Rich Sales Boost Coffee Creamers

February 03 2020 - 9:22AM

Dow Jones News

By Annie Gasparro

Food makers are taking a fresh look at coffee creamers, eager to

benefit from rising demand for products that hadn't changed much

for decades.

Nestlé SA and Danone SA long dominated sales of oil-based

creamers in classic flavors such as French vanilla. Now younger

coffee drinkers with an affinity for indulgent, customized drinks

are stoking demand for new flavors and variety.

Smaller companies are satisfying that demand with creamers made

from dairy alternatives including oats and soy. Meanwhile, the

biggest brands, Nestlé's Coffee Mate and Danone's International

Delight, are generating higher sales with new flavors, such as

Funfetti cake and Peeps candy.

Sales of liquid coffee creamers rose about 9% last year,

according to market-research firm Nielsen, compared with 2% growth

across the food industry overall. Creamer sales have risen at a

faster pace than total food sales for the past four years, Nielsen

said.

Food makers say they are finding fans among younger consumers

reared on sweeter coffee drinks such as Starbucks Corp.'s

Frappuccinos.

"The younger generation is creaming a lot more than their

parents did," said Daniel Jhung, president of Nestlé's beverage

division. "They don't like black coffee. They like coffee

milkshakes."

Suzy Perez, who works for a construction company near Orlando,

Fla., said she recently bought a creamer brand called Kitu Super

Creamer that contains no sugar but includes added protein and MCT

oil, which is said to boost energy.

"I'm trying to be more health conscious and stay away from that

extra sugar," she said.

Competition for customers like Ms. Perez is tougher than

ever.

"Other brands across the food sector are noticing the growth,"

said Olivia Sanchez, vice president of marketing for Danone's

creamer division. The company added Hershey's, Peeps and Reese's

flavors to its International Delight brand to appeal to younger

customers craving sweeter drinks.

"They are in it for the flavor, not necessarily for the coffee,"

Ms. Sanchez said.

Most of Danone's and Nestlé's creamers are made primarily of

vegetable oil and sugar. Sales of plant-based creamers rose 30%

last year to 8% of the creamer market, according to Nielsen. Sales

of fresh-milk creamers and plant-based alternatives are growing

even faster.

Anita Jackson, a mother of two boys in Minneapolis, said she

recently switched to plant-based creamers because she believes they

are healthier. "I still look forward to my light-and-sweet cup of

coffee," she said.

Califia Farms, a maker of plant-based milk substitutes, is

adding an oat-based creamer and other products this year. Chief

Executive Greg Steltenpohl said grocers are allocating more space

to these new creamers as sales in the category grow. "Just plain

half-and-half won't cut it anymore," he said.

Some dairy companies are adding higher-end creamers, too.

Fairlife, a filtered milk brand that Coca-Cola Co. took over this

month, said its creamer has 40% less sugar than leading brands.

"We are capitalizing on the trends of more natural and less

ingredients, " Fairlife Chief Executive Tim Doelman said.

Chobani LLC, maker of Greek yogurt, has added milk-based

creamers to its product line. The company has been looking for new

areas of growth as the yogurt aisle has grown more crowded.

"We want to disrupt creamers like we did yogurt 12 years ago,"

Chobani's President Peter McGuinness said.

Nestlé and Danone are adding creamers that some consumers

consider more healthful because of the narrower list of natural

ingredients they contain. Nestlé created a brand called Natural

Bliss that includes milk-based and plant-based creamers. Danone

recently introduced an oat-milk creamer under its dairy-free Silk

line and a craft-coffee creamer that is high in protein and low in

sugar.

"Consumers want everything," Danone's Ms. Sanchez said. "They

want flavor. But other times they want to do better from a health

standpoint."

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

February 03, 2020 09:07 ET (14:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

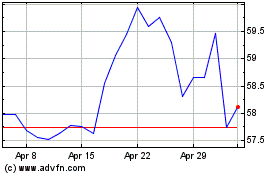

Danone (EU:BN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danone (EU:BN)

Historical Stock Chart

From Apr 2023 to Apr 2024