Credit Agricole to Unwind Part of Switch Guarantee Mechanism

January 16 2020 - 2:15AM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA (ACA.FR) will unwind a regulatory arrangement

in order to simplify the bank's structure, boosting its profit but

hitting its capital position.

On March 2, France's second largest listed bank by assets will

unwind 35% of the "Switch" guarantee mechanism, under which it

transfers part of the regulatory requirements related to its

insurance operations to the regional banks of the group, paying in

return a fixed fee.

The partial dismantling of the guarantee should add roughly 58

million euros ($64.6 million) to Credit Agricole's bottom line in

2020, it said late Wednesday. It should also have a negative impact

of about 40 basis points on its core tier 1 ratio, a key measure of

capital strength.

The bank confirmed its mid-term core tier 1 capital target of

11%.

Last June, the lender said it would unwind half of the mechanism

by 2022.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

January 16, 2020 02:00 ET (07:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

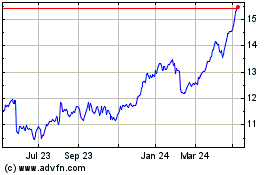

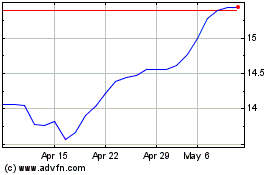

Credit Agricole (EU:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Credit Agricole (EU:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024