Regulatory News:

Carrefour (Paris:CA):

- Solid growth, on an exceptional historical base linked to

precautionary purchases

- Like-for-like (LFL) sales growth of +4.2% in Q1 2021, an

average LFL increase of +6.0% over 2 years

- Continued growth in Spain (+1.7% LFL)

- Strong performance in Brazil (+11.6% LFL) in a deteriorated

sanitary context

- Strong LFL growth in France (+3.5% LFL), including in

hypermarkets

- New market share gain (+0.2pt in Q1), with Carrefour

outperforming in all channels(1)

- Solid momentum in hypermarkets (+3.3% LFL), growing each month

of the quarter

- Marked progression of growth drivers

- Accelerated rollout of food e-commerce, growing +56% in Q1

(+45% in Q1 2020)

- Continued expansion in growth formats (+559 convenience

stores(2), +9 Atacadão, +20 Supeco)

- Acquisition of Grupo BIG, highly value-creating

- Announcement of a €500m share buyback in 2021, in line with

capital allocation policy

- Confirmation of the orientations and objectives of the

Carrefour 2022 plan

Alexandre Bompard, Chairman and Chief Executive Officer,

declared: “Carrefour is

showing sustained commercial momentum and posted a quarter of

growth that is all the more remarkable given that it compares with

the exceptional period of March 2020, marked by the outbreak of the

sanitary crisis. Our growth model, based on operational excellence,

competitiveness and the power of our omnichannel offer, translates

into market share gains in our main countries. This is notably the

case in France, where we outperformed the market in all formats.

Our confidence in the success of our transformation plan as well as

in our ability to generate high cash flow is further strengthened.

And in line with our capital allocation policy, we are seizing the

opportunity offered by current market conditions to announce a

share buyback."

FIRST-QUARTER 2021 KEY FIGURES

First-quarter 2021

Sales inc. VAT (€m)

LFL(3)

Total variation

At current exchange rates

At constant exchange rates

France

9,162

+3.5%

-1.4%

-1.4%

Europe

5,465

-1.6%

-3.2%

-2.6%

Latin America (pre-IAS 29)

3,281

+15.7%

-15.4%

+17.2%

Asia

655

-6.4%

+4.3%

+6.7%

Group (pre-IAS 29)

18,564

+4.2%

-4.5%

+2.2%

IAS 29 (4)

13

Group (post-IAS 29)

18,577

Notes: (1) based on NielsenIQ RMS data; (2) including Bio c’Bon,

Wellcome and part of Supersol stores; (3) excluding petrol and

calendar effects and at constant exchange rates; (4) hyperinflation

and foreign exchange in Argentina

EXCELLENT Q1 PERFORMANCE, NOTABLY IN FRANCE

A very solid Q1, despite an exceptional

comparable base

In Q1 2021, Carrefour posted solid LFL growth of +4.2%, an

average LFL growth of +6.0% over 2 years, despite an exceptional

comparable base linked to the start of the sanitary crisis in March

2020.

Group

Q1 20

Q2 20

Q3 20

Q4 20

Q1 21

LFL

+7.8%

+6.3%

+8.4%

+8.7%

+4.2%

Average LFL over 2 years

+5.5%

+5.1%

+5.4%

+5.9%

+6.0%

Indeed, if January and February 2020 were barely affected by

Covid-19, March was particularly impacted by the introduction of

the first restrictive measures. We observed precautionary purchases

ahead of lockdown measures, leading to a sharp increase in sales in

all formats and online. In the last days of the month, once

lockdowns were in place, consumers favored convenience stores and

supermarkets, at the expense of hypermarkets.

This excellent Q1 2021 performance illustrates the strength of

the multi-format and omnichannel model in the different phases of

the crisis, to which the Group has adapted continuously and

successfully, thanks to the strong investment of all Carrefour

teams. Having hypermarkets, supermarkets, convenience stores, Cash

& Carry, but also a complete e-commerce offer, makes it

possible to offer consumers the most appropriate distribution

channel at any given time.

Strong like-for-like growth in France,

reflecting operational excellence to better serve

customers

In France, Carrefour posted robust Q1 LFL growth (+3.5%,

including +3.3% in hypermarkets). This performance reflects the

success of a method that places customers and in-store execution at

the heart of all commercial initiatives, especially with the

“5/5/5” approach and the “TOP” project deployed in around 90% of

hypermarkets and more than 100 supermarkets to date.

