- Retailer sales and shopping centre footfall satisfactory in

France, fair in Italy and down in Spain

- Well-oriented operating activity

- Covid-19 negotiations with tenants well-advanced; collection

rate satisfactory

Regulatory News:

“Amid a critical health context, Carmila's (Paris:CARM)

satisfactory performances in the third quarter of 2020 once again

underline the high-quality positioning of its leading local

shopping centres. Carmila's teams have provided sustained support

for retailers, with individual tenant negotiations designed to

facilitate business recovery in the best possible conditions. The

Group's leasing and sales activity has been encouraging, and with a

level of debt among the lowest in the industry, Carmila's financial

position is healthy and solid. We must however remain vigilant

given the recent developments in the overall health situation in

the three countries in which we operate,” commented Alexandre de

Palmas, Chairman and Chief Executive Officer of Carmila.

1. Leasing activity

for the first nine months of 2020

In thousands of euros 30 September 2020 30 September

2019 % change 2020/2019

Gross rental income

250,361

268,452

-6.7%

Net rental income

226,828

250,851

-9.6%

France

150,641

168,563

-10.6%

Spain

62,800

65,602

-4.3%

Italy

13,387

16,686

-19.8%

Carmila's net rental income for the first nine months of 2020

came out at €226.8 million compared with €250.9 million over

the same year-ago period, representing a year-on-year decrease of

9.6%.

Main health crisis impacts reflected in the financial

statements at 30 September 2020

Carmila has waived the second-quarter rents of small

businesses (“TPE”) in France at the request of the

government. The full impact of the loss was recognised in gross

rental income at 30 September 2020 in the amount of €10.5

million. For the other tenants, negotiations are ongoing for

specific rent abatements in light of the government-ordered

closures. For agreements signed as at 30 September

2020, rent abatements granted without concessions have been

recognised in the financial statements (negative €1.4 million

impact in third-quarter 2020) and rent-free periods granted in

exchange for lease extensions are being amortised over the residual

term of the lease (negative €0.5 million impact in

third-quarter 2020). The additional adverse impact on 2020

gross rental income in the fourth quarter of Covid-19 rent

abatements currently being negotiated as at 30 September 2020, or

for which the associated legal agreements are in the process of

being finalised, is expected to be between €16 million and €20

million. Allowances for variable rents have also been adjusted

downwards (negative impact of €3.8 million) and allowances for

irrecoverable receivables have been set aside (negative impact of

€4.0 million).

2. Retailer

trading

Retailer sales and footfall

Compared with the third quarter of 2019, Carmila's shopping

centres saw their average footfall drop 12.5% in

third-quarter 2020 (down 8.8% in France, 20.6% in Spain and 23.5%

in Italy). However, their locations within the heart of the regions

helped them to outperform the sector* by almost 5 percentage

points in France and Spain over the period.

Retailer sales saw a contained 6.5% decline over the

period (slight declines of 2.4% in France and of 2.5% in Italy,

and a steep 18.7% drop in Spain). The Ready-to-wear segment was up

by 1.7% in France, but fell back in Spain (down 20%) and Italy

(down 5.2%). Household Furnishings maintained its strong recovery

in all three countries (up 14.1% in France, 4.7% in Spain and 13.2%

in Italy).

Update on Covid-19 negotiations with tenants

Since the start of the pandemic, Carmila has worked tirelessly

to support its retailers, suspending all second-quarter 2020 rents

and charges and deferring payment dates to 30 September 2020 in

France and Italy, and to 30 June and 31 July in Spain.

Besides waiving three months’ rent for small businesses (“TPE”)

in France, Carmila also initiated individual negotiations with its

3,700 other retailers in the Group's three countries, granting

individual relief based on the concessions agreed by the tenants

(e.g., lease term extensions or renewals, or the signing of new

leases).

To date, finalised negotiations represent 48% of gross rental

income in France, 68% in Spain and 70% in Italy. Negotiations and

the finalisation of the associated legal agreements will continue

at least until the first quarter of 2021.

Based on the concessions agreed, the total impact of the

rent-free periods granted remains contained, representing a

rent-free period of around 1.7 months in France, 1 month in Spain

and 1.5 months in Italy.

Ongoing negotiations with tenants have resulted in

satisfactory collection rates in all three countries, which are

continuously improving.

Collection rate

In France, the collection rate for third-quarter

rents (quarterly rent invoiced and payable on 1 July 2020)

stood at 85%, 94% of which was for signed negotiations. For

second-quarter rents (quarterly rent invoiced and payable on 30

September 2020), the collection rate was 61%, 75% of which was for

signed negotiations. Continuing negotiations over second-quarter

rents temporarily weighed on the collection rate for

fourth-quarter rents (quarterly rent invoiced and payable on

1 October 2020), which stood at 58%, 86% of which was for signed

negotiations.

