As Airbus Turns 50, a Look Back at the Role of the Euro -- Journal Report

January 20 2019 - 9:53AM

Dow Jones News

By Robert Wall

Airbus SE, which turns 50 this year, has its roots in a

consortium formed by the leading plane makers of Germany, France

and Spain. But according to Chief Financial Officer Harald Wilhelm,

it couldn't have become the fully integrated company it is today,

with some EUR66 billion ($75 billion) in market capitalization, had

it not been for the introduction of the euro in 1999.

Mr. Wilhelm, who is set to leave in April after more than 27

years at the company and its predecessor businesses, spoke to The

Wall Street Journal about the challenges of piloting the finances

of an international aeronautics giant, and the crucial role the

euro has played. Edited excerpts follow.

WSJ: What did the euro's birth mean for Airbus?

MR. WILHELM: The introduction of the euro in January 1999 was

followed in 2000 by the creation of the European Aeronautic Defence

& Space Co. and its plane-making unit Airbus through the merger

of DaimlerChrysler Aerospace, Aerospatiale Matra and, later that

same year, Construcciones Aeronáuticas SA.

The objective clearly was to create the one European aviation

champion.

When I joined the company in the summer of 2000, my first task

was to create a consolidated balance sheet for Airbus. I don't want

to think about how hard that would have been using French francs,

deutsche marks and so forth. You could say the euro's creation was

a kind of conditional precedent for the merger to create EADS and

Airbus.

WSJ: What tangible benefits did you see from having one

currency?

MR. WILHELM: The creation of one currency allowed us to do

significant investments in Europe without considering the exchange

risk -- how is the value of the investments influenced by currency

changes tomorrow. That is a massive benefit.

Then, imagine the daily flow of goods, of parts, traveling all

over Europe. If all of that needed to be traded at daily spot rates

[without the euro], that would be a massive impact in terms of

volatility every day.

The euro, as such, is a pillar of the EADS/Airbus success story

in the past 20 years. It has generated that long-term visibility

and stability.

WSJ:What other upside has the euro delivered for Airbus?

MR. WILHELM: The euro debt and bond market established itself as

the second-most-important [debt] market and, given the

interest-rate level in Europe now, we can say that it is very

favorable in terms of funding costs. We have made use of that

multiple times with recurring debt issuances for various programs.

Also, there is a significant cash position we have -- the pension

assets under management. Bear in mind what all of this would have

been like with the former national currencies, fluctuations and

volatility.

WSJ: The euro has seen significant value swings against the

dollar. How has that affected Airbus?

MR. WILHELM: Legacy currency hedging, in place before the euro

started trading, caused quite a problem in terms of the balance

sheet. After the launch, the euro for a while traded at exchange

rates lower than its inaugural rate. Then the euro strengthened,

and we had to launch competitiveness programs due to the weaker

dollar. [The first such program, in 2007, was a restructuring plan

Airbus called Power8, which sought to reduce inefficiencies in its

international manufacturing process that were causing excessive

overhead and delays.]

WSJ: How did those programs affect Airbus?

MR. WILHELM: Power8, Power8+ and all of the improvement programs

thereafter, which we are still doing today, have made Airbus much

more resilient. It has allowed us to invest, it improved our

margins and cash flow significantly. Just imagine how difficult it

would have been without the euro. It would have been incredibly

complex to do an industrial restructuring and improvement across

Europe, as everybody would have considered short-term tactical

aspects when determining where to put investments, where to

restructure.

WSJ: How have you tried to mitigate the exchange-rate

volatility?

MR. WILHELM: Airbus has one of the largest hedge books, as the

vast majority of our revenue -- commercial aircraft sales -- is

dollar-denominated, while significant parts of our costs are more

euro-denominated. If we had needed to hedge with a higher number of

currencies, it would have been much more complex and

cumbersome.

So that's why I say the euro has been a foundation for the

success of Airbus, operationally but also on the financial side.

But we also increased dollar sourcing.

Now about 60% of our dollar sales are covered by purchases made

in dollars, so we have that natural hedging, too.

WSJ: How nervous were you that the euro could falter during the

2008-09 financial crisis?

MR. WILHELM: Like a lot of corporations, you always look at the

what-ifs. But I don't think we ever got to a point of activating

the plan. It was a fallback. There was a very strong willingness at

the European leadership level to make sure the euro didn't break

apart. The euro being the symbol of Europe, if you take the euro

away what is left? That experience made the euro, I think, even

more resilient.

Mr. Wall is a senior reporter in The Wall Street Journal's

London bureau. He can be reached at robert.wall@wsj.com.

(END) Dow Jones Newswires

January 20, 2019 09:38 ET (14:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

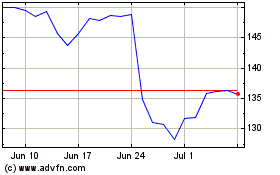

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

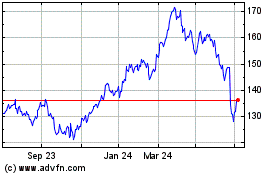

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024