Coronavirus Pandemic Hits Plan Makers, Complicates 737 MAX Return

April 08 2020 - 3:38PM

Dow Jones News

By Doug Cameron

The crisis that has embroiled the world's airlines is now

hitting the industry's biggest aircraft makers, Boeing Co. and

Airbus SE, and further challenging Boeing's efforts to return its

737 MAX to service.

Airbus said it was slashing production by about a third after

booking just 21 net orders for jets in March and delivering 36 jets

to customers, amid a flood of requests by customers to defer and

cancel orders.

Underscoring the challenge for Boeing's 737 MAX, Airbus said it

was cutting its production of the MAX's chief rival -- the A320 --

to 40 a month, down from about 60 precrisis. Chief Executive

Guillaume Faury said the company was working on "operational and

financial mitigation measures to face reality" amid the coronavirus

pandemic, including slashing spending and cutting costs at its

plants.

Boeing is trying to win Federal Aviation Administration approval

to return some 800 MAX jets to service, after two deadly crashes

blamed in part on the plane's flight-control systems.

A sharp drop in demand and government travel restrictions around

the world aimed at curbing Covid-19 fatalities have socked

airlines. Carriers have responded by grounding large chunks of

their capacity. Some 15,500 jetliners -- two-thirds of the global

fleet -- are essentially parked, according to tracking service

Cirium.

Avolon Holdings Ltd., one of the world's largest

aircraft-leasing companies, last week said it had canceled an order

for 75 MAX jets and pushed back the delivery of others until later

in the decade. The Chinese-owned firm delivered the first MAX to an

airline in 2017, but said it hadn't placed any of the new planes it

had ordered with customers. It originally expected to receive 24 of

the planes in 2020.

Boeing had hoped to restart limited MAX production in May. But

the coronavirus pandemic forced the indefinite closure of its main

assembly plants near Seattle and one in South Carolina. It has said

it expects regulators to approve the plane for flight by midyear

after it made a number of fixes to flight-systems software and

pilot training.

Before the pandemic, Boeing had planned to deliver much of its

backlog of completed MAX jets, and analysts forecast it would

assemble as many as 200 more this year. With airlines putting

planes out of service to deal with capacity cuts, those forecasts

are being cut sharply.

Boeing hasn't provided delivery guidance since the MAX was

grounded. It is expected to disclose its own monthly deliveries

next week.

"Any aircraft taken for delivery now would go straight into

storage," said Sheila Kahyaoglu, an analyst at Jefferies &

Co.

Boeing delivered just 30 jets through February, including four

military versions of commercial planes, and a dozen more in March

-- most of those at the start of the month -- according to tracking

service Planespotter.com.

Almost three-quarters of Boeing deliveries went to U.S.

carriers. Travel restrictions in place to curtail the pandemic also

limit the ability for overseas carriers to collect new deliveries

of jets.

U.S. airlines could be a bright spot for MAX deliveries.

American Airlines Group Inc. was due to receive as many as 24 MAX

jets this year. The company said it is still interested in taking

deliveries to replace older planes it has opted to retire

early.

United Airlines Holdings Inc. was down to take 32 in 2020. It

hasn't said how many it might now take, after slicing a third of

its planned capital spending for the remainder of the year.

Like Avolon, other aircraft lessors serving smaller overseas

carriers have backed away from some of their MAX commitments.

AerCap Holdings NV and Air Lease Corp., two of the largest aircraft

lessors, have either deferred some of their MAX orders or swapped

them for other Boeing jets.

Benjamin Katz contributed to this article

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

April 08, 2020 15:23 ET (19:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

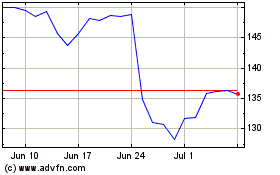

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

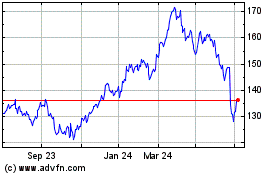

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024