In the Group’s three countries, the average collection

rate for third-quarter rents (quarterly rent invoiced and

payable on 1 July 2020 for France, monthly rent invoiced in advance

for Spain and Italy) stood at 78%, 92% of which was for signed

negotiations. For second-quarter rents (quarterly rent invoiced

and payable on 30 September 2020 for France, monthly rent invoiced

in advance for Spain and Italy), the collection rate was 63%, 77%

of which was for signed negotiations. Negotiations over

second-quarter rents temporarily weighed on the collection rate for

fourth-quarter rents (quarterly rent invoiced and payable on

1 October 2020 for France, monthly rent invoiced in advance for

Spain and Italy), which stood at 61%, 82% of which was for signed

negotiations.

3. Operating

activity in third-quarter 2020

Uninterrupted leasing momentum across all three

countries

In the Group’s three countries, leasing activity remained brisk,

with 98 new leases signed, on a par with the same year-ago

period.

Ten new retailers to open at the Bay 2 shopping centre before

the end of 2020

The Bay 2 shopping centre (in Collégien, Seine-et-Marne)

confirmed its appeal to retailers and customers thanks to the

energy and hard work of the centre’s teams.

Despite the health crisis, operating activity in the centre

proved robust:

- seven new retailers have opened their doors since the start of

the year (Nouvelle Literie, Bonobo, Maison 123, Karenza, Le Repaire

des Sorciers, Borgan Couture and Cache-cache);

- three other projects are planned, including the opening of

Danish retailer Normal, a first for the Seine et Marne region;

- the centre’s longstanding retailers (Jeff de Bruges, SFR,

Valège and Courir) are to revamp their stores in line with their

latest concepts.

Marquette, a concept store for French digital native vertical

brands

At the Labège 2 shopping centre in Toulouse, Carmila joined

forces with Digital Native Group to open Marquette, its first

concept store. Marquette is dedicated exclusively to Digital Native

Vertical Brands (DNVB).

This unique space gives some of France’s most on-trend labels

(My Jolie Candle, Faguo, Cabaïa, Nooz, Les Miraculeux, Merci Handy

and Le Chocolat des Français) a showroom of close to 300 sq.m. to

display their best-selling online products. This collaborative

brick-and-mortar store concept proposes a wide range of cosmetics,

ready-to-wear, accessories, confectionery, wellness and other

products, and aims to bridge the gap between physical and online

retail. The new store thereby provides these popular online brands

with the opportunity to raise their profile.

Business generated through pop-up stores continues to

grow, buoyed by the signing of 15 new leases.

Through its local digital marketing strategy, Carmila

continues to help its retailers grow sales by increasing the

visibility of their products and latest developments in the

vicinity of its shopping centres:

- initiatives targeting retailers were rolled out at the busy

start of the school year in France, for example, and to help boost

attendance at cinemas in Spain;

- digital services on the Kiosque platform helped ensure

successful launches of omni-channel initiatives in the Group’s

three countries (enhanced customer database and digital solution to

streamline administration for new retailers).

Business development: Carmila continues to support its

talented, dynamic retailer partners in developing innovative

concepts

To boost the products and services on offer in its centres and

provide customers with the renewed offerings that they expect,

Carmila has granted financial aid to retailer partners, including

barbers La Barbe de Papa, footwear and accessories specialist

Indémodable, and e-cigarette vendor Cigusto in France, as well as

Centros Ideal beauty clinics in Spain and, in healthcare, the

pharmacist Pharmavalley and dental clinic network Vertuo.

To date, La Barbe de Papa already has a network of 64 stores,

including 30 in Carmila-owned centres (29 branches and 1 franchise)

and Indémodable has 8 stores in Carmila centres, including a

recently-opened store in Aix-en-Provence. Cigusto offers its

products in 60 stores, including 20 in centres owned by

Carmila.

By the end of 2020, La Barbe de Papa plans to open six new

stores and to launch new concepts. Indémodable continues to develop

and is to open six further stores, while Cigusto has 10 new stores

in the pipeline.

Carmila presents Carmila Franchise & Development, a

turnkey service to support tenants and franchisees

Drawing on its retail DNA and extensive local knowledge, Carmila

created Carmila Franchise & Development, which forms part of

its strategy of positioning itself as a business facilitator for

retailers by offering bespoke support. Carmila facilitates the

entire set-up process and is involved in steps from analysing

requirements, prospecting and sourcing candidates, to connecting

stakeholders and assisting with all marketing and digital launch

initiatives.

