- Cash position of € 28.1 million as of December 31, 2020,

reinforced by a €7 million by a state guaranteed loan in August

2020.

- Major steps achieved on three promising portfolio

projects:

- Insulin supply

from partner Tonghua Dongbao clinically validated; a required step

for initiation of Phase 3 in China, Europe and the US.

- Clinical Phase

1b results in patients with type 1 diabetes support ability of

M1Pram to better control postprandial glycemia and reduced body

weight in the overweight or obese patients.

- First patent

for a hydrogel scaffold improving cell therapy treatments for

people with diabetes.

Regulatory News:

Adocia (Euronext Paris: FR0011184241 – ADOC) (Paris:ADOC), a

clinical stage biopharmaceutical company focused the treatment of

diabetes and other metabolic diseases with innovative formulations

of proteins and peptides, announced today its full year 2020

financial results as of December 31st, 2020. The financial

statements were approved by the Board of Directors today and will

be submitted for shareholder approval at the next General

Shareholders’ Meeting on May 20th, 2021.

"We are very pleased to have successfully executed our

development plan despite the constraints imposed by the COVID-19

pandemic,” said Gérard Soula, President and CEO of Adocia. “The

remarkable clinical results obtained in our BC Lispro and M1Pram

projects are major steps forward for Adocia. Furthermore, the

qualification of the insulin supply from our partner Tonghua

Dongbao allows the launch of Phase 3 studies, a major milestone for

our company. The results of our M1Pram project demonstrate the

benefit of pramlintide in type 1 diabetic patients in the

improvement of both blood sugar control and weight control. These

results were encouraging and motivated us to swiftly initiate our

Phase 2 study. We look forward to further investigating this

promising treatment option in our Phase 2 study, as the results of

this study should help define the parameters of a future Phase 3

study. Moreover, we are enthusiastic about the first results

obtained on the cell therapy project for people with type 1

diabetes. This is a project of great importance for patients that

we intend to pursue actively” added Gerard Soula.

Financial Highlights

The following table summarizes the financial statements under

IFRS for the years ended December 31st, 2020 and December 31st,

2019:

In (€) thousands, Consolidated

financial statements, IAS/IFRS

FY2020 (12 months)

FY 2019 (12 months)

Revenue

841

2 143

Grants, Research tax credit,

others

5 992

5 992

Operating revenue

6 833

8 134

Research and development

expenses

(22 547)

(23 307)

General and administrative

expenses

(5 434)

(6 848)

Operating expenses

(27 981)

(30 155)

OPERATING INCOME

(LOSS)

(21 148)

(22 021)

FINANCIAL INCOME

(LOSS)

(2 147)

455

Tax

(29)

2 963

NET INCOME (LOSS)

(23 324)

(18 603)

The consolidated financial statements on December 31st, 2020 as

well as detailed explanations on the evolution of accounts are

presented in the Appendix.

Key Company Results for Full Year 2020

- Net loss of €23.3 million in 2020 compared to a loss of €18.6

million in 2019, mainly consisted of:

- Revenue of €0.8 million in 2020, (compared

to revenue of €2.1 million in 2019), resulting from the recognition

of the initially planned activities by the signature of the license

agreements in April 2018;

- Other operating income of €6 million,

resulting mainly from the research tax credit (CIR) generated on

2020 expenses;

- Total operating expenses of nearly €28

million, a €2.2 million decrease compared to 2019;

- A negative financial income of €2.1million,

reflecting mainly the financial interest paid on the €15 million

loan contracted with IPF Partners in 2019.

- Cash position of €28.1 million as of December 31st, 2020

(compared to €43.7 million on December 31st, 2019) which includes

the state guaranteed loan (PGE) of €7 million granted in August

2020:

- Over the full year 2020, the net amount of

cash needed to finance operations was €22.5 million, compared to

€26.7 million over the same period in 2019 which has been restated

to be comparable).

