ALSTOM SA : Alstom to lead the way to greener and smarter mobility,

worldwide

Alstom to lead the way to greener and

smarter mobility, worldwide

- With the widest

geographical reach and most comprehensive portfolio of the

industry, Alstom is in a unique position to respond to the

unprecedented need for sustainable mobility

- Alstom in Motion

(AiM) 2025 strategic plan is built on proven AiM strategy and

significantly enlarged Group profile

- The Group aims

to further grow leveraging on its reinforced product lines and

geographical presence, commits to accelerate smart and green

mobility innovation with important R&D investments, and will

extend its operational excellence efforts to a new scale

- Bombardier

Transportation integration fully on track, synergies fully

confirmed

- Sales to grow at

over 5% CAGR during the period 2020/21 to 2024/25, strongly

outgrowing the market

- Adjusted EBIT

margin to reach best in class profitability level between 8% and

10% from 2024/25 onwards

- Net income1 to

free cash flow conversion ratio to reach over 80 % from 2024/25

onwards, yet short term focus on legacy Bombardier Transportation

projects stabilization to impact free cash flow in 2021/222

- ESG targets extended to the new

scale

5 July

2021 – The board of Alstom

approved on July 4 Alstom’s strategic plan “Alstom in Motion 2025”

(AiM 2025) and mid-term financial objectives.The expanded strategy

AiM 2025 will focus on capturing the strong market growth

opportunities and reinforcing further the innovation leadership of

Alstom as well as driving efficiency throughout the new

organisation and ensuring the successful integration of Bombardier

Transportation.

“Our Alstom in Motion 2025 strategy is our

answer to the historical acceleration of sustainability and green

mobility need all over the world. Alstom has become the leading

international rail actor in this exceptional context. This is a

unique responsibility we are ready to endorse and our focus is to

offer our solutions wherever they are needed on the planet. We have

a clear ambition, the most comprehensive and innovative portfolio,

and highly engaged teams across the world.By 2025 we will have

outgrown the rail industry significantly and set new industry

standards for smart and green mobility in terms of sustainability,

innovation, and profitability.”, said Henri Poupart-Lafarge, Alstom

Chairman and Chief Executive Officer.

Alstom enters in a new chapter of its history on

a solid base with an Alstom in Motion strategy launched in 2019

fully on track and following the Bombardier Transportation

acquisition, a significantly reinforced profile.

***

The “Alstom in Motion 2025” builds on

well-established strategic pillars

This fiscal year 2020/21 closes the second year

of the Alstom in Motion strategy (AiM) announced by Alstom on 24

June 2019 which sets a clear ambition: be the leading global

innovative player for a sustainable and smart mobility. It also

marks the beginning of a new chapter in Alstom history with the

acquisition of Bombardier Transportation closed in January 2021. In

this context and in the context of the Covid-19 crisis, the Group

continues to make good progress on the AiM priorities:

1. Growth by offering

greater value to customers

The Group expects to outgrow the market

significantly with a sales growth over 5% CAGR and expand its

global market share by 5 percentage points. This reflects the

positive commercial dynamics along with the unique position of

Alstom to fully capture market opportunities.

Regarding market presence, more than 70% share

of the Group sales are in North America and Europe, two regions

that will benefit from strong stimulus packages. Alstom has in

particular a very natural leadership position in Western and

Southern Europe. With the Bombardier Transportation acquisition, it

also strengthened significantly its industrial and commercial

assets in Germany, North America, United Kingdom and Nordics, and

plans to further develop in these geographies. The Group is the

only industry player which such a presence in emerging markets,

with 11 JVs in China, major manufacturing and engineering sites in

India. It also demonstrated strong track record in executing

complex projects in emerging markets and is uniquely placed to

capture growth in Asia, Middle East and Africa stemming from

economic growth and urbanization.

Alstom can also now build on its ability to

offer the best value proposition for its customers based on the

most complete and a high performing portfolio in the industry, with

Rolling Stock ranging from light rail to very high speed train,

parts, maintenance and operations services, and a complete

portfolio in Signalling.

Signalling and Services will continue to have

the fastest growth potential. Alstom aims to be market leader in

Signalling by 2025 benefiting from its technological leadership in

ETCS3, a presence in each strategic market and strong engineering

hubs in mature and emerging markets. In Services, Alstom targets to

grow at solid mid-single digit, leveraging on the widest installed

base of the industry with, 150,000 vehicles, the most extensive

depots network and 15,000 highly skilled service employees. In

Rolling Stock, Alstom comprehensive and best-in-class portfolio,

continuously fuelled with innovation, is positioning the Group

ahead of the game, and Alstom will focus most particularly on

increasing competitiveness and profitability.

