DANONE: Strong progress on profitable growth in 2019; 2020:

investment to accelerate climate action of our brands and

strengthen our growth model

2019 Full-Year

ResultsPress release – Paris, February 26, 2020

Strong progress on profitable growth in

20192020: investment to accelerate climate action

of our brands and strengthen our growth model

2019, a year of progress

- Strong recurring EPS growth: +8.3% at

€3.85

- 2019 sales: €25.3bn, up +2.6% on a reported

and like-for-like bases, with +4.1% in Q4 on a

like-for-like basis

- Strong recurring operating margin improvement at

15.2%, up +76bps on a reported basis and free cash

flow delivery reaching an all-time high of €2.5 bn

- Stronger balance sheet, reaching 2.8x net

debt/EBITDA one year ahead of plan

- Proposed dividend: €2.10 payable in cash, up

+8% from €1.94 last year

Leading the battle against climate

change

- Peak of full scope carbon emissions reached in

2019, five years ahead of initial plans and

commitments

- First step to provide visibility into the cost of

carbon emissions to earnings

- investment to accelerate climate action of our brands

and strengthen our growth model: €2bn over

2020-2022 on brands, agriculture, packaging and

digitalization

Objectives

- For 2020, new guidance of

mid-single-digit recurring EPS growth, reflecting +2 to

+4% like-for-like sales growth and recurring operating margin above

15%, as we accelerate investment and factoring in assessment to

date of the impact of coronavirus outbreak

- Beyond 2020, expecting to deliver in the

mid-term mid to high-single digit recurring EPS growth, with 3 to

5% sales growth on a like-for-like basis

|

|

2019 Key Figures |

|

in millions of euros except if stated otherwise |

FY 2018 |

FY 2019 |

Reported Change |

Like-for-like(LFL) |

|

Sales |

24,651 |

25,287 |

+2.6% |

+2.6% |

|

Recurring operating income |

3,562 |

3,846 |

+8.0% |

+7.4% |

|

Recurring operating margin |

14.45% |

15.21% |

+76 bps |

+71 bps |

|

Non-recurring operating income and expenses |

(821) |

(609) |

+212 |

|

| Operating

income |

2,741 |

3,237 |

+18.1% |

|

|

Operating margin |

11.12% |

12.80% |

+168 bps |

|

|

Recurring net income – Group share |

2,304 |

2,516 |

+9.2% |

|

|

Non-recurring net income – Group share |

46 |

(586) |

(632) |

|

|

Net income – Group share |

2,349 |

1,929 |

-17.9% |

|

|

Recurring EPS (€) |

3.56 |

3.85 |

+8.3% |

|

|

EPS (€) |

3.63 |

2.95 |

-18.7% |

|

|

Free cash flow |

2,232 |

2,510 |

+12.5% |

|

|

Cash flow from operating activities |

3,111 |

3,444 |

+10.7% |

|

All references in this document to Like-for-like

(LFL) changes, Recurring operating income and margin, Recurring net

income, Recurring income tax rate, Recurring EPS, Free cash-flow,

EBITDA correspond to financial indicators not defined in IFRS.

Their definitions, as well as their reconciliation with financial

statements, are listed on pages 9 to 11. The calculation of ROIC

and Net Debt/EBITDA is detailed in the half-year interim financial

report and the annual registration document.

Emmanuel

Faber: Chairman and Chief Executive Officer statement

“2019 has been a year of strong progress for

Danone both in terms of the delivery and the transformation of our

company. The sequential acceleration of our business quarter after

quarter is evidence that we are in the right direction on

sustainable profitable growth, while navigating multiple

headwinds.

I am also excited that our 100,000 employees

became shareholders at our AGM last year, and that our « One

Person. One Voice. One share » program has entered into its second

year resulting in 90,000 of our team members voicing their opinions

for the company local and global strategy, and in 26 volunteers

having a direct and structured dialogue with non executive Board

members.

We end this five-year period of our Danone 2020

plan with a recurring EPS cumulative increase of 50% , a financial

deleverage one year ahead of our plan, and a business that embraced

the food revolution, leading on flexitarian proteins, organic food

and regenerative agriculture.

Yet we read the last 12 months as a shifting

point in civil society, consumer, government, financial

institutions attitudes and expectations towards the daunting

climate and nature issues we are collectively facing. For Danone,

as a company that has adopted One Planet. One Health. as a vision

and as a business model, this is a strategic topic.

On that front, we are proud that we were able to

reach the peak of our full scope carbon emissions last year,

literally five years ahead of our 2015 plan, and that our efforts

on regenerative agriculture have already resulted in a 9% carbon

productivity in our farmers’ fields over the last 2 years. This is

critical to ensure the resilience of farms, sinking carbon in the

soil, therefore reintroducing organic matter and fertility, and

saving costs, pesticides, chemical intrants, and water at a

critical climate juncture for agriculture.

Yet, we are convinced that there is an urgent

and significant opportunity to put climate actions even more at the

core of our business model, truly joining people’s fight for

climate and nature with the power of our brands.

To this effect, we announce a €2 billion climate

acceleration plan today, which in the next three years will further

transform our agriculture, energy and operations, packaging, and

digital capabilities so that we will leverage fully our climate

action to generate resilient growth models for our brands.