- Financial debts as of December 31st, 2020

up €7 million (PGE), totaled €28.2 million, compared to €21.2

million as of December 31st, 2019. Financial debts consisted of the

€7 million state guaranteed loan (PGE) contracted in August 2020

and the €15 million bond issue subscribed to IPF Fund II in 2019,

as well as the €6.1 million bank loans to finance the acquisition

and renovation of the building in which the headquarters and the

research center of the Company are located.

“At the end of 2020, we had a cash position of €28.1 million,

which we believe enables us to finance our clinical study program

in 2021,” commented Valérie Danaguezian, CFO of Adocia. "We

continue to stay focused on our main priorities while maintaining

rigorous management of expenses.”

Key Events in 2020 and

Perspectives for 2021:

While the COVID pandemic disrupted global context, Adocia has

rapidly reacted in order to achieve the objectives set forth:

2020 was mainly marked by the clinical progress made on the

combination of prandial insulin and pramlintide (Insulin analog),

the bi-hormonal product M1Pram (ADO09):

- In April 2020, clinical results obtained on

patients with type 1 diabetes after 3 weeks of treatment,

demonstrated that M1Pram enables the restoration of essential

functions of physiology during the digestion phase including:

improving gastric emptying time recovery, which is abnormally short

in patients with type 1 diabetes, inhibiting glucagon secretion

(trigger of the endogenous glucose synthesis), and promoting a

feeling of satiety. This recovery of a normal metabolism results in

better control of post-meal blood sugar levels, with a significant

reduction in insulin consumption and weight reduction in overweight

/ obese patients.

- In September 2020, Adocia announced the

results of the extension of this clinical study on patients with

type 1 diabetes requiring more than 40 UI/day of insulin and with a

longer period of time of treatment (3 months). The primary endpoint

of this study was met with the reduction of 69% of post-meal

glycemic excursions over four hours vs. Novolog®. This study

demonstrated a mean weight loss of 1.6 kg for 24 days with M1Pram

treatment (versus an increase of 0.4 kg in the control group for

this population). Additionally, a treatment satisfaction

questionnaire was submitted to all patients after each treatment

period. The results reflect the beneficial impact of M1Pram on

individuals, as 87% of them reported an improved appetite control

through the M1Pram study medication, and 75% of the patients would

recommend it to other people with diabetes.

- In light of these results, Adocia rapidly

progressed its clinical program and initiates its Phase 2 study in

March of 2021. The study will evaluate the safety and efficacy of

M1Pram in 80 patients, assessing weight loss in overweight and

obese T1D patients as well as improved HbA1c.

In parallel and considering the significant clinical benefit of

an insulin pramlintide combination, Adocia developed a second

product based on the BioChaperone (BC LisPram) technology.

The development of this product was carried on in 2020 and it will

be tested in a pump study in the first semester 2021.

During 2020, a major step was achieved with Tonghua Dongbao

(THDB) on ultra-rapid insulin BioChaperone® Lispro (BC

Lispro) on the Chinese market, with the filing of a clinical

application to the Chinese Reglementary Authorities (Center for

Drug Evaluation).

In regard to BioChaperone® Combo, co-formulation of

glargine (basal insulin) and lispro (prandial insulin), the

technological transfer to our Chinese partner is over and the

industrialization of the manufacturing process is ongoing. Adocia

is currently involved with Tonghua Dongbao on the project of the

clinical development and in the preparation of the reglementary

application to ensure its commercialization in China, which

represents a market with a strong potential.

In 2020, Adocia realized a clinical study called « bridging »

which demonstrated that the BioChaperone Lispro formulation

composed of insulin lispro manufactured by Tonghua Dongbao, had a

similar ultra-rapid pharmacokinetic/pharmacodynamic and safety

profile, compared with the BioChaperone Lispro formulation composed

with insulin lispro, Humalog®. Results from this study complete the

dossier for BioChaperone Lispro, employing insulin lispro from

Tonghua Dongbao, required for initiation of Phase 3 studies in

China, Europe, and the US.