This demanding daily discipline allows to eliminate irritants,

more accurately target customer expectations and thus propose a

more relevant and attractive offer. Customer satisfaction has been

improving for several quarters.

The good NPS® momentum notably reflects greater staff

availability, more readable product placement, lower stock-out in

core SKUs, freshness of fruit and vegetables, price accuracy and

reduced time at the cashier.

A solid commercial dynamic is in place, translating into a

marked improvement in market share. In Q1, Carrefour

outperformed in each of the benchmark channels: Hypermarkets,

supermarkets, convenience and Drive1. This is the best quarter in

terms of market share trend in France in 4 years, with an increase

of +0.2 point2.

As of early April, new lockdown measures are in place, albeit

less strict than during previous lockdowns (movement is allowed

without having to produce a written authorization within a

10-kilometer radius, lighter restrictions on non-food, schools

closed, favoring at-home consumption, etc.). Like-for-like

growth is solid during the first weeks of April, including in

hypermarkets.

FIRST-QUARTER 2021 SALES INC. VAT

On a like-for-like (LFL) basis, first quarter sales inc. VAT

were up +4.2%. The Group's sales inc. VAT reached €18,564m

pre-IAS 29, an increase of +2.2% at constant exchange rates. After

taking into account an unfavorable exchange rate effect of -6.7%,

mainly due to the depreciation of the Brazilian Real and the

Argentine Peso, the total sales variation at current exchange rates

amounted to -4.5%. The petrol effect was a negative -1.1%. The

impact of the application of IAS 29 was +€13m.

France: Confirmed growth

momentum

In Q1 2021, Carrefour posted +3.5% LFL growth in France (+2.3%

LFL in food and +12.7% LFL in non-food).

- Hypermarkets (+3.3% LFL / +2.1%

2-year average LFL) posted solid growth in each of the three months

of the quarter, even in March against high comparable base.

Hypermarket stores gained +0.3pt in market share vs the benchmark

channel3. Non-food posted solid +10.8% LFL growth, despite the ban

on non-essential products in several regions in March. Food was up

+1.7% LFL on a high comparable base

- Supermarkets (+7.0% LFL / +7.5%

2-year average LFL) maintained their very good momentum and

continued to significantly outperform their benchmark channel1

- Convenience (-2.8% LFL / +4.1%

2-year average LFL) showed good growth momentum in January and

February (+4.5% LFL), despite curfews that penalized evening

shopping. The Q1 performance was slightly negative in regard to

high historical performance, as the strict lockdown in March 2020

particularly benefitted convenience (+24.9% LFL in March 2020)

- Promocash's activities remained

penalized by restaurant closings

- Food e-commerce GMV was up +51%.