This is backing my confidence in the relevance

of our investment plan in the next three years and in both our

short term guidance and mid term objectives as we are setting the

company on a unique path of deep alignment between its vision and

execution.

We start this year under the uncertain clouds of

the coronavirus. Our priority is on the health and safety of our

employees, business partners, customers and the communities in

which we operate, hand in hand with the work of authorities. I

would like in particular to commend and deeply thank our teams in

China for their incredible commitment to their mission serving

relentlessly families, parents, babies and elderlies despite the

difficult conditions. Let me express my support and empathy for the

difficulties and challenges they face and my confidence that life

will return to normal in China and beyond. 坚强, 中国 Stay strong

China.”

I. FOURTH

QUARTER AND FULL YEAR RESULTS

Sales

In 2019, consolidated sales

stood at €25.3 bn, up +2.6% on a like-for-like basis. Sales grew by

+3.8% in value, led by continued positive mix and portfolio

valorization, while volumes declined by -1.2%. Reported sales were

up +2.6%, including a negative scope

effect (-1.0%), mainly reflecting the deconsolidation from

April 1st of Earthbound Farm, a positive impact of

currencies (+0.7%), as well as a

+0.4% organic contribution of Argentina to growth. In the

fourth quarter, sales grew +4.1%

on a like-for-like basis, up from +3% in the previous quarter, with

broadly flat volumes.

| € millionexcept % |

Q42018 |

Q4 2019 |

Reported change |

LFL Sales Growth |

Volume Growth |

FY2018 |

FY2019 |

Reported change |

LFL Sales Growth |

Volume Growth |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

|

|

|

|

EDP |

3,316 |

3,335 |

+0.6% |

+1.5% |

-0.9% |

13,056 |

13,163 |

+0.8% |

+1.1% |

-2.2% |

|

Specialized Nutrition |

1,754 |

1,943 |

+10.8% |

+10.2% |

+0.9% |

7,115 |

7,556 |

+6.2% |

+5.8% |

-0.1% |

|

Waters |

939 |

962 |

+2.5% |

+1.4% |

+0.9% |

4,480 |

4,568 |

+2.0% |

+1.5% |

-0.4% |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

|

|

|

|

Europe & Noram1 |

3,422 |

3,408 |

-0.4% |

+0.6% |

-0.3% |

13,654 |

13,710 |

+0.4% |

+0.3% |

-1.2% |

|

Rest of the World |

2,587 |

2,833 |

+9.5% |

+9.0% |

+0.7% |

10,997 |

11,577 |

+5.3% |

+5.6% |

-0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

6,009 |

6,241 |

+3.9% |

+4.1% |

-0.1% |

24,651 |

25,287 |

+2.6% |

+2.6% |

-1.2% |

1North America (Noram): United States and

Canada

Margin

In 2019, Danone’s recurring operating income

stood at €3.8 bn. The recurring operating margin reached

15.21%, up +76 bps on a reported basis.

On a like-for-like basis, recurring margin

increased by +71bps driven by gross margin improvement - as an

outcome of the continued portfolio valorization efforts and focus

on efficiency offsetting the strong inflation on raw materials –

and sustained sales and marketing investments. In total, gross

savings reached €900 million for the year. The Protein program

delivered approximately €400 milion gross savings, bringing the

cumulated savings since its launch in 2017 to around €700

million.

In addition, reported margin also included:

- The positive scope effect of

+20bps, reflecting the impact of the Earthbound Farm disposal,

- A slight positive effect from

currencies, at +6bps, and

- A negative effect of -21bps

reflecting Argentina’s impact on margin

| Recurring operating profit

(€m) and margin (%) |

FY 2018 |

FY 2019 |

Change |

|

€m |

Margin (%) |

€m |

Margin (%) |

Reported |

Like-for-like |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

EDP |

1,317 |

10.09% |

1,345 |

10.22% |

+13

bps |

-7 bps |

|

Specialized Nutrition |

1,762 |

24.77% |

1,908 |

25.26% |

+49

bps |

+94 bps |

|

Waters |

483 |

10.79% |

593 |

12.98% |

+219 bps |

+189 bps |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

Europe & Noram2 |

1,928 |

14.12% |

1,999 |

14.58% |

+46

bps |

+47 bps |

|

Rest of the World |

1,634 |

14.86% |

1,847 |

15.96% |

+109 bps |

+96 bps |

|

|

|

|

|

|

|

|

|

Total |

3,562 |

14.45% |

3,846 |

15.21% |

+76 bps |

+71 bps |

2North America (Noram): United States and Canada

Performance by reporting entity

ESSENTIAL DAIRY AND PLANT-BASED (EDP)

Essential Dairy & Plant-based

(EDP) posted net sales growth of +1.1% in 2019 on a

like-for-like basis, while margin improved by +13bps to 10.2%.

In the fourth quarter, net sales were up by

+1.5% on a like-for-like basis, including a +2.4% increase in

value, and a -0.9% decline in volumes. The acceleration vs.

previous quarter was driven by a general improvement in Essential

Dairy and a continued strong growth in Plant-Based.

Europe went back to growth in 2019, with

plant-based Alpro brand confirming its double-digit growth trend in

Q4 and Essential Dairy progressively stabilizing, supported by the

deployment of new brands to address new consumer tribes.

