- Dynamic leasing activity maintained (763 leases signed, up

+34% on the first nine months of 2019 and up +105% on the first

nine months of 2020)

- Rent collection returning to normal for third-quarter 2021

rents (collection rate 90.1%)

- Positive reversion in the first nine months of 2021 on new

leases (+3.1% above rental appraisal values) and renewals (+3.7%

above)

- Net rental income down -9.1% on the first nine months of

2020 and stable (down just -0.2%) like-for-like excluding the

temporary effects of the health crisis

- Financial occupancy rate unchanged versus second-quarter

2021 at 95.7%

- A stable rental base (down just -0.4% like-for-like since

end-September 2020)

- Robust retailer sales in the third-quarter (higher than in

third-quarter 2020 in all three countries, and almost in line with

third-quarter 2019 in France and Italy)

- Carmila recognised for the quality of its sustainability

reporting and CSR strategy (EPRA sBPR Gold and GRESB Development

awards)

- New €810 million sustainability-linked revolving credit

facility signed

- S&P confirms Carmila’s BBB credit rating and revises its

outlook from negative to stable

- Launch of a share buyback programme in the third-quarter of

2021

- Carmila expects recurring earnings per share to be stable in

2021 versus 2020 (an increase of more than +10% excluding the IFRS

16 impact)

- Save the date: Carmila Capital Markets Day on 7 December

2021

Regulatory News:

Marie Cheval, Chair and Chief Executive Officer of Carmila

(Paris:CARM) commented: "Carmila has benefited this quarter

from a gradual return to normal performance following the upturn in

trading among its retailers, after a first half disrupted by the

health situation. The strength of Carmila’s model is clearly

illustrated by the exceptional level of leasing activity in the

quarter, as well as a financial performance that remains solid,

with full-year recurring earnings per share expected to be in line

with 2020. The Capital Markets Day to be held in December will be

an opportunity to present Carmila’s strategic and financial

plan."

Key financial information

First nine months 2021

First nine months 2020

Change

Change at constant

scope*

Gross rental income (€m)

263.8

250.4

+5.3%

Net rental income (€m)

206.2

226.8

-9.1%

-0.2%

France

141.5

150.6

-6.1%

Spain

50.6

62.8

-19.4%

Italy

14.1

13.4

+5.1%

*Adjusted for the effects of the health

crisis

Net rental income down -9.1% on the first nine months of 2020

and stable (down just -0.2%) like-for-like excluding the temporary

effects of the health crisis

In the first nine months of the year, net rental income on a

like-for-like basis, excluding the temporary effects of the health

crisis, was stable (down just -0.2%) versus the first nine months

of 2020, demonstrating the strength of Carmila’s rental base.

Excluding these adjustments, net rental income was down -9.1% in

the period.

As a reminder, in 2020 a significant portion of the impact of

the health crisis on net rental income had not yet been booked at

end-September 2020, making it difficult to compare net rental

income for the first nine months of that year with the same period

of 2021. In the first half of 2021, stores in Carmila shopping

centres remained closed for 2.2 months on average.

Rent collection returning to normal for third-quarter 2021

rents (collection rate 90.1%)

The collection rate for third-quarter rents reflected the

gradual return to normal in rent collection, which stood at 90.1%

at 19 October 2021, up +12 points on the collection rate for

third-quarter 2020 at the same prior-year date1. The collection

rate for the first half of 2021 was 76.3% due to closure periods

and the impact of tenants anticipating a financial support package

in France.

Dynamic leasing activity maintained (763 leases signed, up

+34% on the first nine months of 2019 and up +105% on the first

nine months of 2020)

A record number2 of leases were signed in the first nine months

of 2021 (763 leases signed, up +34% on the first nine months of

2019 and up +105% on the first nine months of 2020), for a total

minimum guaranteed rent of €39.2 million, or 11% of the rental

base. Reversion was positive on new leases, coming out +3.1% above

rental appraisal values on average, and reversion on renewals was

+3.7% above on average.

Notable leasing transactions signed in the quarter included:

- Differentiating, high-quality brands: Jack and Jones, Lacoste,

Rituals, Superdry

- New tenants for Carmila: Miniso, Studio Comme J’aime, Crazy

Kids

- Sector leaders: the discounter Action, Intersport

As at 30 September 2021, the rental base was stable versus

end-September 2020 on a like-for-like basis (down just -0.4%) and

the financial occupancy rate was unchanged from second-quarter 2021

at 95.7%, demonstrating that vacancy has been kept at a very low

level in Carmila centres.

Robust retailer sales in the third-quarter (higher than in

third-quarter 2020 in all three countries, and almost in line with

third-quarter 2019 in France and Italy)

Footfall in the third-quarter of 2021 was close to the levels

seen in third-quarter 2020 (98.1% in France, 101.0% in Spain and

102.9% in Italy) but remained below the levels seen in

third-quarter 2019 (89.7% in France, 79.5% in Spain and 84.8% in

Italy). In France, the requirement to show health passes to access

shopping centres of more than 20,000 sq.m. in some French

departments affected footfall in Carmila centres in August and

September. However, Carmila centres in France outperformed the

sector by seven percentage points in the period3.

Retailer sales were very close to third-quarter 2019 levels in

France (98.7%) and Italy (99.6%) but remained below those levels in

Spain (90.3%). Retailer sales were higher than in third-quarter

2020 (up +1.4% in France, +15.9% in Spain and +4.8% in Italy).