Carrefour confirmed its leadership in home delivery. The Group is

accelerating its rollout through a partnership with Deliveroo, and

by raising to 2,000 the number of stores or contact points offering

Carrefour e-commerce services by end-2021

Europe: Continued growth in Spain and

Belgium

- In Spain (+1.7% LFL / +4.2% 2-year average LFL),

Carrefour showed solid momentum over the whole quarter, despite a

very high comparable base in March 2020 and the snow storm in

January 2021 that impacted the Madrid region, where Carrefour has a

strong presence. The Group lowered prices on 1,000

Carrefour-branded products and is offering 600 products (both

Carrefour and national brands) at a price of €0.99. Moreover, the

Group completed the acquisition of Supersol stores in March

- In Italy (-11.3% LFL / -4.4% 2-year average LFL),

Carrefour showed positive signs on customer satisfaction (NPS®

improving continuously), but remained penalized by the sanitary

measures (traffic restrictions, shopping mall closures, etc.),

especially in the north of the country where Carrefour is very

exposed

- In Belgium (+2.9% LFL / +4.6% 2-year average LFL), the

Group continued to gain market share this quarter. Growth momentum

was good, despite an exceptional comparable base, given the impacts

of stockpiling and the closure of borders in March 2020

- In Poland (-2.3% LFL / +3.3% 2-year average LFL),

Carrefour posted a solid performance, given the exceptional

comparable base and the closure of shopping malls

- In Romania (-1.8% LFL / +4.0%2-year average LFL),

Carrefour outperformed the market thanks to strong momentum in

hypermarkets and in e-commerce, in which Carrefour affirms its

leadership

Latin America: Strong performance in a

deteriorated sanitary context

In Brazil, Q1 sales were up +14.2% at constant exchange

rates, with like-for-like growth of +11.6% (+9.6% 2-year average

LFL). This good performance has been achieved in an unfavorable

context, marked by the cancellation of the carnival festivities, a

deceleration in food inflation and new restrictive measures in

March to fight the pandemic. Market share improved once again in

Q1. The contribution from openings, including first converted Makro

stores, was +4.3%, while foreign exchange had an unfavorable effect

of -29.3%.

- Carrefour Retail posted sales up

+8.6% on a LFL basis, driven by both food and non-food. Carrefour

continued to significantly outperform the market, particularly in

hypermarkets

- Atacadão sales were up +17.5% at

constant exchange rates, with LFL growth of +12.9% and a

contribution from openings of +6.0%. The banner opened 9 stores in

Q1, including 5 Makro store conversions

- Food e-commerce grew by +140%

- Financial services continued to

improve: Billings were up +19.9% and the credit portfolio increased

by +17.1% in Q1

In Argentina (+32.9% LFL / +51.5% 2-year average LFL),

Carrefour continued to gain market share, with growth in volumes.

The Group took strong initiatives in favor of its customers’

purchasing power, with 1,400 product prices frozen until the end of

June.

Taiwan: Carrefour strengthened by the

integration of Wellcome stores

In Taiwan, Q1 sales increased +6.7% at constant exchange

rates, with -6.4% LFL in Q1 (-0.2% average LFL over 2 years) and a

contribution from acquisitions of +15.5% with the integration of

the recently-acquired Wellcome stores. Beyond precautionary

purchases linked to the health context, Carrefour had particularly

benefited in Q1 2020 from the success of commercial operations

during the Chinese New Year.

VALUE-CREATING TARGETED ACQUISITIONS

At the end of March, Carrefour Brazil entered into an agreement

with Advent International and Walmart for the acquisition of Grupo

BIG, Brazil’s third-biggest food retailer. This acquisition

strengthens Carrefour Brazil's presence in this market, which

offers significant growth potential. The transaction values Grupo

BIG at an enterprise value of BRL 7.0bn4 (around €1.1bn). This

acquisition offers significant synergy potential from the first

year, gradually ramping up to reach a net EBITDA contribution of

BRL 1.7bn (around €260m) on an annual basis three years after the

effective completion of the transaction. The transaction remains

subject to the authorization of the Brazilian competition authority

(CADE), the approval of the shareholders of Carrefour Brazil, as

well as customary conditions. Closing is expected in 2022.

In mid-March, Carrefour finalized the acquisition of 172

Supersol convenience stores and supermarkets in Spain for a final

enterprise value of 78 million euros5. This acquisition should

result, for Carrefour Spain, in additional EBITDA of around 50

million euros by 2023.

ANNOUNCEMENT OF A €500M SHARE BUYBACK

Carrefour announces that its Board of Directors has approved

operations to buy back Carrefour shares, with a view to their

future cancellation, for a maximum amount of €500m, or

approximately 4% of the Group’s market capitalization.

This decision is part of the capital allocation policy

announced on February 18, aiming at achieving an efficient balance

between capex, acquisitions and return to shareholders.

These buyback operations reflect management's confidence

in the Group's operational performance, its generation of free cash

flow and its prospects, supported by this excellent first

quarter.

These transactions fall within the framework of Carrefour’s

share buyback program6, as authorized by the General Meeting of

shareholders of May 29, 2020 and valid until November 28, 2021, and

if applicable, subject to the approval of the 20th resolution put

to shareholder vote at the General Meeting to be held on May 21,

2021.

Carrefour will appoint one or more independent financial

intermediaries responsible for implementing these buybacks, in

compliance with the regulations in force, in particular in terms of

the price and volume of shares that can be bought back daily.

Subject to market conditions7, Carrefour expects these

transactions to take place by the end of 2021.

The Group will communicate periodically on the progress of these

buybacks, in order to ensure that investors and the market are

properly informed.

CARREFOUR, A COMMITTED COMPANY

Three years after the creation of its CSR and Food Transition

index, Carrefour is raising its objectives and setting new

ones8.