Adocia also developed a new technology in 2020 for cell therapy

and developed an innovative stable biocompatible hydrogel scaffold

to host and protect pancreatic cell implants. This aims to restore

glycemic control without requiring insulin injection and

immunosuppressant drugs. An academic collaboration with Pr.

Pattou’s Inserm Team, a worldwide leader of Langerhans islet

transplant in clinical and non-clinical stages, has been

established to develop this product in animal models and ultimately

in humans. The primary results obtained via this collaboration are

promising.

On a financial basis, in the COVID-19 pandemic

environment, the Company was granted a non-dilutive loan of € 7

million via a State-guaranteed loan (PGE) by BNP, HSBC, LCL and

Bpifrance in August 2020. Its initial term is one year with a

5-year amortization option. Adocia negotiated in parallel with IPF

Partners a rescheduling of loan terms (contracted for a total

amount of €15 million in 2019) with a differed period of 12 months

for an amount of €2 million and issuance of 35 005(BSA) warrants

accordingly.

About ADOCIA

Adocia is a clinical-stage biotechnology company that

specializes in the development of innovative formulations of

therapeutic proteins and peptides for the treatment of diabetes and

metabolic diseases. In the diabetes field, Adocia’s portfolio of

injectable treatments is among the largest and most differentiated

of the industry, featuring five clinical-stage products and three

products in preclinical-stage. The proprietary BioChaperone®

technological platform is designed to enhance the effectiveness

and/or safety of therapeutic proteins while making them easier for

patients to use. Adocia customizes BioChaperone to each protein for

a given application.

Adocia’s clinical pipeline includes four novel insulin

formulations for prandial treatment of diabetes: two ultra-rapid

formulations of insulin analog lispro (BioChaperone® Lispro U100

and U200), a combination of basal insulin glargine and rapid-acting

insulin lispro (BioChaperone® Combo) and one combination of a

prandial insulin with amylin analog pramlintide M1Pram. The

clinical pipeline also includes an aqueous formulation of human

glucagon (BioChaperone® Glucagon) for the treatment of

hypoglycemia.

Adocia preclinical pipeline includes three bi-hormonal products:

two combinations of rapid human insulin analogues and Pramlintide

(BioChaperone® LisPram and BioChaperone® AsPram) and a combination

of insulin glargine with Liraglutide (BioChaperone® GlaLira) for

the treatment of diabetes.

Adocia recently added a fourth program in preclinical with the

development of a hydrogel scaffold for cell therapy in the

treatment of type 1 diabetes. A first patent has been filed.

Disclaimer

This press release contains certain forward-looking statements

concerning Adocia and its business. Such forward-looking statements

are based on assumptions that Adocia considers to be reasonable.

However, there can be no assurance that the estimates contained in

such forward-looking statements will be verified, which estimates

are subject to numerous risks including the risks set forth in the

“Risk Factors” section of the Universal Registration Document filed

with the French Autorité des marchés financiers on April 22, 2020

(a copy of which is available at www.adocia.com) and to the

development of economic conditions financial markets and the

markets in which Adocia operates. The forward-looking statements

contained in this press release are also subject to risks not yet

known to Adocia or not currently considered material by Adocia. The

occurrence of all or part of such risks could cause actual results,

financial conditions, performance, or achievements of Adocia to be

materially different from such forward-looking statements. This

press release and the information contained herein do not

constitute an offer to sell or the solicitation of an offer to buy

Adocia shares in any jurisdiction.

APPENDIX: Full year results for the year ended December 31st,

2020 – IFRS standards

The following table summarizes the Company’s income statement

under IFRS for the fiscal year ended December 31st, 2020 and

provides a comparison with fiscal year 2019.

