PRESS

RELEASE

Montrouge, 6 June 2019

GROUP PROJECT

& 2022 MEDIUM-TERM PLAN

"Working every day in the interest of our customers and

society"

A new Group Project

Crédit Agricole Group is formally setting out its Raison d'être:

"Working every day in the interest of our

customers and society". It confirms its customer-focused

universal banking model with three pillars:

-

Excellence in customer

relations: be number one in customer satisfaction by becoming

the favourite bank of individuals, entrepreneurs and

corporates;

-

Empowered teams for

customers: to accompany digitalisation by offering customers

human, responsible and accessible skills;

-

Commitment to society:

amplify our mutualism commitment to reinforce our position as the

European leader in responsible investment.

A new Medium-Term Plan (2019-2022)

Raised and secured profitability

targets

A strong Group, which allows for agile capital

management

-

Target net income Group share for 2022: >

€5bn for Crédit Agricole S.A.;

-

2022 ROTE: >11% for Crédit Agricole

S.A.;

-

CET1 at year-end 2022 factoring in regulatory

changes:

-

"Switching off"

Three levers for the new Medium-Term

Plan:

-

Growth on all our markets

with the goal of being number one in customer conquest;

-

Revenue synergies totalling

€10bn in 2022;

-

Technological transformation

for greater efficiency with a €15bn allocation over four

years.

|

Today, Crédit Agricole Group is

presenting a new Group Project and a new 2022 Medium-Term Plan

jointly drafted by the Regional banks and Crédit Agricole S.A.

For the first time, the Group

Project spells out Crédit Agricole's Raison d'être. It serves as the basis of its unique

relationship model and lies at the heart of its customer-focused

universal banking model. Forward-looking and true to the daily

expression of the Group's usefulness, this Raison

d'être guides the Group's transformation and development while

promoting its values of usefulness and

universality. It can be summarised as,

"Working every day in the

interest of our customers and society".

Within this new long-term

framework, the 2022 strategic plan is a roadmap for profitable

growth for Crédit Agricole. It builds upon the previous Medium-Term

Plan, Strategic Ambitions 2020, which delivered almost all of its

financial results a year ahead of schedule. It seeks to amplify and

accelerate the Group's growth in an uncertain environment, and in a

context of growing societal expectations.

The economic scenario is based on

interest rates remaining low. Making a prudent assumption of

an increase in cost of risk to

40 basis points (versus 23

basis points in 2018), Crédit

Agricole S.A. aims to deliver higher and secured

profitability, with net income Group share above €5 billion (€4.4

billion in 2018) and a target return on tangible equity (ROTE)

above 11% (12.7% in 2018; 2016-2019 MTP target: 10%). These targets

will be achieved thanks to the Group's diversified business model

and thanks to improvements in operating efficiency, in particular

through a reduction in cost to income ratios of all Crédit Agricole

S.A. business lines, to fall below 60% in 2022 (excluding the

contribution to the Single Resolution Fund).

The CET1 ratio targets set for

Crédit Agricole Group and Crédit Agricole S.A. for end 2022, above

16% and 11% respectively, take into account the much tougher

regulatory requirements expected by this date. Credit Agricole

Group's CET1 ratio guarantees the entire Group's financial

strength. The Group will also pursue its prudent liquidity

management strategy. Finally, the simplification of Crédit Agricole

S.A.'s capital structure will enter a new stage during the MTP

period, with the partial unwinding of the Switch guarantee granted

by the Regional banks to Crédit Agricole S.A., which will have a

favourable impact on earnings per share.

Crédit Agricole S.A. - Financial targets for

2022

| Growth in net income Group share |

> +3% per year (CAGR 2018-2022)

to > €5bn |

| ROTE |

>11% |

| Cost/income ratio (excl. SRF) |

< 60% |

| Cost of risk assumption |

~ 40 basis points |

| CET1 |

11%

> 16% for Crédit Agricole Group |

| Payout ratio |

50% in cash |

"Working every day in the

interest of our customers and society" - the new long-term Group

Project

Crédit Agricole is the number one

bank in France, number one insurer in France, number one

bancassurer in Europe, number one asset manager in Europe and the

world's tenth largest bank. With 51 million customers around the

world and the biggest retail banking customer base in Europe, the

Group has built its growth on a unique relationship model, which it

intends to expand by drawing on three pillars.

Excellence in

customer relations at the centre of the Customer Project

The Group aims to

be the favourite bank of individuals, entrepreneurs and

corporates.