North America improved to slightly positive growth

in Q4, on the back of a better quarter for Yogurts in the US. Top-3

brands in the region - International Delight, Silk, and Horizon –

delivered strong growth while protein powder brand Vega posted

another quarter of steep double-digit decline. In the rest

of the world, CIS registered a low-single digit decline,

similar to Q3. Latam posted strong growth and Morocco delivered

another double-digit growth quarter, closing a year of recovery

that brought the business back to market leader position. In 2019,

Plant-Based sales amounted to €1.9bn growing at high-single-digit

rate for the full-year.

SPECIALIZED NUTRITION

Specialized Nutrition posted

net sales growth of +5.8% in 2019 on a like-for-like basis, while

margin improved by +49bps to reach a record level of 25.3%.

In the fourth quarter, sales growth accelerated,

up +10.2% on a like-for-like basis, with an increase in value of

+9.3% and +0.9% in volumes. Advanced Medical

Nutrition posted mid-single digit growth in Q4, fostered

by a good performance of pediatrics range and Early Life

Nutrition sales grew at double-digit rate. China posted

another exceptional quarter, with growth exceeding 20%, reflecting

notably the outstanding performance of Aptamil brand during 11:11 -

China’s and the world’s largest online shopping event – and

including some benefits from the earlier timing of Chinese New

Year. Outside China, Early Life Nutrition grew mid-single digit,

driven by the rest of Asia and Happy Family in the US. The further

integration of AMN and ELN into one single Specialized Nutrition

organization to create further value has been run successfully.

WATERS

Waters posted net sales growth

of +1.5% in 2019 on a like-for-like basis, while margin improved by

+219bps to reach 13.0%.

In the fourth quarter, net sales were up +1.4%

on a like-for-like basis, with an increase in value of +0.5% and

+0.9% in volumes. In Europe, where demand remained

soft in Q4, business returned to growth driven by better

performance in Spain and Poland. In Emerging

Markets, outside China, growth was solid and led by

Indonesia and Turkey, as well as by plain waters in Mexico. In

China, Mizone sales slowed down at a steep double digit rate in a

context of paused investments in the quarter, ahead of the

repositioning plan initially planned for March 2020 to revitalize

the brand. In 2019, about 50% of Waters’ volumes were offered in

reusable formats (especially jugs in Indonesia, Mexico, and Turkey)

and the use of rPET increased to reach 16% worldwide.

Net income and Earnings per

share

Other operating income and

expense stood at -€609 million, mainly related to a

non-cash charge of -€154 million resulting from the loss on the

divestiture of EarthBound Farm in April 2019, restructuring and

integration costs of more than -€300 million, linked notably to the

further integration of the Early Life and Medical Nutrition

organizations.

The recurring net financial

result slightly increased in 2019 vs 2018 (from -€350

million to -€370 million), reflecting the appreciation of the cost

of US-denominated debt and higher interest rates in Argentina. The

recurring income tax rate stood at 27.5% in 2019,

down 40bps from 2018, supported by a favorable country mix.

Recurring net income from associates increased to

€98 million, reflecting good results from the participation in

Mengniu, offsetting the decrease in the participation in Yakult

from 21.3% to 6.6%, which occurred in March 2018. Recurring

minority interests increased to €103 million, driven by

the good results of Aqua in Indonesia.

Total non-recurring net income (Group

share) amounted to -€586 million in 2019, reflecting, in

addition to the non-recurring operating expenses mentioned above,

the impairment of the goodwill related to the stake held in Yashili

(-€109million). As a result, reported

EPS was €2.95, down -18.7% on the high base of

last year, which embedded an exceptional capital gain of €0.7

billion from the partial sale of Danone’s stake in Yakult last

year.

