscount) was €2.6bn, with €528m in

cash and cash equivalents and €2bn confirmed undrawn lines of

credit, available at any time. The Group also has €339m in

a segregated account for gross debt redemptions.

FIRST-HALF 2021 HIGHLIGHTS -

Retail banners: increased profitability and

progress in priority areas of expansion and E-commerce

Profitability continued to improve for the retail

banners18, with trading profit margin up +81 bps to 2.1%

in H1 2021. Trading profit increased by +50% in H1 2021, to €146m

(vs. €97m in H1 2020), supported by a reduction in the

cost base of €30m per quarter thanks to the transformation

plans initiated in Q3 2020, which drove productivity gains at

the head office and in stores.

Expansion of the store base and

digitalisation

- Expansion of the Group’s store base continued during

the period, with 353 convenience stores opened in urban,

semi-urban and rural areas, of which 26 Naturalia. In

Q2 2021, the Group opened 238 stores, in line with the initial

target of 200 openings.

- The Group had 613 stores equipped with autonomous

solutions as of end-June 2021 (vs. 533 as of end-2020),

facilitating evening and weekend openings. 63% of payments in Géant

hypermarkets and 58% at Casino Supermarkets were made by smartphone

or automatic check-out as of end-June 2021 (vs. 61% and 48%

respectively as of end-2020). CasinoMax app users

accounted for 24% of sales in hypermarkets and supermarkets in Q2

(vs. 22% as of end-2020).

Food E-commerce

- Food E-commerce19 posted same-store sales growth of +15% for

the period and +103% over two years, outperforming

the market (+59%20). The expanded offering now covers the full

spectrum of home delivery solutions, through partnerships with

high-tech players that are leaders in their field:

- Next-day delivery from the O’logistique

warehouse (automated with Ocado technology) via Monoprix Plus

(30,000 items) and Casino Plus (24,000 items) ;

- Same-day delivery/in-store

click & collect solutions picked up pace

with the launch of an Amazon click & collect service within 2

hours from Géant Casino and Casino Supermarkets (target of 180

stores). In addition, new deployments of Amazon lockers are

planned, in addition to the 600 already installed to date in the

Group ;

- Delivery within two hours: extension of the

partnership with Amazon to Montpellier and

Strasbourg, in addition to Paris, Nice, Lyon and Bordeaux ;

- Delivery within 30 minutes: roll-out of

a quick-commerce offering across 800 stores

thanks to Franprix’s delivery services and the partnerships with

Deliveroo and Uber Eats ;

- Launch of a food marktetplace on the Casino.fr

website

Sales initiatives

The Group’s banners are adapting their offering to new consumer

trends by developing a series of initiatives designed to meet their

customers’ expectations:

- Expansion of Monoprix’s range of services

based on three key areas: (i) health, through

Santé Au Quotidien spaces dedicated to health and well-being, with

advice from a qualified pharmacist and a range of

CBD products; (ii) local products, both

food and non-food, from less than 100km away, and

(iii) a sustainable mobility offering

including bikes, kick scooters, a service station and a range

of accessories (helmets, connected devices and fashion

accessories)

- Development of Franprix in suburban areas with

150 store openings scheduled over two years

and specific customer services (newspapers and

magazines, parcel receipt, hot meals and cooked dishes for the

evening, and electric bike rental in partnership with Véligo)

Evolution of concepts within Géant Casino and Casino

Supermarkets: both banners have introduced

artificial intelligence into the operational

management of their stores, and partnerships have been

signed with some fifteen brands and start-ups to introduce

innovative concepts (artisanal products in short circuits: juices,

honeys, dairy products). Géant has deployed expanded fruit

and vegetable areas, cash & carry

spaces, developed electric mobility corners and

will soon launch toy corners with La Grande Récré. In addition,

9 small, loss-making Géant stores have been converted into

Casino Supermarkets to provide an offering that better

suits local needs.

Outlook for H2 2021: given the success of the

banners' transformation plans and their profitability, strong

return to growth in H2 in profitable formats with (i) the expansion

of the store base (400 openings) and (ii) an acceleration in

E-commerce

Cdiscount21: solid performance from the

marketplace, digital marketing and Octopia in the first half of the

year

Cdiscount generated €49m22 in

EBITDA, stable year-on-year (+148% over two years).

The marketplace recorded a half-yearly

increase in gross merchandise volume (GMV) of +33% over two years

(+10% year-on-year):

- The marketplace contribution to GMV rose by +4 pts

year-on-year to 46%

- Marketplace revenues grew by +17% (+39% over two years) to

€199m over the last 12 months

- Fulfillment by Cdiscount services accounted for 35% of

marketplace GMV (up +7 pts year-on-year)

Digital marketing saw its revenues grow by

+44% in H1 2021. It continued to be supported by the

development of the Cdiscount Ads Retail Solution (CARS) digital

marketing platform, where the number of sponsored products rose by

+91% in H1 2021.

Turnkey marketplace solution Octopia recorded

rapid growth in H1 2021, with a +60% increase in GMV (x3

over two years) in Products-as-a-Service and

Fulfillment-as-a-Service solutions. Merchants-as-a-Service and

Marketplace-as-a-Service solutions recorded a good start.

Outlook for H2 2021: further progress on priority

strategic plans (marketplace, digital marketing, Octopia) resulting

in strong EBITDA growth.

GreenYellow: increase in photovoltaic pipeline

of +85% year-on-year and expansion into Europe

For the six months to 30 June 2021,

GreenYellow generated EBITDA of €37m23. Excluding

gains on asset disposals, EBITDA increased by +40%

in H1 2021 compared with H1 2020.

At 30 June 2021, GreenYellow had an

advanced pipeline of 809 MWp in solar power

projects, up a sharp +85% from

30 June 2020, and an additional prospective pipeline of

3.5 GWp. The advanced pipeline for the energy

efficiency business came to 350 GWh, up

+78% from 30 June 2020, with an additional

prospective pipeline of nearly 900 GWh.

Expansion continued with the launch of

an initial 4 MWp solar project in Bulgaria through a

strategic partnership with Solarpro, a key player in the European

photovoltaics market. GreenYellow has indicated that it intends to

expand rapidly in Eastern Europe (Poland, Hungary, Bulgaria).