2. Innovation by

Pioneering Smarter and Greener Mobility for All

Alstom has significantly reinforced his Research

and Development (R&D) resources and intends to expand its

leadership in rail innovation. With the new scale and combined

expertise, the Group now has more than 9,500 patents and a unique

scale and talent base in the industry. R&D investments will be

significantly reinforced - expected at €550-600 million per year in

2024/25 at around 3% of annual sales - to further advance

innovation in the key areas of smart, green, inclusive and

healthier mobility.

The Group is the only rail player that today

offers the entire scope of green traction solutions and in-house

fuel cell technology. Hydrogen trains have been running in Germany

since 2018 and the Group has been awarded firm contracts in

Germany, France and Italy for 59 trains and has multiplied other

partnerships with other countries in Europe. For Smart Mobility,

the Group aims to have fully autonomous trains prototypes for

freight and passengers ready by 2023. Alstom will also be able to

leverage data from the 35,000 vehicles currently maintained and can

count on its 7,500 software engineers and systems architects

working on digital mobility solutions to further advance its

offering to enable fully connected metros, trams as well regional

trains.

3. Efficiency at scale,

Powered by Digital

The continued transformation and efficiency

gains combined with the successful integration of Bombardier

Transportation will be a key focus to deliver on the Group’s

ambitious profitable growth targets. The Group will continue to

deploy its proven ability in operational excellence and project

management, leverage its balanced global footprint, drive the

digitalization of its value chain to optimise sites and projects

and transfer its expertise throughout the new organisation.

This will be achieved on a basis of clear

strategic initiatives supported by a set of dedicated targets by

2025:

The Group will drive the transformation by

deploying its digital suite to reach 100% Group wide, leverage its

scale to invest and accelerate and increase digitalization of its

processes by 20%.

The Group will drive continued project

management excellence in order to achieve a Net Promoter Score of

8.3, implement systematic cash focus in projects, and extend best

practices to lower hard inventories by 20%.

The Group will grow its sites in Best Costs

Countries, leverage its combined locations to optimize its

industrial strategy and optimize its supply chain to increase

global manufacturing work by 20% in Best Costs Countries and

increase manufacturing productivity by 10%.

4. One Alstom Team

Agile, Inclusive and Responsible

The Group reiterates its Corporate Social

Responsibility convictions to aim for carbon neutrality in

transport and increase social equity and inclusion by increasing

the availability and efficiency of public transport. These

convictions are driven by one Alstom team with one set of values:

Agile, Inclusive and Responsible.

The Group extended its ESG 2025 targets and will bring this to

the scope of the new organisation. Its priorities are: Enabling

decarbonisation of mobility, Caring for our people, Creating a

positive impact on society and Acting as a responsible business

partner.

| |

Enablingdecarbonisation of

mobility |

- 25% energy

reduction in solutions4

- 100% of newly

developed solutions eco-designed

- 100% electricity

supply from renewables

- Alstom committed to science-based

CO2 emissions reduction targets within the frame of the Paris

Agreement5

|

Creatinga positive impact on

society |

- 250,000

beneficiaries per year from local actions and Alstom

foundation

|

| |

Caringfor our people |

- Total recordable injury rate at

2

- 28% Women in

management, engineering & professional role

- Global Top Employer

certification

|

Actingas a responsible business

partner |

- 100% of suppliers

monitored or assessed on Corporate Social Responsibility and Ethics

and Compliance standards according to their level of risk

|

Most recently, Alstom has signed in June 2021 a

€400 million Green guarantee facility with BBVA for the issuance of

bank guarantees in support of Alstom’s commercial contracts which

recognizes the Group contribution to Sustainable Development Goals

SDG 9 “Industry, innovation and infrastructure” and SDG 11

“Sustainable Cities and Communities.

***

Integration of Bombardier

Transportation

The integration of Bombardier Transportation is

on track and has received strong employee support and customer

endorsements. Five months after closing, the organisation is

deployed as per target; the product and process convergence

roadmaps are secured, and the organisation is now operating under

one unified IT system. The Group also achieved its first

significant commercial wins from the combined strength of the

portfolio and expanded geographical footprint resulting in around

€6 billion of orders in the first quarter of the current fiscal

year.

A clear integration roadmap and timeline has

been set to complement the Group’s strategy:

- Stabilisation of

challenging Bombardier Transportation legacy projects based on

Alstom’s proven expertise and execution track record in 2 to 3

years with a strong focus on 2021/22;- One

operating model with best-in-class converged processes and product

portfolio in 3 years;- Full leverage of

the significant geographical, industrial and product scale and

complementarities for synergies, enhanced value proposition and

growth from 4-5 years onwards.