Key

drivers:

-

Mobilising all business lines around customer

satisfaction by managing it at the highest level, putting the net

promoter score (NPS) in the assessment of employees, managers and

senior executives, and creating an Academy for Excellence in

Customer Relations;

-

Installing a zero-defect culture (creating a

"customer champion" function to solve customer pain points and a

"process manager" to streamline banking processes).

The Group aims to

increase the number of customers using its digital applications in

France and Italy by 20 points by offering an exceptional digital

customer experience.

Key

drivers:

-

tools and applications at the highest standards,

across all our markets;

-

products and services adapted to new customer

habits including access-offers to all our services, simple and

transparent pricing;

-

leverage data to better know our customers and

be their trusted third party;

-

innovation, with the opening of 17 new Villages

by CA in France and Italy;

-

and customer journeys natively designed for

digital use.

The Group is

investing in an innovative strategy of banking and extra-banking

services platforms operated directly or with partners.

-

Rollouts planned in Regional banks: platforms

for business creation, for the management of non-profits, for car

financing, and for healthcare services from 2019, and in 2020,

platforms offering support for job finding, for housing, as well as

a digital data vault.

Empowered teams

at the centre of the Human Project

Men and women who make up Crédit

Agricole are key to the success of the Group Project. In an

increasingly digital society, the direct responsibility that a

company's empowered employees can offer its customers is crucial.

The Group is placing this empowerment at the centre of its Human

Project, to reinforce the amplification of the Customer

Project.

The Group will stand apart by

always offering its customers a direct access to

an empowered relationship manager. Relationship managers will

be required to show discernment and their responsibilities will be

strengthened, in order to quickly address the specific needs of

customers.

Key

drivers:

-

relationship managers's appraisals based on Net

Promoter Score (NPS) and, for managers at Crédit Agricole S.A.,

assessments based on Engagement and Recommendation Index (ERI)

objectives,

-

a clear delegation framework (80% of decisions

will be taken locally within our retail banking networks in

France),

-

additional customer-facing time, thanks to

native integration of compliance in tools and decisions,

-

relationship managers trained in both

behavioural and digital skills.

These far-reaching changes require

transformations in terms of management and

organisation, to empower teams and bring them closer to

customers.

Key

drivers:

-

100% of Group Executives trained in our new

leadership model,

-

"entrepreneur" managers,

-

shorter decision-making chains,

-

agile ways of working and working spaces,

-

show loyalty towards employee to ensure mutual

commitment between employees and the company.

The Group intends

to be the best company to work for in financial services in France,

and Top 5 in Europe.

A strong

commitment to society at the centre of the Societal Project

Crédit Agricole Group will pursue

its mutualist commitment to inclusive development and it will

continue to make green financing one of its key growth drivers.

Pursuing the

mutualist commitment to inclusive development

The Group will draw upon its

strong local coverage, in particular via the presence of the

Regional banks in the regions, to promote fairer economic

development by:

-

developing a range of affordable offers for all

such as Eko and LCL Essentiel,

-

supporting entrepreneurship: Cafés de la

Création and Villages by CA,

-

preventing and resolving

over-indebtedness.

It will also develop social impact

financing, by:

-

increase significantly investments in the social

and solidarity companies (SSC),

-

strengthening CACIB's leadership in the

arrangement of social bonds,

-

taking action for the economic development of

rural populations in emerging countries (via the Crédit Agricole

Grameen Foundation).

And it will reinforce societal

ties locally, by:

-

organising massively work experience placements

for middle-school students from deprived areas,

-

supporting local associations (culture, sports

and solidarity), alongside projects conducted by the Regional

banks,

-

strengthening the role of its Foundations.

Green finance -

one key growth drivers for the Group

-

commit all the Group's entities to a common

climate strategy, in line with the Paris Agreement, its

implementation will be certified by an independent body and

published in 2020 based on the recommendations of the Task Force on

Climate-related Financial Disclosures (TCFD),

-

strengthen our commitments to financing the

energy transition: exiting from thermal coal production in EU and

OECD countries by 2030 (no new business relations with companies

for which thermal coal accounts for over 25% of their revenues

except those that have announced plans to close their thermal coal

activities or which intend to announce such plans by 2021. No

business relations with companies developing or planning to develop

new thermal coal capacity), financing one in three renewable energy

projects in France, doubling the size of our green loans portfolio

to €13 billion by 2022,

-

promote clean and responsible investment

policies: incorporating ESG criteria in all funds managed by Amundi

and all new investments by Crédit Agricole Assurances, reach €6bn

of the Group's liquidity portfolio in socially responsible

investments (SRI) financial products,

-

assigning a transition rating to large corporate

customers to structure dialogue with them on their energy

transition roadmap.