During the first half of the year, GreenYellow

also strengthened its positions in its traditional

geographies by supporting customers with their projects in

both solar power and energy efficiency:

-

- In Africa, via the largest self-consumption solar power plant

in Senegal (1.6 MWp) for a key player in the country’s

agrifood industry

- In Madagascar, through the extension of the country’s largest

solar power plant by 20 MWp to reach 40 MWp

- In France, with the start-up of the 4.7 MWp solar canopies

in Magny-Cours and the partnership with Franprix, aimed at reducing

the energy use of its refrigeration facilities (by 30%), as well as

their carbon footprint

- In Asia, with the installation of photovoltaic systems at two

sites for Thai particle board manufacturer Panel Plus Co.,

located in the suburbs of Bangkok and in the southern province of

Songkhla

- In Colombia, with a “cold PPA” program in a building under

construction for an international hotel group

Outlook for H2 2021: growth in EBITDA.

RelevanC

RelevanC continued to accelerate, with

growth in net sales of +32% in the second

quarter.

During the quarter, RelevanC strengthened its positioning

with:

-

- A partnership with Google Cloud and Accenture to step up the

development and commercialization of RelevanC solutions

- The allocation of Premier Partner status to RelevanC, and the

integration of RelevanC solutions into the Google Cloud’s B2B

marketplace

Outlook for H2 2021: (i) further implementation of the

partnership strategy and (ii) accelerated growth in France and

internationally thanks to partners, notably Google Cloud and

Accenture

Successful spin-off of Assaí's activities in

Latin America

The spin-off of Assaí’s

businesses was completed on 31 December 2020 and

Assaí shares were admitted to trading on 1 March

2021. Assaí shares were distributed to GPA shareholders at a

ratio of one Assaí share for each GPA share.

Each entity now operates autonomously and has

direct access to the capital markets and different financing

sources.

Casino's stake valuation in Latin America has

doubled since the spin-off of Assaí was announced24, rising from

€1.1bn to €2.3bn.

Reinforcement of the Group's CSR

commitments

As well as being the top retailer in terms of

CSR performance according to Vigeo Eiris25, a subsidiary of

Moody’s, Casino Group maintained its AA rating from MSCI in June

2021.

Pursuing its climate action, the Group has

committed to a 38% reduction in its greenhouse gas

emissions by 203026, stepping up the commitment made in 2018 of

an 18% reduction between 2015 and 20253, which was validated by the

Science Based Targets initiative. The Group is taking action to

reduce carbon emissions in all its geographies

(Franprix/GreenYellow partnership to reduce the carbon footprint of

refrigeration units, carbon-neutral refrigerant gases in Carulla

FreshMarket stores in Colombia).Cdiscount has now reached

carbon-neutral status for its deliveries, by reducing emissions

through 3D packaging and bulk loading and by capturing residual

emissions.

With its strategy designed to promote

responsible consumption, the Group recorded an increase in the

share of organic products of +0.9 pt27 in H1 and

deployed new bulk concepts in partnership with national

brands. Other initiatives carried out by the Group include the

transition to virtual discount coupons for Casino banners

since 2020, thanks to the Casino Max application, and to virtual

receipts and vouchers in March 2021. At Cdiscount, the aim is to

promote reusable packaging, which will be offered to all

customers by end-2021. In addition, the Group has extended

Monoprix’s syndicated credit facility with an annual margin

adjustment clause based on the achievement of CSR objectives

(greenhouse gases, responsible label, vegetable protein

products).

In addition, the Group continued to carry out

solidarity actions during the first half of the year,

making commitments to numerous charities including Secours

Populaire with Franprix and Fondation des Femmes with Monoprix.

Various food drives for students in financial difficulty

were also organised at Casino banners during the period, in

partnership with food banks. Lastly, the Group has decided to help

revitalise rural areas by creating culture corners in Casino

convenience stores, in partnership with Fondation Marc Ladreit de

Lacharrière.

Asset disposal plan

On 27 July 2021, the Group has signed with BNPP

a partnership and an agreement for the sale of Floa for €179m28.

This partnership plans the development of the fractional payment

activity "FLOA PAY". In this context, Casino Group will

remain associated with the successful development of

FLOA's payment activity for 30% of the future created

value29.

In addition, the Group has secured and recorded

in advance a €99m earn-out in relation to the Apollo and Fortress

JVs30.

The total amount from signed or secured

disposals comes to €3.1bn.

Refinancing plan

As announced, Casino Group has improved

the financial conditions and extended the maturity of its main

syndicated credit facility from October 2023 to

July 202631 for an amount of €1.8bn.

To take into account the Group’s improved

financial position and GreenYellow’s growth plan, the financial

covenants have been eased. Consequently, as from 30 June 2021,

the Group undertakes to comply on a quarterly basis with the

following covenants, which replace the previous covenants, for the

France Retail and E-commerce scope, excluding GreenYellow:

-

- a ratio of secured gross debt to EBITDA after lease payments of

less than 3.5x;

- this covenant was comfortably complied with at

30 June 2021, with a ratio of 2.1x, with headroom of €359m on

EBITDA after lease payments

- a ratio of EBITDA after lease payments to net finance costs of

more than 2.5x;

- this covenant was comfortably complied with at

30 June 2021, with a ratio of 3.2x, with headroom of €199m on

EBITDA after lease payments

In addition, Monoprix obtained an

extension to January 2026 for its €130m syndicated credit

facility which includes a yearly margin adjustment

clause based on the satisfaction of CSR objectives:

- Reduction in Scopes 1 & 2 greenhouse gas

emissions

- Proportion of net sales derived from products

labelled "responsible"

- Net sales derived from vegetable protein

products.

Second-quarter 2021 net sales

-

In the second quarter of 2021, the Group

recorded net sales of €7,334m, down -6.5% in total due to

exchange rates and consolidation scope impacts accounting

respectively for -3.0% and -2.2%. The calendar effect was -0.5%.

The Group’s quarterly same-store32 growth

came to +6.0% over two years (-4.1% in Q2 2021, after

+10.4% in Q2 2020). France (including Cdiscount) recorded a

-1.2%1 variation in its same-store sales over two years (-8.4%

year-on-year).