Carmila recognised for the quality of its sustainability

reporting and CSR strategy (EPRA sBPR and GRESB Development 2021

awards)

Carmila received an EPRA sBPR4 Gold award for the second time,

highlighting the company’s alignment with the highest standards in

non-financial reporting, and was ranked number one among listed

commercial real estate peers in the Development category of the

GRESB5 2021 benchmark, with a score of 94/100.

Carmila also received an EPRA Gold BPR award for the quality of

its financial disclosure.

Working in partnership with e-commerce players

Carmila is committed to helping the four winners of its DNVB6

Ready competition roll out their brand in its shopping centres.

Flotte, Le Beau Thé, Baya and Bandit will be supported in setting

up their own store, a sales space in the Marquette DNVB concept

store or a pop-up store. The competition's success attests that

brands first developed online see the value of having a physical

presence in shopping centres.

New €810 million sustainability-linked revolving credit

facility signed

Carmila has strengthened its financial structure by signing a

new €810 million revolving credit facility on 21 October, in two

(three and five-year) tranches, including two one-year extension

options. The facility replaces an existing €759 million revolving

credit facility maturing in 2024. It includes two sustainability

criteria designed to support Carmila’s ambitious strategy to halve

its greenhouse gas emissions by 2030 and to achieve BREEAM

certification for its entire asset portfolio by 2025. Carmila will

see its credit spread reduced if these targets are met and, in all

cases, will be making a financial contribution to sustainability

initiatives.

S&P confirms Carmila’s BBB credit rating and revises its

outlook from negative to stable

On 14 September 2021, S&P confirmed Carmila’s BBB rating and

revised its outlook from negative to stable.

Launch of a share buyback programme in the third-quarter of

2021

Carmila launched a share buyback programme on 3 September 2021,

with a view to cancelling the repurchased shares, for a maximum

amount of €8 million. The share buyback period began on 6 September

and will run until the end of December 2021.

Carmila expects recurring earnings per share to be stable in

2021 versus 2020

With the resumption of retail trading in the third-quarter and

an improved health situation in the three countries where Carmila

operates, there is less uncertainty around the financial outlook.

On that basis, Carmila expects recurring earnings per share to be

stable in 2021 compared with 2020. This corresponds to a more-than

+10% increase in recurring earnings per share excluding the impact

of IFRS 16 (i.e., the effect of the deferral of rent-free periods

related to the first wave of Covid-19 over the remaining life of

leases).

Save the date: Carmila Capital Markets Day on 7 December

2021

Carmila will present its strategic and financial plan on 7

December 2021 in Paris.

INVESTOR AGENDA

7 December 2021: Carmila Capital Markets Day

16 February 2022 (after market close): 2021 Annual

Results

17 February 2022: Investor and Analyst Meeting

21 April 2022 (after market close): Q1 2022 Financial

Information

12 May 2022: Annual General Meeting

ABOUT CARMILA

As the third largest listed owner of commercial property in

continental Europe, Carmila was founded by Carrefour and large

institutional investors in order to transform and enhance the value

of shopping centres adjoining Carrefour hypermarkets in France,

Spain and Italy. At 30 June 2021, its portfolio was valued at €6.13

billion, comprising 214 shopping centres, all leaders in their

catchment areas. Driven by an ambition to simplify and enhance the

daily lives of retailers and customers across the regions, the

local touch is at the heart of everything Carmila does. Carmila’s

teams have a deeply-anchored retail culture, comprising experts in

all aspects of retail attractiveness: operations, shopping centre

management, leasing, local digital marketing, business set-ups and

CSR.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”).

Carmila became part of the FTSE EPRA/NAREIT Global Real Estate

(EMEA Region) indices on 18 September 2017.

Carmila became part of the Euronext CAC Small, CAC Mid &

Small and CAC All-tradable indices on 24 September 2018.

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management's beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Financial Press Release” of Carmila’s Finance webpage:

https://www.carmila.com/en/finance/financial-press-releases/

1 Collection rate for third-quarter 2020 rents, as disclosed on

23 October 2020 2 Record for the first nine months of the year

since the formation of Carmila 3 Quantaflow panel. Change in

footfall versus third-quarter 2019. 4 Sustainability Best Practices

Recommendations 5 Global Real Estate Sustainability Benchmark 6

Digital Native Vertical Brands

Visit our website at https://www.carmila.com/en/

https://www.linkedin.com/company/carmila/

https://twitter.com/CarmilaFrance

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211021005739/en/

INVESTOR AND ANALYST CONTACT Pierre-Yves Thirion – Chief

Financial Officer pierre_yves_thirion@carmila.com +33 6 47 21 60

49

Jonathan Kirk – Head of Investor Relations jonathan_kirk@carmila.com +33 6 31 71 83 98

PRESS CONTACT Morgan Lavielle - Communications Director

morgan_lavielle@carmila.com +33 6 87 77 48 80

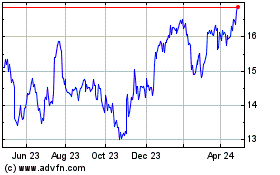

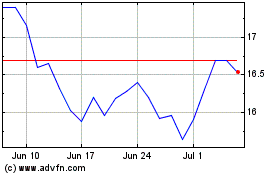

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Apr 2023 to Apr 2024