***

Project stabilization

impacting fiscal year 2021/22

Free Cash Flow

The current fiscal year 2021/22 will be a

transition year, focused on the stabilization of the Bombardier

Transportation challenging legacy projects. During H1 2021/22 free

cash flow is expected to be between (€1.6 billion) and (€1.9

billion) impacted by working capital consumption due to phasing,

industrial ramp-up and project stabilization efforts. In H2

2021/22, the Group expects positive free cash flow driven by

increased deliveries and operations stabilization. Overall, this

should result in significant negative free cash flow in

2021/22.Thereafter, the Group expects to see yearly positive free

cash flow generation towards its mid-term target6, driven by

progressive working capital stabilization.

***

Mid-term financial trajectory and

objectives

- Sales: Between 2020/21 (proforma

sales of €14 billion) – and 2024/25, Alstom is aiming at sales

Compound Annual Growth Rate over 5%, supported by strong market

momentum and unparalleled €74.5 billion backlog securing ca. €30

billion of sales over the next three years. Rolling stock should

grow above market rate, Services at solid mid-single digit path and

Signalling at high single digit path;

- Profitability: The adjusted EBIT

margin should reach between 8% and 10% from 2024/25 onwards,

benefiting from operational excellence initiatives, the completion

of the challenging projects in backlog while synergies are expected

to deliver €400m run rate between 2024/25 and 2025/26;

- Free Cash Flow: From 2024/25

onwards, the conversion from net income7 to free cash flow should

be over 80%8 driven by mid-term stability of working capital,

stabilisation of CAPEX to around 2% of sales and cash focus

initiatives while benefiting from volume and synergies take

up;

- Alstom will maintain its

disciplined capital allocation focusing on maintaining its

investment grade profile while keeping flexibility and ability to

pursue growth opportunities through focused bolt-on M&A.

- Alstom is committed to delivering

sustained shareholder returns with a dividend pay-out ratio of

between 25% and 35%9. For fiscal year 2020/2021, on the dividend

announced on May 1110, Alstom’s board of directors decided to

propose, in its meeting of July 4, to the General Shareholder

Assembly a dividend in share or in cash, which will be detailed in

the notice for the shareholders’ meeting.

Note to investors and editors:

The presentations of the Capital Markets day will be available

online at 8.45 am Paris time and a replay of the meeting will be

available during the day at Capital Markets Day 06/07/2021 |

Alstom.

Orders & Sales of first Quarter of Fiscal

year 2021/22 will be released on 20 July 2021.

1 Adjusted net profit - see definition in

appendix2 During H1 2021/22, free cash flow is expected to reach

between (€1.6 billion) and (€1.9 billion) impacted by working

capital consumption due to phasing, industrial ramp-up and projects

stabilization efforts. In H2 2021/22, the Group expects positive

free cash flow driven by increased deliveries and operations

stabilization. Overall, this should result in significant negative

free cash flow in 2021/223 European Train Control System4 Compared

to 20145 Target on Alstom legacy perimeter covering emissions from

operations (scopes 1 and 2) consistent with reductions required to

keep warming to 1.5°C, the most ambitious goal of the Paris

Agreement. Target on Alstom legacy perimeter for emissions from

value chain (scope 3) meeting the SBTi’s criteria for ambitious

value chain goals, in line with current best practice. As part of

the Bombardier Transportation integration program, CO2 reduction

targets will be reviewed by the end of FY2021/226 Subject to short

term volatility7 Adjusted net income8 Subject to short term

volatility9 Of adjusted net income10 Dividend distribution of €0.25

per share, which corresponds to a 31% payout ratio from the

adjusted net profit group share

Alstom is a trademark of the Alstom Group

Alstom™ and XXX™ are protected trademarks of the Alstom Group

|

|

About Alstom |

|

|

| Leading societies

to a low carbon future, Alstom develops and markets mobility

solutions that provide the sustainable foundations for the future

of transportation. Alstom’s product portfolio ranges from

high-speed trains, metros, monorails and trams, to integrated

systems, customised services, infrastructure, signalling, and

digital mobility solutions. Alstom has 150,000 vehicles in

commercial service worldwide. With Bombardier Transportation

joining Alstom on January 29, 2021, the enlarged Group’s combined

proforma revenue amounts to €14 billion for the 12-month period

ended March 31, 2021. Headquartered in France, Alstom is now

present in 70 countries and employs more than 70,000 people.

