BNP Shares Fall on Cuts to 2020 Revenue, Profitability Targets -- Update

February 06 2019 - 4:28AM

Dow Jones News

(Adds CEO comments, analysts' comments, earnings details, share

price)

--BNP cut its 2020 targets for revenue growth and profitability

amid weak revenue at its investment bank arm

--The bank plans additional cost cuts of EUR600 million

--Fourth-quarter net profit rose 1.1% to EUR1.44 billion

By Pietro Lombardi

Shares in BNP Paribas SA (BNP.FR) fell in early trade after the

bank cut its 2020 revenue growth and profitability targets and

vowed to increase cost savings as weak trading revenue hit its

investment bank arm in the last quarter of 2018.

BNP shares trade 2.8% lower at 0839 GMT after opening more than

3% lower, and are down 37% over the past 12 months.

France's largest listed bank by assets now sees revenue growth

of 1.5% per year between 2016 and 2020, down from a previous

guidance of 2.5%, it said Wednesday. It also lowered the guidance

for 2020 return on equity--a key measure of profitability--to 9.5%

from 10%.

BNP increased its recurring cost savings target to EUR3.3

billion ($3.77 billion) from 2020, up from a previous target of

EUR2.7 billion. Of the additional EUR600 million, roughly EUR350

million will come from its corporate and institutional banking

unit, it said.

"The group is committed to its 2020 ambition and implements

further savings to significantly improve operating efficiency in

all the operating divisions as early as 2019," Chief Executive

Jean-Laurent Bonnafe said.

The performance of its domestic markets and international

financial services divisions are in line with the bank's plan, it

said. However, the unfavorable environment requires an

intensification of the transformation of the CIB unit, BNP

said.

The CIB unit's revenue fell 7.5% last year, with the bank

pointing to a lackluster market context and very challenging

conditions at the end of the year. Revenue at the division declined

9.4% in the fourth quarter compared with a year earlier, hit by

extreme market conditions at the end of the year. Global markets

revenue fell 40% in the quarter, with equity revenue down 70% on

year, hit by extreme market movements at the end of the year on the

valuation of inventories and a loss on index derivative hedging in

the United States. Fixed-income, currencies and commodities revenue

were down 15% amid a lackluster market, in particular on rates and

credit, BNP said.

Net profit for the quarter rose 1.1% on year to EUR1.44 billion,

while revenue fell 3.5% to EUR10.16 billion.

Net profit for the year declined 3% to EUR7.53 billion and

revenue was down 1.5% to EUR42.52 billion.

The results showed some weaknesses, including at the bank's

corporate and institutional banking business and its Belgian

operations, Citi said.

"We expect the market to focus on the updated plan and welcome

the effort on cost and CIB restructuring, while the lower revenues

target [..] is in line with consensus," BNP said.

The bank said it would propose a dividend of EUR3.02 per share,

stable compared with the previous year.

BNP's core Tier 1 capital ratio--a key measure of capital

strength--rose to 11.8% in December from 11.7% in September. It now

targets a ratio of at least 12% in 2020, compared with a previous

guidance of 12%.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 06, 2019 04:13 ET (09:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

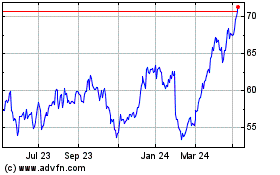

BNP Paribas (EU:BNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

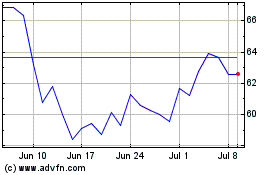

BNP Paribas (EU:BNP)

Historical Stock Chart

From Apr 2023 to Apr 2024