For France Retail,

same-store sales growth came to -8.4% for the

quarter, impacted by an unfavourable basis of

comparison (+6.0% in Q2 2020). The formats hardest

hit were those that benefited the most from the surge in sales

associated with the first lockdown last year, including the

convenience format (-11.2%) and

Franprix (-12.5%).The second quarter of 2021 was

shaped by a tightening of health restrictions with a curfew that

led to an early closure of autonomous stores, France’s third

lockdown which temporarily reduced the number of people in Paris, a

temporary drop in tourism and the closure of sections selling

“non-essential” goods, which affected Géant

hypermarkets (-9.9%) and Monoprix stores

(-4.9%).

Cdiscount33 reported growth in

gross merchandise volume (GMV) of +16% over two years (-6%

year-on-year). Marketplace GMV grew by +30% over a

two-year period (-7% year-on-year).

In Latin America, sales rose by

+5.5% on an organic basis for the quarter. On a

same-store basis, sales were up +12.3% over a two-year

period (stable year-on-year). Second quarter sales growth

in Latin America was again driven by the excellent

performance of Assaí (up +9.2%2 on a same-store basis and

+22%2 on an organic basis), reflecting the commercial format's

continued attractiveness and the success of expansion strategy.

Outlook for H2 2021 in France

-

- With very satisfactory levels of profitability in all

formats, priority focus on growth via the expansion of the store

base and acceleration in E-commerce:

- Opening of 400 convenience stores in H2 2021 (Franprix, Vival,

Naturalia, etc.), bringing the total to 750 openings over the

year

- Acceleration of E-commerce based on structurally profitable

models thanks to our exclusive partnerships (Ocado, Amazon) and the

solutions deployed in stores

- Ongoing development of Cdiscount and

GreenYellow

- Casino Group continues its preparatory work to finance the

accelerated growth of GreenYellow and Cdiscount

- Growth in cash flow from continuing

operations34

- Continued EBITDA growth

- Sharp reduction in non-recurring expenses

- Expansion on convenience and food E-commerce formats, which

require low Capex

The Board of Directors met on 28 July 2021 to

approve the consolidated financial statements for first-half 2021.

These financial statements have been reviewed by the Statutory

Auditors.

The presentation of the

2021 half-year results is available on Casino Group’s corporate

website (www.groupe-casino.fr/en)

APPENDICES – ADDITIONAL H1 2021 FINANCIAL

INFORMATION RELATING TO THE AUTUMN 2019 REFINANCING

DOCUMENTATION

See press release dated 21 November 2019

Financial information for the first half

ended 30 June 2021:

|

In €m |

France Retail + E-commerce |

Latam |

Total |

|

Net sales35 |

7,810 |

6,670 |

14,480 |

|

EBITDA1 |

622 |

477 |

1,099 |

| (-)

impact of leases36 |

(326) |

(145) |

(471) |

|

Adjusted consolidated EBITDA including

leases1 |

296 |

331 |

628 |

Financial information for the 12-month

period ended 30 June 2021:

|

In €m |

France Retail + E-commerce |

Latam |

Total |

|

Net sales1 |

16,319 |

13,933 |

30,253 |

|

EBITDA1 |

1,599 |

1,178 |

2,777 |

| (-)

impact of leases2 |

(640) |

(273) |

(912) |

|

(i) Adjusted consolidated EBITDA including leases1

37 |

959 |

905 |

1 865 |

|

(ii) Gross debt1 38 |

5,279 |

3,198 |

8,477 |

|

(iii) Gross cash & cash equivalents1 39 |

538 |

1,595 |

2,133 |

As at 30th June 2021, the Group’s liquidity

within the “France + E-commerce” perimeter was €2,6bn, with €528m

of cash and cash equivalent and €2,032m confirmed undrawn lines of

credit, available at any time

Additional information regarding

covenants and segregated accounts:

|

Covenants tested as from 30 June 2021 pursuant to the

Revolving Credit Facilitydated 18 November 2019,

as amended in July 2021 |

|

Type of covenant (France and E-commerce excluding

GreenYellow) |

As at

30 June 2021 |

|

Secured gross debt/ EBITDA after lease payments

<3.50x |

2.12x |

|

EBITDA after lease payments/Net finance costs

>2.50x |

3.20x |

The balance of the segregated account was €339m

at June 30, 2021, after taking into account the redemption at

maturity of the bond maturing in May 2021 (€118m).

No cash has been credited or debited from the

bond segregated account and its balance remained at €0.

