Redemption of the EUR 600 million undated deeply subordinated notes (of which EUR 403.3 million are outstanding) issued in 20...

September 01 2020 - 2:00AM

Redemption of the EUR 600 million undated deeply subordinated notes

(of which EUR 403.3 million are outstanding) issued in 2015 (ISIN

FR0012650281)

Roissy (France), 1 September

2020 – Air France-KLM has decided

to proceed with the redemption of all the outstanding perpetual

subordinated notes issued in 2015 (ISIN code FR0012650281),

representing a total nominal amount of €403.3 million, in

accordance with the provisions of paragraph 5(b) (Optional

Redemption) of the terms and conditions of the Notes.

Redemption will be made on 1st October 2020 at

par, i.e. €100,000 per Note, plus interest accrued since the last

date on which interest were paid under the Notes (i.e. 1st October

2019) until the early redemption date (included).

This early redemption is implemented as part of

the Group’s policy to reduce its financial costs. In addition, Air

France-KLM intends to implement measures to strengthen its equity

and quasi-equity by May 2021, subject to market conditions.

The services provider in charge of the financial

service of the Notes is BNP Paribas Securities Services – Les

Grands Moulins de Pantin – 9 rue du Débarcadère – 93500 Pantin

- AFK_Redemption hybrid bonds_Press release_ENG

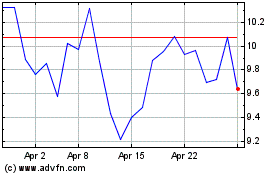

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024