| |

FY 2018 |

FY 2019 |

|

| in millions of

euros except if stated otherwise |

Recurring |

Non-recurring |

Total |

|

Recurring |

Non-recurring |

Total |

|

|

Recurring operating income |

3,562 |

|

3,562 |

|

3,846 |

|

3,846 |

|

| Other

operating income and expense |

|

(821) |

(821) |

|

|

(609) |

(609) |

|

|

Operating income |

3,562 |

(821) |

2,741 |

|

3,846 |

(609) |

3,237 |

|

| Cost of net

debt |

(231) |

|

(231) |

|

(220) |

|

(220) |

|

|

Other financial income and expense |

(119) |

2 |

(117) |

|

(150) |

(0) |

(151) |

|

| Income

before taxes |

3,213 |

(819) |

2,393 |

|

3,477 |

(609) |

2,867 |

|

| Income

tax |

(895) |

179 |

(716) |

|

(956) |

163 |

(793) |

|

|

Effective tax rate |

27.9% |

|

29.9% |

|

27.5% |

|

27.7% |

|

| Net

income from fully consolidated companies |

2,318 |

(640) |

1,678 |

|

2,521 |

(446) |

2,075 |

|

| Net income

from associates |

79 |

683 |

762 |

|

98 |

(144) |

(46) |

|

| Net

income |

2,397 |

43 |

2,440 |

|

2,618 |

(590) |

2,028 |

|

|

• Group

share |

2,304 |

46 |

2,349 |

|

2,516 |

(586) |

1,929 |

|

|

• Non-controlling interests |

93 |

(3) |

90 |

|

103 |

(4) |

99 |

|

|

EPS (€) |

3.56 |

|

3.63 |

|

3.85 |

|

2.95 |

|

Cash flow and Debt

Free cash flow grew +12.5% in

2019 to €2.5bn, and free cash flow conversion ratio significantly

increased to 9.9% of sales, driven by stronger operating

performance and capital discipline. Capex amounted to €951 million

in 2019, or 3.8% of net sales, in line with 2018.The application of

IFRS16 increased Danone’s net debt as of January 1, 2019 by €0.7

billion, from €12.7 bn to €13.4 bn (please refer to IFRS Standards

section page 11). As of December 31, 2019, Danone’s net debt stood

at €12.8 bn, down -€0.6 bn from 2018, with Net Debt /

EBITDA reaching 2.8 times at the end of 2019. ROIC

improved by around +70bps to 9.6% at the end of 2019.

Dividend

At the Annual General Meeting on April 28, 2020,

Danone’s Board of Directors will propose a dividend increase of 16

cents to €2.10 per share, in cash, in respect of

the 2019 fiscal year. This dividend increase is in line with

recurring earnings progression and reflects the solid financial

position of the Company and the strong confidence of both the Board

and the management. Assuming this proposal is approved, the

ex-dividend date will be May 11, 2020 and dividends will be payable

on May 13, 2020.

II. LEADING

THE BATTLE AGAINST CLIMATE CHANGE

2019 Environmental

footprint

To achieve its mission of “bringing health

through food to as many people as possible” and in line with its

“One Planet. One Health.” vision, Danone strives for the highest

standards regarding social, environmental and health performance,

notably when it comes to fighting against climate change. As part

of its pledge towards carbon neutrality on its full value chain by

2050, Danone set intermediate greenhouse gas (GHG) reduction

targets for 2030 which were officially approved by the

Science-Based Targets initiative in 2017. Danone further

strengthened in 2019 its commitments through the signature of

“Business Ambition for 1.5°C” pledge, a significant further step

towards climate urgency.

Danone estimates that the peak of its

carbon emissions on its full scope was reached by the end of

December 2019 (with a total of 27 million tons of GHG),

five years ahead of its original plans and commitments (2025) and

one year prior the 1.5°C Science-Based Targets commitment. Overall

the company has reduced its GHG emission intensity by 24.8%(1) on

its full scope since 2015. Danone was recognized on February

3rd, 2020 as a global environmental leader, becoming one of only 6

companies, among 8,400 organizations assessed, with a ‘triple A’

score by CDP in recognition of its leading environmental efforts,

namely in tackling climate change, fighting deforestation and

protecting water cycles.

(1)The data is based on a constant consolidation

scope and a constant methodology. The GreenHouse Gas protocol

defines three scopes for carbon footprint assessment: Scope 1

emissions are direct emissions from owned or controlled sources.

Scope 2 emissions are indirect emissions from the generation of

purchased energy. Scope 3 emissions are all indirect emissions (not

included in scope 2) that occur in the value chain of the reporting

company, including both upstream and downstream.

Providing visibility into the cost of

carbon emissions to earnings

Danone has been a pioneer in discussing and

setting carbon emission targets on its entire value chain more than

ten years ago, and in including environmental targets in its

management incentives. In light of the urgency for climate action

and in line with its ambition to lead the way to create and share

sustainable value, Danone is taking further steps, with the support

of its Board of Directors, to better connect Environmental, Social,

and Governance metrics and financial performance, starting with

carbon.

Danone shows for the first time a

‘carbon-adjusted’ recurring EPS evolution that takes into account

an estimated financial cost for the absolute GHG emissions on its

entire value chain(1) . This ‘carbon-adjusted’ recurring EPS grew

in 2019 at +12%, faster than the +8.3% recurring EPS growth

reported by the company given the +9% carbon productivity delivered

in 2019.

Going forward, as full scope carbon emissions

peak was reached in 2019 and GHG emissions in absolute levels are

set to decrease, Danone’s ‘carbon-adjusted’ recurring EPS is set to

grow faster than recurring EPS.

Taking into account positive and negative carbon

externalities on the entire value chain in financial disclosure

will help investors to make better investment decisions for the

long-term and drive corporate to accelerate their

transformation.

(1)

Carbon-adjusted recurring EPS is equal to the recurring EPS less an

estimate financial cost for carbon / number of shares after

dilution. The estimated financial cost for carbon is based on

Danone’s full scope (1, 2 and 3) carbon emissions of 27.2 mT for

2019 (26.3 mT for 2018) x a constant carbon cost estimate of

35€/ton, aligned with CDP disclosure. Scopes 1 and 2 emissions

result from activities under the operational control of Danone

assets (production, sites, warehouses, etc.) while Scope 3

emissions refer to Danone’s indirect emissions resulting from its

value chain, upstream and downstream.

Investment to accelerate climate action

of our brands and strengthen our growth model

In a context of shifting point in attitudes and

expectations towards climate and nature issues and growing industry

disruption, Danone is stepping up the speed and increase the depth

of its transformation actions to put climate further at the core of

its growth model, building truly recognized activist brands, moving

from purpose to bold actions.