The Group intends

to be the European leader in responsible investment

2022 Medium-Term

Plan: three levers

The new Medium-Term Plan is based

on three levers: growth on all our markets, development of revenue

synergies and technological transformation for greater

efficiency.

Growth on all our

markets: number one in customer conquest

Intensify

relationships with individual and mass affluent customers:

-

Targets for individual

costumers: number one in net customer conquest with over 1

million additional customers in France and Italy, 26% market share

in home loans in France for the Regional banks, and a 5 point

increase in the share of customers with at least one property &

casualty insurance contract in France.

-

Targets for mass affluent

customers: €20bn increase in yearly net inflows (Regional

banks, LCL, CA Indosuez WM), +240,000 new clients (Regional banks,

LCL, Crédit Agricole Italy).

-

Be the reference bank for

Savings and Wealth management: amplify the value proposition of

the "Trajectoires Patrimoine" offer by completing 50,000 real

estate transactions per year, and +2pp of Regional bank's customers

equipped with death & disability insurance (term life

policies).

Address the

specific needs of small businesses and farmers

-

Targets: number one in

customer conquest in France (Regional banks, LCL), 75% market share

for new farmers (Regional banks), leading apps (Ma Banque Pro, Pro

& Entreprises LCL, etc).

Specific solutions for independent

professions and farmers.

Become the

strategic partner for SMEs / Midcaps

-

Targets: reinforce the

Regional banks' leadership in the corporate market and

accelerate the Group's growth on Midcaps and internationally active

French firms, 1/3 of large SMEs customers of LCL, 1.5pp increase in

financial market share in the French food industry sector for

Crédit Agricole Group.

Roll out a comprehensive range of

bancassurance solutions for companies (the

most complete Group benefits solution for employers in insurance

and collective solutions, property & casualty insurance

solution).

Extend the

product range for large corporates and financial

institutions

Make payments a

key driver for customer loyalty and customer acquisition

As a long-standing leader in

France with a market share of 27% and in the top five in Europe,

Crédit Agricole Group has solid foundations on which to build new

ambitions. It will invest €450m in payments business between 2019

and 2022.

-

Targets for individual

customers: strengthen our leadership by offering all payment

services at the highest standards (mobile payments and services,

card-related innovation, new digital services).

-

Targets for merchants and

corporates: support our customers' development in France and

Europe to capture market share, with digital and mobile payment

solutions for small and medium-sized merchants, a pan-European

electronic payments offering for Tier1 merchants, and a state of

the art e-commerce offer from 2019.

Internationally,

Europe is the priority, with an extension of our universal banking

model in Europe and Asia via partnerships

-

Europe: development of our

retail banking and property & casualty insurance in Italy,

selective growth of CACIB large customer base and development of

Crédit Agricole Leasing & Factoring operations in Germany,

strengthening of our customer-focused universal banking in

Poland.

-

In Asia: development of

joint ventures and strengthening of positions in Japan for Amundi,

focused development for CACIB in China and capitalisation on recent

acquisitions in Singapore and Hong Kong for Indosuez Wealth

Management.

-

Extend our model in Europe and

Asia: while organic growth remains the Group's priority,

continuing and accelerating on partnerships will contribute to

growth in the Group's business lines; targeted acquisitions will

have to accelerate organic growth and meet criteria in terms of

profitability, risks and synergy potential.

Revenue

synergies: €10bn by 2022

In the new Medium-Term Plan, the

Group is continuing its strategy of developing revenue synergies

between its entities. Its universal banking model offers potential

organic growth, to allow each and every business lines to reach the

Group's market share in retail banking. The Group aims to increase

revenue synergies by €1.3bn up to €10bn in 2022. The two main

drivers will be insurance (+€800m) and specialised financial

services (€300m in consumer finance and leasing).

Technological

transformation for greater efficiency: €15bn for IT over 4

years

Align our

technological fundamentals with the best standards on the

market

Speed up and

anticipate the adoption of new technologies

Enhancing

operational efficiency

* *

*

The presentation of the Credit

Agricole Group Medium-Term Plan will be published on the website

www.credit-agricole.com at 8:30 a.m. on Thursday 6 June 2019 (Paris

time).