- On the one hand, Carrefour is raising its objectives in several

areas to confirm and strengthen its commitment to sustainable

fishing, the fight against deforestation, nutrition and health,

local products and reduction of packaging

- The Group has also set itself new objectives on nutrition,

reducing the carbon footprint of products sold, the commitment of

national brand suppliers, diversity and employee engagement

Moreover, Euronext announced on March 22, 2021 Carrefour’s

inclusion in the new CAC 40® ESG index.

STRATEGIC ORIENTATIONS AND OBJECTIVES CONFIRMED

The Group reiterates the orientations of the Carrefour 2022

strategic plan and confirms all of its operational and financial

objectives.

Operational objectives

- Objective of Group NPS® improvement by 2022 of +30 points since

the start of the plan

- Carrefour-branded products accounting for one-third of sales in

2022

- 2,700 convenience store openings by 2022

Financial objectives

- €4.2bn in food e-commerce GMV in 2022

- €4.8bn sales of organic product in 2022

- €2.4bn in additional cost savings by 2023 on an annual basis

(in addition to €3.0bn already achieved at end-2020)

- Net Free Cash Flow at a level above €1bn per year from 2021

(after cash-out of exceptional charges, notably related to

restructuring plans)

- Annual level of capex of around €1.5bn to €1.7bn

- €300m in additional disposals of non-strategic real estate

assets by 2022

AGENDA

- General Shareholders’ Meeting: May 21, 2021

- 2021 second-quarter sales and half-year results: July 29,

2021

APPENDIX

FIRST-QUARTER 2021 SALES INC. VAT

The Group's sales amounted to €18,564m pre-IAS 29. Foreign

exchange had an unfavorable impact in the first quarter of -6.7%,

largely due to the depreciation of the Brazilian Real and the

Argentine Peso. Petrol had an unfavorable impact of -1.1%. The

calendar effect was an unfavorable -1.0%. The effect of openings

was a favorable +0.8%. The effect of acquisitions was +1.2%. The

impact of the application of IAS 29 was +€13m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

9,162

+3.5%

+1.1%

-1.4%

-1.4%

Hypermarkets

4,593

+3.3%

+2.5%

-0.7%

-0.7%

Supermarkets

3,139

+7.0%

+0.8%

-0.9%

-0.9%

Convenience /other formats

1,430

-2.7%

-2.4%

-4.6%

-4.6%

Other European

countries

5,465

-1.6%

-1.7%

-3.2%

-2.6%

Spain

2,291

+1.7%

+2.1%

+0.4%

+0.4%

Italy

1,067

-11.3%

-12.8%

-12.9%

-12.9%

Belgium

1,073

+2.9%

+3.1%

+1.9%

+1.9%

Poland

494

-2.3%

-1.6%

-6.1%

-1.3%

Romania

540

-1.8%

-1.1%

-3.7%

-2.1%

Latin America (pre-IAS

29)

3,281

+15.7%

+18.0%

-15.4%

+17.2%

Brazil

2,750

+11.6%

+14.5%

-15.2%

+14.2%

Argentina (pre-IAS 29)

531

+32.9%

+32.8%

-16.4%

+31.4%

Asia

655

-6.4%

-8.8%

+4.3%

+6.7%

Taiwan

655

-6.4%

-8.8%

+4.3%

+6.7%

Group total (pre-IAS

29)

18,564

+4.2%

+3.5%

-4.5%

+2.2%

IAS 29(1)

13

Group total (post-IAS

29)

