Credit Agricole Presents Plan Through 2022

June 06 2019 - 1:55AM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA (ACA.FR) presented Thursday its new mid-term

plan through 2022, that includes measures to simplify the group's

capital structure and targets a profit growth of more than 3% a

year through 2022.

France's second largest listed bank by assets sees its return on

tangible equity--a key measure of profitability--above 11%, with

net profit growing by more than 3% a year to above 5 billion euros

($5.63 billion) at the end of the plan.

The bank also targets a cost-income ratio below 60% and core

tier 1--a key measure of capital strength for lenders--of 11%.

Credit Agricole will also push forward with the simplification

of its capital structure by partially unwinding the switch

guarantee granted by the regional banks of the group to Credit

Agricole SA. This will have a positive impact on earnings per

share.

The group pledged to invest EUR15 billion in technological

transformation.

Credit Agricole achieved ahead of time most of the targets in

the medium-term plan presented in 2016, which set financial targets

until 2019.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

June 06, 2019 01:40 ET (05:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

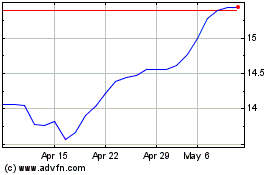

Credit Agricole (EU:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

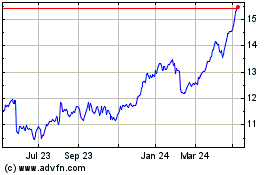

Credit Agricole (EU:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024