This will translate into an accelerated

investment plan of around €2bn cumulative over the 2020-2022 period

on brands, climate and agriculture, packaging and digitalization

with the objective to build the most attractive business platform

in the food industry, with greater recognition from consumers for

climate-proofing actions, and create a virtuous cycle that fuels a

superior growth model and unlocks value further and faster.

The accelerated investment will support new bold

commitments to advance some of the Company’s Goals for 2030,

including:

- Sustaining current high level of innovation,

with increased resources to enable more powerful activations and

scaled distribution, building on the portfolio progress made to

date;

- Accelerating B CorpTM journey with Waters

business expected to be certified as a B CorpTM by 2022. In today’s

world where big companies and their brands are fundamentally

challenged as to whose interests they really serve, B CorpTM

certification is a mark of trust for companies demonstrating

highest standards of social and environmental

performance;

- Building truly recognized activist brands, moving from

purpose to bold actions towards responsible packaging, carbon

neutrality and climate-efficient sourcing

Circular

packaging: For Waters, in addition to the existing objective to

reach 50% rPET worldwide by 2025, Danone is now committed to

reaching 100% rPET in Europe from 2025. To serve this ambition,

evian and Volvic brands will act to offer, starting from April

2020, 100% rPET bottles: Volvic full range in Germany, all evian

and Volvic small and XXL formats in France, and all evian on the go

formats in the UK. In order to accelerate the elimination of

single-use plastics, Danone will pursue its investments to innovate

other packaging alternative to plastics (such as glass, cans, and

paper) and rethink business models for hydration. Danone will also

act to enhance the recyclability of Essential Dairy and Plant-Based

cups, targeting zero polystyrene worldwide by 2025, and zero

polystyrene in Europe by 2024, starting with Alpro brand by 2021.

Those initiatives will be supported by the launch a dedicated fund

to explore next generations of packaging materials and models.

Climate,

diets and agriculture: Danone will accelerate the carbon neutrality

trajectory of its flagship Waters brands in Europe evian and Volvic

to become fully carbon neutral in 2020 on all their ranges (full

scope), by cutting emissions throughout the product life cycle as

well as protecting, restoring and funding projects to sequester

carbon in natural ecosystems. The company will also further invest

to support regenerative agriculture and pivot large brands for

preferred and climate-efficient sourcing.

Digital, end-to-end connected value chain:

Danone will also invest in a ‘data, tech and agile’ enabled

transformation, leveraging data and technology to strengthen

execution, better serve people needs in a cost and

climate-efficient way, to ultimately seize growth and efficiency

opportunities.

This accelerated investment plan for 2020-2022

will include around €600 million of accelerated recurring costs

behind brands, technology and capabilities (c. €200 million in

2020) as well as an accelerated capital expenditure plan of around

€1bn. It will include on top material ‘other income and expenses’

dedicated to the transformation of our operations, notably in EDP.

These ‘other operating income and expenses’ will, as usual, be

determined and communicated in the course of the investment plan.

We consider today they could amount to around €500 million costs in

2020.

Danone is confident that those advanced

commitments and accelerated investments behind its growth model

will allow it to deliver in the mid-term a consistent

mid-to-high single digit recurring EPS growth with

like-for-like sales growth to be in the 3% to 5% range. The

accelerated transformation of the company will continue to be

supported by very disciplined capital strategy, with a leverage Net

Debt/EBITDA ratio that the company expects to maintain in the

2.5x-3.0x range.

III. 2020

OUTLOOK AND GUIDANCE

Danone assumes that economic conditions in 2020

will remain particularly volatile and uncertain overall, including

specific contextual difficulties in a few major markets including

the CIS and Argentina, with an additional pressure on the world

economy since the beginning of the year related to the COVID-19

outbreak that began in Wuhan in China last December.

For the year 2020, Danone is targeting a

mid-single-digit growth of recurring EPS. This assumes a

like-for-like sales growth between +2% and +4% (vs. +4% to +5%

previously) and a recurring operating margin above 15% (vs. above

16% previously), reflecting both the strategic steps the company is

taking from 2020 to transform the business for the long-term and

unlock value further and faster, and the impact of external

environment factors.

Full-year guidance factors include:- an

assessment to date of the COVID-19 impact on (1) the company’s

sales and margin in the first quarter, which the company currently

estimates at around €100 million lost sales, mostly in Waters China

business, expecting to bring Q1 like-for-like sales growth broadly

flat; (2) timing of Mizone’s repositioning plan initially planned

in March, putting at risk its summer season;(3) time to market of

Early Life Nutrition innovations in China

- a year-on-year mid-single digit rise in the

cost of its strategic raw materials, although the impact of

COVID-19 on commodities price in 2020 remains uncertain at this

stage. While we cannot currently predict the duration and

extent of the impact of COVID-19, we remain extremely vigilant and

are closely monitoring the situation every day, working hand in

hand with the local authorities.

Danone is strong and resilient, and, confident

in its strategy, will continue in this context to promote in 2020

strategic growth investments over short-term tactical

allocations.

IV.