In (€) thousands

Notes

FY 2020 (12 months)

FY 2019 (12 months)

Operating revenue

6 833

8 134

Revenue

15

841

2 143

Grants, research tax credits and

others

16

5 992

5 992

Operating expenses excluding

additions and reversals

14

(26 848)

(28 996)

Additions to and reversals of

depreciation, amortization and provisions

19

(1 133)

(1 159)

PROFIT (LOSS) FROM ORDINARY

OPERATING ACTIVITIES

14

(21 148)

(22 021)

Financial income

103

1 310

Financial expense

(2 250)

(856)

FINANCIAL INCOME

(LOSS)

20

(2 147)

455

PROFIT (LOSS) BEFORE

TAX

(23 295)

(21 566)

Tax expense

21

(29)

2 963

NET PROFIT (LOSS)

(23 324)

(18 603)

Base earnings per share (€)

22

(3,3)

(2,7)

Diluted earnings per share

(€)

22

(3,3)

(2,7)

GROUP NET PROFIT

(LOSS)

(23 324)

(18 603)

Operating income

The Company’s operating income resulted from collaboration and

licensing agreements and public funding of research costs. In 2020,

operating income amounted €6.8 million compared to €8.1 million in

2019, based on the following breakdown:

In (€) thousands

FY 2020 (12 months)

FY 2019 (12 months)

Revenue (a)

841

2 143

Research and collaborative

agreements

0

0

Licencing revenues

841

2 143

Grants, public financing,

others (b)

5 992

5 992

OPERATING REVENUE (a) +

(b)

6 833

8 134

In 2019, revenue resulted in €2.1 million from the initial

upfront payment of $50million (€41.1 million) in April 2018 at the

signature of the two partnership and licensing agreement with

Tonghua Dongbao. These revenues related to R&D services

provided by Adocia to Tonghua Dongbao, are recognized based on

progress, in accordance with IFRS 15, by comparison between the

costs incurred by Adocia and the total budget estimated to date

over the term of the contract.

As of December 31, 2020, the turnover of €0.8 million comes

mainly from the licensing agreements signed in April 2018 with the

company Tonghua Dongbao Pharmaceuticals and reflects the R&D

services provided by Adocia for the transfer and the development of

licensed products.

The portion of the initial payment yet to be recognized as

revenue, as of December 31, 2020, amounts to € 1.1 million and is

recognized as deferred income.

Other operating income mainly consists of the Research Tax

Credit which amounted to €6 million as of December 31, 2020

compared to €5.9 million as of December 31, 2019.

Operating expenses

The table below shows a breakdown of operating expenses by

function for the fiscal years ended December 31st, 2020 and

December 31st, 2019:

In (€) thousands

FY 2020 (12 months)

FY 2019 (12 months)

Research and development

expenses

(22 547)

(23 307)

General and administrative

expenses

(5 434)

(6 848)

OPERATING EXPENSES

(27 981)

(30 155)

Research and development expenses mainly consisted of the

payroll costs of research and development employees, subcontracting

costs (including preclinical studies and clinical trials),

intellectual property costs and purchases of materials (reagents

and other consumables), and pharmaceutical products and other raw

materials. In 2020, these expenses amounted to €22.5 million versus

€23.3 million in 2019.

The activities in the 2020 financial year focused on the

development of the Company's portfolio, especially the clinical

development of the M1 PRAM (ADO09) project, combination of insulin

prandial and pramlintide (insulin analog).

General and administrative expenses mainly included payroll

costs of non-research and development employees, as well as the

cost of services related to the management and business development

of the Company and its subsidiary in the United States.

General and administrative expenses amounted to €5.4 million in

2020 compared to €6.8 million in 2019. This decrease of €1.4

million is explained by the wind-down of expenses related to the

legal proceedings against Eli Lilly, which impacted the fees

position in 2019.

Research and Development expenses represented more than 80% of

the operating expenses in 2020 compared to 77% in 2019.

