Credit Agricole 1Q Net Profit Fell More than Expected; Books Provision from Ukraine, Russia Assets

May 05 2022 - 1:56AM

Dow Jones News

By Sabela Ojea

Credit Agricole S.A. on Thursday posted a sharp decline in

pretax profit for the first quarter, which came in below market

expectations, and said it has taken a large amount of provisions

linked to both Russian and Ukrainian assets.

The French bank reported a net profit of 552 million euros

($586.4 million) for the quarter compared with EUR1.05 billion for

the same period a year earlier.

Net profit was expected to decline to EUR588.1 million, taken

from FactSet and based on six analysts' estimates.

Revenue, on the other hand, rose to EUR5.94 billion from EUR5.49

billion for the year-earlier period. It was anticipated to rise to

EUR5.63 billion, according to FactSet and based on six analysts'

forecasts.

"The quarter was impacted by recurring accounting volatility

items at the revenues level, namely debit valuation adjustment for

EUR22 million on net income group share, the hedge on the large

customers loan book in the amount of EUR12 million on net income

Group share, and the variation in the provision for home purchase

savings plans for EUR17 million on net income group share," the

lender said.

Regarding its provision, the company said it has taken a charge

of EUR389 million in relation to Russian exposure and a charge of

EUR195 million on Ukraine's equity risk.

The bank ended the period with a phased-in common equity Tier 1

ratio--a key measure of balance-sheet strength--of 11.0%, down 0.9

percentage points from the end of December.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

May 05, 2022 01:41 ET (05:41 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

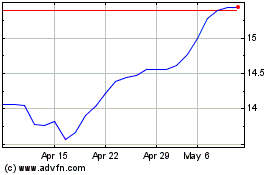

Credit Agricole (EU:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

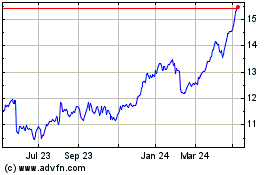

Credit Agricole (EU:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024