Carmila Franchise & Development thereby offers broad-based

support to local retailers aiming to expand using a franchise model

or affiliate network, as well as to franchisors seeking experienced

retailers.

La Banque Postale opts for a local touch with Carmila for its

annual tour

In a bid to connect more closely with their customers, La Banque

Postale and other retailers have chosen Carmila’s shopping centres

thanks to their role as key regional players.

Carmila Event, Carmila’s integrated events agency, is getting

involved in the annual “Sur la route de vos projets” tour launched

by La Banque Postale Financement (a La Banque Postale subsidiary),

RMC, My Cuisine and 01net in eight Carmila shopping centres. For

this event, where experts and advisors are on hand for

consultation, Carmila makes its extensive network available to the

retailers while at the same time strengthening its local service

relationship with its customers.

Carmila picks up two EPRA Gold Awards

As part of its Best Practices Recommendations, EPRA awarded

Carmila a Gold Award for the third consecutive year as an

acknowledgement of the Group’s high-quality financial reporting.

This year, Carmila also picked up a second Gold Award for its 2020

sustainability reporting as part of ERPA’s Sustainability Best

Practices Recommendations (sBPR).

4. CSR highlights

for third-quarter 2020

As part of its “Here we act” sustainability drive, Carmila

rolled out further positive-impact initiatives aimed at boosting

regional economies, protecting the environment and motivating

employees.

In the regional economy space, Carmila is intensifying its

partnerships with local not-for-profit stakeholders. Since early

September, the Cap Saran shopping centre, which is already involved

in a broad spectrum of not-for-profit projects such as second-hand

clothing sales, has hosted the Emmaüs Loiret and La Ressource AAA

charities at a circular economy pop-up store selling pre-owned

clothing and other articles donated to or designed by the

charities.

During the third quarter, Carmila completed the environmental

audit of its shopping centres and set itself new targets, including

a 50% reduction in GHG emissions and a 40% reduction in energy

consumption by 2030. Consistent with its proactive drive to

continuously improve its environmental performance, Carmila visited

all of the sites audited in 2020 for BREEAM in-Use certification in

France and Spain.

After presenting its CSR strategy to all of its teams, during

the summer Carmila organised “Mydea”, a brainstorming initiative

designed to promote innovative employee sustainability projects.

The CSR momentum was maintained over Sustainable Development Week,

with a host of employees taking part in workshops and conferences

on climate-related and responsible consumption issues.

*******

INVESTOR AGENDA

17 February 2021 (after trading): 2020 Annual Results

18 February 2021 (9:00 a.m. Paris time): Investor and

Analyst Meeting 22 April 2021 (after trading): First-quarter

2021 Financial Information 28 July 2021 (after trading):

2021 Half-year Results 29 July 2021 (2:30 p.m. Paris time):

Investor and Analyst Meeting

ABOUT CARMILA

As the third largest listed owner of commercial property in

continental Europe, Carmila was founded by Carrefour and large

institutional investors in order to transform and enhance the value

of shopping centres adjoining Carrefour hypermarkets in France,

Spain and Italy. At 30 June 2020, its portfolio was valued at €6.2

billion, comprising 215 shopping centres, all leaders in their

catchment areas. Driven by an ambition to simplify and enhance the

daily lives of retailers and customers across the regions, the

local touch is at the heart of everything Carmila does. Carmila’s

teams have a deeply-anchored retail culture, comprising experts in

all aspects of retail attractiveness: operations, shopping centre

management, leasing, local digital marketing, business set-ups and

CSR. Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”). Carmila became part of the FTSE

EPRA/NAREIT Global Real Estate (EMEA Region) indices on 18

September 2017. Carmila became part of the Euronext CAC Small, CAC

Mid & Small and CAC All-tradable indices on 24 September

2018.

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management's beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

* Panel Quantaflow/French Council of Shopping Centres (CNCC) for

France, panel Footfall for Spain.

Visit our website at www.carmila.com/en/

https://www.linkedin.com/company/carmila/

https://twitter.com/CarmilaFrance

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201023005358/en/

INVESTOR AND ANALYST CONTACT Florence Lonis – General

Secretary florence_lonis@carmila.com +33 6 82 80 15

64

PRESS CONTACT Morgan Lavielle - Corporate Communications

Director morgan_lavielle@carmila.com +33 6 87 77 48

80

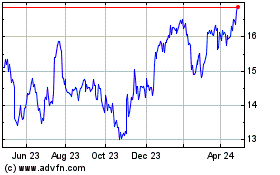

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

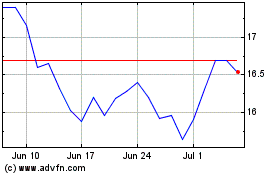

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Apr 2023 to Apr 2024