The table below shows a breakdown of operating expenses by type

of expense for the fiscal years ended December 31st, 2020 and

December 31st, 2019:

In (€) thousands

FY 2020 (12 months)

FY 2019 (12 months)

Purchases used in operations

(1 457)

(1 706)

Payroll expense

(11 857)

(13 054)

Share-based payments

(267)

(890)

External expenses

(13 010)

(13 110)

Taxes and contributions

(257)

(235)

Depreciation, amortization &

provisions

(1 133)

(1 159)

OPERATING EXPENSES

(27 981)

(30 155)

The cost of consumed materials, products and supplies decreased

by €0.25 million between 2019 and 2020, totaling €1.5 million.

Payroll expenses totaled €11.9 million in 2020 compared to

€13.1million in 2019, i.e., a decrease of €1.2 million ( -9%). The

average workforce rose from 138-time equivalents (FTE) in 2019 to

126 FTE in 2020, a decrease of 9%.

The share-based payments line of €0.27 million in 2020 reflects

the impact of the plans implemented in previous years. The decrease

of the share-based payments (€0.6million) is mainly related to the

vesting of several share-based plans in 2020. The 5 new plans put

in place in 2020 had a low impact on the item (37.7 K€). In

accordance with IFRS 2, these expenses correspond to the fair value

of the equity instruments granted to managers and employees. These

elements had no impact on the Company’s corporate financial

statements nor cash position.

External charges include the costs of preclinical studies,

clinical trials, subcontracting expenses, intellectual property

costs, professional fees and administrative expenses and totaled to

€13 million in 2020, at a stable level compared to 2019. This is

mainly due to the end of the legal fees incurred for the

proceedings against Eli Lilly was balanced by the increase of the

R&D external expenses.

Taxes totaled €0.26 million in 2020 compared to €0.24 million in

2019.

Depreciation and amortization totaled by €1.1 million as of

December 31, 2020 compared to €1.2 million in 2019.

Net financial

income/expense

In (€) thousands

FY 2020 (12 months)

FY 2019 (12 months)

Cost of net financial

debt

(1 852)

170

Cash and cash equivalents

income

(14)

809

Interest on conditional

advances

(2 052)

(416)

Fair value revaluation of IPF's

share subscription warrants

214

(223)

Foreign exchange gains and

losses

(304)

238

Other financial income and

expenses

10

47

FINANCIAL INCOME

(LOSS)

(2 147)

455

The negative net financial income amounted €2.1 million as of

December 31, 2020 due to the following:

- Interest generated on borrowings related to

the subscription of the bond issue with IPF Fund II in October 2019

(€1.7 million);

- Revaluation of the fair value of the

warrants granted to IPF Fund II of €0.2 million, with no impact to

the Company's cash position;

- Exchange rate loss (€0.3 million).

As a reminder, as of December 31, 2019, the positive financial

result of €0.5 million was mainly due to the accrued interest

granted by the American Arbitration Association Tribunal within the

context of the first phase of the arbitration proceedings initiated

against Eli Lilly.

The Company’s investment policy focuses on liquidity, the

absence of capital risk and, to the extent possible, guaranteed

performance.

Corporation tax

The carryforward tax losses, after allocation of the fiscal

deficit subject to the standard tax rate for the 2020 financial

year, was €164.8 million. This carryforward loss is not limited in

time. Since the company cannot determine with sufficient

reliability when it will be able to absorb its accumulated tax

loss, it did not recognize a deferred tax asset for this loss.

Net profit/loss

FY 2020 (12 months)

FY 2019 (12 months)

CONSOLIDATED NET PROFIT / LOSS

(in euros thousands)

(23 324)

(18 603)

Average number of shares

6 973 639

6 939 148

NET EARNINGS (LOSS) PER SHARE

(in euros)

(3.3)

(2.7)

NET EARNINGS (LOSS) PER SHARE

FULY DILUTED (in euros)

(3.3)

(2.7)

The net loss for 2020 amounts to € 23.3 million, compared to a

net loss of €18.6 million in 2019. The net loss per share thus

amounts to €3.3, compared to a net loss of €2.68 per share in

2019.