APPENDICES – FULL-YEAR RESULTS

- Consolidated net sales by segment

|

Net sales In €m |

H1 2020 (restated) |

H1 2021 |

Change |

Change at CER |

|

France Retail |

7,791 |

6,863 |

-11.9% |

-8,1%1 |

|

Latam Retail |

7,401 |

6,670 |

-9.9% |

+6.9%40 |

|

E-commerce (Cdiscount) |

948 |

947 |

0.0% |

-0,8%1 |

| Group

total |

16,140 |

14,480 |

-10.3% |

-0.5%1 |

- Consolidated EBITDA by segment

|

EBITDA In €m |

H1 2020 (restated) |

H1 2021 |

Change |

Change at CER |

|

France Retail |

561 |

573 |

+2.2% |

+2.6% |

|

Latam Retail |

459 |

477 |

+3.9% |

+21.4% |

|

E-commerce (Cdiscount) |

43 |

48 |

+12.6% |

+12.6% |

| Group

total |

1,063 |

1,099 |

+3.3% |

+11.1% |

| |

|

|

|

|

|

|

|

|

- Consolidated trading profit by segment

|

Trading profit In €m |

H1 2020 (restated) |

H1 2021 |

Change |

Change at CER |

|

France Retail |

154 |

166 |

+8.1% |

+9.3% |

|

Latam Retail |

239 |

271 |

+13.5% |

+32.9% |

|

E-commerce (Cdiscount) |

6 |

7 |

+11.9% |

+11.9% |

| Group

total |

399 |

444 |

+11.4% |

+23.5% |

| |

|

|

|

|

|

|

|

|

|

In €m |

H1 2020(restated) |

Restated items |

H1 2020 (underlying) |

H1 2021 |

Restated items |

H1 2021 (underlying) |

|

|

Trading profit |

399 |

0 |

399 |

444 |

0 |

444 |

|

| Other

operating income and expenses |

(246) |

246 |

0 |

11 |

(11) |

0 |

|

|

Operating profit (loss) |

153 |

246 |

399 |

455 |

(11) |

444 |

|

|

Net finance costs |

(188) |

0 |

(188) |

(224) |

0 |

(224) |

|

|

Other financial income and expenses41 |

(291) |

74 |

(217) |

(175) |

0 |

(174) |

|

|

Income taxes42 |

15 |

(65) |

(50) |

(46) |

(9) |

(55) |

|

| Share of

profit of equity-accounted investees |

15 |

0 |

15 |

29 |

0 |

29 |

|

|

Net profit (loss) from continuing operations |

(295) |

255 |

(40) |

41 |

(20) |

21 |

|

xx |

xx |

xx |

xx |

|

o/w attributable to non-controlling interests43 |

45 |

9 |

55 |

76 |

18 |

93 |

|

|

o/w Group share |

(340) |

245 |

(95) |

(35) |

(38) |

(72) |

|

Underlying net profit corresponds to net profit

from continuing operations, adjusted for (i) the impact of other

operating income and expenses, as defined in the "Significant

accounting policies" section in the notes to the consolidated

financial statements, (ii) the impact of non-recurring financial

items, as well as (iii) income tax expense/benefits related to

these adjustments and (iv) the application of IFRIC 23.

Non-recurring financial items include fair value

adjustments to equity derivative instruments (such as total return

swaps instruments related to GPA shares) and the effects of

discounting Brazilian tax liabilities.

