Winner Takes All: Bitcoin And DXY Compete For Global Financial Dominance

May 11 2023 - 2:30PM

NEWSBTC

Bitcoin (BTC) and the U.S. Dollar Index (DXY) have been battling

for supremacy in the financial world, with both assets vying for

dominance in a zero-sum game. The recent volatility seen in the

markets is a testament to the intensity of this battle. It is

becoming increasingly clear that the outcome of this showdown will

have significant implications for both assets and the financial

world. Related Reading: BONE Token Dominates India Exchange Poll,

Outshining Rivals Like PEPE And FLOKI How Bitcoin Plans To Take On

The Dollar According to JJ the Janitor, an analyst at Jarvis Labs,

any decline in the dollar’s value is good for Bitcoin, and vice

versa. This means that the two assets are competing for the same

market share, and whichever one comes out on top will dictate the

market’s direction for the rest of 2023. As JJ the Janitor notes,

DXY has held above the crucial line of support at 100.80 since

April 15. This has created market tension, as BTC and DXY have been

consolidating in tightly compressed ranges. However, this

month-long structure will break sooner or later, and both assets

will enter into price discovery – one to the upside, the other to

the downside. One notable thing about DXY, according to JJ the

Janitor, is that since it peaked during March’s banking crisis, it

has been unable to sustain any technical momentum. As a result, it

has now registered six lower highs since March’s peak of 105.90, a

strong confirmation that it is indeed stuck in a downtrend. For

JJ, if the dollar’s yearly low fails to hold upon retest, and

if that failure sends DXY crashing below 100 without relief, it

would create an ideal set-up for Bitcoin to make a series of higher

highs this summer. This would be good news for BTC investors, who

have eagerly anticipated a market breakout. Furthermore, The market

structure of the DXY is beginning to resemble a pattern that

Bitcoin displayed in the spring of 2022, according to JJ the

Janitor. Moreover, JJ compared the current market structure of DXY

to a chart pattern that BTC displayed last spring, which ultimately

led to a collapse in the market. BTC Faces Risk Of Collapse Similar

To Last Year’s Death Spiral? As JJ notes, just after the death

spiral of LUNA and UST last year, Bitcoin appeared to be holding up

surprisingly well while altcoins were collapsing. However, this

resilience was short-lived, as BTC ultimately succumbed to a “head

and shoulders” chart pattern and collapsed after the death spiral

of LUNA caused CeFi exchanges like Celsius and BlockFi to go under.

As seen above, DXY shows a similar head and shoulders pattern below

resistance, which could signal a potentially disastrous outcome for

the asset. This pattern is a bearish technical indicator that

suggests a potential reversal of the current trend. However, there

is a scenario in which the dollar could regain strength and spoil

Bitcoin’s hope for new highs this summer. JJ the Janitor, suggests

that if DXY were to move above the May high at 102.53 and then

reconquer its 50-day and 100-day moving averages, it would be a

clear signal for the market to go “risk-off.” This would be a sign

of strength for the dollar and could result in Bitcoin crashing

into another retest of its 200-day moving average. At the time of

writing, the price of Bitcoin is hovering around $27,100, just

below its 50-day moving average, indicating a notable decline of

over 3.5% in the past 24 hours. The cryptocurrency’s market

volatility has increased liquidations of both short and long

positions, with Coinglass data indicating a peak of $174 million in

the last 24 hours. Related Reading: Uniswap (UNI) Surges After A

Bumpy Ride, Is Bearish Run Over? Featured image from iStock, chart

from TradingView.com

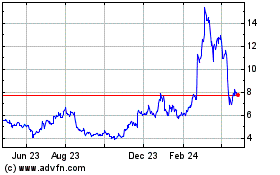

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

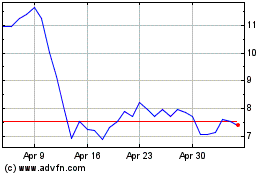

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024