OTHER

Financial transactions and

developments

§ February 2020: Danone and Harrogate

Water Brands announced that they have entered into a final

agreement under which Danone will acquire a majority stake in

Harrogate Water Brands, the parent company of British water brand,

Harrogate Spring Water, and ethical brand Thirsty Planet. With

revenues of approximately £20 million, Harrogate Spring Water is

one of the fastest growing players in the sector, holding strong

positions in Foodservice and On Premise channels. The closing of

the transaction is subject to regulatory approval.

Governance and Financial

Statements

- At its meeting on February 25, 2020, the Board of Directors

approved draft resolutions that will be submitted to the approval

of the Annual General Meeting on April 28. Acting upon the

recommendation of the Governance Committee, the Board proposes that

shareholders renew the appointments of Gregg L. Engles, Gaëlle

Olivier, Isabelle Seillier, Jean-Michel Séverino and Lionel

Zinsou-Derlin, whose current term of office will expire on the next

General Meeting. The Board noted that these renewals fall within

the framework of the Board’s diversity policy and that this

stability ensures the quality and the continuity of its work.

- At its meeting on February 25, 2020, the Board of Directors

closed statutory and consolidated financial statements for the 2019

fiscal year. Regarding the audit process, the statutory auditors

have substantially completed their examination of financial

statements as of today.

IFRS Standards

IFRS16: applicable starting

January 1, 2019, no restatement of 2018 financial

statements

Danone applies IFRS 16 on leases starting

January 1, 2019 and elected for the modified retrospective approach

for its implementation:

- lease assets and lease liabilities are calculated as of January

1, 2019 based on discounted future lease payments,

- they are recognized in the consolidated balance sheet as of

January 1, 2019 and prior-period financial information are not

restated (i.e. IAS17 is applied).

|

2018 |

January 1, 2019 |

2019 |

|

IAS 17 |

- Assets: +€664m

- Liabilities : +€664m

|

IFRS 16 |

IFRS 16 has no significant impact on

the recurring operating income, recurring operating margin and

recurring net income.

IAS29 impact on reported

data

Danone has been applying IAS 29 in Argentina

from July 1st, 2018 (with effect from January 1st, 2018). Adoption

of IAS 29 in this hyperinflationary country requires its

non-monetary assets and liabilities and its income statement to be

restated to reflect the changes in the general pricing power of its

functional currency, leading to a gain or loss on the net monetary

position included in the net income. Moreover, its financial

statements are converted into euro using the closing exchange rate

of the relevant period.

|

IAS29 impact on reported data €

million except % |

Q4 2019 |

|

FY 2019 |

|

|

Sales |

-0.9 |

|

-15 |

|

|

Sales growth (%) |

-0.0% |

|

-0.1% |

|

|

Recurring Operating Income |

|

|

-36 |

|

|

Recurring Net Income – Group share |

|

|

-46 |

|

Breakdown by quarter of FY 2019 sales after

application of IAS 29FY 2019 sales correspond to the addition

of:

- Q4 2019 reported sales;

- Q1, Q2 and Q3 2019 sales resulting from the application of

IAS29 until December 31 to sales of Argentinian entities

(application of the inflation rate until December 31, 2019 and

translation into euros using December 31, 2019 closing rate) and

provided in the table below for information (unaudited data).

|

€ million |

Q1 2019(1) |

Q2 2019(2) |

Q3 2019(3) |

Q4 2019 |

FY 2019 |

| EDP |

3,309 |

3,276 |

3,243 |

3,335 |

13,163 |

|

Specialized Nutrition |

1,828 |

1,864 |

1,921 |

1,943 |

7,556 |

|

Waters |

1,003 |

1,344 |

1,259 |

962 |

4,568 |

|

|

|

|

|

|

|

|

Total |

6,139 |

6,485 |

6,423 |

6,241 |

25,287 |

(1)Results from the application of IAS29 until

December 31, 2019 to Q1 sales of Argentinian entities. (2)Results

from the application of IAS29 until December 31, 2019 to Q2 sales

of Argentinian entities.(3)Results from the application of IAS29

until December 31, 2019 to Q3 sales of Argentinian entities.

FINANCIAL INDICATORS NOT DEFINED IN IFRS

Due to rounding, the sum of values presented may

differ from totals as reported. Such differences are not

material.

Financial

indicators not defined in IFRS

Like-for-like changes in sales

and recurring operating margin reflect Danone's organic performance

and essentially exclude the impact of:

- changes in consolidation scope, with indicators related to a

given fiscal year calculated on the basis of previous-year scope

and, starting January 1st, 2019, previous-year and current-year

scope excluding Argentinian entities;

- changes in applicable accounting principles;

- changes in exchange rates with both previous-year and

current-year indicators calculated using the same exchange rates

(the exchange rate used is a projected annual rate determined by

Danone for the current year and applied to both previous and

current year).