18,577

Note: (1) hyperinflation and foreign exchange

COMPARABLE BASE AND 2-YEAR AVERAGE – FIRST-QUARTER

LFL change excl. petrol and

calendar

Q1 2020

Q1 2021

2-year average

France

+4.3%

+3.5%

+3.9%

Hypermarkets

+0.9%

+3.3%

+2.1%

Supermarkets

+8.1%

+7.0%

+7.5%

Convenience /other formats

+6.8%

-2.7%

+2.0%

Other European

countries

+6.1%

-1.6%

+2.3%

Spain

+6.6%

+1.7%

+4.2%

Italy

+2.5%

-11.3%

-4.4%

Belgium

+6.2%

+2.9%

+4.6%

Poland

+8.8%

-2.3%

+3.3%

Romania

+9.7%

-1.8%

+4.0%

Latin America

+17.1%

+15.7%

+16.4%

Brazil

+7.6%

+11.6%

+9.6%

Argentina

+70.0%

+32.9%

+51.5%

Asia

+6.0%

-6.4%

-0.2%

Taiwan

+6.0%

-6.4%

-0.2%

Group total

+7.8%

+4.2%

+6.0%

TECHNICAL EFFECTS – FIRST-QUARTER 2021

Calendar

Petrol

Foreign exchange

France

-1.1%

-1.1%

-

Hypermarkets

-1.1%

-2.1%

-

Supermarkets

-1.3%

-0.5%

-

Convenience /other formats

-0.8%

0.5%

-

Other European

countries

-0.9%

-0.7%

-0.6%

Spain

-1.3%

-2.1%

-

Italy

-0.1%

0.0%

-

Belgium

-1.2%

-

-

Poland

-0.3%

0.6%

-4.9%

Romania

-1.0%

0.0%

-1.6%

Latin America

-1.0%

-1.0%

-32.5%

Brazil

-0.7%

-1.0%

-29.3%

Argentina

-1.4%

-

-47.8%

Asia

0.0%

-

-2.4%

Taiwan

0.0%

-

-2.4%

Group total

-1.0%

-1.1%

-6.7%

APPLICATION OF IAS 29 - Accounting treatment of

hyperinflation for Argentina

The impact on sales is presented in the table below:

Sales incl. VAT (€m)

2020

pre-IAS 29

LFL(1)

Calendar

Openings

Scope and others(2)

Petrol

2021 at constant rates

pre-IAS 29

Forex

2021 at current rates

pre-IAS29

IAS 29(3)

2021 at current rates post-IAS

29

Q1

19,445

+4.2%

-1.0%

+0.8%

-0.6%

-1.1%

+2.2%

-6.7%

18,564

+13

18,577

Notes: (1) excluding petrol and calendar effects and at constant

exchange rates; (2) including transfers; (3) hyperinflation and

foreign exchange

EXPANSION UNDER BANNERS – FIRST-QUARTER 2021

Thousands of sq. m

Dec. 31

2020

Openings/ Store

enlargements

Acquisitions

Closures/ Store reductions/

Disposals

Total Q1 2021 change

March 31 2021

France

5,507

41

4

-17

+28

5,535

Europe (ex France)

6,165

62

131

-56

+136

6,301

Latin America

2,717

22

26

-1

+47

2,764

Asia

1,035

2

103

-

+105

1,140

Others(1)

1,486

68

-

-2

+67

1,553

Group

16,910

195

264

-76

+383

17,293

Note: (1) Africa, Middle East and Dominican Republic

STORE NETWORK UNDER BANNERS – FIRST-QUARTER 2021

N° of stores

Dec. 31 2020

Openings

Acquisitions

Closures/ Disposals

Transfers

Total Q1 2021 change

March 31 2021

Hypermarkets

1,212

14

1

-

-

+15

1,227

France

248

4

-

-

-

+4

252

Europe (ex France)

456

2

1

-

-

+3

459

Latin America

185

-

-

-

-

-

185

Asia

172

-

-

-

-

-

172

Others(1)

151

8

-

-

-

+8

159

Supermarkets

3,546

85

67

-43

-138

-29

3,517

France

1,173

19

5

-5

-138

-119

1,054

Europe (ex France)

1,864

37

62

-37

-

+62

1,926

Latin America

151

-

-

-

-

-

151

Asia

10

2

-

-

-

+2

12

Others(1)

348

27

-

-1

-

+26

374

Convenience stores

7,827

127

327

-57

138

+535

8,362

France

4,018

34

13

-15

138

+170

4,188

Europe (ex France)

3,156

78

93

-35

-

+136

3,292

Latin America

530

12

-

-7

-

+5

535

Asia

66

-

221

-

-

+221

287

Others(1)

57

3

-

-

-

+3

60

Cash & carry

392

5

5

-2

-

+8

400

France

147

-

-

-1

-

-1

146

Europe (ex France)

13

-

-

-

-

-

13

Latin America

214

4

5

-

-

+9

223

Asia

-

-

-

-

-

-

-

Others(1)

18

1

-

-1

-

-

18

Soft discount (Supeco)

