Aegon Says U.S. Business Merger Will Provide Capital Boost

September 25 2018 - 3:19AM

Dow Jones News

By Adam Clark

Aegon N.V. (AGN.AE) said Tuesday that it expects a one-off boost

of $1.0 billion to its capital-generation from the merger of two of

its U.S. businesses.

The Dutch insurance company said it will merge its Arizona-based

vehicle for reinsuring variable annuities with its Transamerica

Life Insurance Co. business.

"Merging two of our US entities simplifies our legal structure,

increases our capital buffer and leads to the release of reserves

and higher diversification benefits," said Chief Executive Alex

Wynaendts

Aegon said changes to U.S. rules for variable annuity capital

mean the use of its captive Arizona vehicle is no longer

required.

Argon said the capital boost to its Solvency II capital ratio is

expected to be largely offset by the effects of U.S. tax reform in

the second half of 2018, and it doesn't expect any material impact

on its recurring capital-generation.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

September 25, 2018 03:04 ET (07:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

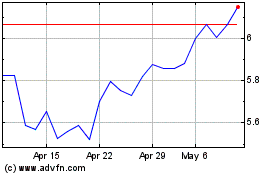

Aegon (EU:AGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aegon (EU:AGN)

Historical Stock Chart

From Apr 2023 to Apr 2024