- Change in net debt by entity

|

Net debt before IFRS 5 In €m |

H1 2020 |

Change over the period |

H1 2021 |

|

France |

(4,620) |

43 |

(4,577) |

|

o/w France Retail excl. GreenYellow |

(4,415) |

210 |

(4,205) |

|

o/w E-commerce (Cdiscount) |

(376) |

-52 |

(428) |

|

o/w GreenYellow |

171 |

-115 |

57 |

|

Latam Retail |

(1,726) |

-41 |

(1,767) |

|

o/w Multivarejo |

(636) |

-144 |

(780) |

|

o/w Assaí |

(866) |

16 |

(851) |

|

o/w Éxito |

(21) |

46 |

26 |

|

o/w Segisor |

(178) |

15 |

(162) |

|

Total |

(6,347) |

3 |

(6,344) |

- France net debt at 30 June before IFRS 5

| In €m –

France + Cdiscount (excluding GreenYellow) |

H1 2020 |

H1 2021 |

|

France net debt before IFRS 5 at 1 January |

(4,222) |

(3,873) |

|

Free cash flow44 before asset disposals,

disposal plan |

(297) |

(346) |

| Financial expenses45 |

(228) |

(164) |

|

Dividends paid to owners of the parent and holders of TSSDI

deeply-subordinated bonds |

(37) |

(28) |

|

Share buybacks and transactions with non-controlling interests |

(1) |

(1) |

|

Other net financial investments |

(255)46 |

14547 |

|

Other non-cash items |

32 |

(458)48 |

|

o/w non-cash financial expenses |

79 |

(30) |

|

Change in net debt before IFRS 5 before asset

disposals |

-786 |

-853 |

|

Disposal plan and other asset disposals |

216 |

9349 |

|

Net debt before IFRS 5 at 30 June |

(4,792) |

(4,633) |

APPENDICES – NET SALES

Quarterly consolidated net sales by

segment

|

|

|

|

|

|

NET SALES (in €m) |

Q2 2021 net sales |

Total growth |

Organicgrowth50 |

Same-storegrowth1 |

Same-store growth1 over two years |

|

France Retail |

3,475 |

-11.0% |

-8.9% |

-8.4% |

-2.9% |

|

Cdiscount |

464 |

-7.0% |

-8.3% |

-8.3% |

+10.9% |

|

Total France |

3,939 |

-10.6% |

-8.9% |

-8.4% |

-1.2% |

|

Latam Retail |

3,394 |

-1.4% |

+5.5% |

-0.2% |

+12.3% |

|

GROUP TOTAL |

7,334 |

-6.5% |

-2.4% |

-4.1% |

+6.0% |

|

Cdiscount GMV |

984 |

-6.1% |

-5.3% |

n.a. |

n.a. |

| |

|

|

|

|

|

|

|

Quarterly consolidated net sales in France by

banner

|

Net sales by banner (in €m) |

Q2 2021 net sales |

Total growth |

Organic growth1 |

Same-store growth1 |

Same-store growth1 over two years |

|

Monoprix |

1,093 |

-3.9% |

-3.3% |

-4.9% |

-2.1% |

|

Supermarkets |

711 |

-8.8% |

-12.7% |

-10.4% |

-1.5% |

|

o/w Casino Supermarkets51 |

670 |

-9.5% |

-13.4% |

-12.2% |

-1.8% |

|

Franprix |

379 |

-15.2% |

-14.4% |

-12.5% |

+0.4% |

|

Convenience & Other52 |

449 |

-28.8% |

-4.2% |

-10.7% |

+0.7% |

|

o/w Convenience53 |

342 |

-5.5% |

-6.7% |

-11.2% |

+4.8% |

|

Hypermarkets |

844 |

-7.5% |

-12.7% |

-9.9% |

-10.6% |

|

o/w Géant2 |

796 |

-8.2% |

-13.9% |

-11.4% |

-11.5% |

|

FRANCE RETAIL |

3,475 |

-11.0% |

-8.9% |

-8.4% |

-2.9% |

Main half-yearly data – Cdiscount54

|

Key figures |

H1 2020 |

H1 2021 |

Reported growth |

Reported growth over two years |

|

Total GMV including tax |

1,946 |

1,991 |

+2.3% |

+13.5% |

|

o/w direct sales |

906 |

865 |

-4.5% |

|

|

o/w marketplace sales |

676 |

747 |

+10.5% |

|

|

Marketplace contribution (%) |

42.7% |

46.3% |

+3.6 pts |

|

|

Net sales (in €m) |

1,049 |

1,009 |

-3.8% |

+1.4% |

|

Traffic (millions of visits) |

554 |

550 |

-0,7% |

|

| |

|

|

|

|

|

APPENDICES – OTHER INFORMATION

Gross sales under banner in France

|

TOTAL ESTIMATED GROSS FOOD SALES UNDER BANNER (in €m,

excluding fuel) |

Q2 2021 |

Same-store change (excl. calendar effects) |

Same-store change (excl. calendar effects) over 2

years |

|

|

|

|

Monoprix |

|

987 |

-4.9% |

-2.1% |

|

Franprix |

|

445 |

-13.6% |

-0.9% |

|

Supermarkets |

|

667 |

-10.1% |

-1.2% |

|

Hypermarkets |

|

691 |

-6.2% |

-7.4% |

|

Convenience & Other |

|

581 |

n.a. |

n.a. |

|

o/w Convenience |

|

424 |

-11.3% |

+4.7% |

|

TOTAL FOOD |

|

3,370 |

-8.3% |

-2.4% |

|

TOTAL ESTIMATED GROSS NON-FOOD SALES UNDER BANNER (in €m,

excluding fuel) |

Q2 2021 |

Same-store change (excl. calendar effects) |

Same-store change (excl. calendar effects) over 2

years |

|

|

|

|

Hypermarkets |

|

95 |

-26.3% |

-27.3% |

|

Cdiscount |

|

791 |

-5.3% |

+14.5% |

|

TOTAL NON-FOOD |

|

887 |

-5.5% |

+11.3% |

|

TOTAL GROSS SALES UNDER BANNER (in €m, excluding fuel) |

Q2 2021 |

Same-store change (excl. calendar effects) |

Same-store change (excl. calendar effects) over 2

years |

|

|

|

|

TOTAL FRANCE AND CDISCOUNT |

|

4,257 |

-7.9% |

-0.3% |

| |

|

|

|

|

|

Store network at period-end

|

FRANCE |

30 June 2020 |

30 Sept. 2020 |

31 Dec. 2020 |

31 March 2021 |

30 June 2021 |

|

Géant Casino hypermarkets |

104 |

105 |

105 |

104 |

95 |

|

o/w French franchised affiliates |

4 |

4 |

4 |

3 |

3 |

|

International affiliates |

6 |

7 |

7 |

7 |

7 |

|

Casino Supermarkets |

415 |

414 |

419 |

417 |

422 |

|

o/w French franchised affiliates |

69 |

68 |

71 |

68 |

64 |

|

International affiliates |

22 |

23 |

24 |

25 |

22 |

|

Monoprix |

789 |

791 |

799 |

806 |

830 |

|

o/w franchised affiliates |

190 |

191 |

192 |

195 |

201 |

|

Naturalia integrated

stores |

181 |

181 |

184 |

189 |

203 |

|

Naturalia franchises |

26 |

28 |

32 |

34 |

39 |

|

Franprix |

869 |

869 |

872 |

877 |

890 |

|

o/w franchises |

481 |

463 |

479 |

493 |

533 |

|

Convenience |

5,134 |

5,166 |

5,206 |

5,311 |

5,502 |

|

Other businesses |

219 |

219 |

233 |

334 |

320 |

|

Total France |

7,530 |

7,564 |

7,634 |

7,849 |

8,059 |

|

|

|

|

|

|

|

|

INTERNATIONAL |

30 June 2020 |

30 Sept. 2020 |

31 Dec. 2020 |

31 March 2021 |

30 June 2021 |

|

ARGENTINA |

25 |

25 |

25 |

25 |

25 |

|