Bridge from reported data to

like-for-like data

|

(€ million except %) |

FY 2018 |

Impact of changesin scope of

consolidation |

Impact of changes in exchange rates and others, including

IAS29 |

Argentina organic contribution |

Like-for-like growth |

FY 2019 |

|

|

|

|

|

|

|

|

|

Sales |

24,651 |

-1.0% |

+0.7% |

+0.4% |

+2.6% |

25,287 |

|

Recurring operating margin |

14.45% |

+20 bps |

+6 bps |

-21 bps |

+71 bps |

15.21% |

Recurring operating income is

defined as Danone’s operating income excluding Other operating

income and expenses. Other operating income and expenses is defined

under Recommendation 2013-03 of the French CNC (format of

consolidated financial statements for companies reporting under

international reporting standards), and comprises significant items

that, because of their exceptional nature, cannot be viewed as

inherent to its recurring activities. These mainly include capital

gains and losses on disposals of fully consolidated companies,

impairment charges on goodwill, significant costs related to

strategic restructuring and major external growth transactions, and

costs related to major crisis and major litigations. Furthermore,

in connection with IFRS 3 (Revised) and IAS 27 (Revised) relating

to business combinations, the Company also classifies in Other

operating income and expenses (i) acquisition costs related to

business combinations, (ii) revaluation profit or loss accounted

for following a loss of control, (iii) changes in earn-outs

relating to business combinations and subsequent to acquisition

date.

Recurring operating margin is

defined as Recurring operating income over Sales ratio.

Other non-recurring financial income and

expense corresponds to capital gains or losses on disposal

and impairment of non-consolidated interests as well as significant

financial income and expense items that, in view of their

exceptional nature, cannot be considered as inherent to Danone’s

recurring financial management.

Non-recurring income

tax corresponds to income tax on non-recurring

items as well as significant tax income and expense items that, in

view of their exceptional nature, cannot be considered as inherent

to Danone’s recurring performance.

Recurring effective tax rate

measures the effective tax rate of Danone’s recurring performance

and is computed as the ratio income tax related to recurring items

over recurring net income before tax.

Non-recurring results from

associates include significant items that, because of

their exceptional nature, cannot be viewed as inherent to the

recurring activity of those companies and distort the reading of

their performance. They include primarily (i) capital gains and

losses on disposal and impairment of Investments in associates, and

(ii) when material, non-recurring items as defined by Danone

included in the net income from associates.

Recurring net income (or

Recurring net income – Group Share) corresponds to the Group share

of the consolidated recurring net income. The recurring net income

measures Danone’s recurring performance and excludes significant

items that, because of their exceptional nature, cannot be viewed

as inherent to its recurring performance. Such non-recurring income

and expenses mainly include other operating income and expense,

other non-recurring financial income and expense, non-recurring

tax, and non-recurring income from associates. Such income and

expenses excluded from Net income are defined as Non-recurring net

income and expenses.

Recurring EPS (or Recurring net

income – Group Share, per share after dilution) is defined as the

ratio of Recurring net income adjusted for hybrid financing over

Diluted number of shares. In compliance with IFRS, income used to

calculate EPS is adjusted for the coupon related to the hybrid

financing accrued for the period and presented net of tax.

|

|

FY 2018 |

|

FY 2019 |

|

|

Recurring |

|

Total |

|

Recurring |

|

Total |

|

|

Net income-Group share (€ million) |

2,304 |

|

2,349 |

|

2,516 |

|

1,929 |

|

|

Coupon related to hybrid financing net of tax (€ million) |

(14) |

|

(14) |

|

(14) |

|

(14) |

|

|

Number of shares |

|

|

|

|

|

|

|

|

|

• Before dilution |

642,721,076 |

|

642,721,076 |

|

648,250,543 |

|

648,250,543 |

|

|

• After dilution |

643,450,446 |

|

643,450,446 |

|

649,106,039 |

|

649,106,039 |

|

|

EPS (€) |

|

|

|

|

|

|

|

|

|

• Before dilution |

3.56 |

|

3.63 |

|

3.86 |

|

2.95 |

|

|

• After dilution |

3.56 |

|

3.63 |

|

3.85 |

|

2.95 |

|

Free cash-flow represents

cash-flows provided or used by operating activities less capital

expenditure net of disposals and, in connection with IFRS 3

(Revised), relating to business combinations, excluding (i)

acquisition costs related to business combinations, and (ii)

earn-outs related to business combinations and paid subsequently to

acquisition date.

|

(€ million) |

FY 2018 |

FY 2019 |

|

Cash-flow from operating activities |

3,111 |

3,444 |

|

Capital expenditure |

(941) |

(951) |

|

Disposal of tangible assets & transaction fees related to

business combinations1 |

61 |

17 |

|

Free cash-flow |

2,232 |

2,510 |

1 Represents acquisition costs related to business combinations

paid during the period.

Net financial debt represents

the net debt portion bearing interest. It corresponds to current

and non-current financial debt (i) excluding Liabilities related to

put options granted to non-controlling interests and (ii) net of

Cash and cash equivalents, Short term investments and Derivatives –

assets managing net debt.