Balance sheet analysis

Non-current assets

Non-current assets amounted to €8.7 million at the end of 2020,

compared with €9.7 million in 2019. These investments are partially

offset by depreciation for the year amounting to €1 million between

2019 and 2020. This decrease reflects the amortization of fixed

assets for the period as well as a low level of investment in

2020.

Current assets

Current assets amounted to €36.4 million at December 31st, 2020

compared to €52.2 million at December 31st, 2019, consisting of the

following items:

- "Cash and cash equivalents" decreased from

€43.7 million as of December 31st, 2019 to €28.1 million as of

December 31st, 2020. The €15.5 million variation in 2020 is mainly

due to the consumption of cash over the year, which amounted to €22

million, partially offset by the subscription of PGE loans for a

total amount of €7 million. In August 2020, Adocia was indeed

granted a loan of €7 million from BNP, HSBC, LCL and Bpifrance in

the form of a State- Guaranteed Loan (PGE).

- Other current assets amounted to €7.8

million at December 31st, 2020 and consisted mainly of the

receivable related to the research tax credit (CIR) of €6 million.

At December 31st, 2019, this item amounted to €8 million, of which

€5.9 million related to CIR. There is no comment regarding the

variation of this item.

Current and non-current liabilities

Liabilities consisted mainly of four items presented on the

balance sheet according to their maturity:

- "Trade payables” under current liabilities

amount to €4.9 million at December 31st, 2020, compared to €5.3

million at December 31st, 2019.

- "Financial debt” totaling €28.2 million at

December 31st, 2020, increasing by €7 million compared to the

previous year. This increase is mainly due to the subscription of a

state-guaranteed loan (PGE) by BPI, HSBC, BNP and LCL banks for an

amount of € 7 million in August 2020.

- “Long-term provisions” mainly comprise

provisions of retirement benefits, which totaled €2.2 million for

fiscal year 2020 versus €3.1 million for fiscal year 2019.

- “Other liabilities” for 2020 included tax

and social security liabilities which amounted to €2.3 million.

This item is stable and there is no further comment. In 2020, other

liabilities also included €1.1 million, versus €1.9 million last

year, in deferred revenue related to the agreements signed with

Tonghua Dongbao Pharmaceuticals Co. Ltd, in April 2018.

Cash and financing

Debt financing

Thanks to its research activities, the Company has benefited

from reimbursable grants from BpiFrance and COFACE, without bearing

any interest, for a total amount of €4.1 million.

As of December 31st, 2020, the outstanding amount of the loans

receives from BpiFrance were €0.5 million and relates solely to the

repayable advance of €0.8 million received in 2012 for the

development of a formulation of fast-acting "human" insulin and the

Phase 2a clinical study. In 2015, the Company noted the end of the

program and proceeded with the reimbursements provided in the event

of commercial failure of the program in 2017 and 2018. An expertise

commissioned by BpiFrance was realized in 2020 and should make it

possible to close this dossier in 2021.

In addition, the Company uses other financial liabilities to

finance the acquisition of lab equipment and materials. Future

obligations under these leasing contracts amounted to €0.2 million

as of December 31st, 2020.

The Company contracted its first bank loan, in 2016, to finance

the purchase of the building that it has occupied since its

creation as well as adjoining parking and a second loan, in 2019,

to finance building renovations. At the end of 2020, the

outstanding capital of these bank loans amounted to €5.1

million.

In 2019, the Company subscribed to a bond issue, with warrants,

for a total of €15 million from IPF Fund II, through two tranches

of €7.5 million each, on October 11th, 2019 and December 10th,

2019.