Libertad hypermarkets |

15 |

15 |

15 |

15 |

15 |

|

Mini Libertad and Petit Libertad mini-supermarkets |

10 |

10 |

10 |

10 |

10 |

|

URUGUAY |

93 |

92 |

93 |

93 |

92 |

|

Géant hypermarkets |

2 |

2 |

2 |

2 |

2 |

|

Disco supermarkets |

29 |

29 |

30 |

30 |

30 |

|

Devoto supermarkets |

24 |

24 |

24 |

24 |

24 |

|

Devoto Express mini-supermarkets |

36 |

35 |

35 |

35 |

34 |

|

Möte |

2 |

2 |

2 |

2 |

2 |

|

BRAZIL |

1 070 |

1,054 |

1,057 |

1,058 |

1,058 |

|

Extra hypermarkets |

107 |

104 |

103 |

103 |

103 |

|

Pão de Açúcar supermarkets |

182 |

182 |

182 |

182 |

181 |

|

Extra supermarkets |

151 |

147 |

147 |

147 |

147 |

|

Compre Bem |

28 |

28 |

28 |

28 |

28 |

|

Assaí (cash & carry) |

169 |

176 |

184 |

184 |

187 |

|

Mini Mercado Extra & Minuto Pão de Açúcar

mini-supermarkets |

238 |

239 |

236 |

237 |

236 |

|

Drugstores |

122 |

104 |

103 |

103 |

102 |

|

+ Service stations |

73 |

74 |

74 |

74 |

74 |

|

COLOMBIA |

1 981 |

1,980 |

1,983 |

1,974 |

2,006 |

|

Éxito hypermarkets |

92 |

92 |

92 |

92 |

92 |

|

Éxito and Carulla supermarkets |

157 |

154 |

153 |

153 |

155 |

|

Super Inter supermarkets |

69 |

69 |

69 |

61 |

61 |

|

Surtimax (discount) |

1 536 |

1,539 |

1,544 |

1,548 |

1,577 |

|

o/w “Aliados” |

1 459 |

1,465 |

1,470 |

1,476 |

1,505 |

|

B2B |

32 |

34 |

34 |

34 |

34 |

|

Éxito Express and Carulla Express mini-supermarkets |

95 |

92 |

91 |

86 |

87 |

|

CAMEROON |

1 |

2 |

2 |

2 |

3 |

|

Cash & Carry |

1 |

2 |

2 |

2 |

3 |

|

Total International |

3,170 |

3,153 |

3,160 |

3,152 |

3,184 |

Consolidated income

statement

|

In € millions |

|

First-half 2021 |

First-half 2020 (restated)55 |

|

CONTINUING OPERATIONS |

|

|

|

| Net

sales |

|

14,480 |

16,140 |

|

Other revenue |

|

224 |

245 |

|

Total revenue |

|

14,704 |

16,385 |

|

Cost of goods sold |

|

(11,071) |

(12,402) |

|

Gross margin |

|

3,633 |

3,983 |

| Selling

expenses |

|

(2,531) |

(2,928) |

|

General and administrative expenses |

|

(657) |

(656) |

|

Trading profit |

|

444 |

399 |

| As a %

of net sales |

|

3.1% |

2.5% |

| Other

operating income |

|

247 |

225 |

|

Other operating expenses |

|

(236) |

(471) |

|

Operating profit |

|

455 |

153 |

| As a %

of net sales |

|

3.1% |

1.0% |

| Income

from cash and cash equivalents |

|

8 |

9 |

| Finance

costs |

|

(231) |

(197) |

|

Net finance costs |

|

(224) |

(188) |

| Other

financial income |

|

69 |

87 |

|

Other financial expenses |

|

(243) |

(377) |

|

Profit (loss) before tax |

|

57 |

(325) |

| As a %

of net sales |

|

0.4% |

-2.0% |

| Income

tax benefit (expense) |

|

(46) |

15 |

|

Share of profit of equity-accounted investees |

|

29 |

15 |

|

Net profit /(loss) from continuing operations |

|

41 |

(295) |

| As a %

of net sales |

|

0.3% |

-1.8% |

|

Attributable to owners of the parent |

|

(35) |

(340) |

|

Attributable to non-controlling interests |

|

76 |

45 |

|

DISCONTINUED OPERATIONS |

|

|

|

|

Net profit (loss) from discontinued

operations |

|

(169) |

(158) |

|

Attributable to owners of the parent |

|

(170) |

(162) |

|

Attributable to non-controlling interests |

|

2 |

4 |

|

CONTINUING AND DISCONTINUED OPERATIONS |

|

|

|

|

Consolidated net profit (loss) |

|

(128) |

(452) |

|

Attributable to owners of the parent |

|

(205) |

(502) |

|

Attributable to non-controlling interests |

|

77 |

50 |

Earnings per share

|

In € |

|

First-half 2021 |

First-half 2020 (restated)1 |

|

From continuing operations, attributable to owners of the

parent |

|

|

|

|

|

|

(0.66) |

(3.48) |

|

|

|

(0.66) |

(3.48) |

|

From continuing and discontinued operations, attr. to

owners of the parent |

|

|

|

|

|

|

(2.24) |

(4.98) |

|

|

|

(2.24) |

(4.98) |

Consolidated statement of comprehensive

income

|

In € millions |

For the six months ended

30 June 2021 |

For the six months ended 30 June 2020

(restated)56 |

|

Consolidated net profit (loss) |

(128) |

(452) |

|

Items that may be subsequently reclassified to profit or

loss |

137 |

(1,184) |

|

Cash flow hedges and cash flow hedge reserve(i) |

20 |

(14) |

|

Foreign currency translation adjustments(ii) |

120 |

(1,148) |

|

Debt instruments at fair value through other comprehensive income

(OCI) |

(1) |

- |

|

Share of items of equity-accounted investees that may be

subsequently reclassified to profit or loss |

3 |

(26) |

|

Income tax effects |

(5) |

4 |

|

Items that will never be reclassified to profit or

loss |

(3) |

2 |

|

Equity instruments at fair value through other comprehensive

income |

- |

- |

|

Actuarial gains and losses |

(4) |

3 |

|

Share of items of equity-accounted investees that will never be

subsequently reclassified to profit or loss |

- |

- |

|

Income tax effects |

1 |

(1) |

|

Other comprehensive income (loss) for the year, net of

tax |

134 |

(1,182) |

|

Total comprehensive income (loss) for the year, net of

tax |

6 |

(1,634) |

| o/w

Group share |

(127) |

(979) |

|

Attributable to non-controlling interests |

133 |

(655) |

- The change in the cash flow hedge reserve in first-half 2021

and first-half 2020 was not material.

- The €120 million positive net translation adjustment in

first-half 2021 arose mainly from the appreciation of the Brazilian

real for €218 million, partially offset by the depreciation of the

Uruguayan peso for -€81 million. The €1,148 million negative net

translation adjustment in first-half 2020 arose primarily from the

depreciation of the Brazilian and Colombian currencies (-€839

million and -€259 million, respectively).

