Casino Group takes another step in the refinancing of its debt

March 22 2021 - 3:49AM

Casino Group takes another step in the refinancing of its debt

Paris, 22 March 2021

Casino Group announces the launch of a

refinancing to extend the maturity of its debt and to reduce its

costs.

The refinancing includes (i) a new Term Loan B

of maturity August 2025 of a targeted size of €800 million and (ii)

the potential launch of a new €425 million senior unsecured debt

instrument of maturity April 2027.

The funds will be used to fully redeem the

current €1.225 billion Term Loan B which matures in 2024. The

refinancing is expected to almost halve the 2024 payments, and to

extend the debt maturity profile while reducing its costs.

The completion of the transactions is expected

in the coming weeks.

This press release constitutes a public

disclosure of inside information by Casino, Guichard-Perrachon S.A.

(the “Company”) under Regulation (EU) 596/2014 (16 April 2014) and

Implementing Regulation (EU) No 2016/1055 (10 June 2016).

Disclaimer

This press release may include forward-looking

statements. These forward-looking statements can be identified by

the use of forward-looking terminology, including the terms as

“believe”, “expect”, “anticipate”, “may”, “assume”, “plan”,

“intend”, “will”, “should”, “estimate”, “risk” and or, in each

case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts and include statements regarding the

Company’s or any of its affiliates’ intentions, beliefs or current

expectations concerning, among other things, the Company’s or any

of its affiliates’ results of operations, financial condition,

liquidity, prospects, growth, strategies and the industries in

which they operate. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future.

Readers are cautioned that forward-looking statements are not

guarantees of future performance and that the Company’s or any of

its affiliates’ actual results of operations, financial condition

and liquidity, and the development of the industries in which they

operate may differ materially from those made in or suggested by

the forward-looking statements contained in this press release. In

addition, even if the Company’s or any of its affiliates’ results

of operations, financial condition and liquidity, and the

development of the industries in which they operate are consistent

with the forward-looking statements contained in this press

release, those results or developments may not be indicative of

results or developments in subsequent periods.

The forward-looking statements and information

contained in this announcement are made as of the date hereof and

the Company undertakes no obligation to update publicly or revise

any forward-looking statements or information, whether as a result

of new information, future events or otherwise, unless so required

by applicable securities laws.

ANALYST AND INVESTOR

CONTACTS

Lionel BENCHIMOL – +33 (0)1 53

65 64 17 lbenchimol@groupe-casino.fror+33 (0)1 53

65 24 17 IR_Casino@groupe-casino.fr

PRESS CONTACTSCasino

Group – Direction of CommunicationStéphanie ABADIE -

sabadie@groupe-casino.fr - +33 (0)6 26 27 37

05or+33(0)1 53 65 24 78 -

directiondelacommunication@groupe-casino.frAgence IMAGE

7Karine ALLOUIS – +33(0)1 53 70 74 84 -

kallouis@image7.frFranck PASQUIER – +33 (0)6 73 62 57 99 -

fpasquier@image7.fr

- 2021.03.22 - PR - Casino Group takes another step in the

refinancing of its debt

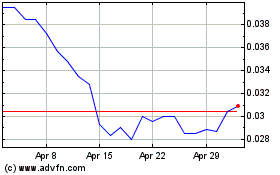

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Apr 2023 to Apr 2024