In July 2020, in a by the Covid-19 pandemic context, the Company

obtained a restructuring of the debt with a new payment deferral of

additional 12 months, the final maturity dates of the two tranches

remaining unchanged.

The Board of Directors of the Company allocated, in return for

this arrangement, to the IPF Fund II SCA SICAV FIAR a total number

of 35,005 share subscription warrants (BSA), under terms and

conditions similar to those warrants allocated to IPF Fund II SCA

SICAV FIAR under the main contract, with an exercise price of the

warrants of €7.70.

Finally, in August 2020, Adocia was granted a loan of €7 million

from BNP, HSBC, LCL and BpiFrance Banks, in the form of a State

-Guaranteed Loan (PGE).

These loans are guaranteed by the French State up to 90% of the

amounts due and are not subject to any payment during the first

year. At the end of the first year, the repayment of the principal

may again be deferred and amortized over a maximum period of 5

years, at the option of the Company. These loans will carry annual

fixed interest rates of between 0.25% and 1.75% for the first

year.

As of December 31st, 2020, Adocia's financial debt was €28.2

million, with a short-term (less than a year) component of €3

million.

Cash flows

In (€) thousands, Consolidated

financial statements, IAS/IFRS

FY 2020 (12 months)

FY 2019 (12 months)

Net cash flow generated by

operating activities

(21 854)

(9 655)

Net cash flow in connection with

investment transactions

(204)

(2 054)

Net cash flow in connection with

financing transactions

6 512

15 529

Changes in net cash

(15 547)

3 820

Cash and cash equivalents at the

start of the year

43 661

39 841

Cash and cash equivalents at

year-end

28 114

43 661

Net cash flow from operations

For fiscal year 2020, net cash outflows related to operations

amounted to €21.9 million compared to a net cash inflow of €9.7

million in the previous year. This change mainly reflects a similar

level of expenses as last year ones (after restatement of flows

related to legal proceedings against Eli Lilly on 2019).

Net cash flow in 2019 included:

- Collection of $14.3 million, or €13

million, from Eli Lilly following the favorable outcome of the

first part of the arbitration proceedings,

- Reimbursement of insurance of $4 million,

or €3.6 million, following the absence of a gain in the second part

of the arbitration against Eli Lilly,

Collection of €3.4 million relating to the corporate income tax

claim for year 2014 and the fiscal treatment of the upfront payment

paid by Eli Lilly.

Net cash flow from investments

Cash used in investing activities amounted to 0.2 million euros,

compared to 2.1 million euros last year. This decrease reflects the

low level of investment over the year 2020.

In 2019, the Company had carried out renovation work on two 450

square meter floors intended mainly for the Analysis department's

activities (for 1.8 million euros including exterior fittings and

furniture).

Net cash from financing investments

In 2020, cash consumption related to investment transactions of

€0.2 million is mainly due to the subscription of the PGE loans for

an amount of €7 million.

In 2019, cash consumption related to investment transactions was

mainly due to the subscription of a bond issue loan by IPF for an

amount of €15 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210318005792/en/

Adocia Gérard Soula CEO contactinvestisseurs@adocia.com Ph: +33

4 72 610 610 www.adocia.com

MC Services AG Adocia Press Relations Europe Raimund Gabriel

Managing Partner adocia@mc-services.eu Ph: +49 89 210 228 0

The Ruth Group Adocia Investor Relations USA James Salierno

Vice-President jsalierno@theruthgroup.com Ph.: +1 646 536 7035

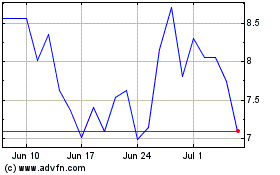

Adocia (EU:ADOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

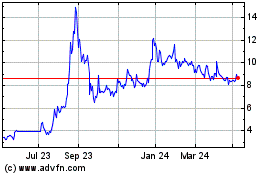

Adocia (EU:ADOC)

Historical Stock Chart

From Apr 2023 to Apr 2024