Consolidated statement of financial

position

|

ASSETS |

|

|

30 June 2021 |

31 December 2020 |

|

In € millions |

|

Goodwill |

|

|

6,764 |

6,656 |

|

Intangible assets |

|

|

2,126 |

2,061 |

|

Property and equipment |

|

|

4,457 |

4,279 |

|

Investment property |

|

|

423 |

428 |

|

Right-of-use assets |

|

|

4,862 |

4,888 |

|

Investments in equity-accounted investees |

|

|

214 |

191 |

|

Other non-current assets |

|

|

1,217 |

1,217 |

|

Deferred tax assets |

|

|

1,111 |

1,035 |

|

Non-current assets |

|

|

21,174 |

20,754 |

|

Inventories |

|

|

3,349 |

3,209 |

|

Trade receivables |

|

|

860 |

941 |

|

Other current assets |

|

|

1,967 |

1,770 |

|

Current tax assets |

|

|

202 |

167 |

|

Cash and cash equivalents |

|

|

2,133 |

2,744 |

|

Assets held for sale |

|

|

1,064 |

932 |

|

Current assets |

|

|

9,574 |

9,763 |

|

TOTAL ASSETS |

|

|

30,748 |

30,517 |

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

|

30 June 2021 |

31 December 2020 |

|

In € millions |

|

Share capital |

|

|

166 |

166 |

|

Additional paid-in capital, treasury shares, retained earnings and

consolidated net profit (loss) |

|

|

2,937 |

3,097 |

|

Equity attributable to owners of the parent |

|

|

3,103 |

3,263 |

|

Non-controlling interests |

|

|

2,998 |

2,856 |

|

Total equity |

|

|

6,101 |

6,118 |

|

Non-current provisions for employee benefits |

|

|

348 |

351 |

|

Other non-current provisions |

|

|

380 |

374 |

|

Non-current borrowings and debt, gross |

|

|

7,244 |

6,701 |

|

Non-current lease liabilities |

|

|

4,260 |

4,281 |

|

Non-current put options granted to owners of non-controlling

interests |

|

|

53 |

45 |

|

Other non-current liabilities |

|

|

173 |

201 |

|

Deferred tax liabilities |

|

|

540 |

508 |

|

Total non-current liabilities |

|

|

12,998 |

12,461 |

|

Current provisions for employee benefits |

|

|

12 |

12 |

|

Other current provisions |

|

|

163 |

189 |

|

Trade payables |

|

|

5,392 |

6,190 |

|

Current borrowings and debt, gross |

|

|

1,823 |

1,355 |

|

Current lease liabilities |

|

|

706 |

705 |

|

Current put options granted to owners of non-controlling

interests |

|

|

119 |

119 |

|

Current tax liabilities |

|

|

64 |

98 |

|

Other current liabilities |

|

|

3,170 |

3,059 |

|

Liabilities associated with assets held for sale |

|

|

201 |

210 |

|

Current liabilities |

|

|

11,650 |

11,937 |

|

TOTAL EQUITY AND LIABILITIES |

|

|

30,748 |

30,517 |

Consolidated statement of cash

flows

|

In € millions |

|

First-half 2021 |

First-half 2020 (restated)57 |

|

Profit (loss) before tax from continuing operations |

|

57 |

(325) |

|

Profit (loss) before tax from discontinued operations |

|

(209) |

(104) |

|

Consolidated profit (loss) before tax |

|

(151) |

(429) |

|

Depreciation and amortisation expense |

|

654 |

664 |

|

Provision and impairment expense |

|

(81) |

94 |

|

Losses (gains) arising from changes in fair value |

|

(4) |

73 |

|

Expenses (income) on share-based payment plans |

|

9 |

6 |

|

Other non-cash items |

|

(13) |

(31) |

|

(Gains) losses on disposals of non-current assets |

|

(97) |

(49) |

|

(Gains) losses due to changes in percentage ownership of

subsidiaries resulting in acquisition/loss of control |

|

11 |

20 |

|

Dividends received from equity-accounted investees |

|

10 |

15 |

| Net

finance costs |

|

224 |

188 |

|

Interest paid on leases, net |

|

154 |

165 |

|

Non-recourse factoring and associated transaction costs |

|

23 |

32 |

|

Disposal gains and losses and adjustments related to discontinued

operations |

|

90 |

15 |

|

Net cash from operating activities before change in working

capital, net finance costs and income tax |

|

829 |

764 |

|

Income tax paid |

|

(87) |

(45) |

|

Change in operating working capital |

|

(906) |

(766) |

|

Income tax paid and change in operating working capital:

discontinued operations |

|

(97) |

105 |

|

Net cash from operating activities |

|

(262) |

58 |

|

of which continuing operations |

|

(45) |

42 |

|

Cash outflows related to acquisitions of: |

|

|

|

|

§ Property, plant and equipment, intangible assets and

investment property |

|

(499) |

(447) |

|

§ Non-current financial assets |

|

(3) |

(472) |

|

Cash inflows related to disposals of: |

|

|

|

|

§ Property, plant and equipment, intangible assets and

investment property |

|

19 |

169 |

|

§ Non-current financial assets |

|

158 |

254 |

|

Effect of changes in scope of consolidation resulting in

acquisition or loss of control |

|

(9) |

165 |

|

Effect of changes in scope of consolidation related to

equity-accounted investees |

|

(6) |

(10) |

|

Change in loans and advances granted |

|

(16) |

(21) |

|

Net cash from/(used in) investing activities of discontinued

operations |

|

(49) |

(14) |

|

Net cash from (used in) investing activities |

|

(404) |

(375) |

|

of which continuing operations |

|

(355) |

(361) |

|

Dividends paid: |

|

|

|

|

§ to owners of the parent |

|

- |

- |

|

§ to non-controlling interests |

|

(77) |

(33) |

|

§ to holders of deeply-subordinated perpetual bonds |

|

(32) |

(33) |

|

Increase (decrease) in the parent's share capital |

|

- |

- |

|

Transactions between the Group and owners of non-controlling

interests |

|

3 |

(21) |

|

(Purchases) sales of treasury shares |

|

- |

(1) |

|

Additions to loans and borrowings |

|

2,636 |

1,064 |

|

Repayments of loans and borrowings |

|

(1,998) |

(837) |

|

Repayments of lease liabilities |

|

(321) |

(311) |

|

Interest paid, net |

|

(335) |

(455) |

|

Other repayments |

|

(13) |

(9) |

|

Net cash used in financing activities of discontinued

operations |

|

(6) |

(27) |

|

Net cash used in financing activities |

|

(143) |

(664) |

|

of which continuing operations |

|

(138) |

(637) |

|

Effect of changes in exchange rates on cash and cash equivalents of

continuing operations |

|

74 |

(398) |

|

Effect of changes in exchange rates on cash and cash equivalents of

discontinued operations |

|

- |

- |

|

Change in cash and cash equivalents |

|

(735) |

(1,379) |

|

Net cash and cash equivalents at beginning of

period |

|

2,675 |

3,530 |

- of which net cash and cash equivalents of continuing

operations

|

|

2,675 |

3,471 |

- of which net cash and cash equivalents of discontinued

operations

|

|

(1) |

59 |

|

Net cash and cash equivalents at end of

period |

|

1,940 |

2,151 |

- of which net cash and cash equivalents of continuing

operations

|

|

1,941 |

2,086 |

- of which net cash and cash equivalents of discontinued

operations

|

|

(1) |

65 |

Analyst and investor contacts -

Lionel Benchimol+ 33 (0)1 53 65

64 17 - lbenchimol@groupe-casino.fror+ 33 (0)1 53 65 24 17 -

IR_Casino@groupe-casino.fr

Press contacts -

Casino Group - Communications

Department

Stéphanie Abadie+ 33 (0)6 26 27

37 05 - sabadie@groupe-casino.fror+ 33(0)1 53 65 24 78 -

directiondelacommunication@groupe-casino.fr

-

Agence IMAGE 7

Karine Allouis +33 (0)1 53

70 74 84 - kallouis@image7.frFranck

Pasquier + 33(0)6 73 62 57 99 -

fpasquier@image7.fr

Disclaimer

This press release was prepared solely for

information purposes, and should not be construed as a solicitation

or an offer to buy or sell securities or related financial

instruments. Likewise, it does not provide and should not be

treated as providing investment advice. It has no connection with

the specific investment objectives, financial situation or needs of

any receiver. No representation or warranty, either express or

implied, is provided in relation to the accuracy, completeness or

reliability of the information contained herein. Recipients should

not consider it as a substitute for the exercise of their own

judgement. All the opinions expressed herein are subject to change

without notice.

