Akzo Nobel 4Q Net Profit Rose Sharply on Sale; To Start EUR2.5 Billion Buyback

February 13 2019 - 2:06AM

Dow Jones News

By Adria Calatayud

Akzo Nobel NV (AKZA.AE) said Wednesday that net profit soared in

the fourth quarter after the sale of its specialty-chemicals

business and that it will start a share buyback of up to 2.5

billion euros ($2.82 billion) later this month.

Net profit for the quarter ended Dec. 31 was EUR5.85 billion

compared with EUR75 million in the year-earlier period, the Dutch

paints company said. This included a EUR5.8 billion boost from the

specialty-chemicals sale, said the company, which houses the Dulux,

Polycell and Cuprinol brands.

Akzo last year split its specialty-chemicals unit and sold the

business--now called Nouryon--to U.S. private-equity giant Carlyle

Group LP and Singapore's GIC Private Ltd.

Operating profit fell 51% in the fourth quarter to EUR68

million, Akzo said. This was below analysts' forecasts of EUR102.1

million, according to a consensus estimate compiled by the

company.

Quarterly revenue increased to EUR2.31 billion from EUR2.28

billion, the company said. Analysts had forecast Akzo to generate

revenue from continuing operations of EUR2.21 billion, according to

a company-provided consensus.

The board declared a final dividend of EUR1.43 a share

post-consolidation, compared with a payout of EUR1.94 a share a

year earlier.

Akzo said it will start a stock-repurchase program worth up to

EUR2.5 billion around Feb. 25 as part of its plans to distribute

EUR6.5 billion to shareholders. The buyback is due to be completed

by the end of 2019, the company said.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

February 13, 2019 01:51 ET (06:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

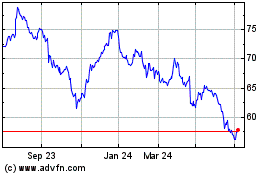

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Mar 2024 to Apr 2024

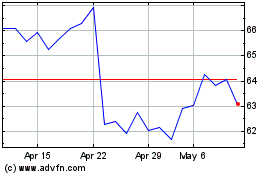

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Apr 2023 to Apr 2024