Crédit

Agricole press contacts

| Charlotte

de Chavagnac |

+ 33 1 57

72 11 17 |

charlotte.dechavagnac@credit-agricole-sa.fr |

| Olivier

Tassain |

+ 33 1 43

23 25 41 |

olivier.tassain@credit-agricole-sa.fr |

Pauline

Vasselle

Caroline de Cassagne |

+ 33 1 43

23 07 31

+ 33 1 49 53 41 72 |

pauline.vasselle@credit-agricole-sa.fr

Caroline.decassagne@ca-fnca.fr |

Crédit Agricole S.A. investor relations

contacts

|

Institutional investors |

+ 33 1 43

23 04 31 |

investor.relations@credit-agricole-sa.fr |

|

Individual shareholders |

+ 33 800

000 777 (toll-free number France only) |

credit-agricole-sa@relations-actionnaires.com |

|

|

|

|

| Cyril

Meilland, CFA |

+ 33 1 43

23 53 82 |

cyril.meilland@credit-agricole-sa.fr

|

| Equity investors |

|

|

| Letteria

Barbaro-Bour |

+ 33 1 43

23 48 33 |

letteria.barbaro-bour@credit-agricole-sa.fr |

| Oriane

Cante |

+ 33 1 43

23 03 07 |

oriane.cante@credit-agricole-sa.fr |

| Emilie

Gasnier |

+ 33 1 43

23 15 67 |

emilie.gasnier@credit-agricole-sa.fr |

| Ibrahima

Konaté |

+ 33 1 43

23 51 35 |

ibrahima.konate@credit-agricole-sa.fr |

| Vincent

Liscia |

+ 33 1 57

72 38 48 |

vincent.liscia@credit-agricole-sa.fr |

| Annabelle

Wiriath |

+ 33 1 43

23 55 52 |

annabelle.wiriath@credit-agricole-sa.fr |

|

|

|

|

| Debt investors

and rating agencies: |

|

| Caroline

Crépin |

+ 33 1 43

23 83 65 |

caroline.crepin@credit-agricole-sa.fr |

| Laurence

Gascon |

+ 33 1 57

72 38 63 |

laurence.gascon@credit-agricole-sa.fr |

|

Marie-Laure Malo |

+ 33 1 43

23 10 21 |

marielaure.malo@credit-agricole-sa.fr |

|

|

|

|

|

|

|

|

See all our press releases at:

www.credit-agricole.com - www.creditagricole.info

| |

Crédit_Agricole |

|

Crédit Agricole

Group |

|

créditagricole_sa |

This presentation may include

forward-looking information and prospective statements on

Crédit Agricole Group, supplied as information on trends.

These statements and information include financial projections and

estimates and their underlying assumptions, statements regarding

plans, objectives and expectations with respect to future

operations, products and services, and statements regarding future

performance. These statements and information do not represent

forecasts within the meaning of European Regulation 809/2004 of 29

April 2004 (chapter 1, article 2, § 10). These statement and

information were developed from scenarios based on a number of

economic assumptions for a given competitive and regulatory

environment. These assumptions are by nature subject to random

factors and uncertainties, many of which are difficult to predict

that could cause actual results to differ materially from those

expressed in, or implied or projected by, the forward-looking

information and prospective statements.

Other than as required by applicable laws and regulations, neither

Crédit Agricole S.A. nor any other entities of

Crédit Agricole Group undertake any obligation to update

or revised any forward-looking information and prospective

statements in light of any new information and/or event.

Likewise, the financial statements

are based on estimates, particularly in calculating market value

and asset impairment. Readers must take all these risk factors and

uncertainties into consideration before making their own

judgement.

The figures presented are not audited. The figures presented for

the twelve-month period ending 31 December 2018, approved by

Crédit Agricole S.A.'s Board of Directors on

13 February 2019, have been prepared in accordance with

IFRS as adopted in the European Union and applicable at end-2018,

and with prudential regulations currently in force. The financial

targets have been prepared in accordance with IFRS as adopted in

the European Union and applicable at 1st January of 2019,

they are also based on a series of assumptions on the application

of prudential regulations.

Note:

Crédit Agricole Group's scope of consolidation comprises:

the Regional banks, the Local Banks and

Crédit Agricole S.A. and their respective subsidiaries.

This is the scope of consolidation that has been privileged by the

competent authorities to assess Crédit Agricole Group's

situation, notably in the 2016 and 2018 Stress test

exercises.

Crédit Agricole S.A. is a listed entity that owns

subsidiaries performing the business line activities (Asset

gathering, Retail banking France and International, Specialised

financial services, and Large customers).

The sum of values contained in the

tables and analyses may differ slightly from the total reported due

to rounding.

Group Project & 2022

Medium-Term Plan

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

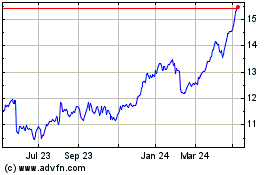

Credit Agricole (EU:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

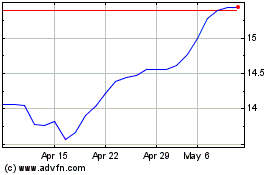

Credit Agricole (EU:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024