1 France Retail excluding GreenYellow, real estate development

and Vindémia (sold on 30 June 2020)

2 Source: Nielsen, YTD P06 2021, over two years

3 Same-store change in sales for the four weeks to 25 July

2021

4 Contribution to consolidated EBITDA. Data published by the

subsidiary: EBITDA of €49m (stable vs. H1 2020)

5 Including €129m relating to the sale of shares and an

additional €50m notably linked to the renewal of commercial

agreements between Cdiscount, Casino banners and FLOA

6 As part of the real estate disposals made in 2019

7 Secured gross debt to EBITDA after lease payments on France

Retail + E-commerce perimeter excluding GreenYellow (see press

release dated 19 July 2021)

8 Announcement of the Assaí spin-off on 9 September

2020

9 Organic growth excluding fuel and calendar effects

10 Of which €6m in tax credits

11 The difference compared to the change in net debt excluding

IFRS 5 (-€158m) is mainly due to the decrease in IFRS 5 related to

the sale of Leader Price, which was classified under IFRS 5 at June

30, 2020

12 Excluding fuel and calendar effects

13 Data published by the subsidiary

14 Contribution to consolidated EBITDA. Data

published by the subsidiary: EBITDA of €37m in H1 2021

15 Tax credits restated by subsidiaries in the calculation of

adjusted EBITDA

16 See definition on page 13

17 Underlying diluted EPS includes the dilutive effect of TSSDI

deeply-subordinated bond distributions

18 France Retail operations excluding Vindémia, real estate

development and GreenYellow

19 Food E-commerce = E-commerce France excluding Cdiscount

20 Source: Nielsen, YTD P06 2021, over two years

21 Data published by the subsidiary

22 Data published by the subsidiary. Contribution to

consolidated EBITDA: €48m (€43m in H1 2020)

23 Data published by the subsidiary. Contribution to

consolidated EBITDA: €28m (€34m in H1 2020)

24Announcement of the spin-off on 9 September 2020

25 A subsidiary of rating agency Moody’s (Vigeo Eiris rating,

December 2020)

26 Scopes 1 and 2

27 In France

28 Including €129m relating to the sale of shares and an

additional €50m notably linked to the renewal of commercial

agreements between Cdiscount, Casino banners and FLOA

29 By 2025

30 As part of the real estate disposals made in 2019

31 May 2025 if Term Loan B, maturing in August

2025, is not repaid or refinanced at that date

32 Same-store change excluding fuel and calendar effects

33 Data published by the subsidiary

34 France scope excluding GreenYellow for which

development and transition to a company-owned asset model is

ensured by its own resources

35 Unaudited data, scope as defined in refinancing documentation

of November 2019 with mainly Segisor accounted for within the

France Retail + E-commerce scope

36 Interest paid on lease liabilities and repayment of lease

liabilities as defined in the documentation

37 EBITDA after lease payments (i.e., repayments of principal

and interest on lease liabilities)

38 Loans and other borrowings

39 At 30 June 2021

40 Organic change excluding fuel and calendar effects

41 Other financial income and expenses have been

restated, primarily for the impact of discounting tax liabilities,

as well as for changes in the fair value of the total return swaps

on GPA shares

42 Income taxes have been restated for the tax

effects of other operating income and expenses and of the

restatements of financial income and expenses described above, as

well as for the effects of IFRIC 23 "Uncertainty about tax

treatments"

43 Non-controlling interests have been restated

for the amounts relating to the restated items listed above

44 Before dividends to the owners of the parent and holders of

TSSDI deeply-subordinated bonds, excluding financial expenses,

including lease payments (repayments of lease liabilities and

interest on leases)

45 Excluding interest on lease liabilities

46 Including -€248m related to the unwinding of the GPA TRS

47 Including €149m in disbursements from the segregated account

dedicated to debt repayment

48 Including -€149m in disbursements from the segregated

account, and -€288m from discontinued operations (effect of

seasonality and operating losses of Leader Price before conversion

of stores to the Aldi brand, scheduled to end in September

2021)

49 Including a €99m earn-out in relation with the Apollo and

Fortress JVs

50 Excluding fuel and calendar effects

51 Excluding Codim stores in Corsica: 8 supermarkets and 4

hypermarkets

52 Other: mainly Vindémia and restaurants

53 Net sales on a same-store basis include the same-store

performance of franchised stores

54 Data published by the subsidiary

55 The financial statements for first-half 2020 have been

restated to reflect the retrospective application of the IFRIC IC

decision with regard to the enforceable period of a lease and the

amortisation period of fixtures in accordance with IFRS 16 –

Leases

56The financial statements for first-half 2020 have been

restated to reflect the retrospective application of the IFRIC IC

decision with regard to the enforceable period of a lease and the

amortisation period of fixtures in accordance with IFRS 16 –

Leases

57 The financial statements for first-half 2020 have been

restated to reflect the retrospective application of the IFRIC IC

decision with regard to the enforceable period of a lease and the

amortisation period of fixtures in accordance with IFRS 16 –

Leases

- 20210729 - PR - H1 2021 Results

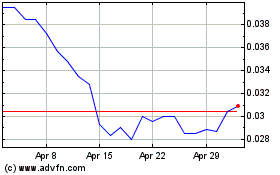

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Apr 2023 to Apr 2024