Banco Comercial Português, S.A. informs about minimum prudential requirements

December 17 2019 - 1:25PM

Banco Comercial Português, S.A. informs about minimum prudential

requirements

Banco Comercial Português, S.A. (BCP) hereby

informs that it has been notified of the decision of the European

Central Bank (ECB) regarding minimum prudential requirements to be

fulfilled on a consolidated basis from January 1st, 2020, based on

the results of the Supervisory Review and Evaluation Process

(SREP). In addition, BCP was informed by the Bank of Portugal on

its capital buffer requirement as “other systemically important

institution” (O-SII).

The ECB’s decision prescribes the following

minimum ratios as a percentage of total risk weighted assets (RWA)

from January 1st, 2020:

(table in the attached document)

Buffers include the conservation buffer (2.5%),

the countercyclical buffer (0%) and the buffer for other

systemically important institutions (O-SII: 0.563%). Given the

increased systemic importance of BCP for the Portuguese financial

system, its future O-SII reserve requirement was revised from 0.75%

to 1.00%, and BCP was granted an additional year (January 1st,

2022) to fulfill it, as communicated by the Bank of Portugal in its

website.

According to ECB’s decision under SREP, the

Pillar 2 requirement for BCP was set at 2.25%, the same value as

for 2019.

Taking into account its capital ratios as of

September 30th, 2019, BCP complies comfortably with the minimum

capital ratio requirements for CET1 (Common Equity Tier 1), Tier 1

and total ratio.

End of announcement

Banco Comercial Português, S.A.

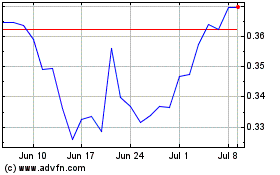

Banco Comercial Portugues (EU:BCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

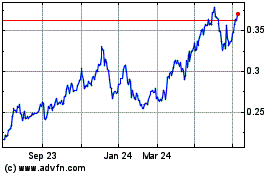

Banco Comercial Portugues (EU:BCP)

Historical Stock Chart

From Apr 2023 to Apr 2024