www.alstom.com |

|

|

|

| |

Contacts |

Press:Coralie COLLET - Tel.: +33 (1) 57 06 18

81coralie.collet@alstomgroup.com Samuel MILLER - Tel.: +33

(1) 57 06 67 74Samuel.miller@alstomgroup.com Investor

relations:Julie MOREL - Tel.: +33 (6) 67 61 88

58Julie.morel@alstomgroup.com Claire LEPELLETIER –

Tel.: +33 (6) 76 64 33 06claire.lepelletier@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or form

part of a prospectus or any offer or invitation for the sale or

issue of, or any offer or inducement to purchase or subscribe for,

or any solicitation of any offer to purchase or subscribe for any

shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the visa from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Banks, their affiliates,

shareholders, and their respective directors, officers, advisers,

employees or representatives undertake no obligation to provide the

recipient with access to any additional information

APPENDIX - NON-GAAP FINANCIAL

INDICATORS DEFINITIONS

This section presents financial indicators used

by the Group that are not defined by accounting standard

setters.

1.1. Orders

receivedA new order is recognised as an order received

only when the contract creates enforceable obligations between the

Group and its customer. When this condition is met, the order is

recognised at the contract value.

If the contract is denominated in a currency

other than the functional currency of the reporting unit, the Group

requires the immediate elimination of currency exposure using

forward currency sales. Orders are then measured using the spot

rate at inception of hedging instruments.

Order backlog

Order backlog represents sales not yet

recognised from orders already received. Order backlog at the end

of a financial year is computed as follows:

- order backlog at the beginning of the year;

- plus new orders received during the year;

- less cancellations of orders recorded during the year;

- less sales recognised during the year.

The order backlog is also subject to changes in

the scope of consolidation, contract price adjustments and foreign

currency translation effects.Order backlog corresponds to the

transaction price allocated to the remaining performance

obligations, as per IFRS 15 quantitative and qualitative

disclosures requirement.

Adjusted EBIT

Adjusted EBIT (“aEBIT”) is the Key Performance

Indicator to present the level of recurring operational

performance. This indicator is also aligned with market practice

and comparable to direct competitors.

Starting September 2019, Alstom has opted for the inclusion of

the share in net income of the equity-accounted investments into

the aEBIT when these are considered to be part of the operating

activities of the Group (because there are significant operational

flows and/or common project execution with these entities).This

mainly includes Chinese joint-ventures, namely CASCO joint-venture

for Alstom as well as, following the integration of Bombardier

Transportation, Bombardier Sifang (Qingdao) Transportation Ltd.,

Bombardier NUG Propulsion System Co. Ltd. and Changchun Bombardier

Railway Vehicles Company Ltd.

aEBIT corresponds to Earning Before Interests

and Tax adjusted for the following elements:

- net restructuring expenses

(including rationalization costs);

- tangibles and intangibles

impairment;

- capital gains or loss/revaluation

on investments disposals or controls changes of an entity;

- any other non-recurring items, such

as some costs incurred to realize business combinations and

amortisation of an asset exclusively valued in the context of

business combination, as well as litigation costs that have arisen

outside the ordinary course of business;

- and including the share in net

income of the operational equity-accounted investments.

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.Adjusted EBIT margin corresponds to Adjusted

EBIT in percentage of sales.

Adjusted net profit

Following the Bombardier Transportation

acquisition and with effect from these Fiscal year 2020/21

consolidated financial statements, Alstom decided to introduce the

“adjusted net profit” indicator aimed at restating its net profit

from continued operations (Group share) to exclude the impact of

amortisation of assets exclusively valued when determining the

purchase price allocations (“PPA”) in the context of business

combination, net of the corresponding tax effect. This indicator is

also aligned with market practice.

Free cash flow

Free Cash Flow is defined as net cash provided by

operating activities less capital expenditures including

capitalised development costs, net of proceeds from disposals of

tangible and intangible assets. Free Cash Flow does not include any

proceeds from disposals of activity.

The most directly comparable financial measure

to Free Cash Flow calculated and presented in accordance with IFRS

is net cash provided by operating activities.

Alstom uses the Free Cash Flow both for internal

analysis purposes as well as for external communication as the

Group believes it provides accurate insight into the actual amount

of cash generated or used by operations.

Pay-out ratio

The payout ratio is calculated by dividing the

amount of the overall dividend with the “Adjusted Net profit from

continuing operations attributable to equity holders of the parent,

group share” as presented in the management report in the

consolidated financial statements.

- 05072021 - PR Capital Market Day 2021 - VA

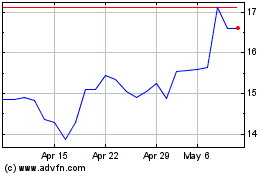

Alstom (EU:ALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alstom (EU:ALO)

Historical Stock Chart

From Apr 2023 to Apr 2024