71

4

16

-2

-

+18

89

France

6

2

-

-

-

+2

8

Europe (ex France)

64

2

16

-2

-

+16

80

Latin America

1

-

-

-

-

-

1

Asia

-

-

-

-

-

-

-

Others(1)

-

-

-

-

-

-

-

Group

13,048

235

416

-104

-

+547

13,595

France

5,592

59

18

-21

-

+56

5,648

Europe (ex France)

5,553

119

172

-74

-

+217

5,770

Latin America

1,081

16

5

-7

-

+14

1,095

Asia

248

2

221

-

-

+223

471

Others(1)

574

39

-

-2

-

+37

611

Notes: (1) Africa, Middle East and Dominican Republic

DEFINITIONS

Free cash flow

Free cash flow corresponds to cash flow from operating

activities before net finance costs and net interests related to

lease commitment, after the change in working capital, less net

cash from/(used in) investing activities.

Net Free Cash Flow

Net Free Cash Flow corresponds to free cash flow after net

finance costs and net lease payments.

Like for like sales growth (LFL)

Sales generated by stores opened for at least twelve months,

excluding temporary store closures, at constant exchange rates,

excluding petrol and calendar effects and excluding IAS 29

impact.

Organic sales growth

Like for like sales growth plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

® Net Promoter, Net Promoter System, Net Promoter Score, NPS and

the NPS-related emoticons are registered trademarks of Bain &

Company, Inc., Fred Reichheld and Satmetrix Systems, Inc

DISCLAIMER

This press release contains both historical and forward-looking

statements. These forward-looking statements are based on Carrefour

management's current views and assumptions. Such statements are not

guarantees of future performance of the Group. Actual results or

performances may differ materially from those in such forward

looking statements as a result of a number of risks and

uncertainties, including but not limited to the risks described in

the documents filed with the Autorité des Marchés Financiers as

part of the regulated information disclosure requirements and

available on Carrefour's website (www.carrefour.com), and in

particular the Universal Registration Document. These documents are

also available in English on the company's website. Investors may

obtain a copy of these documents from Carrefour free of charge.

Carrefour does not assume any obligation to update or revise any of

these forward-looking statements in the future.

1 Based on NielsenIQ RMS data for FMCG-Fresh excluding wine for

the 12-week period ending 28/03/2021 for Carrefour Hypermarkets vs

total Hypermarket banners, Carrefour Supermarkets vs total

Supermarket banners, Carrefour Convenience vs total Convenience

banners, Carrefour Drive vs total Drive banners (Copyright © 2021,

NielsenIQ) 2 Based on NielsenIQ RMS data for FMCG-Fresh excluding

wine for the 259-week period ending 28/03/2021 for the French total

retail market (Copyright © 2021, NielsenIQ) 3 Based on NielsenIQ

RMS data for FMCG-Fresh excluding wine for the 12-week period

ending 28/03/2021 for Carrefour Hypermarket vs total Hypermarket

banners and Carrefour Supermarkets vs total Supermarket banners

(Copyright © 2021, NielsenIQ) 4 Before capitalized leases (IFRS 16)

that amount to BRL 2.2bn 5 IFRS 16 capitalized leases are estimated

at 87 million euros 6 See section 8.2.3 of the 2020 Universal

Registration Document 7 The implementation of these buybacks, their

duration, and the final amounts thus repurchased will depend in

particular on market conditions. Carrefour reserves the right to

change all or part of the terms of these buybacks, within the

limits indicated above. 8 See press release of April 19, 2021: "

Raised ambition: Carrefour sets itself some new targets for its CSR

and Food Transition Index"

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210420006258/en/

Investor Relations Selma Bekhechi, Anthony Guglielmo and

Antoine Parison Tel: +33 (0)1 64 50 79 81 Shareholder

Relations Tel: 0 805 902 902 (toll-free in France) Group

Communication Tel: +33 (0)1 58 47 88 80

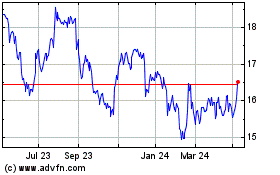

Carrefour (EU:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

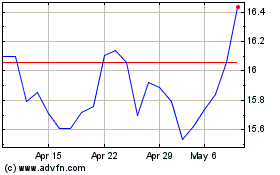

Carrefour (EU:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024