|

(€ million) |

December 31, 2018 |

December 31, 2019 |

|

Non-current financial debt1 |

14,343 |

12,906 |

|

Current financial debt1 |

3,546 |

4,474 |

|

Short-term investments |

(4,199) |

(3,631) |

|

Cash and cash equivalents |

(839) |

(644) |

|

Derivatives — non-current assets2 |

(81) |

(271) |

|

Derivatives — current-assets2 |

(27) |

(16) |

|

Net debt |

12,744 |

12,819 |

|

·Liabilities related to put options granted to non-controlling

interests — non-current |

(46) |

(13) |

|

·Liabilities related to put options granted to non-controlling

interests — current |

(463) |

(469) |

|

Net financial debt |

12,235 |

12,337 |

Note: The application of IFRS16 increased

Danone’s net debt as of January 1, 2019 by €0.7 billion; 2018

comparative information has not been restated.1 Including

derivatives-liabilities. As from January 1st 2019, also include

debt related to leases in compliance with IFRS16 2 Managing net

debt only

o o O o o

FORWARD-LOOKING STATEMENTS

This press release contains certain

forward-looking statements concerning Danone. In some cases, you

can identify these forward-looking statements by forward-looking

words, such as “estimate”, “expect”, “anticipate”, “project”,

“plan”, “intend”, “objective”, “believe”, “forecast”, “guidance”,

“foresee”, “likely”, “may”, “should”, “goal”, “target”, “might”,

“will”, “could”, “predict”, “continue”, “convinced” and

“confident,” the negative or plural of these words and other

comparable terminology. Forward looking statements in this document

include, but are not limited to, predictions of future activities,

operations, direction, performance and results of Danone.

Although Danone believes its expectations are

based on reasonable assumptions, these forward-looking statements

are subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those anticipated in these

forward-looking statements. For a detailed description of these

risks and uncertainties, please refer to the “Risk Factor” section

of Danone’s Registration Document (the current version of which is

available on www.danone.com).

Subject to regulatory requirements, Danone does

not undertake to publicly update or revise any of these

forward-looking statements. This document does not constitute an

offer to sell, or a solicitation of an offer to buy Danone

securities.

The

presentation to analysts and investors, held by Chairman and CEO

Emmanuel Faber, and CFO Cécile Cabanis, will be broadcast live

today from 8:30 a.m. (Paris time) on Danone’s website

(www.danone.com). Related slides will also be available on the

website in the Investors section.

APPENDIX 1 – Sales by reporting entity

and by geographical area (in € million)

| |

First quarter |

Second quarter |

Third quarter |

Fourth quarter |

Full Year |

| |

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDP |

3,296 |

3,308 |

3,257 |

3,283 |

3,214 |

3,240 |

3,316 |

3,335 |

13,056 |

13,163 |

|

Specialized Nutrition |

1,812 |

1,828 |

1,831 |

1,866 |

1,723 |

1,920 |

1,754 |

1,943 |

7,115 |

7,556 |

|

Waters |

976 |

1,002 |

1,325 |

1,346 |

1,248 |

1,258 |

939 |

962 |

4,480 |

4,568 |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe & Noram1 |

3,311 |

3,381 |

3,453 |

3,471 |

3,468 |

3,451 |

3,422 |

3,408 |

13,654 |

13,710 |

|

Rest of the World |

2,774 |

2,757 |

2,961 |

3,025 |

2,719 |

2,966 |

2,587 |

2,833 |

10,997 |

11,577 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

6,085 |

6,138 |

6,414 |

6,496 |

6,186 |

6,418 |

6,009 |

6,241 |

24,651 |

25,287 |

| |

First quarter 2019 |

Second quarter 2019 |

Third quarter 2019 |

Fourth quarter 2019 |

Full Year 2019 |

|

| |

Reported change |

Like-for-like change |

Reported change |

Like-for-like change |

Reported change |

Like-for-like change |

Reported change |

Like-for-like change |

Reported change |

Like-for-like change |

|

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDP |

+0.4% |

+0.2% |

+0.8% |

+2.2% |

+0.8% |

+0.7% |

+0.6% |

+1.5% |

+0.8% |

+1.1% |

|

Specialized Nutrition |

+0.9% |

+0.4% |

+1.9% |

+3.2% |

+11.4% |

+9.8% |

+10.8% |

+10.2% |

+6.2% |

+5.8% |

|

Waters |

+2.7% |

+3.9% |

+1.6% |

+2.1% |

+0.7% |

-0.9% |

+2.5% |

+1.4% |

+2.0% |

+1.5% |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe & Noram1 |

+2.1% |

-0.8% |

+0.5% |

+1.1% |

-0.5% |

+0.3% |

-0.4% |

+0.6% |

+0.4% |

+0.3% |

|

Rest of the World |

-0.6% |

+3.0% |

+2.2% |

+4.2% |

+9.1% |

+6.5% |

+9.5% |

+9.0% |

+5.3% |

+5.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

+0.9% |

+0.8% |

+1.3% |

+2.5% |

+3.7% |

+3.0% |

+3.9% |

+4.1% |

+2.6% |

+2.6% |

1North America (Noram): United States and

Canada

APPENDIX 2 – Focus on Danone in

China

- China is the second largest country of Danone, representing

~10% of the company’s sales in 2019, with ~1/3 of its

revenues from Waters and ~2/3 from Specialized Nutrition

- It employs around 8,200 employees and runs 8 production sites:

7 for Waters (of which one in Wuhan) and 1 for Medical

Nutrition

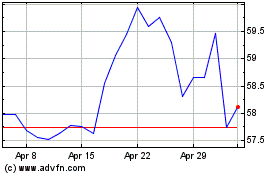

Danone (EU:BN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danone (EU:BN)

Historical Stock Chart

From Apr 2023 to Apr 2024